概述

Ichimoku 云九策略是基于 Ichimoku 云指标并结合 Williams 分型的一个交易策略。该策略利用 Ichimoku 云指标提供的多个交易信号来产生交易信号。这是一个面向实际交易的策略。

策略原理

该策略主要基于以下几个 Ichimoku 信号进行入场:

- 云层突破:当价格收盘突破云层上边缘或下边缘时产生信号

- TK 交叉:当转向线(Tenkan)与基准线(Kijun)交叉时产生信号

- 云层扭转:当 Senkou Span A 线和 Senkou Span B 线交叉时产生信号

- 边沿交叉:当价格从一侧云层进入另一侧云层时产生信号

此外,该策略还会在以下情况平仓:

- 价格收盘进入云层时平仓

- TK 反向交叉时平仓

- Williams 分型被突破时部分平仓

该策略融合了 Ichimoku 云图的多个交易信号,旨在提高交易信号的可靠性,同时利用分型来设置止损,控制风险。

策略优势

相比单一信号的策略,该策略综合利用 Ichimoku 云图的多个信号,可以过滤掉一些错位信号,提高信号的准确率。同时,策略参数可以灵活配置,适用于不同品种和参数优化。

另外,策略中引入 Williams 分型突破来设置止损,可以更主动地控制风险,锁定利润,避免巨额亏损。

策略风险

该策略主要面临以下风险:

- 云图指标存在滞后性,不能及时反映价格变化

- 多重信号可能过于保守,错过部分机会

- 分型止损可能被突破造成损失

针对滞后性问题,可以适当调整参数,或关闭部分过滤信号。针对分型止损风险,可以调整分型的时间周期,或只部分止损。

策略优化方向

该策略主要可以从以下几个方面进行优化:

- 调整 Ichimoku 参数,适应不同周期和品种

- 调整或关闭部分过滤信号,保留核心信号

- 调整分型的参数,使用更大时间周期的分型,或只采用部分止损

- 增加其他指标过滤,如量能指标等

总结

Ichimoku 云九策略通过集成 Ichimoku 云图多个交易信号,在发挥云图指标优势的同时,提高信号的准确率和胜率。策略还采用分型作为止损方式来控制风险。该策略可以通过参数和信号优化,适用于多品种的算法交易。

策略源码

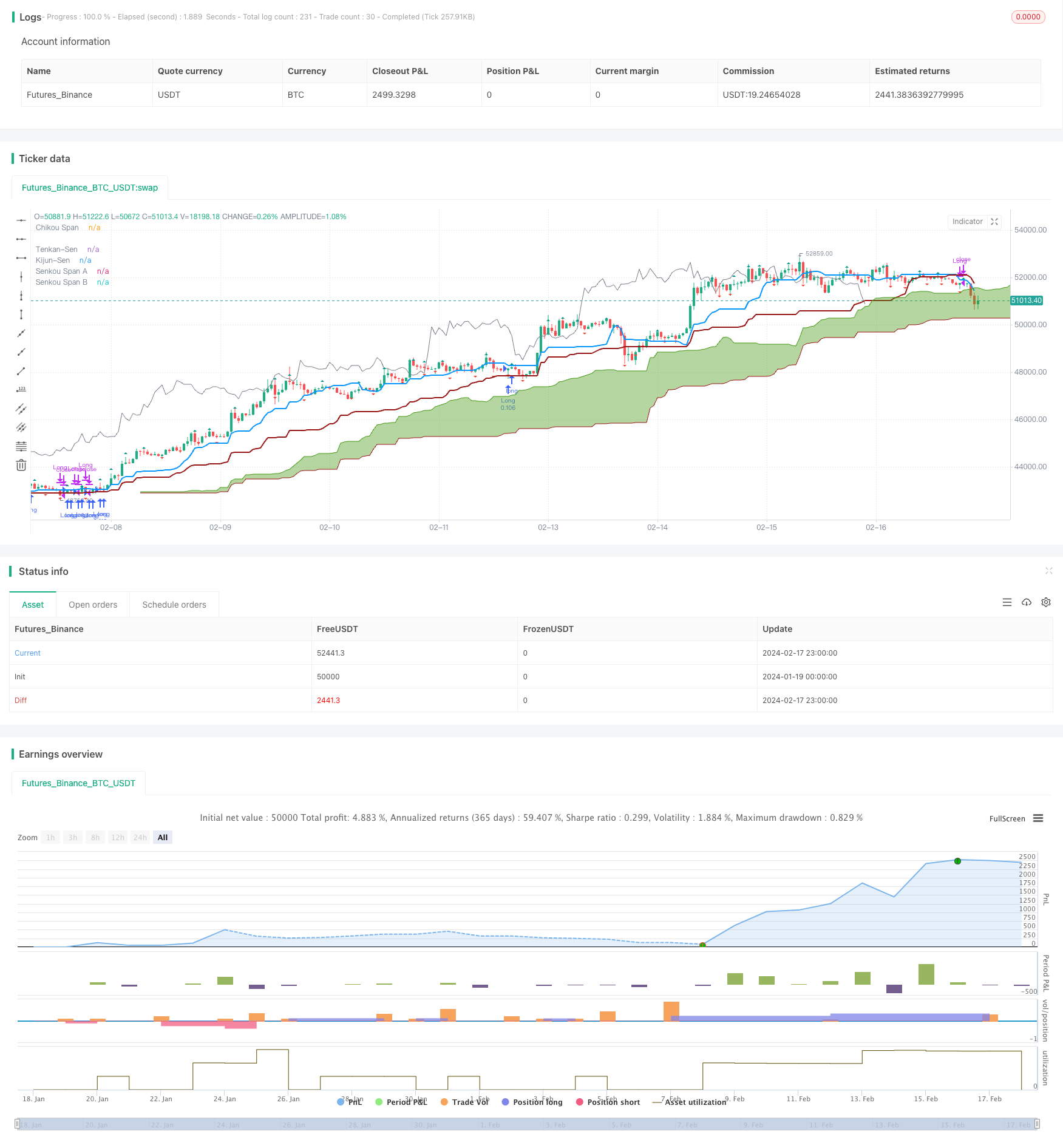

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Cloud Nine", shorttitle="Ichimoku Cloud Nine", overlay=true, calc_on_every_tick = true, calc_on_order_fills = false, initial_capital = 5000, currency = "USD", default_qty_type = "percent_of_equity", default_qty_value = 10, pyramiding = 3, process_orders_on_close = true)

color green = #459915

color red = #991515

// --------

// Fractals

// --------

// Define "n" as the number of periods and keep a minimum value of 2 for error handling.

close_on_fractal = input.bool(false, title="Use William Fractals for SL?", group = "Fractals")

n = input.int(title="Periods", defval=2, minval=2, group = "Fractals")

fractal_close_percentage = input.int(100, minval=1, maxval=100, title="Position % to close on fractal breach", group = "Fractals")

selected_fractals_timeframe = input.timeframe('Current', "Timeframe", options=["Current", "1D", "12H", "8H", "4H", "1H"], group = "Fractals", tooltip = "Timeframe to use to look for fractals. Example: if 12H is selected, it will close positions when the last 12H fractal is breached.")

string fractals_timeframe = switch selected_fractals_timeframe

"1D" => "1D"

"12H" => "720"

"8H" => "480"

"4H" => "240"

"1H" => "60"

// Default used when the three first cases do not match.

=> ""

prev_high = request.security(syminfo.tickerid, fractals_timeframe, high)

prev_low = request.security(syminfo.tickerid, fractals_timeframe, low)

period_high=prev_high

period_low=prev_low

// UpFractal

bool upflagDownFrontier = true

bool upflagUpFrontier0 = true

bool upflagUpFrontier1 = true

bool upflagUpFrontier2 = true

bool upflagUpFrontier3 = true

bool upflagUpFrontier4 = true

for i = 1 to n

upflagDownFrontier := upflagDownFrontier and (period_high[n-i] < period_high[n])

upflagUpFrontier0 := upflagUpFrontier0 and (period_high[n+i] < period_high[n])

upflagUpFrontier1 := upflagUpFrontier1 and (period_high[n+1] <= period_high[n] and period_high[n+i + 1] < period_high[n])

upflagUpFrontier2 := upflagUpFrontier2 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+i + 2] < period_high[n])

upflagUpFrontier3 := upflagUpFrontier3 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+3] <= period_high[n] and period_high[n+i + 3] < period_high[n])

upflagUpFrontier4 := upflagUpFrontier4 and (period_high[n+1] <= period_high[n] and period_high[n+2] <= period_high[n] and period_high[n+3] <= period_high[n] and period_high[n+4] <= period_high[n] and period_high[n+i + 4] < period_high[n])

flagUpFrontier = upflagUpFrontier0 or upflagUpFrontier1 or upflagUpFrontier2 or upflagUpFrontier3 or upflagUpFrontier4

upFractal = (upflagDownFrontier and flagUpFrontier)

var float upFractalPrice = 0

if (upFractal)

upFractalPrice := period_high[n]

// downFractal

bool downflagDownFrontier = true

bool downflagUpFrontier0 = true

bool downflagUpFrontier1 = true

bool downflagUpFrontier2 = true

bool downflagUpFrontier3 = true

bool downflagUpFrontier4 = true

for i = 1 to n

downflagDownFrontier := downflagDownFrontier and (period_low[n-i] > period_low[n])

downflagUpFrontier0 := downflagUpFrontier0 and (period_low[n+i] > period_low[n])

downflagUpFrontier1 := downflagUpFrontier1 and (period_low[n+1] >= period_low[n] and period_low[n+i + 1] > period_low[n])

downflagUpFrontier2 := downflagUpFrontier2 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+i + 2] > period_low[n])

downflagUpFrontier3 := downflagUpFrontier3 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+3] >= period_low[n] and period_low[n+i + 3] > period_low[n])

downflagUpFrontier4 := downflagUpFrontier4 and (period_low[n+1] >= period_low[n] and period_low[n+2] >= period_low[n] and period_low[n+3] >= period_low[n] and period_low[n+4] >= period_low[n] and period_low[n+i + 4] > period_low[n])

flagDownFrontier = downflagUpFrontier0 or downflagUpFrontier1 or downflagUpFrontier2 or downflagUpFrontier3 or downflagUpFrontier4

downFractal = (downflagDownFrontier and flagDownFrontier)

var float downFractalPrice = 0

if (downFractal)

downFractalPrice := period_low[n]

plotshape(downFractal, style=shape.triangledown, location=location.belowbar, offset=-n, color=#F44336, size = size.auto)

plotshape(upFractal, style=shape.triangleup, location=location.abovebar, offset=-n, color=#009688, size = size.auto)

// --------

// Ichimoku

// --------

previous_close = close[1]

conversionPeriods = input.int(20, minval=1, title="Conversion Line Periods", group = "Cloud Settings"),

basePeriods = input.int(60, minval=1, title="Base Line Periods", group = "Cloud Settings")

laggingSpan2Periods = input.int(120, minval=1, title="Lagging Span 2 Periods", group = "Cloud Settings"),

displacement = input.int(30, minval=1, title="Displacement", group = "Cloud Settings")

long_entry = input.bool(true, title="Longs", group = "Entries", tooltip = "Will look for longs")

short_entry = input.bool(true, title="Shorts", group = "Entries", tooltip = "Will look for shorts")

wait_for_twist = input.bool(true, title="Wait for kumo twist?", group = "Entries", tooltip = "Will wait for the Kumo to turn green (longs) or red (shorts)")

ignore_lagging_span = input.bool(true, title="Ignore Lagging Span Signal?", group = "Entries", tooltip = "Will not wait for lagging span to be above/below price and cloud")

bounce_entry = input.bool(true, title="Kijun Bounce", group = "Entries", tooltip = "Will enter position on a Kijun bounce")

e2e_entry = input.bool(true, title="Enable", group = "Edge 2 Edge", tooltip = "Will look for edge-to-edge trades")

e2e_entry_tk_confluence = input.bool(true, title="Require TK Confluence?", group = "Edge 2 Edge", tooltip = "Require confluent TK cross in order to enter an e2e trade")

min_cloud_thickness = input.float(10, minval=1, title="Minimun Cloud Thickness (%)", group = "Edge 2 Edge", tooltip = "Minimum cloud thickness for entering e2e trades")

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

tenkan = donchian(conversionPeriods)

kijun = donchian(basePeriods)

spanA = math.avg(tenkan, kijun)

spanB = donchian(laggingSpan2Periods)

plot(tenkan, color=#0496ff, title="Tenkan-Sen", linewidth = 2)

plot(kijun, color=red, title="Kijun-Sen", linewidth = 2)

plot(close, offset = -displacement, color=color.gray, title="Chikou Span")

p1 = plot(spanA, offset = displacement, color=green, title="Senkou Span A")

p2 = plot(spanB, offset = displacement, color=red, title="Senkou Span B")

fill(p1, p2, color = spanA > spanB ? color.new(green, 50) : color.new(red, 50))

cloud_high = math.max(spanA[displacement], spanB[displacement])

cloud_low = math.min(spanA[displacement], spanB[displacement])

lagging_span_above_price_and_cloud = (close > close[displacement] and close > cloud_high[displacement]) or ignore_lagging_span

lagging_span_below_price_and_cloud = (close < close[displacement] and close < cloud_low[displacement]) or ignore_lagging_span

step1=cloud_high-cloud_low

step2=(cloud_high+cloud_low)/2

cloud_thickness = (step1/step2)*100

// --------

// Trades

// --------

// LONGS

// kumo breakout

if (long_entry and ta.crossover(close, cloud_high) and tenkan > kijun and close > kijun and lagging_span_above_price_and_cloud and (not wait_for_twist or spanA > spanB))

comment = "Long - Kumo Breakout"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// tk cross above cloud

if (long_entry and close > cloud_high and ta.crossover(tenkan, kijun) and lagging_span_above_price_and_cloud and (not wait_for_twist or spanA > spanB))

comment = "Long - TK Cross"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// kumo twist

if (long_entry and close > cloud_high and tenkan > kijun and ta.crossover(spanA, spanB) and lagging_span_above_price_and_cloud)

comment = "Long - Kumo Twist"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

// close inside cloud

if (ta.crossunder(close, cloud_high))

comment = "Close Long - Close inside cloud"

strategy.close("Long", comment = comment)

alert(comment, alert.freq_once_per_bar)

// bearish tk cross

if (ta.crossunder(tenkan, kijun))

comment = "Close Long - TK Cross"

strategy.close("Long", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossunder(low, downFractalPrice))

comment = "Close Long - Fractal"

strategy.close("Long", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// SHORTS

// kumo breakout

if (short_entry and ta.crossunder(close, cloud_low) and tenkan < kijun and close < kijun and lagging_span_below_price_and_cloud and (not wait_for_twist or spanA < spanB))

comment = "Short - Kumo Breakout"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// tk cross below cloud

if (short_entry and close < cloud_low and ta.crossunder(tenkan, kijun) and lagging_span_below_price_and_cloud and (not wait_for_twist or spanA < spanB))

comment = "Short - TK Cross"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// kumo twist

if (short_entry and close < cloud_low and tenkan < kijun and lagging_span_below_price_and_cloud and ta.crossunder(spanA, spanB))

comment = "Short - Kumo Twist"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)

// close inside cloud

if (ta.crossover(close, cloud_low))

comment = "Close Short - Close inside cloud"

strategy.close("Short", comment = comment)

alert(comment, alert.freq_once_per_bar)

// bullish tk cross

if (ta.crossover(tenkan, kijun))

comment = "Close Short - TK Cross"

strategy.close("Short", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossover(high, upFractalPrice))

comment = "Close Short - Fractal"

strategy.close("Short", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// BULL EDGE TO EDGE

if (e2e_entry and e2e_entry_tk_confluence and ta.crossover(close, cloud_low) and tenkan > kijun and open > kijun and cloud_thickness > min_cloud_thickness)

comment = "Long e2e"

strategy.entry("Long e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (e2e_entry and not e2e_entry_tk_confluence and ta.crossover(close, cloud_low) and open > kijun and cloud_thickness > min_cloud_thickness)

comment = "Long e2e"

strategy.entry("Long e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.cross(high, cloud_high))

comment = "Close Long e2e - Target Hit"

strategy.close("Long e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.crossunder(close, cloud_low))

comment = "Close Long e2e - Close below cloud"

strategy.close("Long e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossunder(low, downFractalPrice))

comment = "Close Long e2e - Fractal"

strategy.close("Long e2e", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// BEAR EDGE TO EDGE

if (e2e_entry and e2e_entry_tk_confluence and ta.crossunder(close, cloud_high) and tenkan < kijun and open < kijun and cloud_thickness > min_cloud_thickness)

comment = "Short e2e"

strategy.entry("Short e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (e2e_entry and not e2e_entry_tk_confluence and ta.crossunder(close, cloud_high) and open < kijun and cloud_thickness > min_cloud_thickness)

comment = "Short e2e"

strategy.entry("Short e2e", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.cross(low, cloud_low))

comment = "Close Short e2e - Target Hit"

strategy.close("Short e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (ta.crossover(close, cloud_high))

comment = "Close Short e2e - Close below cloud"

strategy.close("Short e2e", comment = comment)

alert(comment, alert.freq_once_per_bar)

if (close_on_fractal and ta.crossover(high, upFractalPrice))

comment = "Close Short e2e - Fractal"

strategy.close("Short e2e", comment = comment, qty_percent = fractal_close_percentage)

alert(comment, alert.freq_once_per_bar)

// Kijun Bounce

if (bounce_entry and long_entry and open > cloud_high and open > kijun and ta.crossunder(low, kijun) and close > kijun and tenkan > kijun and kijun > cloud_high and lagging_span_above_price_and_cloud)

comment = "Long - Kijun Bounce"

strategy.entry("Long", strategy.long, comment = comment)

alert(comment, alert.freq_once_per_bar)

if (bounce_entry and short_entry and open < cloud_low and open < kijun and ta.crossover(high, kijun) and close < kijun and tenkan < kijun and kijun < cloud_low and lagging_span_below_price_and_cloud)

comment = "Short - Kijun Bounce"

strategy.entry("Short", strategy.short, comment = comment)

alert(comment, alert.freq_once_per_bar)