概述

动量绝对值指标策略是基于Tushar Chande开发的动量指标CMO的改进版本。该策略通过计算价格的绝对动量值,判断市场目前是否处于超买或超卖状态,以捕捉市场中期的价格波动。

策略原理

该策略的核心指标是经过改进的CMO指标,称为AbsCMO。AbsCMO的计算公式为:

AbsCMO = abs(100 * (最新收盘价 - Length周期前的收盘价) / (Length周期内价格波动绝对值的简单移动平均 * Length))

其中,Length代表平均期间长度。AbsCMO值区间为0至100。该指标结合了动量方向性和强度 monumentality,能清晰判断市场中期趋势和超买超卖区域。

当AbsCMO上穿指定的上轨(默认70)时,表示市场步入超买,做空;当AbsCMO下穿指定的下轨(默认20)时,表示市场步入超卖,做多。

优势分析

与其他动量指标相比,AbsCMO指标具有如下优势:

- 反映价格绝对动量,判断市场中期趋势更加准确;

- 结合方向性和强度,识别超买超卖更为明确;

- 限定范围在0-100,更适合多个品种之间比较;

- 对于短期剧烈波动不敏感,反应市场中期趋势;

- 可自定义参数,适应性强。

风险分析

该策略主要存在以下风险:

- 中期指标,对短期波动反应不够灵敏;

- 默认参数可能不适合全部品种,需要优化;

- 长期持仓可能带来较大的回撤。

可以通过适当缩短持仓周期,优化参数,或与其他指标组合使用来减少风险。

优化方向

该策略可从以下几个方面进行优化:

- 优化AbsCMO的参数,适应更多品种;

- 结合其他指标过滤假信号;

- 制定止损和止盈规则,控制风险;

- 结合深度学习等技术寻找更佳入场点。

总结

动量绝对值指标策略整体来说是一个比较实用的中期交易策略。它反应价格中期绝对动量特性,判断市场中期趋势的判断力较强。但该策略对短期剧烈波动不敏感,存在一定的风险。通过参数优化、指标过滤、止损机制等进一步完善,可以使该策略的实盘表现更加稳定可靠。

策略源码

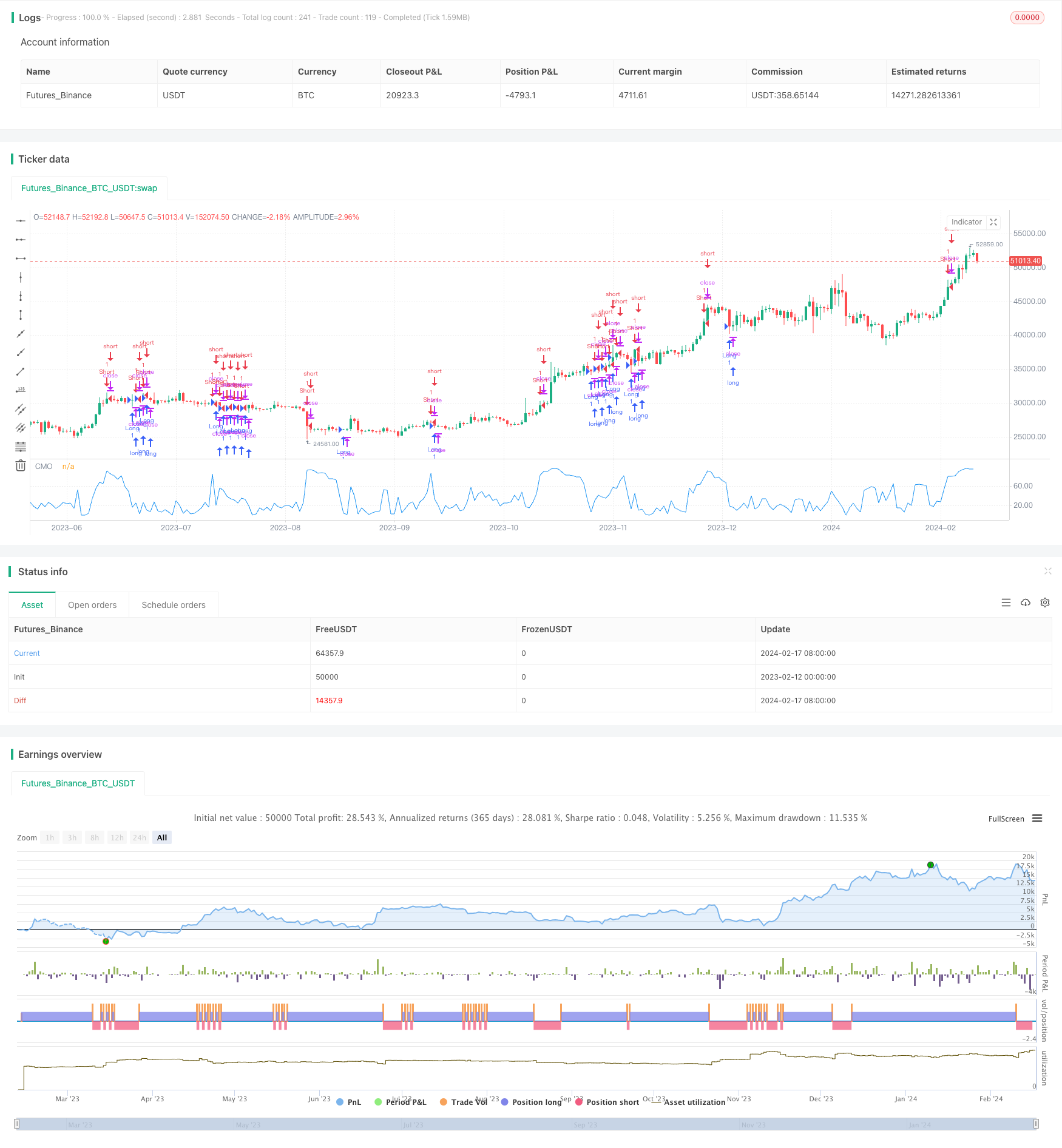

/*backtest

start: 2023-02-12 00:00:00

end: 2024-02-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 17/02/2017

// This indicator plots the absolute value of CMO. CMO was developed by Tushar

// Chande. A scientist, an inventor, and a respected trading system developer,

// Mr. Chande developed the CMO to capture what he calls "pure momentum". For

// more definitive information on the CMO and other indicators we recommend the

// book The New Technical Trader by Tushar Chande and Stanley Kroll.

// The CMO is closely related to, yet unique from, other momentum oriented indicators

// such as Relative Strength Index, Stochastic, Rate-of-Change, etc. It is most closely

// related to Welles Wilder`s RSI, yet it differs in several ways:

// - It uses data for both up days and down days in the numerator, thereby directly

// measuring momentum;

// - The calculations are applied on unsmoothed data. Therefore, short-term extreme

// movements in price are not hidden. Once calculated, smoothing can be applied to

// the CMO, if desired;

// - The scale is bounded between +100 and -100, thereby allowing you to clearly see

// changes in net momentum using the 0 level. The bounded scale also allows you to

// conveniently compare values across different securities.

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="CMOabs", shorttitle="CMOabs")

Length = input(9, minval=1)

TopBand = input(70, minval=1)

LowBand = input(20, minval=0)

reverse = input(false, title="Trade reverse")

// hline(0, color=gray, linestyle=dashed)

// hline(TopBand, color=red, linestyle=line)

// hline(LowBand, color=green, linestyle=line)

xMom = abs(close - close[1])

xSMA_mom = sma(xMom, Length)

xMomLength = close - close[Length]

nRes = abs(100 * (xMomLength / (xSMA_mom * Length)))

pos = iff(nRes > TopBand, -1,

iff(nRes < LowBand, 1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(nRes, color=blue, title="CMO")