概述

本策略综合利用了RSI指标识别超买超卖信号,布林带判断价格突破进行操作,以及均线的金叉死叉形态,从而在趋势的不同阶段对市场进行判断,实现盈利。

策略原理

该策略主要由以下几部分指标组成:

RSI指标:当RSI指标线上穿过设定的超买线或者下穿超卖线时,进行相应的做多或者做空操作。

布林带:当价格突破布林带上轨时,进行做空操作;当价格跌破布林带下轨时,进行做多操作。

均线:计算一定周期(如5周期)内的最高价和最低价,当价格高于最近5周期的最高点时,做多;当价格低于最近5周期的最低点时,做空。

MACD:计算快线,慢线和MACD线的金叉死叉,作为辅助判断指标。

这几个指标相互结合,在趋势行情中,利用布林带判断价格突破和回归中轴的时间点;在盘整行情中,利用均线判断突破来抓取趋势转换点;在超买超卖行情中,利用RSI指标的极值区域判断来实现逆向操作。

优势分析

该策略具有以下几个优势:

多指标组合,判断精确。RSI,布林带,均线等指标相互验证,使得交易信号更加可靠。

适合不同行情。趋势行情利用布林带,盘整行情利用均线,超买超卖行情利用RSI,多种行情都能应对。

操作频率适中。指标参数设置较为谨慎,避免过于频繁交易。

程序结构清晰。代码编写规范,容易读懂和二次开发。

风险分析

该策略也存在一些风险:

参数设置风险。指标参数设置不当可能导致交易信号错误。需要反复测试优化参数。

多头空头切换风险。在行情转折点多头空头切换可能比较频繁,交易成本会加大。可以适当调整持仓时间。

编程实现风险。代码中可能存在一些难以发现的逻辑错误,导致异常交易。需要完善异常处理和日志记录。

优化方向

该策略还可以从以下几个方向进行优化:

增加止损策略,以锁定利润,减少亏损。

结合交易量指标,避免虚假信号。例如突破布林带时检查交易量。

增加机器学习算法,利用历史数据训练,自动优化参数。

增加图形化展示,能直观显示策略表现。

进行回测优化,选择最佳参数组合。

总结

本策略综合运用了均线、布林带、RSI等多个指标,通过指标组合判断,形成交易信号。策略优势是适应性强,判断精确;风险主要在参数设定和程序实现,需要不断优化测试。接下来将持续完善该策略,增加止损机制,利用机器学习训练最佳参数,并开发图形化界面,完善监控和异常处理功能。

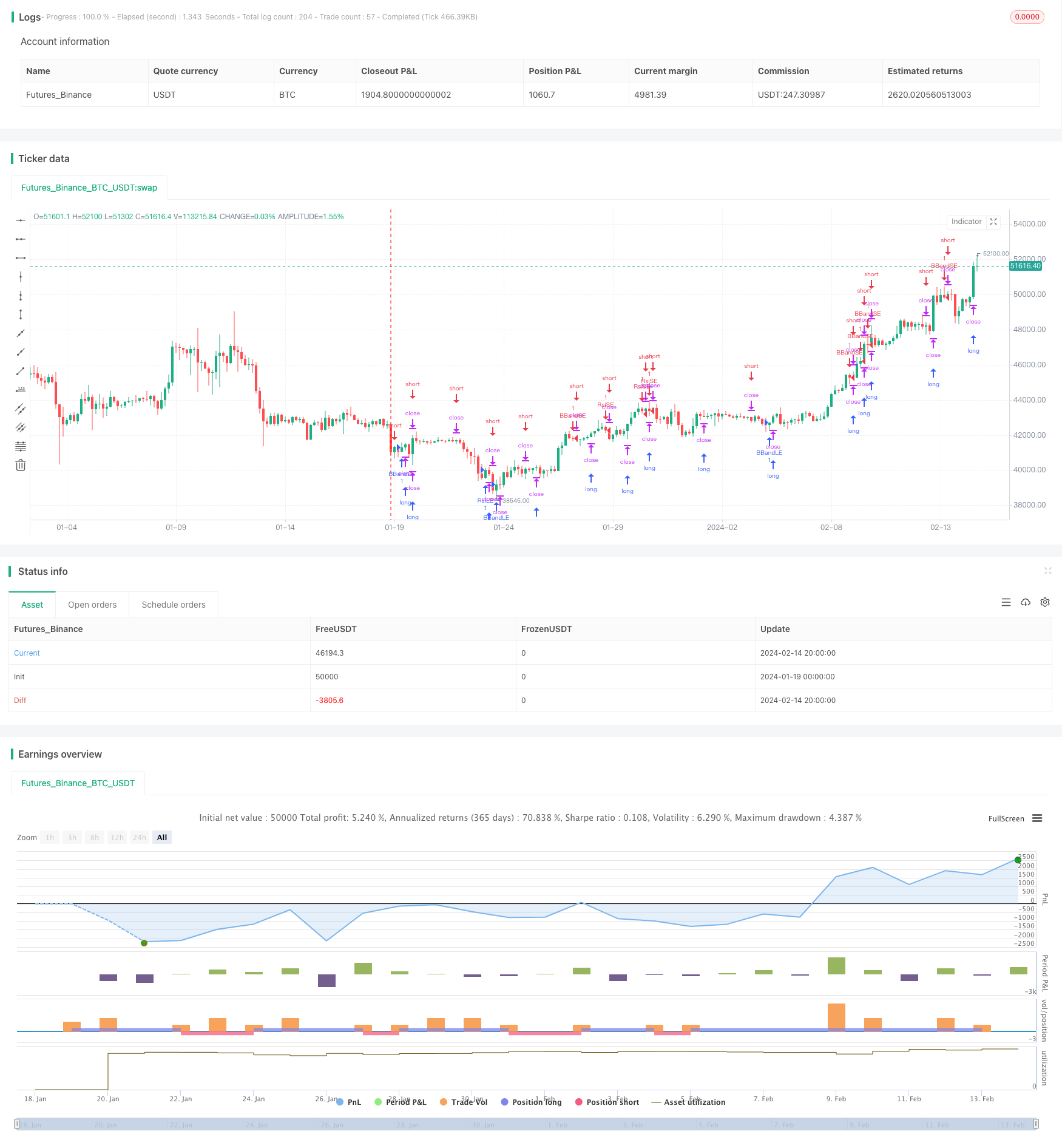

/*backtest

start: 2024-01-19 00:00:00

end: 2024-02-15 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("MD strategy", overlay=true)

lengthrsi = input( 14 )

overSold = input( 30 )

overBought = input( 70 )

price = close

source = close

lengthbb = input(20, minval=1)

mult = input(2.0, minval=0.001, maxval=50)

direction = input(0, title = "Strategy Direction",minval=-1, maxval=1)

fastLength = input(12)

slowlength = input(26)

MACDLength = input(9)

consecutiveBarsUp = input(3)

consecutiveBarsDown = input(3)

lengthch = input( minval=1, maxval=1000, defval=5)

upBound = highest(high, lengthch)

downBound = lowest(low, lengthch)

ups = price > price[1] ? nz(ups[1]) + 1 : 0

dns = price < price[1] ? nz(dns[1]) + 1 : 0

MACD = ema(close, fastLength) - ema(close, slowlength)

aMACD = ema(MACD, MACDLength)

delta = MACD - aMACD

strategy.risk.allow_entry_in(direction == 0 ? strategy.direction.all : (direction < 0 ? strategy.direction.short : strategy.direction.long))

basis = sma(source, lengthbb)

dev = mult * stdev(source, lengthbb)

upper = basis + dev

lower = basis - dev

vrsi = rsi(price, lengthrsi)

if (not na(vrsi))

if (crossover(vrsi, overSold))

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

if (crossunder(vrsi, overBought))

strategy.entry("RsiSE", strategy.short, comment="RsiSE")

if (crossover(source, lower))

strategy.entry("BBandLE", strategy.long, stop=lower, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if (crossunder(source, upper))

strategy.entry("BBandSE", strategy.short, stop=upper, oca_name="BollingerBands", comment="BBandSE")

else

strategy.cancel(id="BBandSE")

if (not na(close[lengthch]))

strategy.entry("ChBrkLE", strategy.long, stop=upBound + syminfo.mintick, comment="ChBrkLE")

strategy.entry("ChBrkSE", strategy.short, stop=downBound - syminfo.mintick, comment="ChBrkSE")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)