概述

双动能均线交易策略是一种联合使用OTT指标和Wavetrend振荡器指标的策略。它结合使用Anıl Özekşi老师开发的OTT指标和lonestar108的Wavetrend振荡器指标,形成一个成功的交易指标。该策略可以在双向市场中进行做多做空操盘。

策略原理

双动能均线交易策略首先计算布林带中轨,也就是移动平均线MAvg。然后根据用户设定的百分比范围和周期,计算出长停损位longStop和短停损位shortStop。当价格突破上轨时做多,突破下轨时做空。关闭信号是价格重新回到均线附近。

具体来说,该策略的核心指标是OTT指标。OTT指标由均线和边界线组成,是根据一定算法根据市场波动程度调整边界线的位置。当价格跌破下边界线OTT时,做空;当价格涨破上边界线OTT时,做多。

该策略同时使用Wavetrend指标判断价格趋势方向,如果判断为向下的趋势,则只做空不做多;如果判断为向上的趋势,则只做多不做空。

优势分析

双动能均线交易策略结合了移动平均线、布林带和OTT指标的优点,可以自动调整止损位置,降低了止损被激活的概率。同时结合趋势判断指标,避免在震荡趋势中被套。

具体来说,该策略的主要优势有:

- 可以自动调整止损位,有效控制风险

- OTT指标可以比较准确地判断反转点位

- 结合趋势判断指标,避免震荡市场的套牢

- 规则相对简单清晰,容易理解运用

风险分析

双动能均线交易策略也存在一定的风险,主要集中在以下几个方面:

- 在剧烈行情中,止损线可能被突破,造成较大的亏损

- OTT指标判断的反转信号不一定准确,可能发生故障信号

- 趋势判断也可能发生错误,在震荡向下中做多亏损

- 参数设置不当也会影响策略效果

对策方式主要是:

- 适当放宽止损幅度,确保止损线不会轻易被激活

- 结合其他指标判断OTT信号的可靠性,避免假信号

- 适当调整参数,使趋势判断更加可靠

- 优化参数,找到最佳参数组合

优化方向

双动能均线交易策略仍有进一步优化的空间:

- 可以考虑与其他指标结合,提高信号判断的准确性

- 可以研究自适应止损算法,使止损线可以根据市场波动程度进行调整

- 可以加入交易量指标,避免低量的假突破

- 可以测试不同的移动平均线种类,找到最匹配的均线

- 可以尝试机器学习等方法自动优化参数

总结

双动能均线交易策略整合了多种指标的优点,可以自动调整止损位,判断反转信号,识别趋势方向。它具有风险控制能力强,容易理解使用等优势。但也存在被套、信号不准等风险。该策略可以进一步优化,与其他指标组合使用,研究自适应算法等。总体来说,双动能均线交易策略是一种实用的突破类交易策略。

策略源码

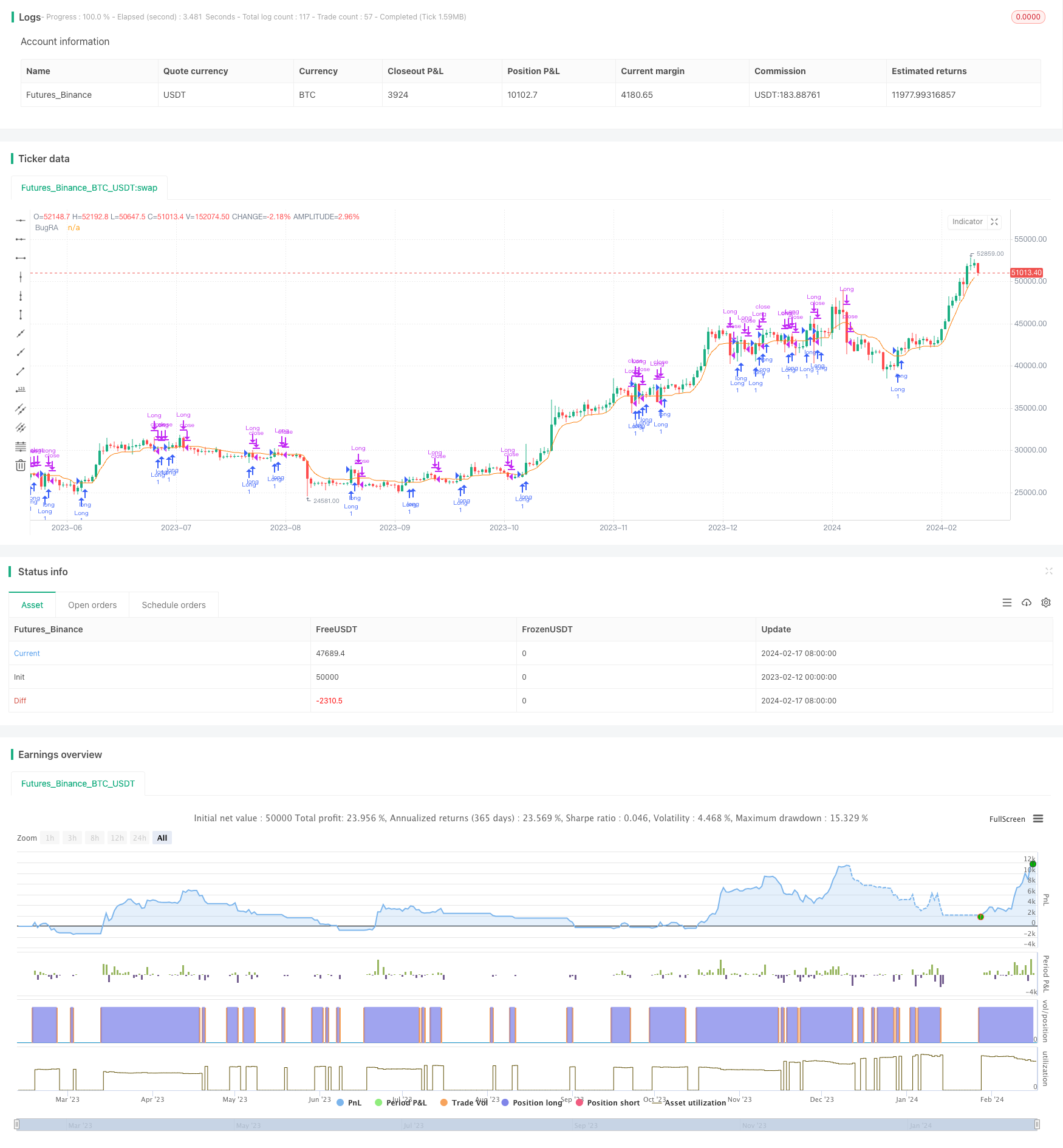

/*backtest

start: 2023-02-12 00:00:00

end: 2024-02-18 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Bugra trade strategy", shorttitle="Bugra trade strategy", overlay=true)

// Kullanıcı Girdileri

length = input(5, title="Period", minval=1)

percent = input(1, title="Sihirli Yüzde", type=input.float, step=0.1, minval=0)

mav = input(title="Hareketli Ortalama Türü", defval="VAR", options=["SMA", "EMA", "WMA", "TMA", "VAR", "WWMA", "ZLEMA", "TSF"])

wt_n1 = input(10, title="Kanal Periyodu")

wt_n2 = input(21, title="Averaj Uzunluğu")

src = close

// Tarih Aralığı Girdileri

startDate = input(20200101, title="Başlangıç Tarihi (YYYYMMDD)")

endDate = input(20201231, title="Bitiş Tarihi (YYYYMMDD)")

// Tarih Filtresi Fonksiyonu

isDateInRange() => true

// Özel Fonksiyonlar

Var_Func(src, length) =>

valpha = 2 / (length + 1)

vud1 = src > src[1] ? src - src[1] : 0

vdd1 = src < src[1] ? src[1] - src : 0

vUD = sum(vud1, length)

vDD = sum(vdd1, length)

vCMO = (vUD - vDD) / (vUD + vDD)

varResult = 0.0

varResult := nz(valpha * abs(vCMO) * src + (1 - valpha * abs(vCMO)) * nz(varResult[1]))

varResult

Wwma_Func(src, length) =>

wwalpha = 1 / length

wwma = 0.0

wwma := wwalpha * src + (1 - wwalpha) * nz(wwma[1])

wwma

Zlema_Func(src, length) =>

zxLag = floor(length / 2)

zxEMAData = src + (src - src[zxLag])

zlema = ema(zxEMAData, length)

zlema

Tsf_Func(src, length) =>

lrc = linreg(src, length, 0)

lrs = lrc - linreg(src, length, 1)

tsf = lrc + lrs

tsf

getMA(src, length) =>

ma = mav == "SMA" ? sma(src, length) :

mav == "EMA" ? ema(src, length) :

mav == "WMA" ? wma(src, length) :

mav == "TMA" ? sma(sma(src, ceil(length / 2)), floor(length / 2) + 1) :

mav == "VAR" ? Var_Func(src, length) :

mav == "WWMA" ? Wwma_Func(src, length) :

mav == "ZLEMA" ? Zlema_Func(src, length) :

mav == "TSF" ? Tsf_Func(src, length) : na

// Strateji Hesaplamaları

MAvg = getMA(src, length)

fark = MAvg * percent * 0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir==1 ? longStop: shortStop

OTT = MAvg > MT ? MT*(200+percent)/200 : MT*(200-percent)/200

plot(OTT, title="BugRA", color=color.rgb(251, 126, 9))

// Alım ve Satım Koşulları

longCondition = crossover(src, OTT) and isDateInRange()

shortCondition = crossunder(src, OTT) and isDateInRange()

// Strateji Giriş ve Çıkış Emirleri

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.close("Long")