概述

该策略是一种swing策略,适用于像加密货币和股票这样的趋势性市场,使用较大的时间框架,如8小时。该策略使用包括SMA、EMA、VWMA、ALMA、SMMA、LSMA和VWMA在内的多种移动平均线,分别应用于高点和低点,形成两个平均线通道。

当收盘价高于应用于高点的平均线时做多;当收盘价低于应用于低点的平均线时做空。

策略原理

该策略使用7种不同的移动平均线指标,包括SMA、EMA、VWMA、ALMA、SMMA、LSMA和VWMA。这些移动平均线分别应用于K线的最高价和最低价,生成两条平均线。

应用于最高价的平均线被称为avg_high,应用于最低价的平均线被称为avg_low。这两条平均线构成一个通道。

当收盘价大于avg_high时,做多;当收盘价低于avg_low时,做空。

做多时,止损线为avg_low,止盈线为开仓价(1+tp_long);做空时,止损线为avg_high,止盈线为开仓价(1-tp_short)。

优势分析

该策略最大的优势在于利用多种移动平均线指标提高获利概率。不同周期和计算方式的移动平均线指标对价格的反应速度不同,结合使用可以形成更为可靠的交易信号。

另一个优势是采用通道方式交易。上下通道限制了止损范围,降低了风险,更适合swing策略。

风险分析

该策略主要面临两方面的风险:

多种移动平均线指标组合使用,参数设置较为复杂,需要大量测试和优化来找到最佳参数组合。

在横盘和无明确趋势的市场中,该策略容易产生亏损和多次无效突破的交易信号。

为降低这些风险,需要选择趋势明显的交易品种,同时对参数组合进行大量回测和优化,找到最适合当前市场状况的参数设置。

优化方向

该策略还需要从以下几个方面进行优化:

测试更多种类的移动平均线,寻找更好的组合。可以考虑SMA、EMA、KAMA、TEMA等。

对移动平均线长度和通道宽度进行参数优化,找到最佳参数设置。

测试不同的止盈止损设置。可以考虑trailing stop或动态止损等方式。

结合趋势判断指标,避免无明确趋势的市场中频繁交易。例如ADX,ATR等。

优化 entry 和 exit 逻辑,设置额外 filter 条件,减少无效交易。

总结

该策略通过多种移动平均线指标提高获利概率,采用上下通道方式降低风险,是一种swing趋势跟踪策略。该策略适用于趋势性明显的交易品种,在参数优化后效果较好。但市场转折时容易承受较大亏损,需要进一步优化以降低风险。

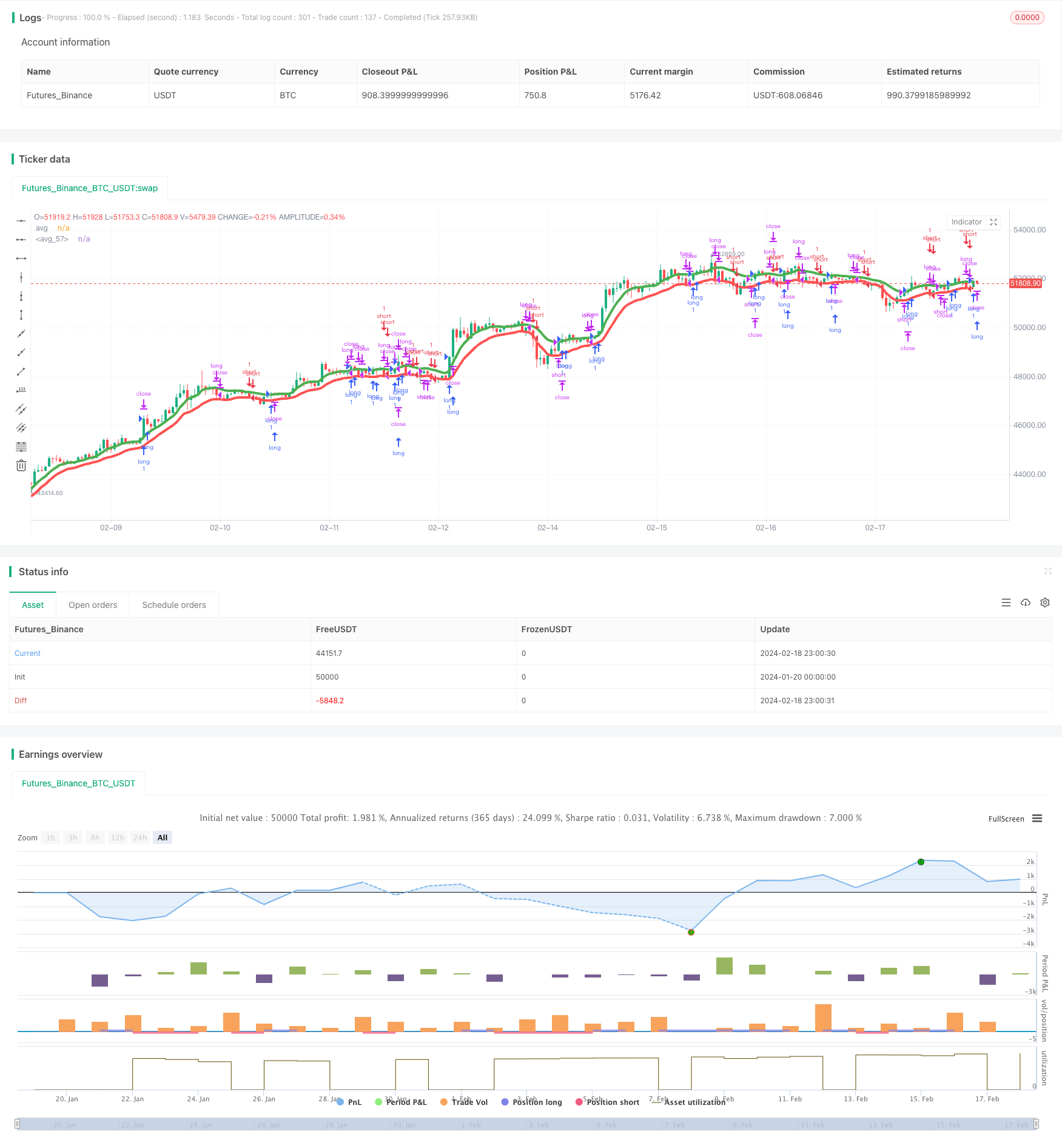

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © exlux99

//@version=4

strategy(title="High/Low channel swing", shorttitle="Multi MA swing", overlay=true)

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2000, title = "From Year", minval = 1970)

//monday and session

// To Date Inputs

toDay = input(defval = 31, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 12, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2021, title = "To Year", minval = 1970)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = true

//////

length_ma= input(defval=12, title="Length Moving averages", minval=1)

////////////////////////////////SETUP///////////////////////////////////////////

sma_high = sma(high, length_ma)

ema_high = ema(high, length_ma)

wma_high = wma(high, length_ma)

alma_high = alma(high,length_ma, 0.85, 6)

smma_high = rma(high,length_ma)

lsma_high = linreg(high, length_ma, 0)

vwma_high = vwma(high,length_ma)

avg_high = (sma_high+ema_high+wma_high+alma_high+smma_high+lsma_high+vwma_high)/7

///////////////////////////////////////////

sma_low = sma(low, length_ma)

ema_low = ema(low, length_ma)

wma_low = wma(low, length_ma)

alma_low = alma(low,length_ma, 0.85, 6)

smma_low = rma(low,length_ma)

lsma_low = linreg(low, length_ma, 0)

vwma_low = vwma(low,length_ma)

avg_low = (sma_low+ema_low+wma_low+alma_low+smma_low+lsma_low+vwma_low)/7

////////////////////////////PLOTTING////////////////////////////////////////////

plot(avg_high , title="avg", color=color.green, linewidth = 4)

plot(avg_low , title="avg", color=color.red, linewidth = 4)

long= close > avg_high

short = close < avg_low

tplong=input(0.06, title="TP Long", step=0.01)

sllong=input(0.05, title="SL Long", step=0.01)

tpshort=input(0.045, title="TP Short", step=0.01)

slshort=input(0.05, title="SL Short", step=0.01)

if(time_cond)

strategy.entry("long",1,when=long)

strategy.exit("closelong", "long" , profit = close * tplong / syminfo.mintick, loss = close * sllong / syminfo.mintick, alert_message = "closelong")

strategy.close("long", when=crossunder(low,avg_low))

strategy.entry("short",0,when=short)

strategy.exit("closeshort", "short" , profit = close * tpshort / syminfo.mintick, loss = close * slshort / syminfo.mintick, alert_message = "closeshort")

strategy.close("short",when=crossover(high,avg_high))