概述

三色交叉趋势追踪策略是一种基于K线形态的趋势追踪交易策略。该策略通过识别特定的三色K线形态来判断当前趋势的方向,并在识别到形态时选择性地进行做多或做空。

策略原理

该策略的核心逻辑是:连续出现三根同色K线(三根红色或三根绿色),然后反转为一根不同颜色的K线,最后再反转回原先三根K线的颜色时,说明原先的趋势正在持续,因此在这个时候进行追踪入场。

具体来说,策略通过检测最近五根K线的情况来判断是否符合入场条件。如果最近五根K线为:第五根K线低点低于前一根低点(若做多则判断高点高于前一根高点),第四根为阳线(若做多则为阴线),第三根为阴线(若做多则为阳线),第二根为阴线(若做多则为阳线),第一根为阴线(若做多则为阳线),那么就进行做空追踪;相反,如果最近五根K线为:第五根K线高点高于前一根高点,第四根为阴线,第三根为阳线,第二根为阳线,第一根为阳线,那么就进行做多追踪。通过这种特定K线形态的判断,可以在趋势持续时获取额外利润。

策略优势

- 利用K线形态判断趋势方向,容易操作

- 可以在趋势持续阶段获利

- 策略规则简单清晰

策略风险

- K线形态判断错误可能导致损失

- 无法判断趋势反转点,可能顺势亏损

- 可能频繁打开头寸,增加交易成本

策略优化方向

- 结合其他指标判断K线形态的可靠性

- 设置止损点,控制单笔亏损

- 优化开仓条件,降低错误判断概率

- 考虑调整仓位大小,降低风险

总结

三色交叉趋势追踪策略通过识别特定K线形态来判断当前趋势方向,在趋势持续时选择性地打开仓位。该策略简单清晰,易于操作,能够在趋势阶段获得额外收益。但也存在一定的风险,需要进一步优化以提高稳定性。总体来说,该策略为量化交易策略组合中一个有效的补充组成部分。

策略源码

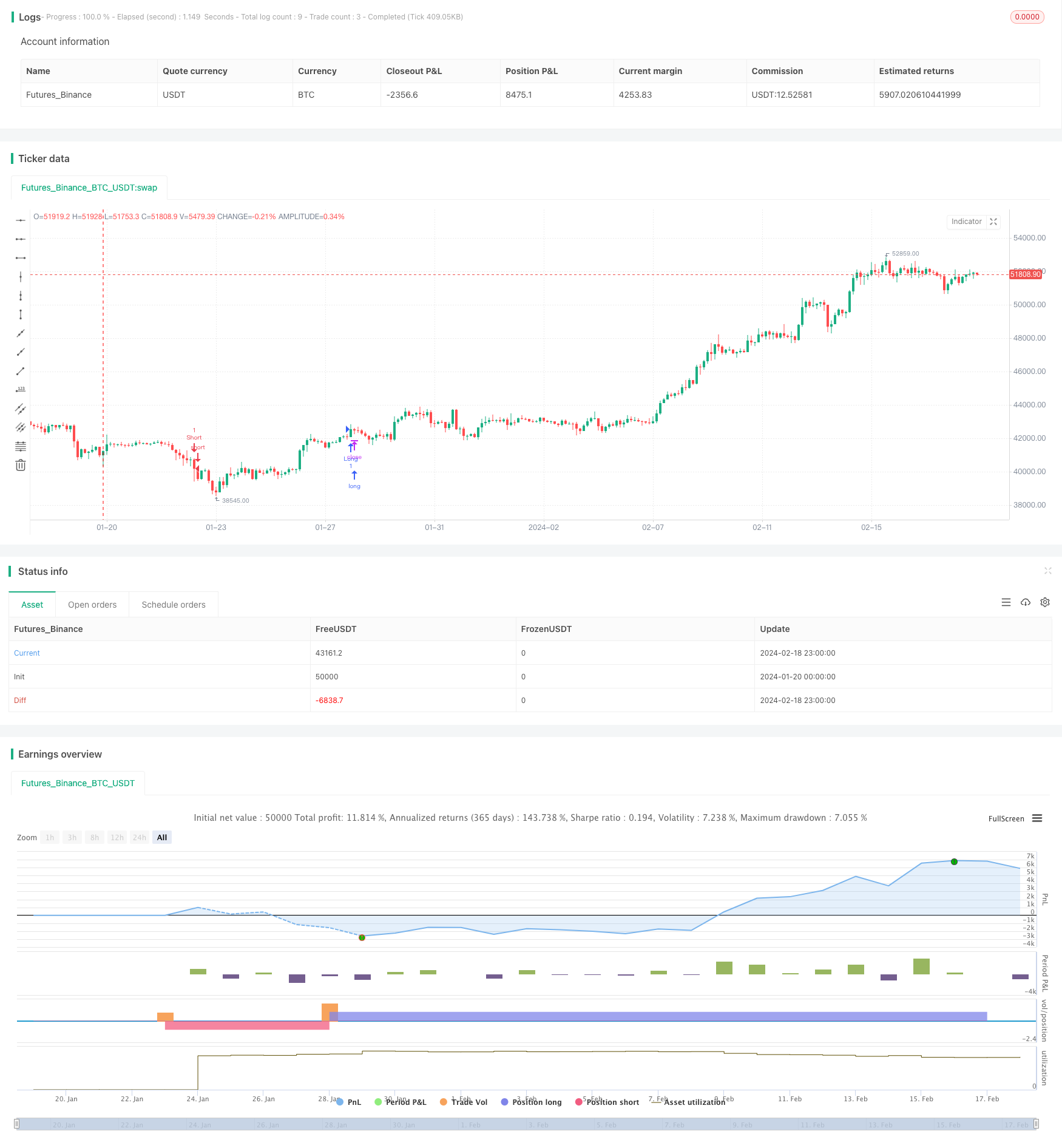

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © softinterface2000

//@version=5

strategy("3 Line Strick", overlay=true, margin_long=100, margin_short=100)

//Sell

fifth= close < low[1]

fourth= close[1] > open[1]

third= close[2] < open[2]

seccond= close[3] < open[3]

first= close[4] < open[4]

//Buy

fifth1= close > high[1]

fourth1= close[1] < open[1]

third1= close[2] > open[2]

second1= close[3] > open[3]

first1= close[4] > open[4]

longCondition = fifth1 and fourth1 and third1 and second1 and first1

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = fifth and fourth and third and seccond and first

if (shortCondition)

strategy.entry("Short", strategy.short)