概述

本策略的核心思想是利用枢轴点进行量化交易。它寻找重要的枢轴高点和低点,当价格突破这些关键点时,进行逆转交易。

策略原理

该策略首先定义了寻找枢轴高点和低点的函数pivotHighSig()和pivotLowSig()。这两个函数会在左侧和右侧寻找符合条件的枢轴点。

具体来说,对于枢轴高点,它会在左侧寻找连续多个更高的高点,在右侧寻找连续多个更低的高点。这样枢轴高点就处在一个相对更高的位置。枢轴低点的判断条件相反,它会在左右两侧寻找更高和更低的低点。

找到枢轴高低点后,策略会进一步挑选出枢轴的枢轴点,也就是枢轴点中的重要点。这通过定义枢轴高低点的多个历史变量如ph1,ph2等实现。

最后,当价格突破枢轴的枢轴点时,进行逆转交易。

策略优势

这种基于枢轴点的量化策略有以下几个优势:

- 利用了市场的支撑阻力区域,这些区域往往是价格反转的机会点

- 同时找重要的高点和低点,实现了多空双边交易

- 枢轴点是比较突出的 extremum 点,突破这样的点信号较强

- 利用枢轴的枢轴点,使信号更加可靠

风险及解决方法

该策略也存在一些风险:

- 误判枢轴点,导致错误信号。解决方法是调整左右区间参数,确保枢轴点识别更加准确。

- 突破假突破。解决方法是结合更多因素过滤信号,如量能,成交量等。

优化方向

这种策略还可以从以下几个方向进行优化:

- 增加止损策略,使策略更加稳定

- 结合更多指标进行信号过滤

- 开发反转PRED策略,利用ml进一步优化枢轴点预测

- 增加参数自适应功能

总结

本策略overall表现良好,核心思路是发现重要的枢轴点并在其突破时进行反转交易。通过进一步优化,这种策略可以获得更加稳定可靠的信号,从而获得良好的收益。

策略源码

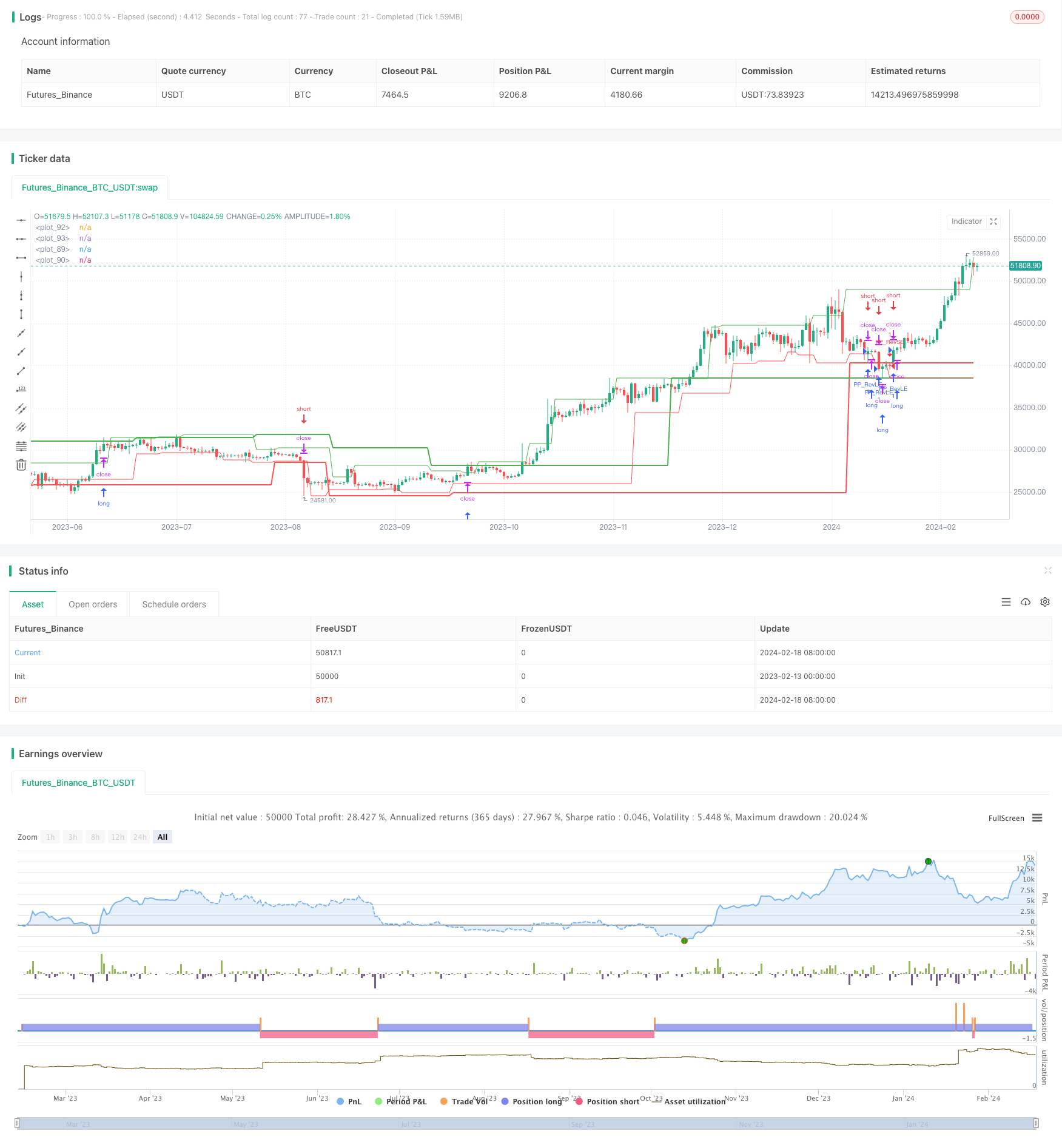

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Pivot of Pivot Reversal Strategy [QuantNomad]", shorttitle = "PoP Reversal Strategy [QN]", overlay=true)

// Inputs

leftBars = input(4, title = 'PP Left Bars')

rightBars = input(2, title = 'PP Right Bars')

atr_length = input(14, title = 'ATR Length')

atr_mult = input(0.1, title = 'ATR Mult')

// Pivot High Significant Function

pivotHighSig(left, right) =>

pp_ok = true

atr = atr(atr_length)

for i = 1 to left

if (high[right] < high[right+i] + atr * atr_mult)

pp_ok := false

for i = 0 to right-1

if (high[right] < high[i] + atr * atr_mult)

pp_ok := false

pp_ok ? high[right] : na

// Pivot Low Significant Function

pivotLowSig(left, right) =>

pp_ok = true

atr = atr(atr_length)

for i = 1 to left

if (low[right] > low[right+i] - atr * atr_mult)

pp_ok := false

for i = 0 to right-1

if (low[right] > low[i] - atr * atr_mult)

pp_ok := false

pp_ok ? low[right] : na

swh = pivotHighSig(leftBars, rightBars)

swl = pivotLowSig (leftBars, rightBars)

swh_cond = not na(swh)

hprice = 0.0

hprice := swh_cond ? swh : hprice[1]

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

swl_cond = not na(swl)

lprice = 0.0

lprice := swl_cond ? swl : lprice[1]

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

// Pivots of pivots

ph1 = 0.0

ph2 = 0.0

ph3 = 0.0

pl1 = 0.0

pl2 = 0.0

pl3 = 0.0

pphprice = 0.0

pplprice = 0.0

ph3 := swh_cond ? nz(ph2[1]) : nz(ph3[1])

ph2 := swh_cond ? nz(ph1[1]) : nz(ph2[1])

ph1 := swh_cond ? hprice : nz(ph1[1])

pl3 := swl_cond ? nz(pl2[1]) : nz(pl3[1])

pl2 := swl_cond ? nz(pl1[1]) : nz(pl2[1])

pl1 := swl_cond ? lprice : nz(pl1[1])

pphprice := swh_cond and ph2 > ph1 and ph2 > ph3 ? ph2 : nz(pphprice[1])

pplprice := swl_cond and pl2 < pl1 and pl2 < pl3 ? pl2 : nz(pplprice[1])

if (le)

strategy.entry("PP_RevLE", strategy.long, comment="PP_RevLE", stop=pphprice + syminfo.mintick)

if (se)

strategy.entry("PP_RevSE", strategy.short, comment="PP_RevSE", stop=pplprice - syminfo.mintick)

// Plotting

plot(lprice, color = color.red, transp = 55)

plot(hprice, color = color.green, transp = 55)

plot(pplprice, color = color.red, transp = 0, linewidth = 2)

plot(pphprice, color = color.green, transp = 0, linewidth = 2)