概述

双重反转动量策略通过结合价格反转信号和波动率反转信号,实现趋势交易。它主要基于123形态判断价格反转点,同时辅助采用Donchian通道波动率来过滤虚假信号。该策略适用于中长线持仓,通过双重反转过滤,可以有效抓住市场转折点,实现超额收益。

策略原理

价格反转部分采用123形态判断。该形态含义是前两根K线价格出现反向(上涨或下跌),第三根K线再次反转(下跌或上涨),因此称为123形态。当价格出现三根K线反转现象时,通常预示着短期趋势即将出现转折。为了进一步验证价格反转的可靠性,该策略还采用了随机指标判断,只有当随机指标也出现反转时(快线回落或快速上升),才会触发交易信号。

波动率反转部分采用Donchian通道波动率。Donchian通道主要反映价格的波动范围。当价格波动加大时,Donchian通道宽度也会扩大;当价格波动减小时,Donchian通道宽度也会收窄。Donchian通道波动率(宽度)可以有效衡量市场的波动程度和风险水平。该策略采用Donchian通道波动率的反转来过滤虚假信号,只有当波动率和价格同时反转时,才会发出交易信号,避免被迂回操作套住。

综上,该策略通过双重反转验证,既确保了交易信号的可靠性,也控制了风险,是一种相对稳健的趋势策略。

策略优势

- 双重过滤机制,确保交易信号可靠性,避免假断裂

- 控制风险,降低亏损概率

- 适合中长线持仓,避开市场Noise,抓住超额收益

- 参数优化空间大,可调整至最优状态

- 风格独特,与常见技术指标组合使用效果好

策略风险

- 依赖参数优化,参数不当会影响策略表现

- 止损策略还需进一步提升,最大回撤控制有待改进

- 交易频率可能偏低,无法适应高频算法交易

- 需选择合适品种和时间周期,适用范围有限

- 可采用机器学习等方式寻找最优参数

优化方向

- 增加自适应止损模块,可以大幅减少最大回撤

- 加入交易量指标,确保在高量突破时入场

- 优化参数以取得最佳稳定性

- 尝试不同品种和时间周期,寻找最佳适配环境

- 尝试与其它指标或策略组合,取得1+1>2的协同效应

总结

双重反转动量策略通过价格反转和波动率反转的双重验证,实现了较好的风险控制。相比单一指标,它过滤了大量噪声,稳定性更优。通过参数优化、止损模块增强、量能引入等手段,该策略可以进一步提升信号质量和收益稳定性。它适合作为股票、数字货币等中长线策略的组成部分,与其他模块合理搭配,可以获得良好超额收益。

策略源码

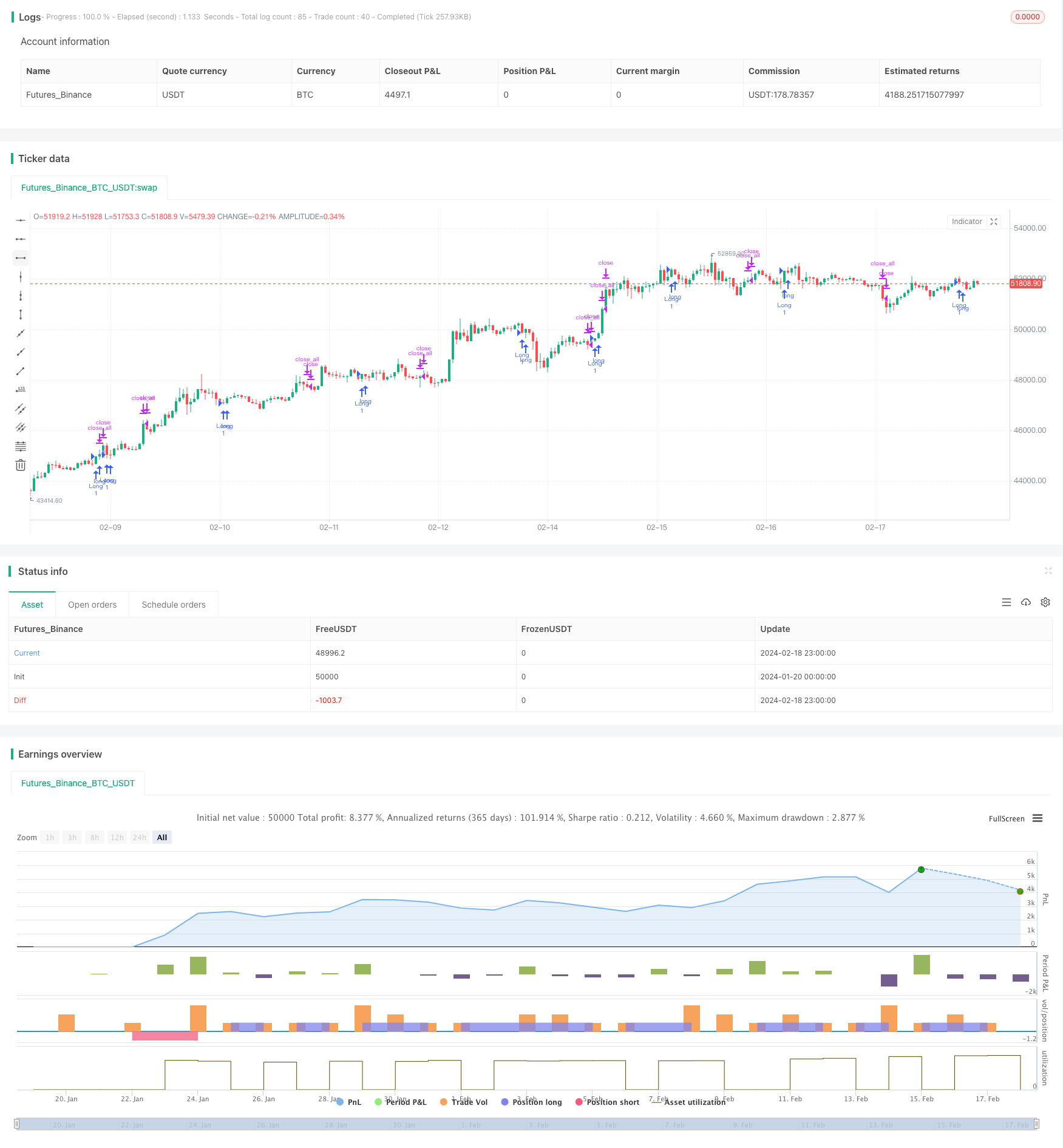

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 06/03/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Donchian Channel was developed by Richard Donchian and it could be compared

// to the Bollinger Bands. When it comes to volatility analysis, the Donchian Channel

// Width was created in the same way as the Bollinger Bandwidth technical indicator was.

//

// As was mentioned above the Donchian Channel Width is used in technical analysis to measure

// volatility. Volatility is one of the most important parameters in technical analysis.

// A price trend is not just about a price change. It is also about volume traded during this

// price change and volatility of a this price change. When a technical analyst focuses his/her

// attention solely on price analysis by ignoring volume and volatility, he/she only sees a part

// of a complete picture only. This could lead to a situation when a trader may miss something and

// lose money. Lets take a look at a simple example how volatility may help a trader:

//

// Most of the price based technical indicators are lagging indicators.

// When price moves on low volatility, it takes time for a price trend to change its direction and

// it could be ok to have some lag in an indicator.

// When price moves on high volatility, a price trend changes its direction faster and stronger.

// An indicator's lag acceptable under low volatility could be financially suicidal now - Buy/Sell signals could be generated when it is already too late.

//

// Another use of volatility - very popular one - it is to adapt a stop loss strategy to it:

// Smaller stop-loss recommended in low volatility periods. If it is not done, a stop-loss could

// be generated when it is too late.

// Bigger stop-loss recommended in high volatility periods. If it is not done, a stop-loss could

// be triggered too often and you may miss good trades.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

DCW(length, smoothe) =>

pos = 0.0

xUpper = highest(high, length)

xLower = lowest(low, length)

xDonchianWidth = xUpper - xLower

xSmoothed = sma(xDonchianWidth, smoothe)

pos := iff(xDonchianWidth > xSmoothed, -1,

iff(xDonchianWidth < xSmoothed, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Donchian Channel Width", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LengthDCW = input(20, minval=1)

SmootheSCW = input(22, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posDCW = DCW(LengthDCW, SmootheSCW)

pos = iff(posReversal123 == 1 and posDCW == 1 , 1,

iff(posReversal123 == -1 and posDCW == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )