概述

该策略是一个基于价格行动和短期趋势的仅买入策略。它使用多个指数移动平均线(EMA)作为买入和卖出的技术指标。

策略原理

该策略使用5日线、10日线、20日线、50日线、100日线和200日线六条EMA。它的买入信号是:

- 5日线上穿10日线

- 10日线上穿20日线

- 20日线上穿50日线

- 50日线上穿100日线

- 100日线上穿200日线

- 收盘价上穿5日线

当上述六个条件同时满足时,做多入场。

退出信号是收盘价下穿200日线时平仓。

优势分析

该策略具有以下优势:

- 使用六条EMA作为滤波器,能有效识别中短期趋势

- 多重EMA上的构型要求较高,可有效过滤假突破

- 收盘价的参与可避免假突破的风险

- 仅做多,避免做空的风险

- 退出机制比较保守,有利于获利了结

风险分析

该策略也存在一些风险:

- 多重EMA连续上穿的概率较低,容易错过机会

- 仅做多,无法利用下跌赚钱

- 震荡行情中容易被套

- 退出位置比较保守,可能放弃部分盈利

- 参数静态设置,不同品种和市场环境不适应

对应解决方法:

- 可根据市场情况适当减少EMA数量

- 可考虑结合CCI等指标引入做空机会

- 可设置移动止损或及时人工干预

- 可根据趋势品种调整参数

- 建议人工配合,根据市场调整参数

优化方向

该策略可从以下方面进行优化:

- 引入成交量指标,避免假突破

- 利用波动率指标优化参数

- 增加机器学习模型动态优化参数

- 增加突破 validation 机制

- 结合深度学习模型判断趋势

- 引入止损和止盈机制

总结

该策略整体来说是一个基于价格技术指标的中短期趋势追踪策略。它利用多重EMA滤波来识别趋势,并结合收盘价避免假突破。优点是策略思路简单清晰,容易理解实现,可根据市场环境人工调节参数。缺点是机会较少,容易被套。建议作为辅助决策工具,与人工结合使用。可从成交量、参数优化、机器学习等方面进行扩展,使策略更具鲁棒性。

策略源码

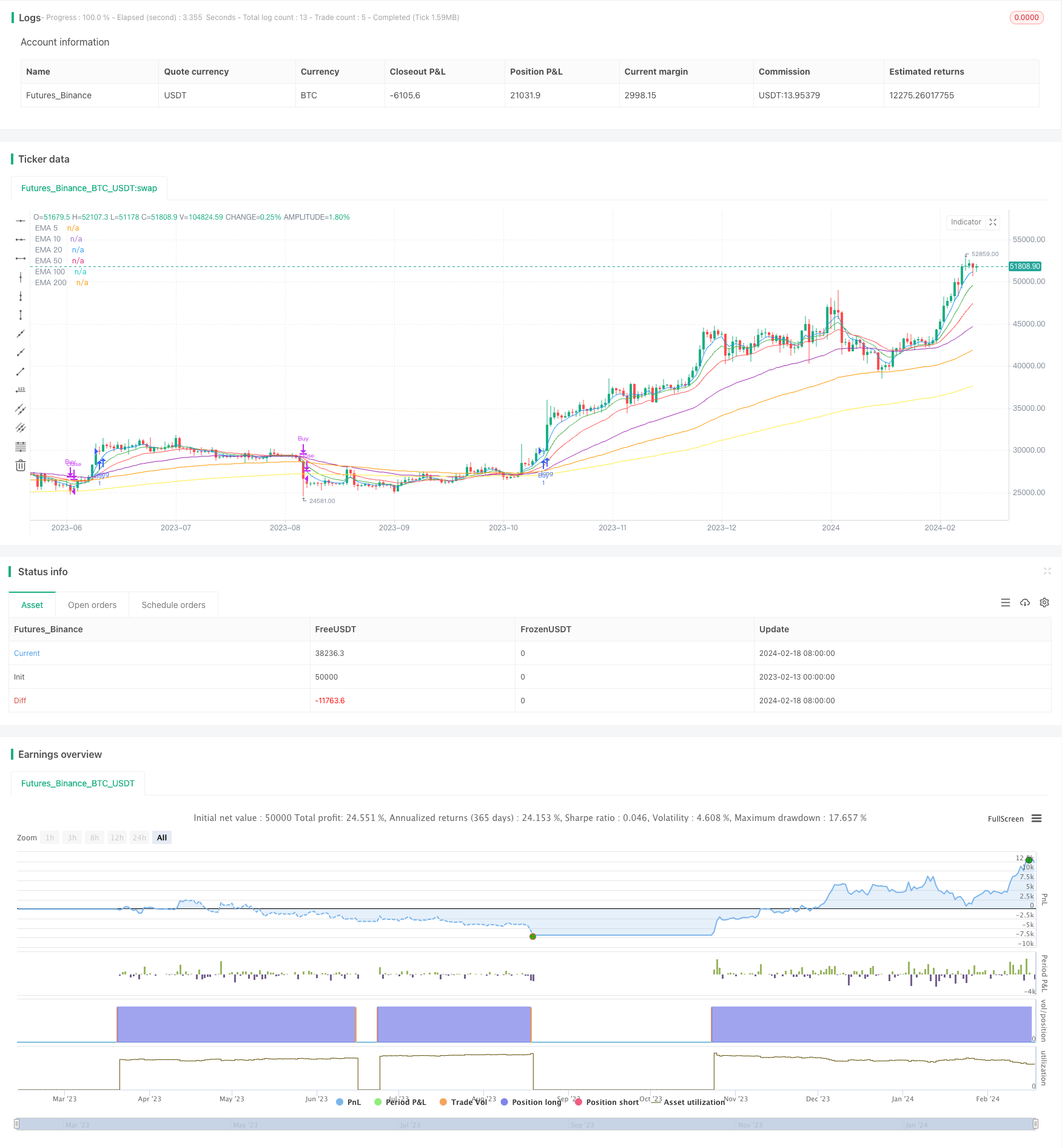

/*backtest

start: 2023-02-13 00:00:00

end: 2024-02-19 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Multiple EMA Buy Strategy with Price Condition", overlay=true)

// Calculate EMAs

ema5 = ta.ema(close, 5)

ema10 = ta.ema(close, 10)

ema20 = ta.ema(close, 20)

ema50 = ta.ema(close, 50)

ema100 = ta.ema(close, 100)

ema200 = ta.ema(close, 200)

// Plot EMAs

plot(ema5, color=color.blue, title="EMA 5")

plot(ema10, color=color.green, title="EMA 10")

plot(ema20, color=color.red, title="EMA 20")

plot(ema50, color=color.purple, title="EMA 50")

plot(ema100, color=color.orange, title="EMA 100")

plot(ema200, color=color.yellow, title="EMA 200")

// Entry conditions

buy_condition = ema5 > ema10 and ema10 > ema20 and ema20 > ema50 and ema50 > ema100 and ema100 > ema200 and close > ema5

// Exit conditions

exit_condition = close < ema200

// Strategy entry and exit conditions

strategy.entry("Buy", strategy.long, when = buy_condition)

strategy.close("Buy", when = exit_condition)