概述

该策略是一个突破交易系统,它主要基于价格的突破来进行买入和卖出操作。该系统使用布林带指标来确定突破的价格区域。当价格从布林带的下轨向上突破时,进行买入操作;当价格从布林带的中轨或下轨向下突破时,进行卖出操作。

策略原理

该策略使用布林带指标来确定价格的突破区域。布林带由一个n天的简单移动平均线及其标准差的乘数所构成。在这里,我们计算了20天的最高价和最低价的均线来确定布林带的上轨和下轨,以及计算上轨和下轨的平均值作为基线。

当收盘价从下轨向上突破时,表明价格开始进入涨势,这是一个买入信号。当收盘价从中轨或下轨向下突破时,表明涨势结束,需要卖出头寸。该策略利用了价格突破继续向上或向下运行的特性来获利。

优势分析

- 该策略利用价格的趋势性和惯性来获利,这与市场的本质特征相一致

- 使用布林带指标,可以清晰地看到价格的突破口

- 策略逻辑简单清晰,容易理解和修改

- 可设定止损条件,控制风险

风险分析

- 布林带并不能完全预测价格行为,价格可能会有剧烈波动

- 突破信号可能是错误的,从而导致交易亏损

- 单纯依靠价格的突破来决定交易时机,容易受到市场噪音的影响

对策:

- 结合其他指标来确认突破信号

- 适当调整参数,确保突破信号有效

- 设置止损来控制单笔亏损

优化方向

- 可以测试不同参数下的表现,选择最优参数

- 可以结合其他指标来过滤假突破,例如交易量

- 可以结合趋势和反转策略,在不同市场环境中进行交易

- 可以根据不同品种的参数设置进行优化

- 可以结合机器学习算法来预测价格趋势和关键价格点

总结

该策略是一个基于布林带的价格突破交易策略。它利用价格突破的特性来寻找交易机会。优点是简单易懂,容易实现;缺点是可能出现假突破,导致亏损。我们可以通过调整参数、结合其他指标以及设置止损来优化该策略,在回测和实盘中都可以获得不错的效果。总的来说,该策略适用于能充分挖掘价格趋势性的市场环境。

策略源码

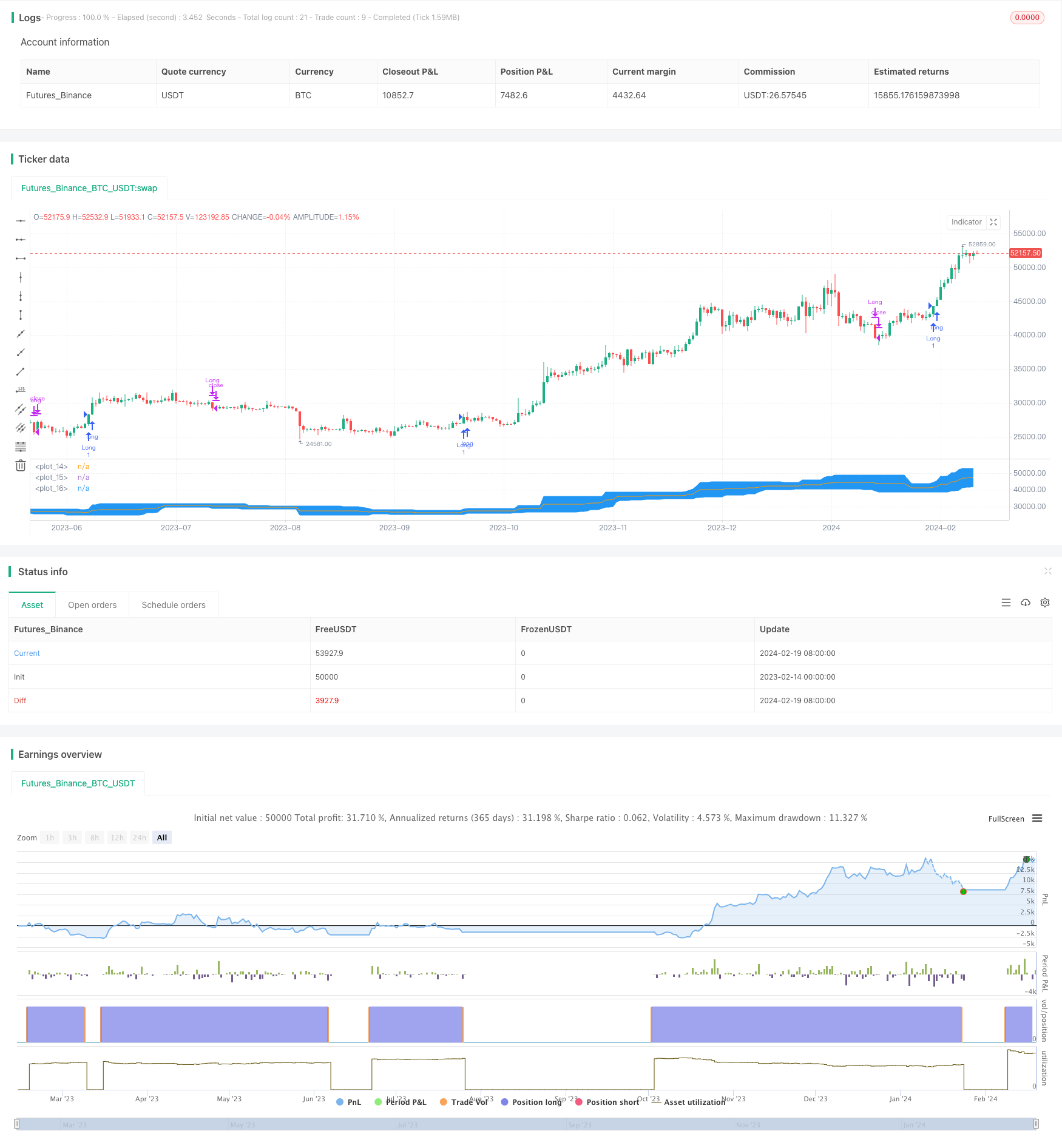

/*backtest

start: 2023-02-14 00:00:00

end: 2024-02-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0

//Break out trading system works best in a weekly chart and daily chart of Nifty and BankNifty

//@version=4

strategy("Eswar New",shorttitle = "ESW")

length = input(20, minval=1)

exit = input(1, minval=1, maxval=2,title = "Exit Option") // Use Option 1 to exit using lower band; Use Option 2 to exit using basis line

lower = lowest(length)

upper = highest(length)

basis = avg(upper, lower)

l = plot(lower, color=color.blue)

u = plot(upper, color=color.blue)

plot(basis, color=color.orange)

fill(u, l, color=color.blue)

longCondition = crossover(close,upper[1])

if (longCondition)

strategy.entry("Long", strategy.long)

if(exit==1)

if (crossunder(close,lower[1]))

strategy.close("Long")

if(exit==2)

if (crossunder(close,basis[1]))

strategy.close("Long")