概述

该策略是一种基于OBV和CCI指标的趋势追踪策略。它通过OBV指标判断市场趋势和资金流向,再利用CCI指标进行滤波,产生交易信号。当OBV和CCI指标都确认当前是上升趋势时,做多;当OBV和CCI指标都确认当前是下降趋势时,做空。

策略原理

该策略主要依赖OBV和CCI两个指标。OBV指标可以反映市场的资金流动情况。当OBV是绿色时,表示当前是资金流入的趋势;当OBV是红色时,表示当前是资金流出的趋势。CCI指标则是用来滤波, Setting一个阈值,当CCI高于阈值时视为多头市场,当CCI低于阈值时视为空头市场。

在进入信号判断上,如果前一周期OBV值为绿色(资金流入)而且CCI高于阈值(属于多头市场),同时OBV线上穿其EMA均线,产生买入信号。

在平仓信号判断上,如果前一周期OBV值为红色(资金流出)而且CCI低于阈值(属于空头市场),同时OBV线下穿其EMA均线,产生卖出信号。

这样,通过OBV判断大方向,CCI指标进行滤波,两者结合 using EMA均线的金叉死叉产生具体的交易信号,实现了趋势追踪。

优势分析

该策略主要有以下优势:

使用OBV判断市场资金流向和趋势方向,避免被短期市场噪音干扰;

借助CCI指标进行滤波,使交易信号更加可靠;

使用EMA均线金叉死叉产生具体的交易信号点,质量较高;

规则清晰简单,容易理解和实施。

风险分析

该策略也存在一些潜在风险:

OBV和CCI指标发出错误信号的可能性;

交易信号频繁,容易过度交易;

回调期间可能被套牢;

参数设置不当导致策略效果变差。

针对这些风险,可以通过优化参数,调整交易频率,设置止损以及使用过滤器等方法进行控制和优化。

优化方向

该策略可以从以下几个方向进行优化:

评估不同参数对策略效果的影响,寻找最优参数组合;

设置交易频率限制,避免过度交易;

增加止损机制,控制单笔损失;

添加其他指标过滤器,提升信号质量;

优化进入和平仓逻辑,使交易信号更加可靠。

总结

该策略整体来说是一个基础性策略,可有效追踪价格趋势,避免噪音干扰。但也存在一定风险,需要通过参数优化,止损设置,交易频率控制等手段进行改进。如果参数选取科学,回测效果可以获得明显改善。该策略适合更高级别的量化交易员学习和实践。

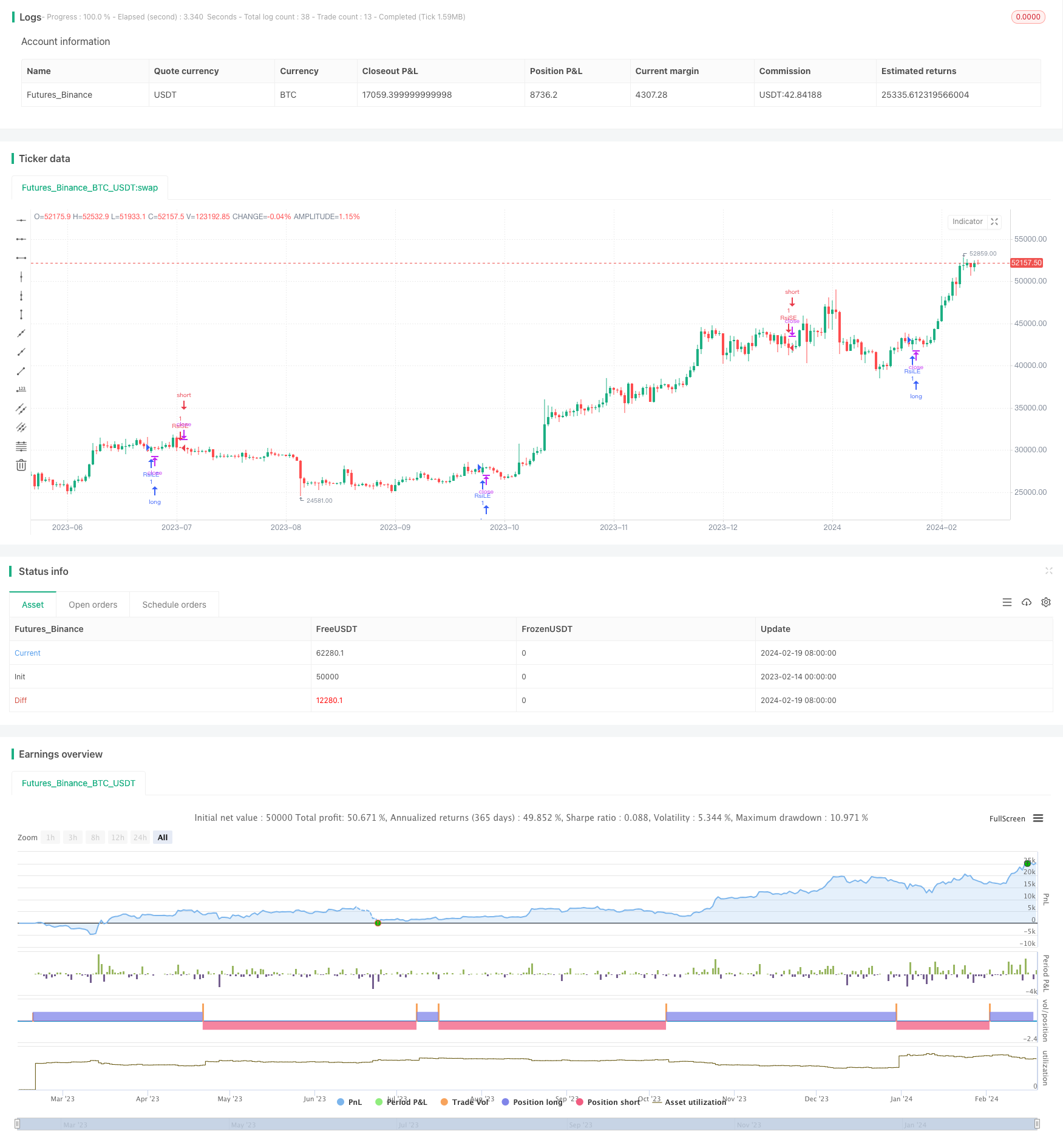

/*backtest

start: 2023-02-14 00:00:00

end: 2024-02-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//author: SudeepBisht

//@version=3

strategy("SB_CCI coded OBV Strategy", overlay=true)

src = close

length = input(20, minval=1, title="CCI Length")

threshold=input(0, title="CCI threshold for OBV coding")

lengthema=input(13, title="EMA length")

obv(src) =>

cum(change(src) > 0 ? volume : change(src) < 0 ? -volume : 0*volume)

o=obv(src)

c=cci(src, length)

col=c>=threshold?green:red

chk=col==green?1:0

ema_line=ema(o,lengthema)

//plot(o, color=c>=threshold?green:red, title="OBV_CCI coded", linewidth=2)

//plot(ema(o,lengthema), color=orange, linewidth=2)

if (not na(ema_line))

if (crossover(o, ema_line) and chk[1]==1)

strategy.entry("RsiLE", strategy.long, comment="RsiLE")

if (crossunder(o, ema_line) and chk[1]==0)

strategy.entry("RsiSE", strategy.short, comment="RsiSE")