概述

反转极端设置策略是一种利用极端K线反转的策略。它会根据最新K线的实体大小和平均值进行判断,在实体大小大于平均值且出现反转时,产生交易信号。

策略原理

该策略主要判断当前K线的实体大小以及整体K线大小。

它会记录下最新一根K线的实体大小(开盘价与收盘价的差值)和整体K线大小(最高价与最低价的差值)。

然后利用平均真实范围平均法(RMA)计算最近20根K线的平均实体大小和K线大小。

当最新K线上涨且实体大小大于平均实体大小,而整体K线大小也大于平均K线大小的2倍时,产生做多信号。

相反,当最新K线下跌且实体大小也满足上述条件时,产生做空信号。

也就是在极端K线反转时,利用平均值判断,产生交易信号。

优势分析

该策略的主要优势有:

- 利用极端K线特征,容易形成反转

- 比较实体大小和整体K线大小的极值情况,寻找异常点

- 使用RMA计算动态平均值,适应市场变化

- 结合反转形态,信号较为可靠

风险分析

该策略也存在一些风险:

- 极端K线不一定会反转,可能继续运行

- 参数设置不当可能导致过于灵敏或迟钝

- 需要足够的行情波动作为支撑,不适合盘整市

- 可能会产生频繁的交易信号,增加交易成本和滑点风险

为了降低风险,可以适当调整参数,或者加入止损以控制亏损。

优化方向

该策略可以从以下几个方面进行优化:

- 增加成交量的过滤,避免假突破

- 利用波动率指标优化参数的动态设置

- 结合趋势指标,避免反向做多做空

- 增加机器学习模型判断K线反转概率

- 加入止损机制

总结

反转极端设置策略通过判断最新K线的极端情况,在出现反转时产生交易信号。它有利用异常极端K线特征的优势,但也存在一定的风险。通过参数优化和风控手段,可以获得更好的策略表现。

策略源码

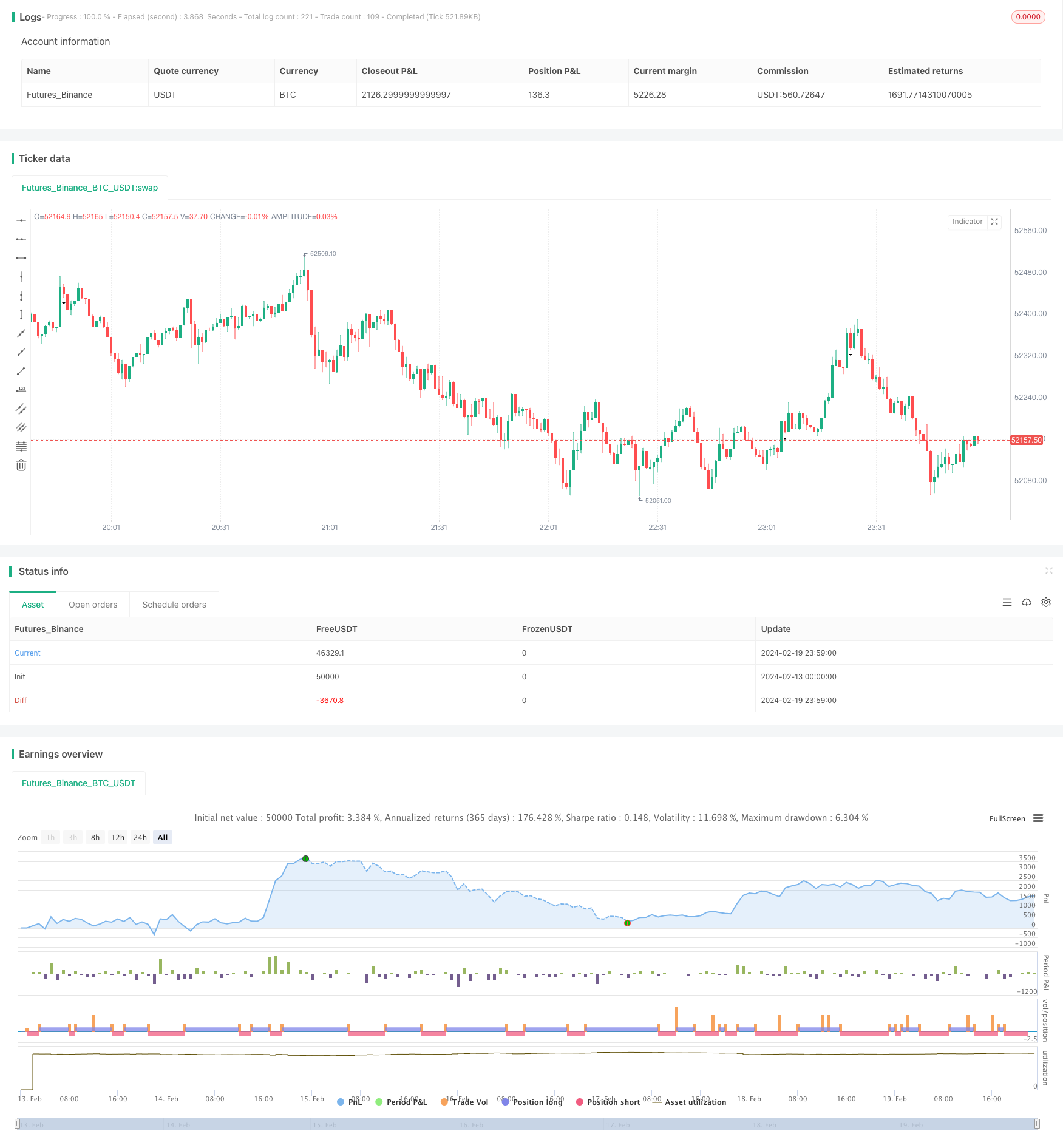

/*backtest

start: 2024-02-13 00:00:00

end: 2024-02-20 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Extreme Reversal Setup", overlay=true)

bodySize = input(defval=0.75)

barsBack = input(title="Lookback Period", type=input.integer, defval=20, minval=0)

bodyMultiplier = input(title="Bar ATR Multiplier", type=input.float, defval=2.0, minval=0)

myBodySize = abs(close - open)

averageBody = rma(myBodySize, barsBack)

myCandleSize = abs(high - low)

averageCandle = rma(myCandleSize, barsBack)

signal_long = open[1]-close[1] >= bodySize*(high[1]-low[1]) and

high[1]-low[1] > averageCandle*bodyMultiplier and

open[1]-close[1] > averageBody and close > open

signal_short = close[1]-open[1] >= bodySize*(high[1]-low[1]) and

high[1]-low[1] > averageCandle*bodyMultiplier and

close[1]-open[1] > averageBody and open > close

plotshape(signal_long, "LONG", shape.triangleup, location.belowbar, size=size.normal)

plotshape(signal_short, "SHORT", shape.triangledown, location.belowbar, size=size.normal)

strategy.entry("LONG", strategy.long, when=signal_long)

strategy.entry("SHORT", strategy.short, when=signal_short)