概述

本策略融合了多时间框架EMA指标与K线形态判断,实现了较为灵敏的长线信号捕捉与止损退出。

策略原理

本策略主要基于以下几个指标进行判断:

EMA均线:采用13周期、21周期2组EMA,判断价格突破形成交易信号。

K线形态:判断K线实体方向,与EMA指标联合使用,过滤假突破。

支持阻力:采用近期10周期 highest高点构建,判断突破通过该区域增强信号可靠性。

上升分时:120周期close收盘价在open开盘价之上判断为上升分时,作为辅助判断。

交易信号生成规则为:

多头信号:快速EMA向上突破慢速EMA,并且为阳线K线,关闭空仓开多。

空头信号:快速EMA向下跌破慢速EMA,并且为阴线K线,平掉多仓。

止损退出:反手信号发出时止损退出当前头寸。

策略优势

- 多时间框架EMA指标,判断趋势更可靠,避免假突破。

- 结合K线实体方向进行过滤,识别趋势更准确。

- 增加分时判断和支持阻力判断,确保信号质量。

- 采用反手做为止损方式,降低亏损风险。

策略风险

- 无效突破带来损失风险。即使引入多时间框架EMA和K线实体判断,也无法完全避免无效突破对策略的影响。

- 参数选择风险。EMA周期、K线判断周期等参数设置不当,会导致信号质量下降。

- 支撑阻力失效风险。历史支持阻力失效是常见情况,这也会导致信号产生时没有足够动量。

- 分时失效风险。分时情况是变化的,不能完全依赖分时判断。

以上风险可以通过避免过度优化,审慎选择参数,严格把控仓位规模等方法加以缓解。

策略优化方向

- 引入机器学习模型辅助判断。可以训练分类模型判断K线实体方向,提高判断准确性。

- 增加自适应止损机制。如 trailing stop 或基于波动率的止损。

- 结合情绪面分析。引入一定的媒体舆论判断机制,避免重大负面消息对策略的影响。

- 增加仓位管理模块。如引入固定仓位比例,或基于资金管理的仓位调节模块。

总结

本策略整合多时间框架EMA指标与K线实体判断,实现了较为可靠的趋势判断。同时结合支持阻力与分时情况进行辅助,确保信号质量。通过反手信号机制止损,可以有效控制单笔止损。未来可通过引入机器学习模型、自适应止损、情绪面分析和仓位管理模块等进行优化,使策略更为稳健。

策略源码

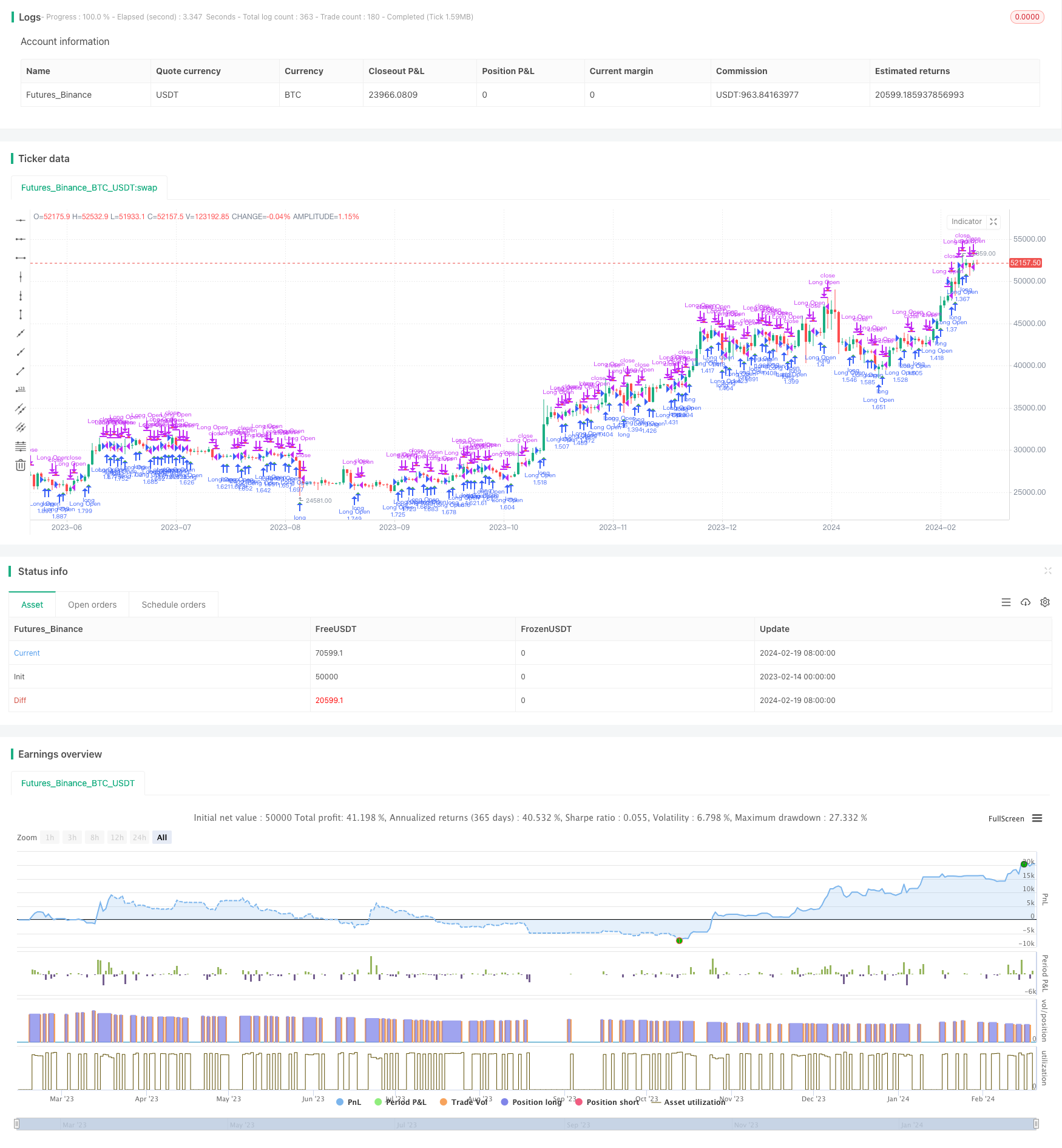

/*backtest

start: 2023-02-14 00:00:00

end: 2024-02-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title='ck - CryptoSniper Longs Only (Strategy)', shorttitle='ck - CryptoSniper Longs (S) v1', overlay=true, precision=2, commission_value=0.25, default_qty_type=strategy.percent_of_equity, pyramiding=0, default_qty_value=100, initial_capital=100)

open_long = 0

close_position = 0

last_long=close

last_short=close

//Candle body resistance Channel-----------------------------//

len = 34

src = input(close, title="Candle body resistance Channel")

out = sma(src, len)

last8h = highest(close, 13)

lastl8 = lowest(close, 13)

bearish = cross(close,out) == 1 and falling(close, 1)

bullish = cross(close,out) == 1 and rising(close, 1)

channel2=false

//-----------------Support and Resistance

RST = input(title='Support / Resistance length:', defval=10)

RSTT = valuewhen(high >= highest(high, RST), high, 0)

RSTB = valuewhen(low <= lowest(low, RST), low, 0)

//--------------------Trend colour ema------------------------------------------------//

src0 = close, len0 = input(13, minval=1, title="EMA 1")

ema0 = ema(src0, len0)

direction = rising(ema0, 2) ? +1 : falling(ema0, 2) ? -1 : 0

//-------------------- ema 2------------------------------------------------//

src02 = close, len02 = input(21, minval=1, title="EMA 2")

ema02 = ema(src02, len02)

direction2 = rising(ema02, 2) ? +1 : falling(ema02, 2) ? -1 : 0

//=============Hull MA//

show_hma = false

hma_src = input(close, title="HullMA Source:")

hma_base_length = input(8, minval=1, title="HullMA Base Length:")

hma_length_scalar = input(5, minval=0, title="HullMA Length Scalar:")

hullma(src, length)=>wma(2*wma(src, length/2)-wma(src, length), round(sqrt(length)))

//============ signal Generator ==================================//

Period=input(title='Period', defval='120')

ch1 = request.security(syminfo.tickerid, Period, open)

ch2 = request.security(syminfo.tickerid, Period, close)

// Signals//

long = crossover(request.security(syminfo.tickerid, Period, close),request.security(syminfo.tickerid, Period, open))

short = crossunder(request.security(syminfo.tickerid, Period, close),request.security(syminfo.tickerid, Period, open))

last_long := long ? time : nz(last_long[1])

last_short := short ? time : nz(last_short[1])

long_signal = crossover(last_long, last_short) ? 1 : -1

short_signal = crossover(last_short, last_long) ? -1 : 1

if (long_signal == 1)

strategy.entry("Long Open", strategy.long)

if (short_signal == -1)

strategy.close("Long Open")

if (long_signal[1] == 1 and short_signal[1] == 1)

open_long := 1

close_position := 0

if (short_signal[1] == -1 and long_signal[1] == -1)

open_long := 0

close_position := 1

plotshape(open_long == 1, title="Open Long", location=location.belowbar, style=shape.triangleup, size=size.small, color=green, transp=10)

plotshape(close_position == 1, title="Close Long", location=location.abovebar, style=shape.triangledown, size=size.small, color=red, transp=10)

//plot(0, title="Trigger", color=white)

///////////////////////////////////////////////////////////////////////////////////////////