概述

这是一个利用Renko平均线进行趋势判断和追踪的交易策略。该策略的核心逻辑是当价格突破22周期的HL2平均线时,做出相应的买入或卖出操作。同时,该策略还设置了止损、止盈、移动止损等风险管理机制。

策略原理

当Renko柱线收盘价上穿22周期HL2平均线时,做多;当Renko柱线收盘价下穿22周期HL2平均线时,做空。这样通过判断价格与平均线的关系,来捕捉趋势的方向。

HL2平均线(Highest High + Lowest Low)/2)是一种趋势型平均线,它结合最高价和最低价的信息,可以更准确地判断趋势的发展方向。22是一个经验值,用于平衡平均线的灵敏度。

此外,策略还设置了只在特定交易时段开仓的限制,以规避市场可能存在的剧烈波动。

优势分析

这是一个较为简单直观的趋势追踪策略,具有如下优势:

使用Renko柱线作为交易信号,可以有效过滤市场噪音,捕捉主要趋势。

HL2平均线结合最高价和最低价信息,对趋势判断更为准确可靠。

设定固定的止损、止盈点位,可以很好控制单笔交易的风险。

移动止损可以随着趋势的发展来锁定利润,实现趋势跟踪。

限制交易时间段,可以一定程度规避剧烈行情的冲击。

风险分析

该策略也存在一些风险,主要体现在:

平均线策略容易产生较多的虚假信号。

无法有效应对突发事件导致的断头风险。

Renko设置不当可能导致错过较好的交易机会。

固定的止损、止盈难以适应市场的变化。

优化方向

该策略可以从以下几个方向进行优化:

增加其他指标或条件来过滤信号,减少虚假信号。例如量能指标、震荡指标等。

可以测试不同参数的平均线,寻找更合适的周期数值。

Renko的箱体大小也可以进行测试优化,以获得最佳的参数。

增加基于波动率的自适应止损机制。

可以测试不同的交易时间段设置,优化这一条件。

总结

总的来说,这是一个利用Renko平均线进行趋势判断和追踪的简单实用策略。它有较直观的交易逻辑、风险控制机制,适合追求稳定收益的交易者。但也存在一些改进空间,通过参数优化、增加过滤条件、自适应止损等手段可以获得更好的策略效果。

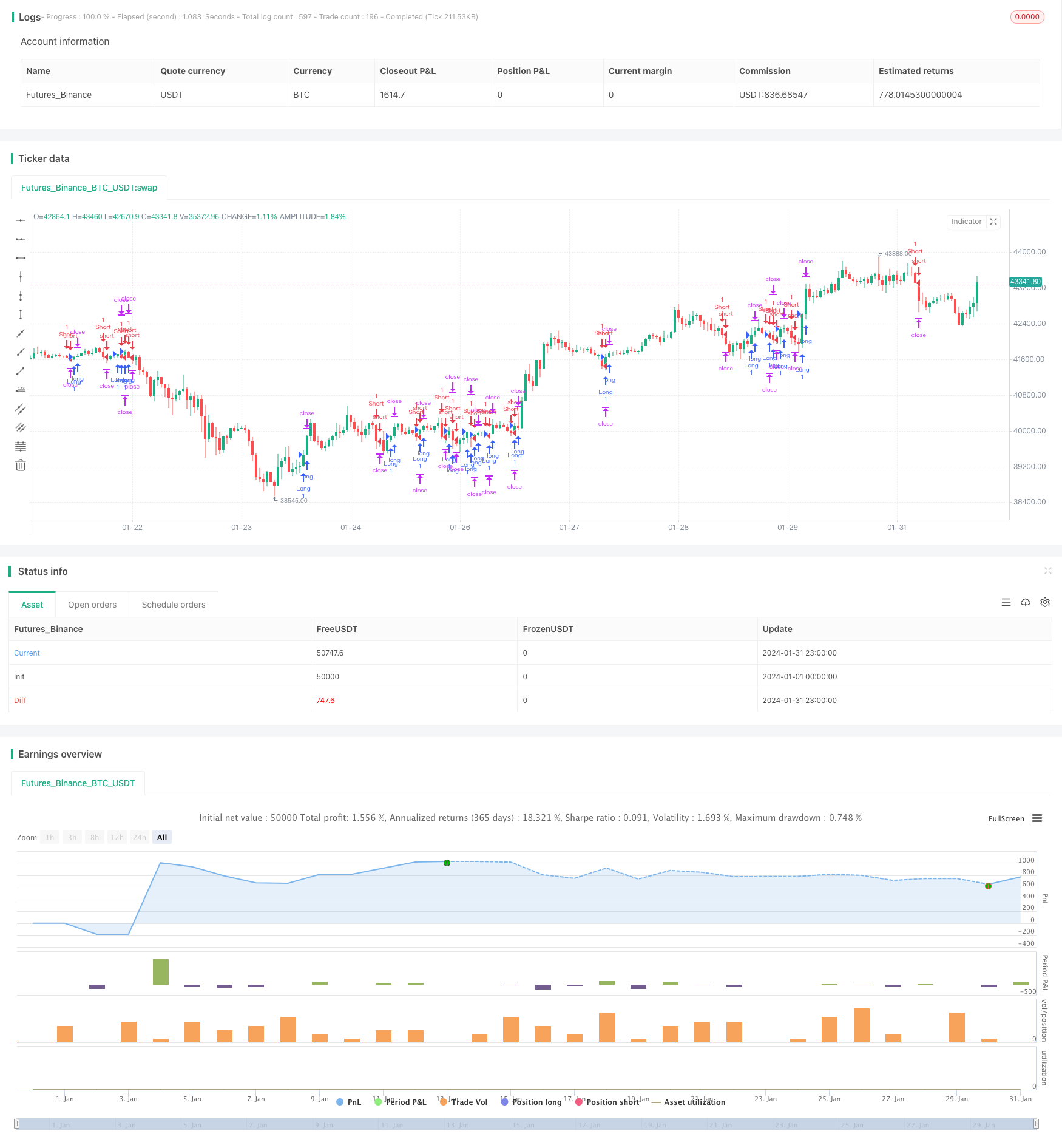

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("HL2 - 22 Cross", overlay=true)

// Stops and Profit inputs

inpTakeProfit = input(defval = 300, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 200, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 200, title = "Trailing Stop", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Offset", minval = 0)

// Stops and Profit Targets

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

//Specific Time to Trade

myspecifictradingtimes = input('0500-1600', title="My Defined Hours")

longCondition1 = crossover(close, ema(hl2, 22))

longCondition2 = time(timeframe.period, myspecifictradingtimes) != 0

if longCondition1 and longCondition2

strategy.entry("Long", strategy.long, comment="LongEntry")

shortCondition1 = crossunder(close, ema(hl2, 22))

shortCondition2 = time(timeframe.period, myspecifictradingtimes) != 0

if shortCondition1 and shortCondition2

strategy.entry("Short", strategy.short, comment="ShortEntry")

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)