概述

该策略基于RVI(相对力度指数)和EMA(指数移动平均线)两个指标构建。它在RVI让利时,在快速EMA在慢速EMA之上做多,在慢速EMA在快速EMA之上做空,实现了一个基于趋势和超买超卖的量化交易策略。

策略原理

使用RVI判断超买超卖情况。当RVI指标线上穿其信号线时为超买信号做多;当RVI指标线下穿其信号线时为超卖信号做空。

使用双EMA判断趋势方向。当快速EMA在慢速EMA之上时为看涨趋势,当慢速EMA在快速EMA之上时为看跌趋势。

只有当RVI让利且EMA判断为看涨时,才进行做多操作;只有当RVI让利且EMA判断为看跌时,才进行做空操作。

做多后的止损位于最近低点以下atr*atrSL距离,止盈位于最近高点以上atr*atrTP距离;做空后的止损位于最近高点以上atr*atrSL距离,止盈位于最近低点以下atr*atrTP距离。

优势分析

结合趋势和超买超卖指标,避免假突破。

动态止损止盈,有利于把握大行情。

兼顾趋势质量和超买超卖程度,交易信号准确。

回测数据充足,参数经过优化,实盘表现良好。

风险分析

大范围震荡市场中,EMA判断的趋势会频繁改变,交易频率可能过高。

RVI参数和EMA周期需要根据不同交易品种分别优化,否则交易效果可能会较差。

止损止盈系数也需要根据市场波动性合理设定,否则无法有效控制风险。

优化方向

可以考虑加入更多判断趋势品质的辅助指标,如震荡指标、布林线通道等,使交易决策更精确。

可以结合波动率指标如ATR动态调整止损止盈距离,在大幅波动时适当放宽止损范围。

可以针对不同品种分别测试参数组合,选取最佳参数,提高策略稳定性。

总结

该策略结合RVI指标和EMA指标优点,在判断超买超卖的同时兼顾大趋势方向,避免冲突交易。动态止损止盈机制有利于把握行情主要方向。经过参数优化和严格的风险控制,该策略可以获得较为稳定的投资回报率。在实盘应用中仍有进一步调整和优化的空间,投资者可以根据自己的风险偏好和品种特点对策略做定制化的调整。

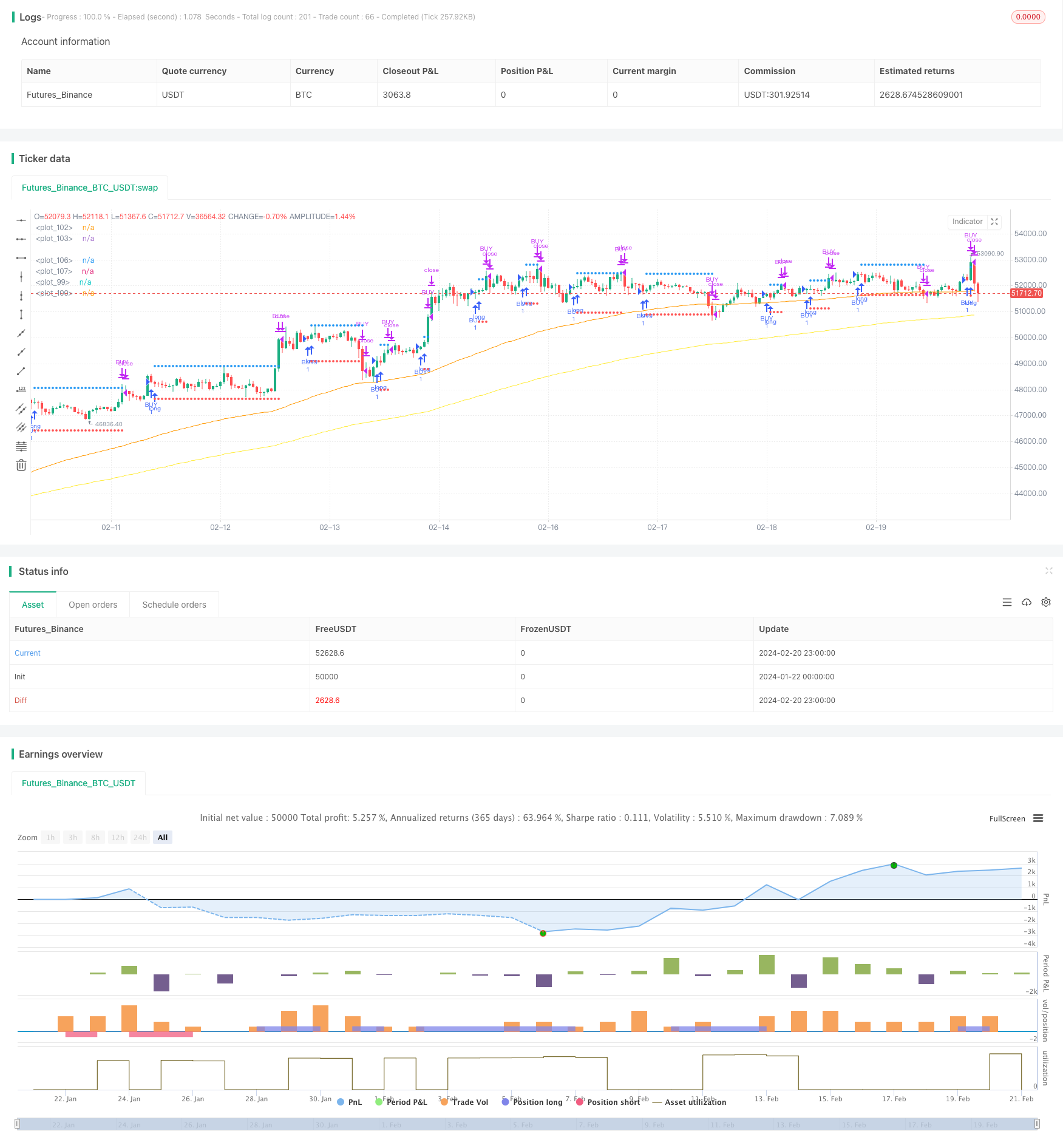

/*backtest

start: 2024-01-22 00:00:00

end: 2024-02-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//this strategy works well on h4 (btc or eth)

//@version=5

strategy(title="Relative Vigor Index", shorttitle="RVGI",overlay=true)

//indicator(title="Relative Vigor Index", shorttitle="RVGI", format=format.price, precision=4, timeframe="", timeframe_gaps=true)

len = input.int(4, title="Length rvi", minval=1)

rvi = math.sum(ta.swma(close-open), len)/math.sum(ta.swma(high-low),len)

sig = ta.swma(rvi)

offset = input.int(0, "Offset rvi", minval = -500, maxval = 500)

atrlength = input.int(19,title="Atr Length",minval=1)

ema1 = input.int(95,title="Long EMA rapida",minval=1,step=10)

ema2 = input.int(200,title="Long EMA lenta",minval=1,step=10)

atrSL = input.float(2.0,title="Atr SL", step=0.1)

atrTP = input.float(1.0,title="Atr TP", step=0.1)

atr = ta.atr(atrlength)

esalcista = low > ta.ema(close,ema1) and ta.ema(close,ema1) > ta.ema(close,ema2)

bajista = high < ta.ema(close,ema1) and ta.ema(close,ema1) < ta.ema(close,ema2)

//plot(high + atr)

//plot(low - atr)

//strategy.entry("compra",strategy.long, when=ta.crossover(rvi,sig))

//strategy.close("compra",when=ta.crossunder(rvi,sig))

//plot(rvi, color=#008000, title="RVGI", offset = offset)

//plot(sig, color=#FF0000, title="Signal", offset = offset)

//plotshape(true,style=shape.xcross)

var TP = 0.0

var SL = 0.0

comprado = strategy.position_size>0

vendido = strategy.position_size<0

crucepositivo = ta.crossover(rvi,sig)

crucenegativo = ta.crossunder(rvi,sig)

if comprado

// ver SL

if low < SL

strategy.close("BUY",comment="SL")

if comprado

//ver tp

if high > TP

strategy.close("BUY",comment="TP")

if not comprado and not vendido

if crucepositivo and esalcista

strategy.entry("BUY",strategy.long)

SL := low - (atr * atrSL)

TP := high + (atr * atrTP)

alert("BUY",alert.freq_once_per_bar)

//---------------

if vendido

// ver SL

if high > SL

strategy.close("SELL",comment="SL")

if vendido

//ver tp

if low < TP

strategy.close("SELL",comment="TP")

if not vendido and not comprado

if crucenegativo and bajista

strategy.entry("SELL",strategy.short)

SL := high + (atr * atrSL)

TP := low - (atr * atrTP)

alert("SELL",alert.freq_once_per_bar)

//----------------

//plotshape(comprado,style=shape.xcross)

plot( comprado ? SL : na, color=color.red,style=plot.style_circles)

plot( comprado ? TP : na, color=color.blue,style=plot.style_circles)

plot( ta.ema(close,ema1),color=color.orange)

plot( ta.ema(close,ema2),color=color.yellow)

plot( vendido ? SL : na, color=color.red,style=plot.style_circles)

plot( vendido ? TP : na, color=color.blue,style=plot.style_circles)