概述

本策略是一种趋势跟踪策略,它结合了Nadaraya-Watson回归和ATR通道来识别趋势方向和入场点。当价格突破下轨时,做多;当价格突破上轨时,平仓。同时设置了止损机制。

策略原理

首先,该策略使用 Nadaraya-Watson 核回归来计算两个不同滞后期的回归曲线,然后比较两条回归曲线的交叉来判断趋势方向。具体来说,分别计算 h期和 h-lag期的回归曲线,当 h-lag期曲线上穿 h期曲线时判断为看多;当 h-lag期曲线下穿 h期曲线时判断为看空。

其次,该策略使用ATR通道来确定入场点。上轨为回归曲线加上n期ATR的乘数,下轨为回归曲线减去n期ATR的乘数。当价格突破上轨时看空并入场,突破下轨时看多并入场。

最后,设置了止损机制。如果价格连续stopLossBars根K线低于入场价,则止损出场。

策略优势分析

这种策略结合回归分析和通道 breakthrough,能比较准确地把握市场趋势的方向和力度。相比单一使用移动均线等指标识别趋势,这种方法减少了假信号,从而提高了策略的稳定性。

另外,ATR通道设置了合理的入场点,避免在趋势反转点附近错误入场。止损机制也有效控制了单笔损失。

所以,这种策略具有识别趋势能力强、出入场比较准确、单笔止损风险可控等优势。

风险分析

这种策略最大的风险在于当突破ATR通道时,价格可能就是在做反转或者盘整,从而导致不适合入场或者入场后很快就止损出场。

另外,回归曲线和ATR通道都需要一定参数优化。如果参数设置不当,回归分析效果不佳,或者ATR幅度过大过小,都会影响策略的效果。

优化方向

可以考虑结合其他指标判断趋势和反转信号,例如VOLUME,MACD等,以提高策略的稳定性和准确性。

回归分析中的核函数也可以调整,如考虑Epanechnikov核等,看是否能获得更好的拟合效果。

ATR通道的ATR周期和乘数也需要反复测试优化,找到最佳的参数组合。

总结

本策略综合运用回归分析和通道突破方法,识别趋势方向和力度,在合理点位入场,并设置止损,从而实现稳定的趋势跟踪策略。次策略优化空间还很大,值得进一步测试改进。

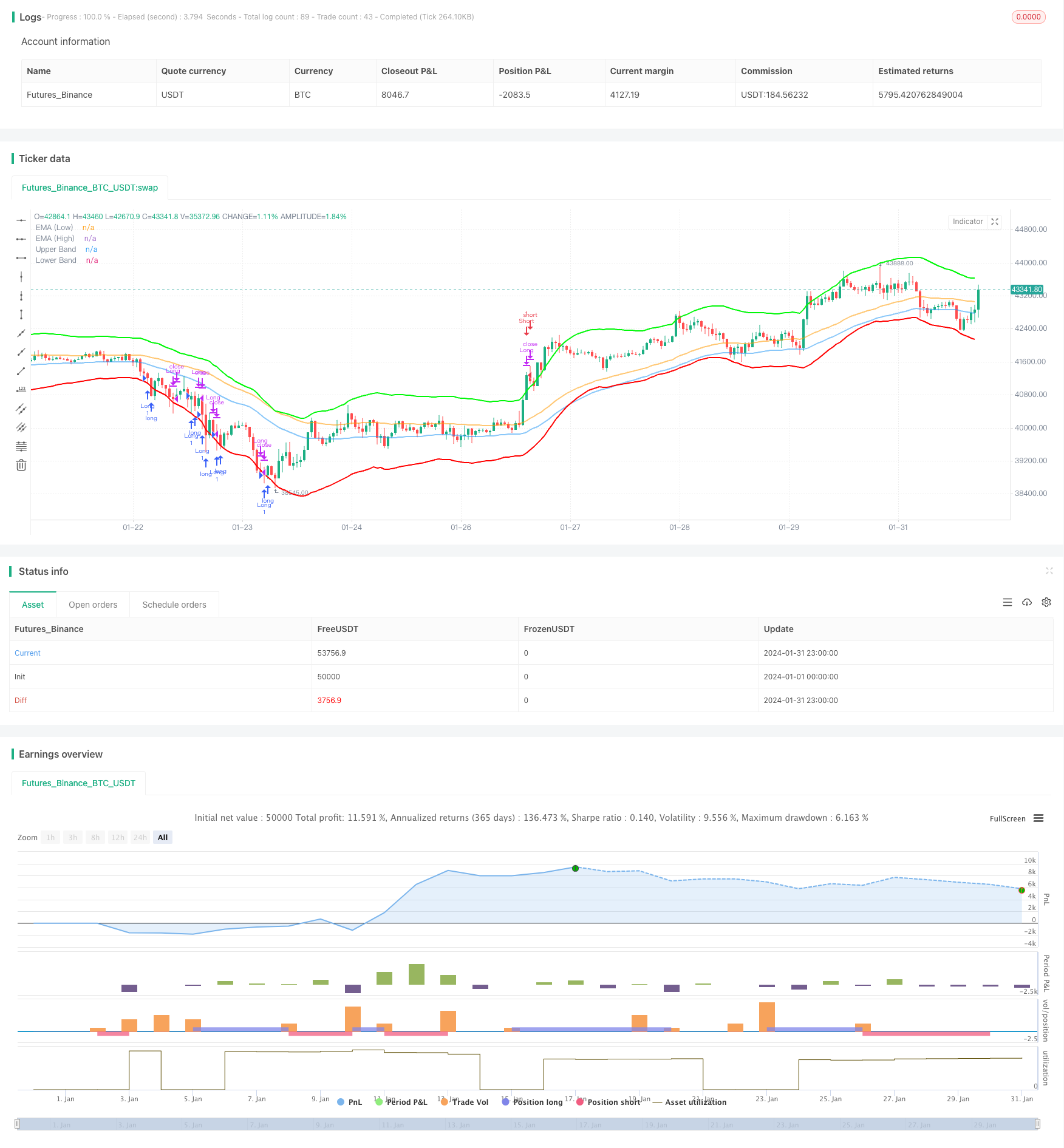

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Custom Strategy with Stop Loss and EMA", overlay=true)

src = input(close, title='Source')

h = input(10, title='Lookback Window', tooltip='The number of bars used for the estimation.')

r = input(10, title='Relative Weighting', tooltip='Relative weighting of time frames.')

x_0 = input(50, title='Start Regression at Bar', tooltip='Bar index on which to start regression.')

lag = input(2, title='Lag', tooltip='Lag for crossover detection.')

stopLossBars = input(3, title='Stop Loss Bars', tooltip='Number of bars to check for stop loss condition.')

emaPeriod = input(46, title='EMA Period', tooltip='Period for Exponential Moving Averages.')

lenjeje = input(32, title='ATR Period', tooltip='Period to calculate upper and lower band')

coef = input(2.7, title='Multiplier', tooltip='Multiplier to calculate upper and lower band')

// Function for Nadaraya-Watson Kernel Regression

kernel_regression1(_src, _size, _h) =>

_currentWeight = 0.0

_cumulativeWeight = 0.0

for i = 0 to _size + x_0

y = _src[i]

w = math.pow(1 + (math.pow(i, 2) / ((math.pow(_h, 2) * 2 * r))), -r)

_currentWeight += y * w

_cumulativeWeight += w

[_currentWeight, _cumulativeWeight]

// Calculate Nadaraya-Watson Regression

[currentWeight1, cumulativeWeight1] = kernel_regression1(src, h, h)

yhat1 = currentWeight1 / cumulativeWeight1

[currentWeight2, cumulativeWeight2] = kernel_regression1(src, h-lag, h-lag)

yhat2 = currentWeight2 / cumulativeWeight2

// Calculate Upper and Lower Bands

upperjeje = yhat1 + coef * ta.atr(lenjeje)

lowerjeje = yhat1 - coef * ta.atr(lenjeje)

// Plot Upper and Lower Bands

plot(upperjeje, color=color.rgb(0, 247, 8), title="Upper Band", linewidth=2)

plot(lowerjeje, color=color.rgb(255, 0, 0), title="Lower Band", linewidth=2)

// Calculate EMAs

emaLow = ta.ema(low, emaPeriod)

emaHigh = ta.ema(high, emaPeriod)

// Plot EMAs

plot(emaLow, color=color.rgb(33, 149, 243, 47), title="EMA (Low)", linewidth=2)

plot(emaHigh, color=color.rgb(255, 153, 0, 45), title="EMA (High)", linewidth=2)

// Long Entry Condition

longCondition = low < lowerjeje

strategy.entry("Long", strategy.long, when=longCondition)

// Stop Loss Condition

stopLossCondition = close[1] < strategy.position_avg_price and close[2] < strategy.position_avg_price and close[3] < strategy.position_avg_price

strategy.close("Long", when=stopLossCondition)

// Close and Reverse (Short) Condition

shortCondition = high > upperjeje

strategy.close("Long", when=shortCondition)

strategy.entry("Short", strategy.short, when=shortCondition)