概述

本策略基于动态通道和均线的趋势跟踪原理设计。它计算价格的动态通道,通过通道上下轨判断价格趋势方向,结合均线滤波价格离散度,产生交易信号。该策略适用于中短线趋势交易。

原理

该策略主要基于以下原理:

计算动态价格通道。通过最高价和最低价计算通道中线,通道上轨为中线+价格离散度均线,下轨为中线-价格离散度均线。

判断趋势方向。当价格上穿上轨时,定义为看涨;当价格下破下轨时,定义为看跌。

滤波噪音。使用一定周期的价格离散度均线,滤波价格随机波动带来的噪音。

产生交易信号。看涨时,在该周期收盘价低于开盘价时产生买入信号;看跌时,在该周期收盘价高于开盘时产生卖出信号。

优势

该策略具有以下优势:

- 动态通道能实时捕捉价格趋势;

- 均线滤波能减少假信号;

- 结合趋势方向和K线实体方向产生交易信号,避免被套。

风险

该策略也存在以下风险:

- Params选取不当可能导致过度优化;

- 震荡盘整理时容易产生错误信号;

- 无法预测价格剧烈波动。

对应解决方法:

- 严格的Params选择和测试;

- 增加过滤条件,识别震荡盘整理;

- 设置止损止盈,控制风险。

优化方向

该策略可以从以下方面进行优化:

- 测试不同周期参数的稳定性;

- 增加VOLUME或波动度指标判断力度;

- 结合波段、通道等判断进入和退出。

总结

本策略整合动态通道和均线趋势判断的思想,在中短线捕捉趋势方向中表现不俗。但也存在一定局限性,需要进一步测试优化以适应更多市场情况。

策略源码

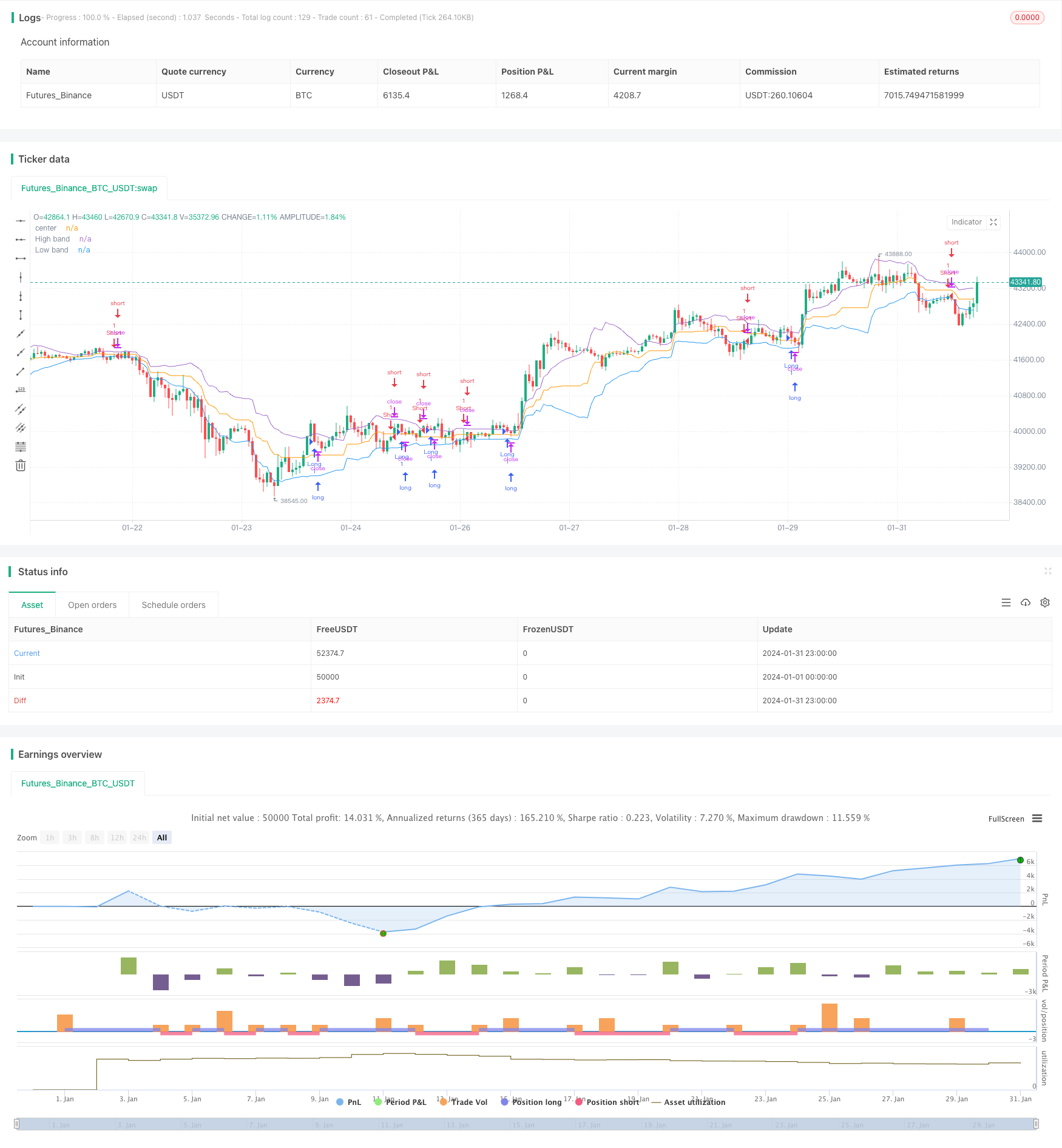

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Noro's Bands Strategy v1.0", shorttitle = "NoroBands str 1.0", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value=100.0, pyramiding=0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

len = input(20, defval = 20, minval = 2, maxval = 200, title = "Period")

color = input(true, "Color")

needbb = input(false, defval = false, title = "Show Bands")

needbg = input(false, defval = false, title = "Show Background")

src = close

//PriceChannel 1

lasthigh = highest(src, len)

lastlow = lowest(src, len)

center = (lasthigh + lastlow) / 2

//dist

dist = abs(src - center)

distsma = sma(dist, len)

hd = center + distsma

ld = center - distsma

//Trend

trend = close < ld and high < hd ? -1 : close > hd and low > ld ? 1 : trend[1]

//Lines

colo = needbb == false ? na : black

plot(hd, color = colo, linewidth = 1, transp = 0, title = "High band")

plot(center, color = colo, linewidth = 1, transp = 0, title = "center")

plot(ld, color = colo, linewidth = 1, transp = 0, title = "Low band")

//Background

col = needbg == false ? na : trend == 1 ? lime : red

bgcolor(col, transp = 90)

//up = and trend == 1 ? 1 : 0

//dn = and trend == -1 ? 1 : 0

up = close < hd and trend == 1 and (close < open or color == false) ? 1 : 0

dn = close > ld and trend == -1 and (close > open or color == false) ? 1 : 0

longCondition = up == 1

if (longCondition)

strategy.entry("Long", strategy.long, needlong == false ? 0 : na)

shortCondition = dn == 1

if (shortCondition)

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)