概述

该策略是基于XAUUSD黄金1分钟时间范围内的30日和200日移动均线交叉实现的。当短期均线从下方上穿长期均线时生成买入信号;当短期均线从上方下穿长期均线时生成卖出信号。

该策略同时设置了4万点的止损和止盈位,用于控制单笔交易的风险和回报。当出现反向信号时,会平仓现有头寸并按相反方向开仓。这有助于避免积累期的大幅亏损和捕捉趋势反转带来的利润。

策略原理

该策略使用30日和200日的移动均线交叉来判断趋势方向。当短期均线上穿长期均线时表示牛市来临,做多;当短期均线下穿长期均线时表示熊市来临,做空。

同时设置4万点的止损和止盈来控制单笔交易的风险。此外,在出现反向信号时会主动平仓原有头寸并按相反方向开新单,以捕捉潜在趋势反转机会。

优势分析

该策略具有如下优势:

- 使用移动均线交叉判断趋势方向准确性高

- 设置止损止盈控制单笔交易风险

- 主动平仓反向开仓可有效控制亏损和捕捉反转

- 可用于日内和跨市交易

- 适用于高波动性品种如黄金

风险分析

该策略也存在一定的风险:

- 若跨趋势震荡过大 may 被套牢

- 参数设置不当 may 过频交易或漏单

- 反向开仓需谨慎,确保趋势反转

可以通过优化移动均线周期参数、设置止损范围、判断反转信号可靠性等方法来控制和降低风险。

优化方向

该策略可从以下几个方面进行优化:

- 优化移动均线交叉周期,寻找最佳参数组合

- 动态调整止损止盈幅度,优化风险回报率

- 增加量价碎形等指标过滤反转信号

- 增加交易品种和时间范围,进行多品种综合优化

总结

该移动均线交叉策略整体效果良好,使用移动均线判断趋势方向的方法准确性较高,同时带止损止盈控制风险,在趋势性品种如黄金中效果尤为明显。可以通过多种方式进行优化与改进,应用范围广泛。

策略源码

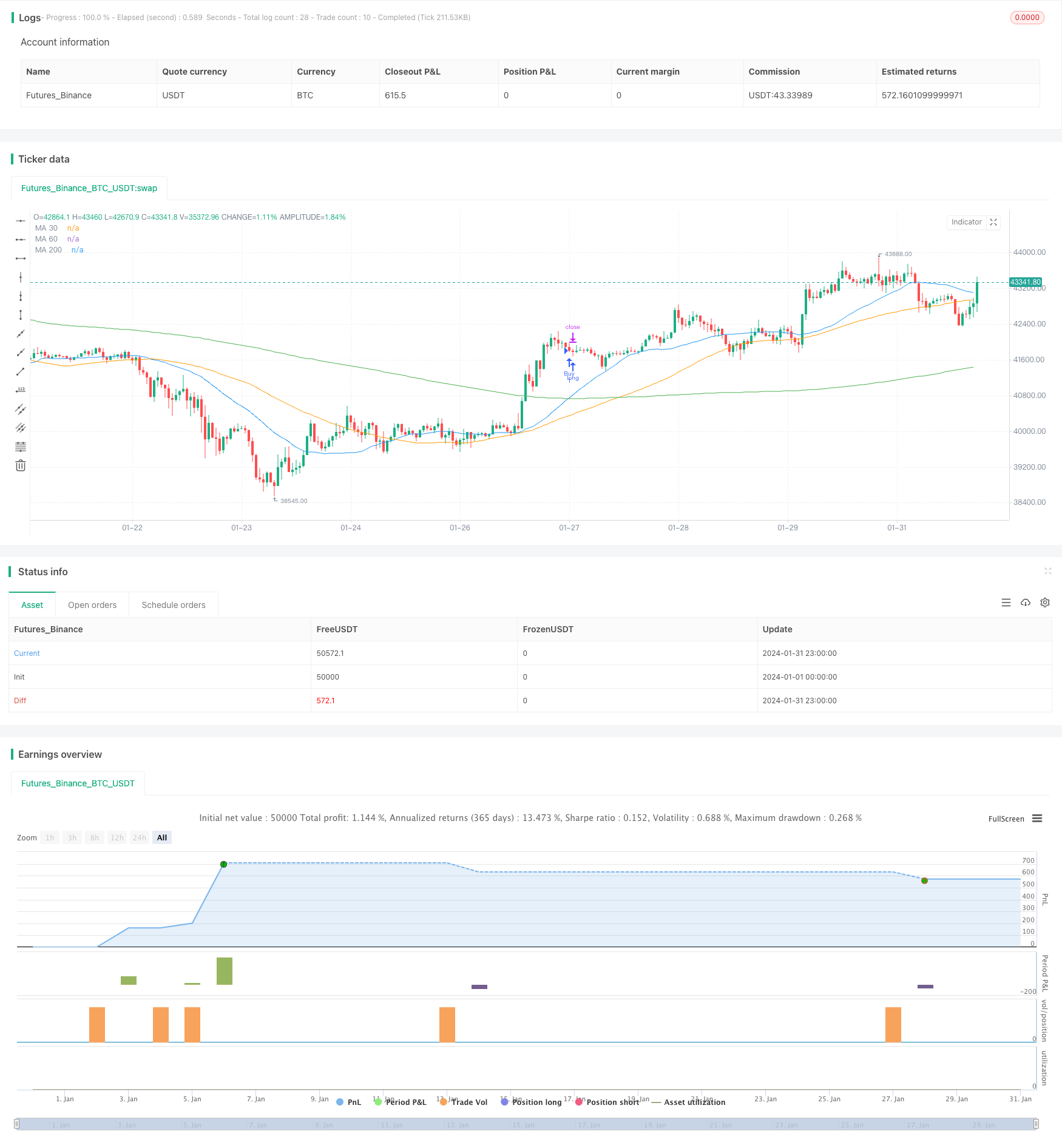

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Moving Averages Crossover Strategy", overlay=true)

// Moving Averages

ma30 = ta.sma(close, 30)

ma60 = ta.sma(close, 60)

ma200 = ta.sma(close, 200)

// Moving Averages Crossover

crossoverUp = ta.crossover(ma30, ma200)

crossoverDown = ta.crossunder(ma30, ma200)

// Buy and Sell Signals

longCondition = crossoverUp

shortCondition = crossoverDown

// Order Execution

if (longCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("Cover", "Buy", stop=close - 40.000, limit=close + 40.000)

if (shortCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=close + 40.000, limit=close - 40.000)

// Plotting Moving Averages

plot(ma30, color=color.blue, title="MA 30")

plot(ma60, color=color.orange, title="MA 60")

plot(ma200, color=color.green, title="MA 200")

// Conditions to close opposite position

if (strategy.position_size > 0)

if (crossoverDown)

strategy.close("Buy")

if (strategy.position_size < 0)

if (crossoverUp)

strategy.close("Sell")