概述

该策略通过计算最近一定周期内的成交量的最高值和最低值,形成一个自适应的波动范围,当当前周期的成交量突破この范围时产生交易信号。信号方向根据阴阳烛判断,属于简单有效的追踪市场突发性大单的策略。

策略原理

核心逻辑是计算最近N周期内的正负成交量的最高最低值,形成一个自适应波动范围。基于这个范围判断当期是否出现突破。同时综合阴阳线信号,完成判断。

具体计算流程是:

- 计算最近N周期的最高成交量Highest和最低成交量Lowest

- 判断当前周期的成交量Volume是否高于Highest

- 结合当前是阴线还是阳线,完成突破信号判断

- 产生做多做空信号

优势分析

该策略主要有以下优势:

- 自适应范围设定,对市场变化敏感

- 捕捉高波动突发行情,降低漏单率

- 结合烛形判断,避免假突破

- 实现简单,容易理解和修改

- 可灵活调整参数,适应不同品种

风险分析

该策略也存在一些风险:

- 容易追高杀跌,需要调整参数控制

- 大周期震荡市场中可能出现频繁错误信号

- 无法区分正常和异常突破,需要結合其他指标或模式判断

- 每次突破只有一次入场机会,不能追踪趋势

可以通过调整参数周期,结合其他指标过滤来优化。

优化方向

该策略可以从以下几个方向进行优化:

- 增加参数调整区间长度,适应不同市场周期

- 添加均线、布林带等指标,过滤信号

- 优化结合K线形态,避免假突破误入

- 增加再入场和止损模块,使策略可以追踪趋势

总结

该策略整体简单实用,通过自适应范围和量价合并判断,可有效捕捉突发性单边行情。但也存在一定的误报风险,需要适当调整参数并配合其他工具使用,方能发挥最大效果。

策略源码

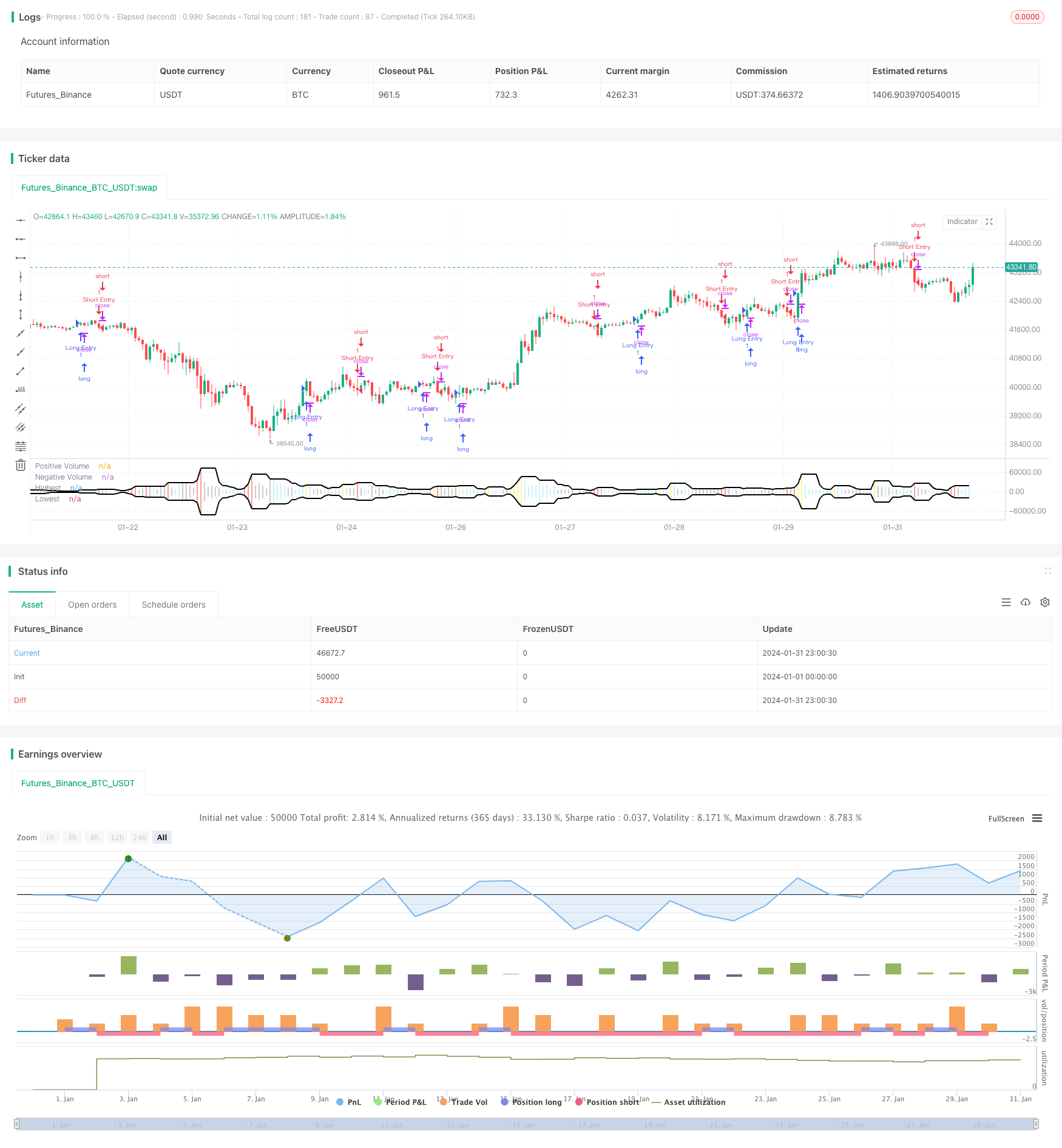

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © EvoCrypto

//@version=4

strategy("Ranged Volume Strategy - evo", shorttitle="Ranged Volume", format=format.volume)

// INPUTS {

Range_Length = input(5, title="Range Length", minval=1)

Heikin_Ashi = input(true, title="Heikin Ashi Colors")

Display_Bars = input(true, title="Show Bar Colors")

Display_Break = input(true, title="Show Break-Out")

Display_Range = input(true, title="Show Range")

// }

// SETTINGS {

Close = Heikin_Ashi ? security(heikinashi(syminfo.tickerid), timeframe.period, close) : close

Open = Heikin_Ashi ? security(heikinashi(syminfo.tickerid), timeframe.period, open) : open

Positive = volume

Negative = -volume

Highest = highest(volume, Range_Length)

Lowest = lowest(-volume, Range_Length)

Up = Highest > Highest[1] and Close > Open

Dn = Highest > Highest[1] and Close < Open

Volume_Color =

Display_Break and Up ? color.new(#ffeb3b, 0) :

Display_Break and Dn ? color.new(#f44336, 0) :

Close > Open ? color.new(#00c0ff, 60) :

Close < Open ? color.new(#000000, 60) : na

// }

//PLOTS {

plot(Positive, title="Positive Volume", color=Volume_Color, style=plot.style_histogram, linewidth=4)

plot(Negative, title="Negative Volume", color=Volume_Color, style=plot.style_histogram, linewidth=4)

plot(Display_Range ? Highest : na, title="Highest", color=color.new(#000000, 0), style=plot.style_line, linewidth=2)

plot(Display_Range ? Lowest : na, title="Lowest", color=color.new(#000000, 0), style=plot.style_line, linewidth=2)

barcolor(Display_Bars ? Volume_Color : na)

// }

if (Up)

strategy.entry("Long Entry", strategy.long)

if (Dn)

strategy.entry("Short Entry", strategy.short)