一、策略概述

RSI金叉超级做空策略运用ATR波带、双RSI指标以及EMA均线的金叉死叉来实现趋势判断和entries。ATR波带用来判断价格是否处于超买超卖状态,双RSI指标用来确认价格趋势,EMA均线金叉用来寻找entries机会。本策略设计简单,容易实现,是一个高效灵活的做空策略。

二、策略原理

该策略使用ATR波带、双RSI指标和EMA均线三个部件共同实现entries信号。当价格打开高于上ATR波带时我们判断为超买,此时如果快周期RSI低于慢周期RSI表明趋势由牛转熊,而且如果EMA均线发生死叉表明趋势进一步转弱,综合这三个信号我们可以确定一个较强有力的做空机会。

具体来说,价格打开时判断是否高于上ATR波带即open>upper_band,如果满足则可能处于超买区域。然后我们判断快速RSI是否低于慢速RSI即rsi1<rsi2,如果成立则表示趋势转弱由牛转熊。最后我们检测EMA均线是否发生死叉即ta.crossover(longSMA, shortSMA)成立,如果三个条件都满足,我们就发出做空信号进行入场。

相反,如果价格打开时低于下ATR波带,快速RSI高于慢速RSI并且发生EMA金叉,则产生做多入场信号。

该策略主要创新点是引入双RSI指标进行趋势判断,相比单一RSI可靠性更高,同时结合ATR波带和EMA均线进行信号过滤,使信号更加准确可靠,这是该策略的核心亮点。

三、策略优势

该策略具有以下优势:

- 使用双RSI指标判断趋势更准确可靠

- ATR波带判断超买超卖区域,避免假突破

- EMA均线发生明确金叉/死叉时入场,增加信号准确度

- 多种指标组合进行互相验证,可靠性较高

- 策略设计简单易实现

- 可同时获利超买超卖两边状况

- 可调参数较多,可根据不同市场调整

四、策略风险

该策略也存在一些风险需要注意:

- EMA均线容易产生错诊,可能 smoothed MA 更稳定

- 震荡行情中容易被套住止损

- 参数设置不当可能增加错误信号

- 突破ATR波带时机言之尚早,可能是假突破

以上风险主要可从以下几个方面进行优化处理: 1. 测试使用 smoothed MA 代替 EMA 均线 2. 适当宽松止损幅度,避免震荡市被频繁止损 3. 调整参数组合找到最佳平衡 4. 在突破波带时引入更多指标进行二次验证

五、策略优化方向

该策略可从以下方面进行进一步优化:

- 测试使用 Smoothed MA 代替 EMA 均线,看是否可以减少错诊信号

- 增加波动率指标如 Keltner 通道进行二次验证,避免假突破

- 增加更多趋势指标如 ADX 进行大趋势判断

- 根据具体品种特点调整参数设置找到最佳组合

- 测试不同时间周期参数下的表现

- 增加机器学习算法自动优化参数

这些优化措施可以进一步提高策略的稳定性、灵活性与盈利能力。

六、总结

RSI金叉超级做空策略整体来说是一个非常高效实用的短线做空策略。它同时利用三种指标的优势进行集成实现 entries 信号,通过参数调整可以适应不同品种和市场环境。本策略核心创新在于运用双RSI指标判断趋势转势,与ATR波带和EMA均线互相验证形成高准确度entries时机。整体来说,该策略实用性非常强,值得投资者积极运用,但也需要关注可能存在的一些风险因素。通过不断测试与优化,相信该策略可以成为投资者盈利工具中的一大利器。

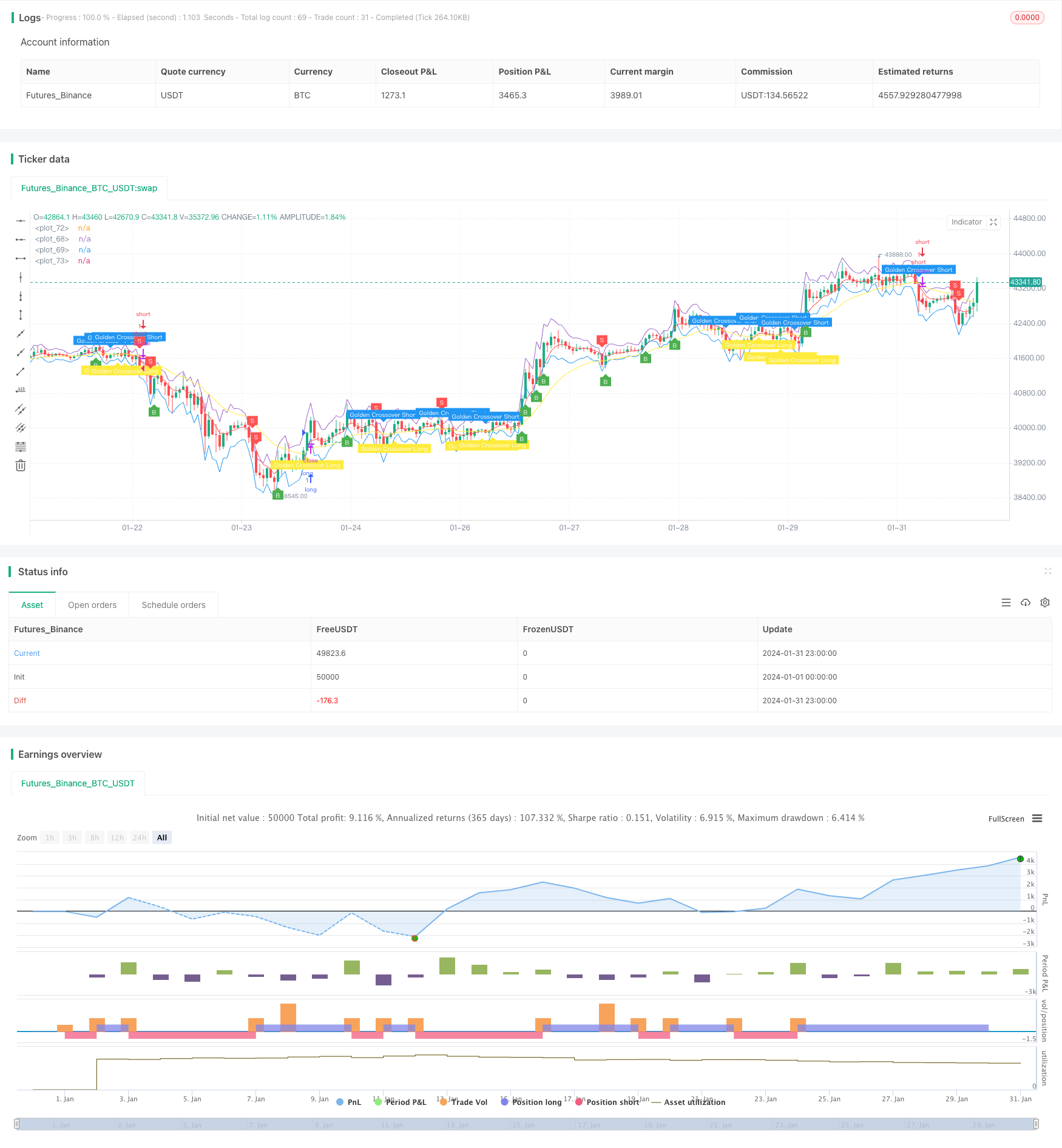

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

//Revision: Updated script to pine script version 5

//added Double RSI for Long/Short prosition trend confirmation instead of single RSI

strategy("Super Scalper - 5 Min 15 Min", overlay=true)

source = close

atrlen = input.int(14, "ATR Period")

mult = input.float(1, "ATR Multi", step=0.1)

smoothing = input.string(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

ta.rma(source, atrlen)

else

if smoothing == "SMA"

ta.sma(source, atrlen)

else

if smoothing == "EMA"

ta.ema(source, atrlen)

else

ta.wma(source, atrlen)

atr_slen = ma_function(ta.tr(true), atrlen)

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

// Create Indicator's

ShortEMAlen = input.int(5, "Fast EMA")

LongEMAlen = input.int(21, "Slow EMA")

shortSMA = ta.ema(close, ShortEMAlen)

longSMA = ta.ema(close, LongEMAlen)

RSILen1 = input.int(40, "Fast RSI Length")

RSILen2 = input.int(60, "Slow RSI Length")

rsi1 = ta.rsi(close, RSILen1)

rsi2 = ta.rsi(close, RSILen2)

atr = ta.atr(atrlen)

//RSI Cross condition

RSILong = rsi1 > rsi2

RSIShort = rsi1 < rsi2

// Specify conditions

longCondition = open < lower_band

shortCondition = open > upper_band

GoldenLong = ta.crossover(shortSMA, longSMA)

Goldenshort = ta.crossover(longSMA, shortSMA)

plotshape(shortCondition, title="Sell Label", text="S", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.white)

plotshape(longCondition, title="Buy Label", text="B", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.white)

plotshape(Goldenshort, title="Golden Sell Label", text="Golden Crossover Short", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.new(color.blue, 0), textcolor=color.white)

plotshape(GoldenLong, title="Golden Buy Label", text="Golden Crossover Long", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.new(color.yellow, 0), textcolor=color.white)

// Execute trade if condition is True

if (longCondition)

stopLoss = low - atr * 1

takeProfit = high + atr * 4

if (RSILong)

strategy.entry("long", strategy.long)

if (shortCondition)

stopLoss = high + atr * 1

takeProfit = low - atr * 4

if (RSIShort)

strategy.entry("short", strategy.short)

// Plot ATR bands to chart

////ATR Up/Low Bands

plot(upper_band)

plot(lower_band)

// Plot Moving Averages

plot(shortSMA, color=color.red)

plot(longSMA, color=color.yellow)