概述

双EMA黄金交叉长线策略是一种仅开启做多头仓位的趋势跟踪策略。该策略同时使用短期EMA、中期EMA和长期EMA三条移动平均线。具体进入规则是:价格高于长期EMA,同时短期EMA从下方上穿中期EMA构成黄金交叉时,开仓做多。

策略原理

使用三条EMA周期可配置,分别计算出短期EMA、中期EMA和长期EMA。

如果价格高于长期EMA,则证明目前处于多头趋势中。

如果短期EMA从下方上穿中期EMA,形成黄金交叉,则进一步证实多头趋势加强中。

当上述两个条件同时满足时,开仓做多。

优势分析

该策略最大的优势是能够有效识别趋势,采用多周期EMA结合判断,避免被短期市场噪音误导。同时,配置停损作为风险控制手段,能够将损失控制在一定范围。

风险分析

该策略主要风险在于多头仓位。当行情反转时,无法及时关闭头寸,导致亏损扩大的风险。此外,EMAS周期设置不当也会导致交易频繁,增加交易成本。

优化方向

增加仓位数量管理,当回撤达到一定比例时降低仓位。

增加突破新高停损设置。

优化EMAS周期参数,降低交易频率。

总结

本策略整体为稳定优质的长线持仓策略。识别趋势能力较强,风险控制到位。通过进一步优化,可望获得更好的稳定收益。

策略源码

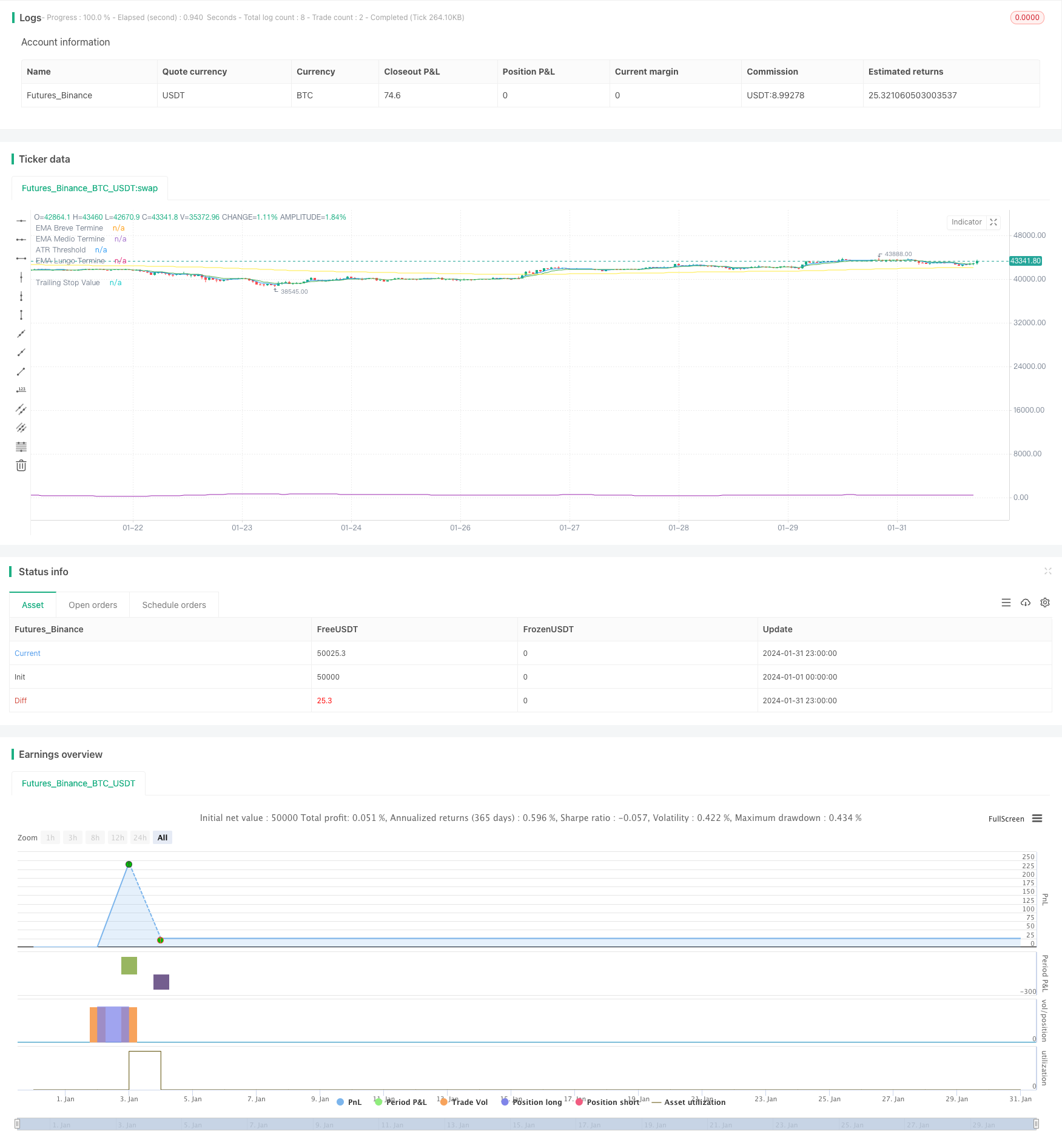

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Strategia EMA Long con Opzioni di Uscita Avanzate e Periodi EMA Personalizzabili", overlay=true)

// Parametri di input generali

useVolatilityFilter = input.bool(true, title="Usa Filtro di Volatilità")

atrPeriods = input.int(14, title="Periodi ATR", minval=1)

atrMultiplier = input.float(1.5, title="Moltiplicatore ATR", step=0.1)

useTrailingStop = input.bool(true, title="Usa Trailing Stop")

trailingStopPercent = input.float(15.0, title="Percentuale Trailing Stop", minval=0.1, step=0.1) / 100.0

useEMAExit = input.bool(true, title="Usa Uscita EMA Corta incrocia EMA Media al Ribasso")

// Parametri di input per periodi EMA personalizzabili

emaLongTermPeriod = input.int(200, title="Periodo EMA Lungo Termine", minval=1)

emaShortTermPeriod = input.int(5, title="Periodo EMA Breve Termine", minval=1)

emaMidTermPeriod = input.int(10, title="Periodo EMA Medio Termine", minval=1)

// Calcolo delle EMA con periodi personalizzabili

longTermEMA = ta.ema(close, emaLongTermPeriod)

shortTermEMA = ta.ema(close, emaShortTermPeriod)

midTermEMA = ta.ema(close, emaMidTermPeriod)

// Calcolo ATR e soglia di volatilità

atr = ta.atr(atrPeriods)

atrThreshold = ta.sma(atr, atrPeriods) * atrMultiplier

// Condizione di entrata

enterLongCondition = close > longTermEMA and shortTermEMA > midTermEMA

enterLong = useVolatilityFilter ? (enterLongCondition and atr > atrThreshold) : enterLongCondition

if (enterLong)

strategy.entry("Enter Long", strategy.long)

// Tracking del prezzo di entrata e del massimo prezzo raggiunto per il trailing stop

var float entryPrice = na

var float maxPriceSinceEntry = na

if (strategy.position_size > 0)

maxPriceSinceEntry := math.max(na(maxPriceSinceEntry) ? high : maxPriceSinceEntry, high)

entryPrice := na(entryPrice) ? strategy.position_avg_price : entryPrice

else

maxPriceSinceEntry := na

entryPrice := na

// Calcolo del valore del trailing stop

trailStopPrice = maxPriceSinceEntry * (1 - trailingStopPercent)

// Implementazione delle condizioni di uscita

exitCrossUnder = close < longTermEMA

emaCross = ta.crossunder(shortTermEMA, midTermEMA)

if (useEMAExit and emaCross)

strategy.close("Enter Long", comment="EMA Cross Exit")

if (useTrailingStop)

strategy.exit("Trailing Stop", from_entry="Enter Long", stop=trailStopPrice)

// Visualizzazioni

plot(longTermEMA, color=color.yellow, title="EMA Lungo Termine")

plot(shortTermEMA, color=color.blue, title="EMA Breve Termine")

plot(midTermEMA, color=color.green, title="EMA Medio Termine")

plot(useVolatilityFilter ? atrThreshold : na, color=color.purple, title="ATR Threshold")

plot(strategy.position_size > 0 ? trailStopPrice : na, color=color.orange, title="Trailing Stop Value", style=plot.style_linebr)