概述

该策略是一种基于布林带和MACD指标的量化交易策略。它融合了布林带的突破交易和MACD的趋势跟踪,旨在提高交易信号的质量。

策略原理

该策略主要基于布林带指标和MACD指标进行交易信号的判断。

布林带指标由中轨、上轨和下轨组成。当价格突破下轨时生成买入信号;当价格突破上轨时生成卖出信号。该策略使用布林带的突破原理来确定较强的突破信号。

MACD指标反映了短期和长期移动平均线之间的关系,通过差值线和信号线的金叉、死叉来判断买入和卖出时机。该策略融合使用MACD指标来过滤布林带交易信号,在差值线向上突破信号线时产生更有效的买入信号。

整体而言,该策略结合布林带的趋势跟踪和MACD的移动平均线优势,旨在在强势趋势中捕捉更大的行情波动。

策略优势

结合布林带和MACD指标,交易信号更加可靠。

在趋势行情中,布林带趋势跟踪和MACD移动平均线交叉可产生较强的入场信号。

通过双重指标判断,可有效过滤假信号,降低交易风险。

策略参数优化空间大,可根据不同品种和周期进行调整。

策略风险

在震荡行情中,布林带和MACD产生的交易信号可能频繁,带来套利风险。

MACD指标在低位区域出现三次金叉买入信号,可能面临反转下跌风险。

策略使用了较多指标,参数优化和策略测试难度较大。

针对上述风险,可通过适当调整持仓时间、设置止损线、优化参数等方法来控制。

策略优化方向

测试更长周期布林带参数,降低交易频率。

优化MACD快慢均线参数,提高指标敏感度。

增加其他指标过滤,如KDJ、RSI等,提升信号质量。

设置动态止损,自动止损退出,控制单笔交易风险。

总结

该策略整合布林带突破交易和MACD指标过滤,在理论上可产生高质量的交易信号。通过参数优化和风险控制手段,可望获得较好的回测结果。但任何策略都无法完全避免亏损,需谨慎评估实际交易效果。

策略源码

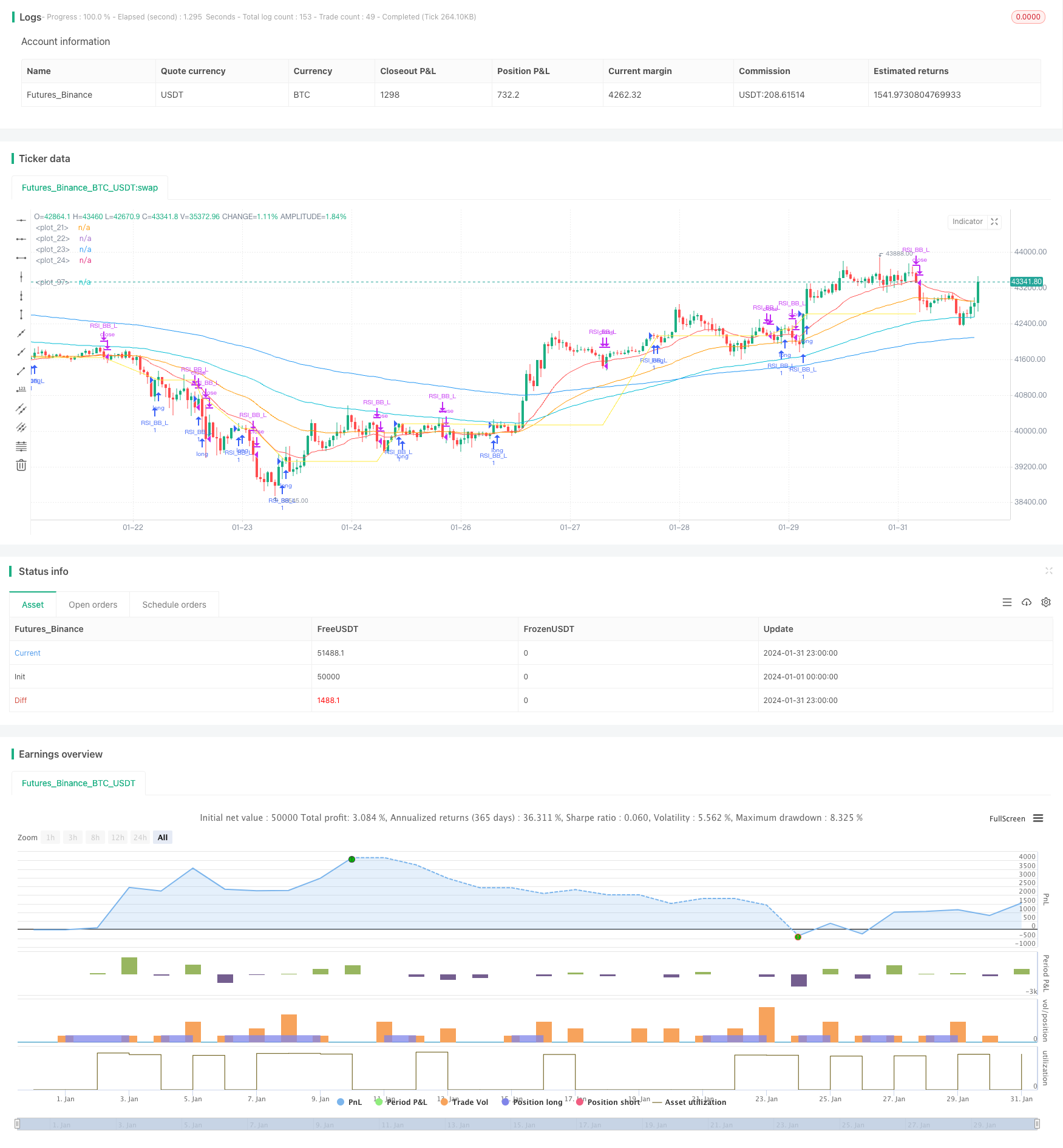

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Nabz-BBMACD-2022-V1.1", shorttitle="BBM-Nabz", overlay=true)

// My 1st Pine Scrpt Indicator

// Work on best on 1Hr Chart

// Open for Help/Donations.

var float lastentry=1

int result = 0

float x = 0

drawshape = false

/////////////EMA

shortest = ta.ema(close, 20)

short = ta.ema(close, 50)

longer = ta.ema(close, 100)

longest = ta.ema(close, 200)

plot(shortest, color = color.red)

plot(short, color = color.orange)

plot(longer, color = color.aqua)

plot(longest, color = color.blue)

///////////// RSI

RSIlength = input(6,title="RSI Period Length")

RSIoverSold = 50

RSIoverBought = 50

price = close

vrsi = ta.rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input.int(200, minval=1,title="Bollinger Period Length")

BBmult = 2 // input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = ta.sma(price, BBlength)

BBdev = BBmult * ta.stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyEntry = ta.crossover(source, BBlower)

sellEntry = ta.crossunder(source, BBupper)

////////////// MACD

fastLength = input(12)

slowlength = input(26)

MACDLength = input(9)

MACD = ta.ema(close, fastLength) - ta.ema(close, slowlength)

aMACD = ta.ema(MACD, MACDLength)

delta = MACD - aMACD

///////////// Colors

switch1=input(true, title="Enable Bar Color?")

switch2=input(true, title="Enable Background Color?")

TrendColor = RSIoverBought and (price[1] > BBupper and price < BBupper) and BBbasis < BBbasis[1] ? color.red : RSIoverSold and (price[1] < BBlower and price > BBlower) and BBbasis > BBbasis[1] ? color.green : na

///////////Strategy

bool tcu = not (ta.crossunder(price[0],shortest[0]))

if (((price[1]<BBlower[1]) and (ta.crossover(price,BBlower))))

lastentry := low[1]

strategy.entry("RSI_BB_L", strategy.long, comment="Buy 1st IF")

if (((ta.crossover(delta, 0.0) and (ta.crossover(price,BBlower)))))

lastentry := low[1]

strategy.entry("RSI_BB_L", strategy.long, comment="Buy 2nd IF")

if (((ta.crossover(delta, 0.0)) and (low[0]>shortest[0])) and (price[1]<low))

lastentry := low[1]

strategy.entry("RSI_BB_L", strategy.long, comment="Buy 3rd IF") //else

if (((ta.crossover(delta, 0.01)) and (high[1]<BBupper)) and (tcu))

lastentry := low[1]

strategy.entry("RSI_BB_L", strategy.long, comment="Buy 4th IF")

if ((ta.crossunder(low[0],shortest[0]) and close<shortest))

strategy.close(id="RSI_BB_L", comment="Close by 1st IF")

if (price<lastentry)

drawshape := true

if (price<strategy.opentrades.entry_price(0)/1.01175734321249)

strategy.close(id="RSI_BB_L", comment="Close by 2nd IF")

plot(strategy.opentrades.entry_price(0), color=color.yellow)