概述

本策略的核心思想是利用ATR指标计算出的价格波动范围来判断价格突破,以及EMA指标判断整体趋势方向,实现趋势跟随交易。当价格从ATR范围上沿或下沿突破时,如果突破方向与EMA方向一致,则入场做多或做空。平仓条件为价格回破ATR范围。

策略原理

首先,该策略使用ATR指标计算出一定周期内的价格波动范围。ATR范围的上限为SMA+ATR,下限为SMA-ATR。其中SMA代表当日收盘价的简单移动平均,ATR代表真实波幅平均值。

当价格从ATR范围上沿或下沿突破时,就形成交易机会。此时需要判断方向,如果是向上突破则做多,如果是向下突破则做空。为了确保突破方向与趋势方向一致,策略利用EMA指标判断整体趋势方向。只有当突破方向与EMA方向一致时,才会入场。

最后,策略以价格回破ATR范围作为平仓信号。做多后价格跌破下限就平仓;做空后价格涨破上限就平仓。

策略优势

利用ATR指标判断突破,可以有效抓取价格趋势性突破。ATR范围根据波动率设定,不会对正常波动产生过多干扰。

增加EMA指标作为方向判断,避免与趋势方向相反交易,可大幅提高获利率。

采用价格回破ATR范围作为止损方式,可以最大限度控制亏损风险。

策略风险

在震荡行情中,ATR范围可能被频繁打穿,容易造成过多无效交易和扩大亏损。

EMA作为判断趋势方向的指标,存在一定滞后性。所以可能错过价格短期反转的机会。

止损方式为价格回破,容易因突发事件造成扩大亏损。

策略优化方向

可以考虑结合其他指标判断趋势和回撤,避免EMA单一判断错误。例如MACD,KDJ等。

可以考虑根据市场波动率实时调整ATR参数,使ATR范围更贴近真实波动。

可以结合移动止损方式,实时调整止损点,最大限度控制单笔亏损风险。

总结

本策略整体思路清晰,利用ATR指标判断价格突破并配合EMA判断方向,可以有效跟随趋势;止损方式直接,容易操作。但同时也存在一定风险,优化空间较大,有待进一步测试和调整。总体来说,本策略适合追求高胜率的趋势交易者。

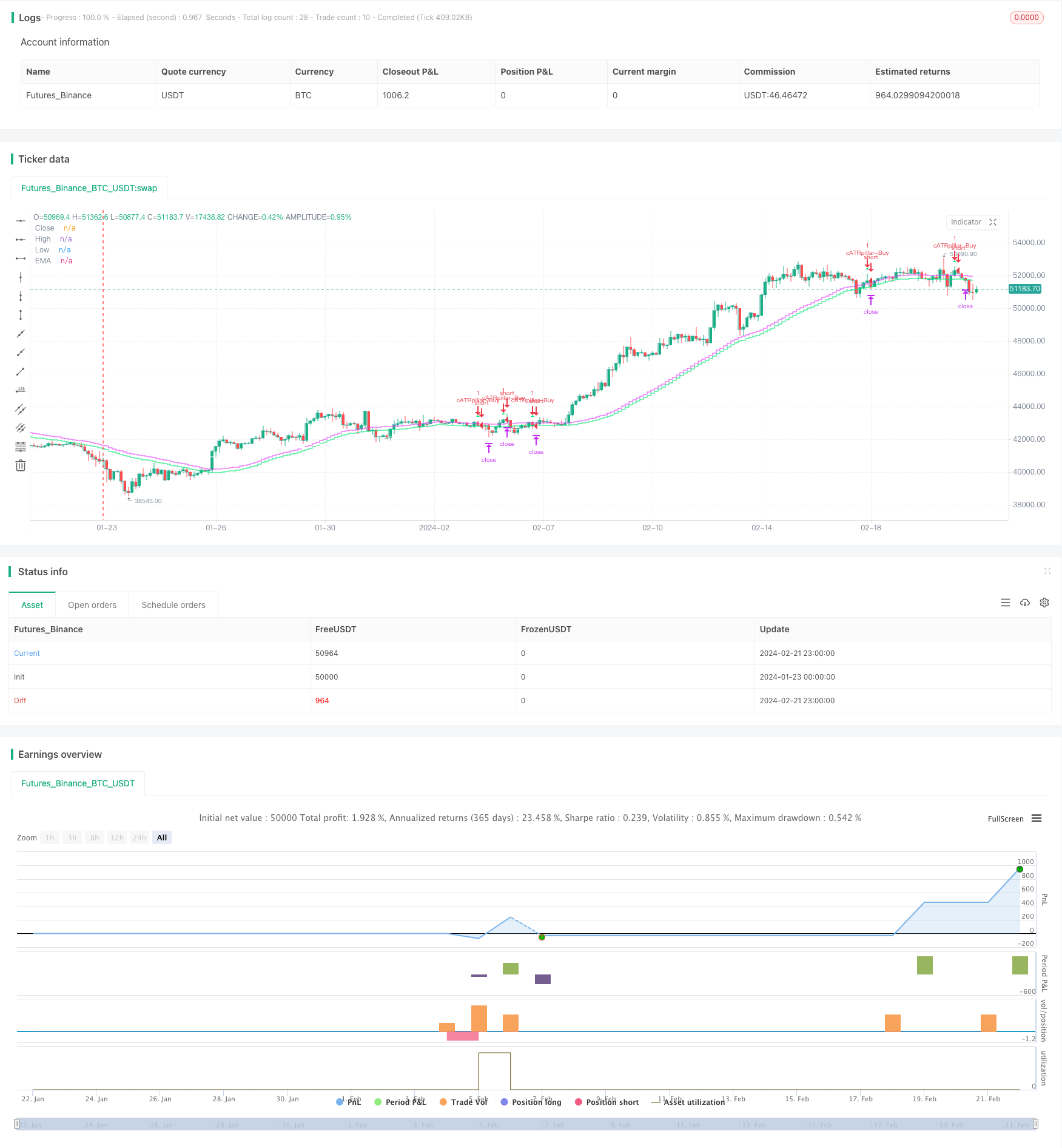

/*backtest

start: 2024-01-23 00:00:00

end: 2024-02-22 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © cwagoner78

//@version=4

strategy("cATRpillar", overlay=true)

//------------

//inputs

lookback = input(title="Periods", type=input.integer, defval=37)

atrMult = input(title="Range Multiplier", type=input.float, defval=.2)

takeProfit = input(title="Take Profit", type=input.float, defval=5000)

stopLoss = input(title="Stop Loss", type=input.float, defval=2500)

lots = input(title="Lots to Trade", type=input.float, defval=1)

//------------

//indicators

atr=atr(lookback)*atrMult

sma=sma(close, lookback)

ema=ema(close,lookback*2)

rangeLo=sma-atr

rangeHi=sma+atr

//------------

//draw objects

p0 =plot(close, title="Close", color=#26A69A, linewidth=0, transp=80,style=plot.style_stepline)

p1 =plot(rangeHi, title="High", color=color.fuchsia, linewidth=0, transp=80,style=plot.style_stepline)

p2 =plot(rangeLo, title="Low", color=color.lime, linewidth=0, transp=80,style=plot.style_stepline)

p3 =plot(ema, title="EMA", color=color.white, linewidth=0, transp=80, style=plot.style_stepline)

fill(p1, p0, color=color.fuchsia)

fill(p0, p2, color=color.lime)

//------------

//Trading

atrShort=open[1] > rangeHi and open < rangeLo

atrLong=open[1] < rangeLo and open > rangeHi

exitLong=open>rangeLo

exitShort=open<rangeHi

//Long

longCondition=atrLong and open>ema+atr

strategy.entry(id="cATRpillar-Buy", long=true, when=longCondition)

longCloseCondition=exitLong

strategy.exit(id="cATRpillar-Exit", qty=lots, profit=takeProfit, loss=stopLoss, when=longCloseCondition)

//Short

shortCondition=atrShort and open<ema-atr

strategy.entry(id="cATRpillar-Sell", long=false, when=shortCondition)

shortCloseCondition=exitShort

strategy.exit(id="cATRpillar-Exit", qty=lots, profit=takeProfit, loss=stopLoss, when=shortCloseCondition)

plotshape(shortCondition, title= "Short", location=location.belowbar, color=color.fuchsia, transp=80, style=shape.triangledown, size=size.tiny)

plotshape(longCondition, title= "Long", location=location.abovebar, color=color.lime, transp=80, style=shape.triangleup, size=size.tiny)

//------------