概述

间隔交易策略是一种基于移动平均线的趋势跟踪策略。该策略利用30天的指数移动平均线来识别价格趋势,在价格突破平均线时进入场内,当价格回落到平均线以下时平仓离场。这种策略适用于30分钟到日线时间框架下的交易。

策略原理

该策略主要基于价格与30日指数移动平均线的关系来判断入场和离场信号。具体来说:

- 计算30日EMA指数移动平均线,作为判断趋势的标准。

- 当价格上涨突破EMA时,发出做多信号,进入场内。

- 当价格下跌突破EMA时,发出平仓信号,离场。

这样,通过CAPTURE价格趋势上的突破,来锁定趋势交易机会。

优势分析

这种策略具有以下几个优势:

- 策略逻辑简单清晰,容易理解实现,运行成本低。

- 利用EMA滤除价格noise,锁定主要趋势。

- 选取30日EMA,时间框架适中,既可以识别中长线趋势,也可跟踪短线机会。

- 可自定义参数,适应不同品种和市场环境。

风险及解决方案分析

该策略也存在一些风险:

- whipsaw风险:价格震荡突破EMA后又快速回撤,造成损失。可适当延长EMA周期。

- 趋势反转风险:中长线趋势发生反转时,可能积累较大亏损。可设置止损策略减少损失。

- 参数选择风险:EMA周期设置不当,无法有效跟踪趋势。可使用自适应EMA或多EMA组合方式。

策略优化方向

该策略可从以下几个方面进行优化:

- 增加自适应EMA:根据市场波动性和品种特征自动调整EMA参数,提高稳健性。

- 增加多EMA系统:组合使用短期和长期EMA,同时跟踪长短线趋势。

- 增加止损机制:设立移动止损或盘整止损,降低单笔损失。

- 结合其他指标:整合动量指标、波动率指标等Filter信号,提高策略效率。

- 参数优化:采用机器学习等方法寻找最优参数组合。

总结

间隔交易策略通过捕捉价格突破EMA的方式来进行趋势跟踪,是一种简单实用的量化策略。该策略可W灵活定制和优化,适合中长线持仓,也可进行短线交易。总体来说,该策略风险可控,如果参数设定得当,能够获取稳定收益。

策略源码

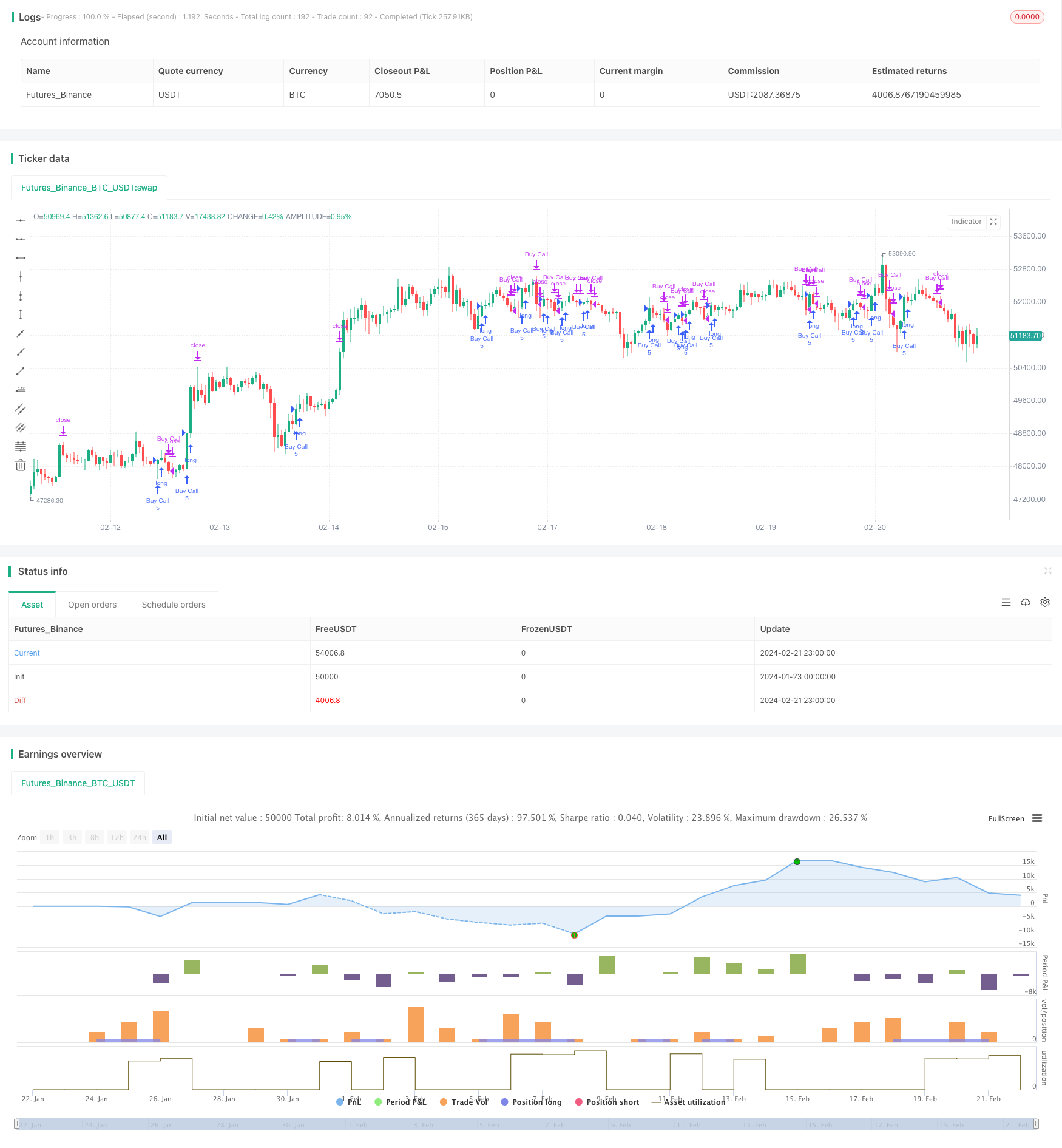

/*backtest

start: 2024-01-23 00:00:00

end: 2024-02-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Spaced Out Trading Strategy", overlay=true)

// Define strategy parameters

emaPeriod = input(30, title="EMA Period") // Longer EMA period for more spaced-out trades

stopLossPct = input(2.0, title="Stop Loss Percentage") // Stop loss percentage

takeProfitPct = input(3.0, title="Take Profit Percentage") // Take profit percentage

// Calculate EMA

emaValue = ta.ema(close, emaPeriod)

// Define entry and exit conditions

enterLong = ta.crossover(close, emaValue)

exitLong = ta.crossunder(close, emaValue)

// Place orders

contractsQty = 5 // Number of contracts to buy

var float lastTradePrice = na // Track the last trade price

if enterLong and strategy.position_size == 0

strategy.entry("Buy Call", strategy.long, qty = contractsQty)

lastTradePrice := close

else if exitLong and strategy.position_size > 0

strategy.close("Buy Call")

lastTradePrice := na

// Calculate stop loss and take profit

stopLossPrice = lastTradePrice * (1 - stopLossPct / 100)

takeProfitPrice = lastTradePrice * (1 + takeProfitPct / 100)

strategy.exit("Sell Call", "Buy Call", stop = stopLossPrice, limit = takeProfitPrice)