概述

该策略是一个基于移动平均线的趋势跟踪交易策略。它使用14日简单移动平均线来判断市场趋势方向,并在价格接近移动平均线时进行买入或卖出。

策略原理

该策略的核心逻辑是:

- 计算14日简单移动平均线(SMA)

- 当收盘价低于移动平均线的99%时,认为处于超卖状态,产生买入信号

- 入场后设置止损和止盈价格

- 止损价格为入场价格再向下10个点

- 止盈价格为入场价格再向上60个点

该策略属于趋势跟踪策略,通过移动平均线判断市场总体走势,在超卖时段介入,随大趋势运行止损止盈。

优势分析

该策略有以下主要优势:

- 策略逻辑简单清晰,容易理解和实现

- 利用移动平均线判断市场走势,可以过滤掉部分噪音

- 只在超卖阶段介入,可以避开大幅下跌的风险

- 止损和止盈设置合理,避免亏损扩大

- 回撤和损失可以控制在一定范围内

风险分析

该策略也存在一些风险:

- 移动平均线存在滞后,可能错过短线交易机会

- 止损设置过于激进,可能被秒出

- 市场出现大幅跳空或重大消息导致方向反转

- 机器人套利或高频交易干扰

可以通过适当放宽入场条件、调整止损位置等方法来规避部分风险。

优化方向

该策略还可以从以下几个方面进行优化:

- 优化移动平均线的参数,适配更多市场环境

- 增加多个时间周期的移动平均线,进行组合判断

- 在特定时间段使用不同的止损止盈比率

- 利用波动率指标过滤入场时机

- 增加机器学习等算法判断趋势和关键点

总结

该策略整体来说是一种简单实用的趋势跟踪策略。它利用移动平均线判断趋势方向,在超卖点位介入,并设置合理的止损止盈,可以有效控制风险。通过一定的优化和组合,可以适配更多的市场情况,进一步提高策略的稳定性和盈利能力。

策略源码

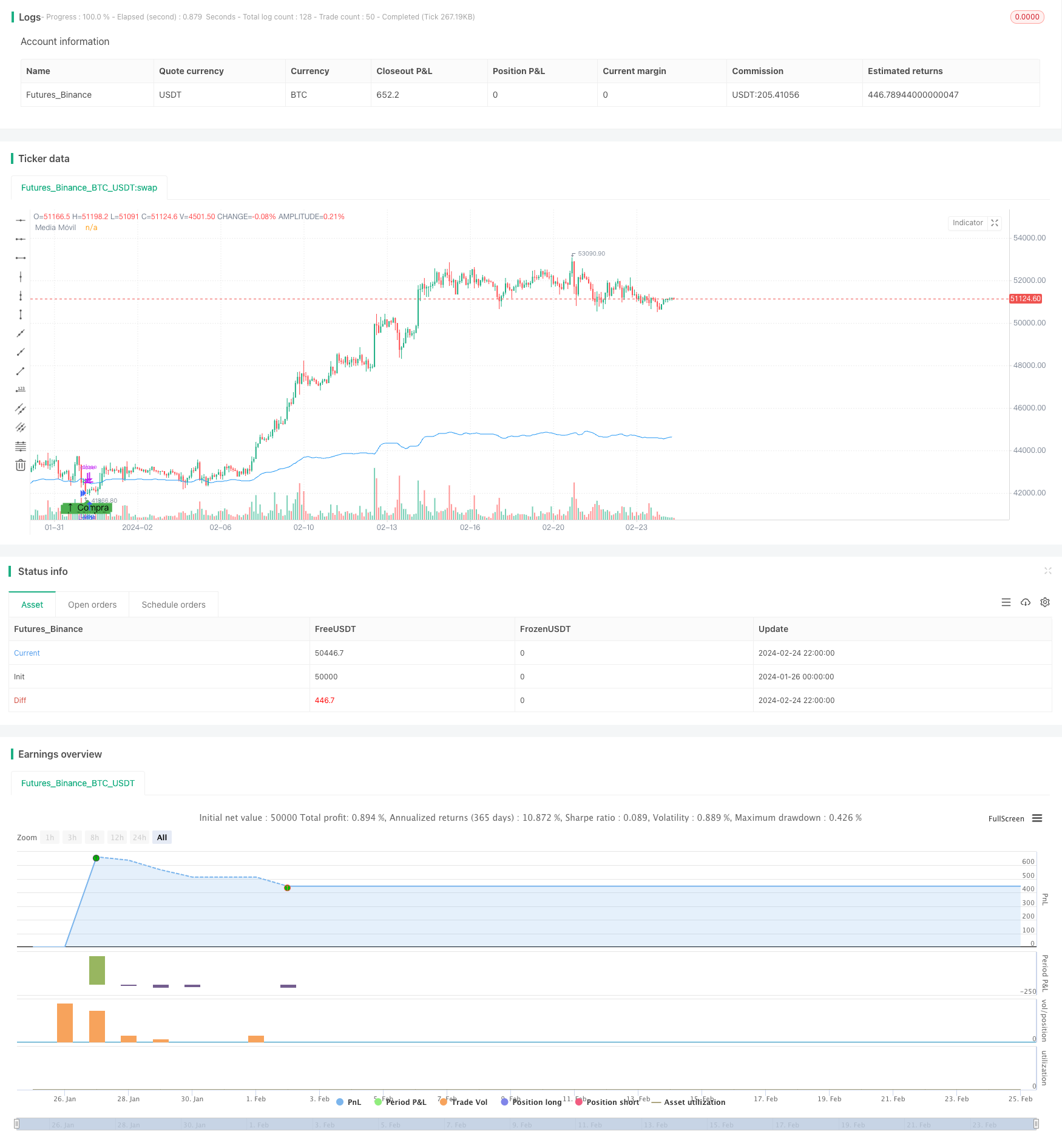

/*backtest

start: 2024-01-26 00:00:00

end: 2024-02-25 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia MA - mejor", overlay=true)

// Parámetros de la estrategia

initialCapital = 1000 // Inversión inicial

riskPerTrade = 0.02 // Riesgo por operación (2% del capital por operación)

lengthMA = 14 // Período de la media móvil

pipValue = 20 / 10 // Valor de un pip (30 euros / 10 pips)

// Apalancamiento

leverage = 10

// Cálculo de la media móvil en el marco temporal de 30 minutos

ma = request.security(syminfo.tickerid, "30", ta.sma(close, lengthMA))

// Condiciones de Entrada en Sobreventa

entryCondition = close < ma * 0.99 // Ejemplo: 1% por debajo de la MA

// Lógica de entrada y salida

if entryCondition

riskAmount = initialCapital * riskPerTrade // Cantidad de euros a arriesgar por operación

size = 1 // Tamaño de la posición con apalancamiento

strategy.entry("Long", strategy.long, qty=size)

stopLossPrice = close - (10 * pipValue / size)

takeProfitPrice = close + (60 * pipValue / size)

strategy.exit("Exit Long", "Long", stop=stopLossPrice, limit=takeProfitPrice)

// Gráficos

plot(ma, color=color.blue, title="Media Móvil")

plotshape(series=entryCondition, title="Entrada en Sobreventa", location=location.belowbar, color=color.green, style=shape.labelup, text="↑ Compra")