概述

该策略是一个基于30日和200日移动平均线交叉的交易策略。它在XAUUSD黄金1分钟图表上运行,用于捕捉短期价格趋势。该策略同时使用止损和止盈设置来管理风险。

策略原理

该策略使用30日和200日移动平均线交叉作为交易信号。当30日移动平均线上穿200日移动平均线时,做多;当30日移动平均线下穿200日移动平均线时,做空。此外,在出现反向信号时,会平仓当前头寸,再按照新信号的方向开仓。

该策略结合了趋势跟踪和均线交叉的优点。30日均线能更快地响应价格变化,200日均线具有更强的趋势过滤性。它们的交叉为进出市提供了清晰的信号。同时,它利用反转开仓来锁定利润,避免在价格盘整时造成较大亏损。

优势分析

- 利用双均线交叉提高信号的可靠性

- 反转开仓机制有助于避免盘整造成的亏损

- 同时设置止损和止盈有利于风险控制

- 可在多种时间周期使用

- 易于通过参数优化提高效果

风险分析

该策略主要面临以下风险:

- 双均线生成假信号的概率较大,可能导致交易频繁,增加交易成本和滑点风险

- 未考虑交易品种的基本面因素,忽视了价格波动的内在逻辑

- 没有设置资金管理规则,无法控制单笔交易风险暴露

可以通过以下方法降低风险:

- 增加过滤条件,避免信号频繁反转

- 结合交易品种的基本面分析

- 引入资金管理模块,限制单笔头寸规模

优化方向

该策略可从以下方面进行优化:

- 测试不同参数的均线组合,找到最佳的参数

- 增加其他指标过滤,如成交量、波动率指标等

- 引入自适应止损机制,让止损根据市场波动率调整

- 应用资金管理规则,限制单笔头寸规模

- 进行回测优化,找到最佳的参数组合

总结

该策略整体运作流畅,核心交易逻辑清晰简洁。它利用双均线交叉产生交易信号,并采用反转开仓的方式锁定利润。这种交易方式可避免价格盘整期间的大幅亏损。同时设置止损止盈也有利于风险控制。但该策略也存在一定的缺陷,主要表现为信号频繁,忽视了价格波动的基本面因素。通过引入过滤条件、资金管理模块以及参数优化,可以降低风险,提高策略的稳定性和收益率。

策略源码

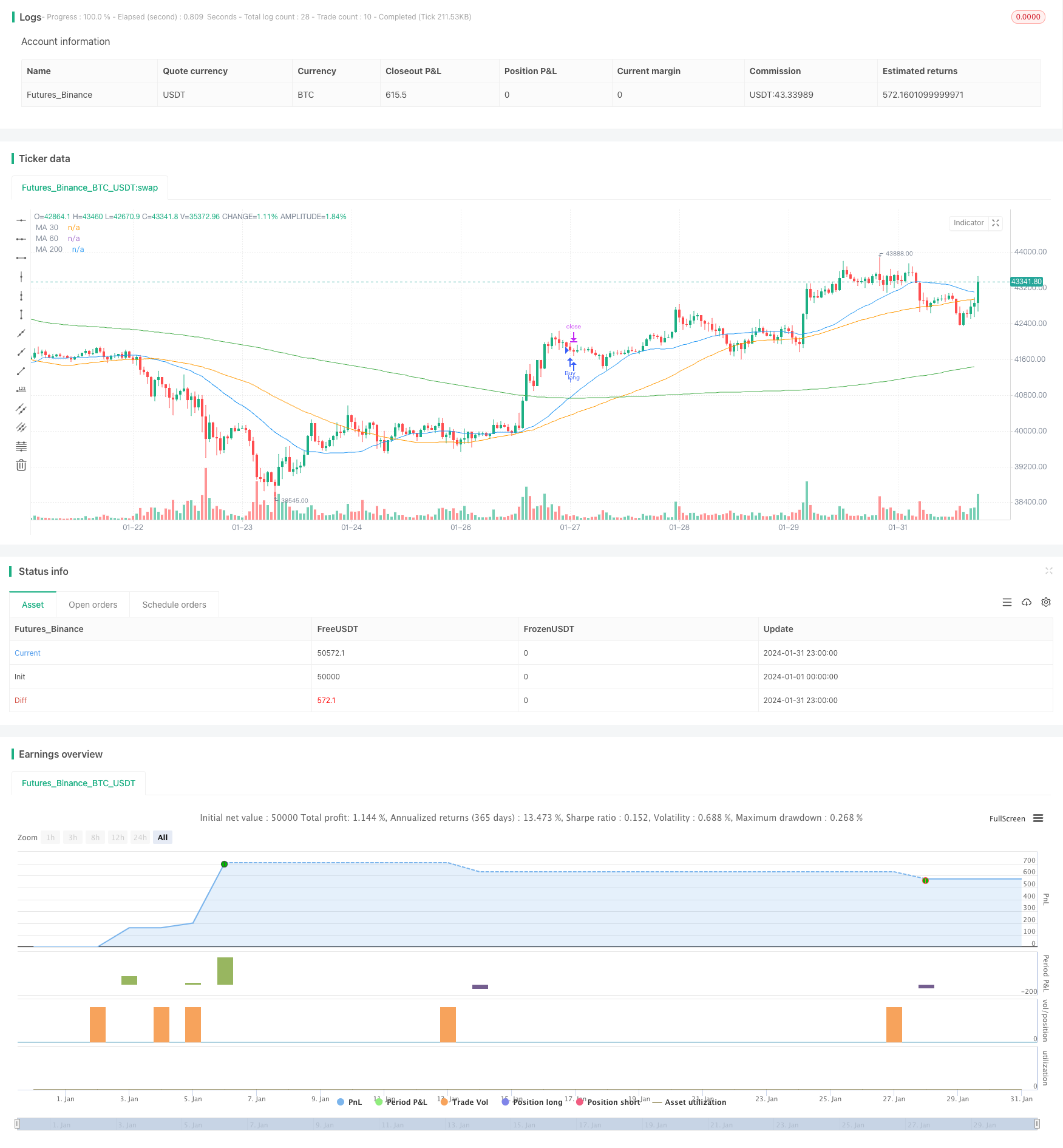

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia de Cruce de Medias Móviles", overlay=true)

// Medias móviles

ma30 = ta.sma(close, 30)

ma60 = ta.sma(close, 60)

ma200 = ta.sma(close, 200)

// Cruce de medias móviles

crossoverUp = ta.crossover(ma30, ma200)

crossoverDown = ta.crossunder(ma30, ma200)

// Señales de compra y venta

longCondition = crossoverUp

shortCondition = crossoverDown

// Ejecución de órdenes

if (longCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("Cover", "Buy", stop=close - 40.000, limit=close + 40.000)

if (shortCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("Cover", "Sell", stop=close + 40.000, limit=close - 40.000)

// Plot de las medias móviles

plot(ma30, color=color.blue, title="MA 30")

plot(ma60, color=color.orange, title="MA 60")

plot(ma200, color=color.green, title="MA 200")

// Condiciones para cerrar la posición contraria

if (strategy.position_size > 0)

if (crossoverDown)

strategy.close("Buy")

if (strategy.position_size < 0)

if (crossoverUp)

strategy.close("Sell")