概述

该策略通过RSI指标识别多空分离现象,据此进行交易决策。其核心思想是当价格出现新低但RSI指标出现新高时,构成“多头分离”信号,表明底部已经形成,做多;当价格出现新高但RSI指标出现新低时,构成“空头分离”信号,表明顶部已经形成,做空。

策略原理

该策略主要运用RSI指标识别价格与RSI之间的多空分离现象,具体方法如下:

- 使用RSI指标参数为13,源数据为收盘价

- 定义多头分离的向左回溯范围为14天,向右回溯范围为2天

- 定义空头分离的向左回溯范围为47天,向右回溯范围为1天

- 当价格创下更低的低点,但RSI指标创下更高的低点时,满足多头分离条件,产生做多信号

- 当价格创下更高的高点,但RSI指标创下更低的高点时,满足空头分离条件,产生做空信号

通过识别价格和RSI指标之间的多空分离现象,可以提前捕捉到价格走势的转折点,据此进行交易决策。

策略优势

该策略主要具有以下优势:

- 识别价格和RSI指标之间的多空分离现象,可以提前判断价格趋势的转折点,把握交易机会

- 由于利用的是指标分析,因此不受主观情绪影响

- 采用固定回溯区间识别分离现象,避免调参频繁

- 结合日线RSI等额外条件,可以减少误交易概率

风险及解决方法

该策略也存在一定的风险:

RSI指标发生背离不一定预示着价格立即反转,可能存在时间差,这会导致止损被触发的风险。解决方法是适当放宽止损幅度,给价格足够的时间去确认分离信号。

分离现象持续过长时间也会增加风险。解决方法是结合更长期的日线或周线RSI指标作为过滤条件。

分离幅度过小也无法确认趋势转折,需要适当放大回溯区间来搜寻更明显的RSI分离。

策略优化方向

该策略还可以从以下几个方向进行优化:

优化RSI参数,寻找最佳的参数组合

尝试其他的技术指标如MACD、KD等来识别多空分离现象

增加适当的震荡期过滤条件,避免震荡期的增多误交易

结合更多时间周期的RSI指标,寻找最佳的组合信号

总结

RSI多空分离交易策略通过识别RSI指标与价格之间的多空分离现象,判断价格走势的转折点,据此建立交易信号。该策略简单实用,通过优化参数设置和增加过滤条件,可以进一步提高盈利概率。总的来说,RSI多空分离策略是一个很有效的量化交易策略。

策略源码

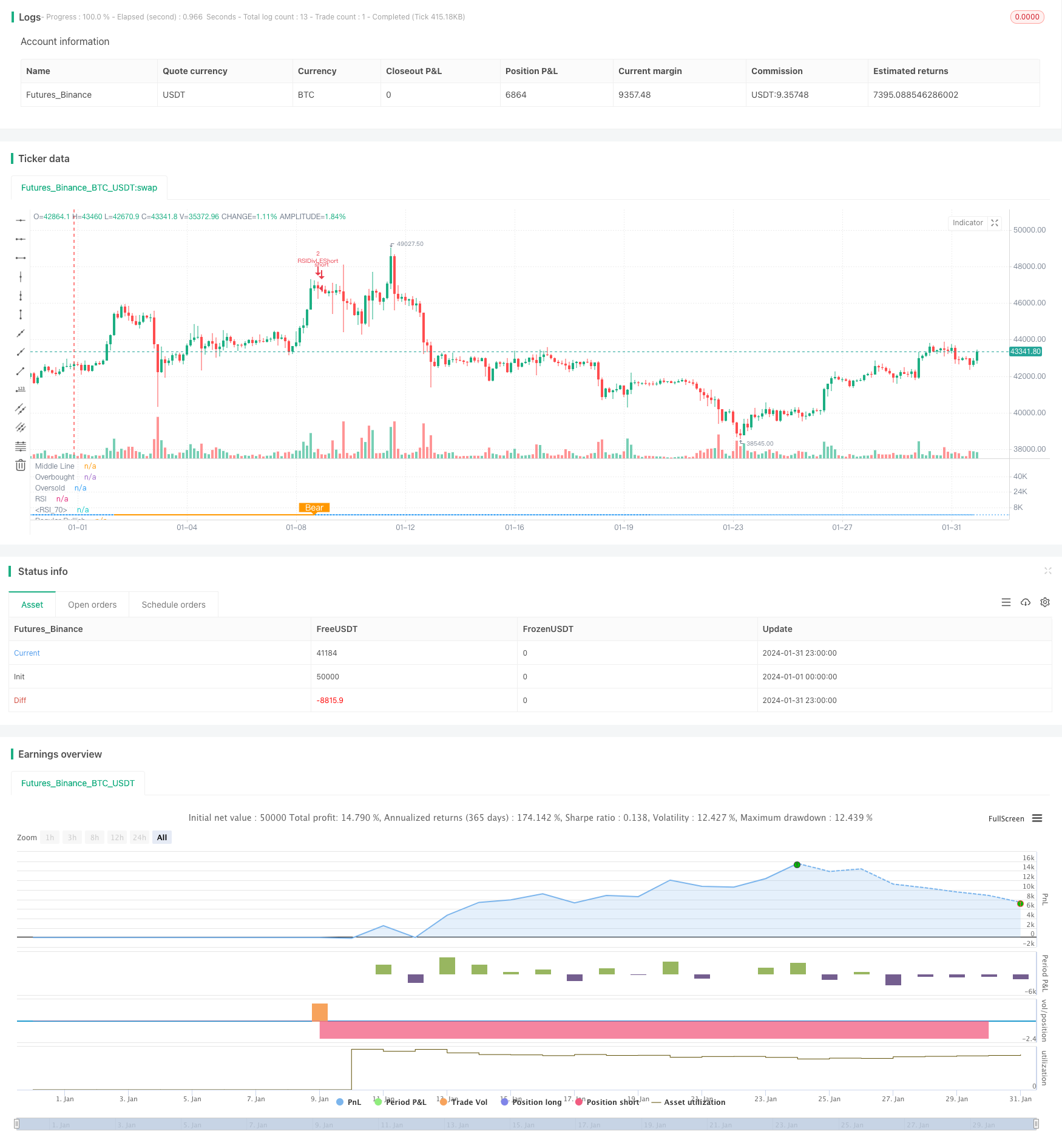

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Nextep

//@version=4

strategy(title="RSI top&bottom destroy ", overlay=false, pyramiding=4, default_qty_value=2, default_qty_type=strategy.fixed, initial_capital=10000, currency=currency.USD)

// INPUT Settings --------------------------------------------------------------------------------------------------------------------------------------------------

len = input(title="RSI Period", minval=1, defval=13)

src = input(title="RSI Source", defval=close)

// defining the lookback range for shorts

lbRshort = input(title="Short Lookback Right", defval=1)

lbLshort = input(title="Short Lookback Left", defval=47)

// defining the lookback range for longs

lbRlong = input(title="Long Lookback Right", defval=2)

lbLlong = input(title="Long Lookback Left", defval=14)

rangeUpper = input(title="Max of Lookback Range", defval=400)

rangeLower = input(title="Min of Lookback Range", defval=1)

// take profit levels

takeProfitLongRSILevel = input(title="Take Profit at RSI Level", minval=0, defval=75)

takeProfitShortRSILevel = input(title="Take Profit for Short at RSI Level", minval=0, defval=25)

// Stop loss settings

longStopLossType = input("PERC", title="Long Stop Loss Type", options=['ATR','PERC', 'FIB', 'NONE'])

shortStopLossType = input("PERC", title="Short Stop Loss Type", options=['ATR','PERC', 'FIB', 'NONE'])

longStopLossValue = input(title="Long Stop Loss Value", defval=14, minval=0)

shortStopLossValue = input(title="Short Stop Loss Value", defval=5, minval=-10)

// PLOTTING THE CHARTS --------------------------------------------------------------------------------------------------------------------------------------------------

// Plotting the Divergence

plotBull = input(title="Plot Bullish", defval=true)

plotBear = input(title="Plot Bearish", defval=true)

bearColor = color.orange

bullColor = color.green

textColor = color.white

noneColor = color.new(color.white, 100)

// Adding the RSI oscillator

osc = rsi(src, len)

ma_len = 14 // Length for the moving average

rsi_ma = sma(osc, ma_len) // Calculate the moving average of RSI

plot(osc, title="RSI", linewidth=1, color=color.purple)

plot(rsi_ma, color=color.blue, title="RSI MA") // Plot the RSI MA

// Adding the lines of the RSI oscillator

plot(osc, title="RSI", linewidth=1, color=color.purple)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(75, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(25, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=color.purple, transp=80)

atrLength = input(14, title="ATR Length (for Trailing stop loss)")

atrMultiplier = input(3.5, title="ATR Multiplier (for Trailing stop loss)")

// RSI PIVOTS --------------------------------------------------------------------------------------------------------------------------------------------------

// Define a condition for RSI pivot low

isFirstPivotLowlong = not na(pivotlow(osc, lbLlong, lbRlong))

// Define a condition for RSI pivot high

isFirstPivotHighlong = not na(pivothigh(osc, lbLlong, lbRlong))

// Define a condition for the first RSI value

firstPivotRSIValuelong = isFirstPivotLowlong ? osc[lbRlong] : na

// Define a condition for the second RSI value

secondPivotRSIValuelong = isFirstPivotLowlong ? valuewhen(isFirstPivotLowlong, osc[lbRlong], 1) : na

// Define a condition for RSI pivot low

isFirstPivotLowshort = not na(pivotlow(osc, lbLshort, lbRshort))

// Define a condition for RSI pivot high

isFirstPivotHighshort = not na(pivothigh(osc, lbLshort, lbRshort))

// Define a condition for the first RSI value

firstPivotRSIValueshort = isFirstPivotLowshort ? osc[lbRshort] : na

// Define a condition for the second RSI value

secondPivotRSIValueshort = isFirstPivotLowshort ? valuewhen(isFirstPivotLowshort, osc[lbRshort], 1) : na

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

// ADDITIONAL ENTRY CRITERIA --------------------------------------------------------------------------------------------------------------------------------------------------

// RSI crosses RSI MA up by more than 2 points and subsequently down

rsiUpCross = crossover(osc, rsi_ma + 1)

rsiDownCross = crossunder(osc, rsi_ma - 1)

// Calculate the daily RSI

rsiDaily = security(syminfo.ticker, "D", rsi(src, 14))

// BULLISH CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// LOWER LOW PRICE & HIGHER LOW OSC

// Price: Lower Low

priceLL = na(isFirstPivotLowlong[1]) ? false : (low[lbRlong] < valuewhen(isFirstPivotLowlong, low[lbRlong], 1))

// Osc: Higher Low

oscHL = na(isFirstPivotLowlong[1]) ? false : (osc[lbRlong] > valuewhen(isFirstPivotLowlong, osc[lbRlong], 1) and _inRange(isFirstPivotLowlong[1]))

// BULLISH PLOT

bullCond = plotBull and priceLL and oscHL and isFirstPivotLowlong

plot(

isFirstPivotLowlong ? osc[lbRlong] : na,

offset=-lbRlong,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? osc[lbRlong] : na,

offset=-lbRlong,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

// BEARISH CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// HIGHER HIGH PRICE & LOWER LOW OSC

// Osc: Lower High

oscLH = na(isFirstPivotHighshort[1]) ? false : (osc[lbRshort] < valuewhen(isFirstPivotHighshort, osc[lbRshort], 1) and _inRange(isFirstPivotHighshort[1]))

// Price: Higher High

priceHH = na(isFirstPivotHighshort[1]) ? false : (high[lbRshort] > valuewhen(isFirstPivotHighshort, high[lbRshort], 1))

// BEARISH PLOT

bearCond = plotBear and priceHH and oscLH and isFirstPivotHighshort

plot(

isFirstPivotHighshort ? osc[lbRshort] : na,

offset=-lbRshort,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? osc[lbRshort] : na,

offset=-lbRshort,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

// ENTRY CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

longCondition = false

shortCondition = false

// Entry Conditions

longCondition := bullCond

shortCondition := bearCond

// Conditions to prevent entering trades based on daily RSI

longCondition := longCondition and rsiDaily >= 23

shortCondition := shortCondition and rsiDaily <= 80

// STOPLOSS CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

// Stoploss Conditions

long_sl_val =

longStopLossType == "ATR" ? longStopLossValue * atr(atrLength)

: longStopLossType == "PERC" ? close * longStopLossValue / 100 : 0.00

long_trailing_sl = 0.0

long_trailing_sl := strategy.position_size >= 1 ? max(low - long_sl_val, nz(long_trailing_sl[1])) : na

// Calculate Trailing Stop Loss for Short Entries

short_sl_val =

shortStopLossType == "ATR" ? 1 - shortStopLossValue * atr(atrLength)

: shortStopLossType == "PERC" ? close * (shortStopLossValue / 100) : 0.00 //PERC = shortstoplossvalue = -21300 * 5 / 100 = -1065

short_trailing_sl = 0.0

short_trailing_sl := strategy.position_size <= -1 ? max(high + short_sl_val, nz(short_trailing_sl[1])) : na

// RSI STOP CONDITION

rsiStopShort = (strategy.position_avg_price != 0.0 and close <= strategy.position_avg_price * 0.90) or (strategy.position_avg_price != 0.0 and rsi(src, 14) >= 75)

rsiStopLong = (strategy.position_avg_price != 0.0 and close >= strategy.position_avg_price * 1.10) or (strategy.position_avg_price != 0.0 and rsi(src, 14) <= 25)

// LONG CONDITIONS --------------------------------------------------------------------------------------------------------------------------------------------------

strategy.entry(id="RSIDivLELong", long=true, when=longCondition)

strategy.entry(id="RSIDivLEShort", long=false, when=shortCondition)

// Close Conditions

shortCloseCondition = bullCond // or cross(osc, takeProfitShortRSILevel)

strategy.close(id="RSIDivLEShort", comment="Close All="+tostring(-close + strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) <= -1 and shortStopLossType == "NONE" and shortCloseCondition )

strategy.close(id="RSIDivLEShort", comment="TSL="+tostring(-close + strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= -1 and ((shortStopLossType == "PERC" or shortStopLossType == "ATR") and cross(short_trailing_sl,high))) // or rsiStopShort)// or rsiStopShort)

longCloseCondition = bearCond

strategy.close(id="RSIDivLELong", comment="Close All="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= 1 and longStopLossType == "NONE" and longCloseCondition)

strategy.close(id="RSIDivLELong", comment="TSL="+tostring(close - strategy.position_avg_price, "####.##"), when=abs(strategy.position_size) >= 1 and ((longStopLossType == "PERC" or longStopLossType == "ATR") and cross(long_trailing_sl,low))) //or rsiStopLong