概述

本文介绍了一个基于 Stochastics Momentum Index(SMI)指标的追踪股票趋势的策略。该策略名为“Momentum Surfer策略”。它利用 SMI 指标识别股票的超买超卖区域,并在趋势反转点进行买入卖出,以获利。

策略原理

SMI 指标用于识别股票的超买超卖区域。当 SMI 指标进入红色区域时表示股票过卖,绿色区域时表示股票超买。该策略的交易信号来源于 SMI 指标和其 EMA 的交叉。

具体来说,当 SMI 指标上穿其 EMA 线,并且此时 SMI 值在 -40 以下过卖区域时,产生买入信号。当 SMI 指标下穿其 EMA 线,并且此时 SMI 值在 40以上超买区域时,产生卖出信号。

这样,该策略就可以在股票价格反转的时候及时捕捉信号,实现低买高卖的目的。从而顺势追踪股票的涨跌趋势。

策略优势分析

该策略最大的优势在于可以顺势追踪股票的趋势。因为它利用 SMI 指标识别入场和出场的时机,所以可以在股票价格反转的时候捕捉到信号。

另外,SMI 指标本身就具有平滑价格的特点。相比简单的移动平均线等指标,它对价格变动的反应更为平稳。这也使得产生的交易信号更加可靠,不易被短期的市场噪音所影响。

总的来说,该策略成功利用 SMI 指标的优势,实现了对股票趋势的有效追踪。它可以帮助投资者获利,而且也非常适合自动化交易。

风险分析

该策略主要依赖 SMI 指标,所以它存在一些与 SMI 相关的风险。

首先,SMI 指标对参数设置比较敏感。如果参数设置不当,那么产生的交易信号效果会大打折扣。这需要投资者经过反复测试以确定最佳参数组合。

另外,SMI 本身也无法完全避免错误交易信号的出现。当市场出现剧烈波动时,它可能会产生虚假信号导致不必要的亏损。这需要与其他指标组合使用来确认交易信号,降低错误交易概率。

最后,该策略无法改变整体股票市场风险。当整个市场进入熊市时,该策略依然难以避免较大的亏损。这是所有基于技术分析策略都无法完全规避的系统性风险。

策略优化方向

该策略可以从以下几个方面进行进一步优化:

组合其他指标,利用指标组合的优势来减少错误交易信号的概率,提高盈利概率。例如可以加入基本面的因子、波动率指标等。

利用机器学习方法自动优化 SMI 参数。通过大量历史数据训练,寻找最优参数组合。

增加止损策略。合理止损可以极大的降低单次亏损的影响,减少风险。

结合量化选股策略,提高股票池的整体质量。良好的股票池质量,将直接提升策略的稳定性。

总结

本文详细介绍了基于 SMI 指标实现趋势跟踪的 Momentum Surfer 策略。该策略最大的优势是可以顺势捕捉价格反转,顺势追踪股票趋势变化。它也存在一些参数设置敏感性、信号可靠性等风险。我们给出了进一步提升策略效果的几点优化建议。总的来说,该策略对于自动化交易而言非常有吸引力,值得实盘验证。

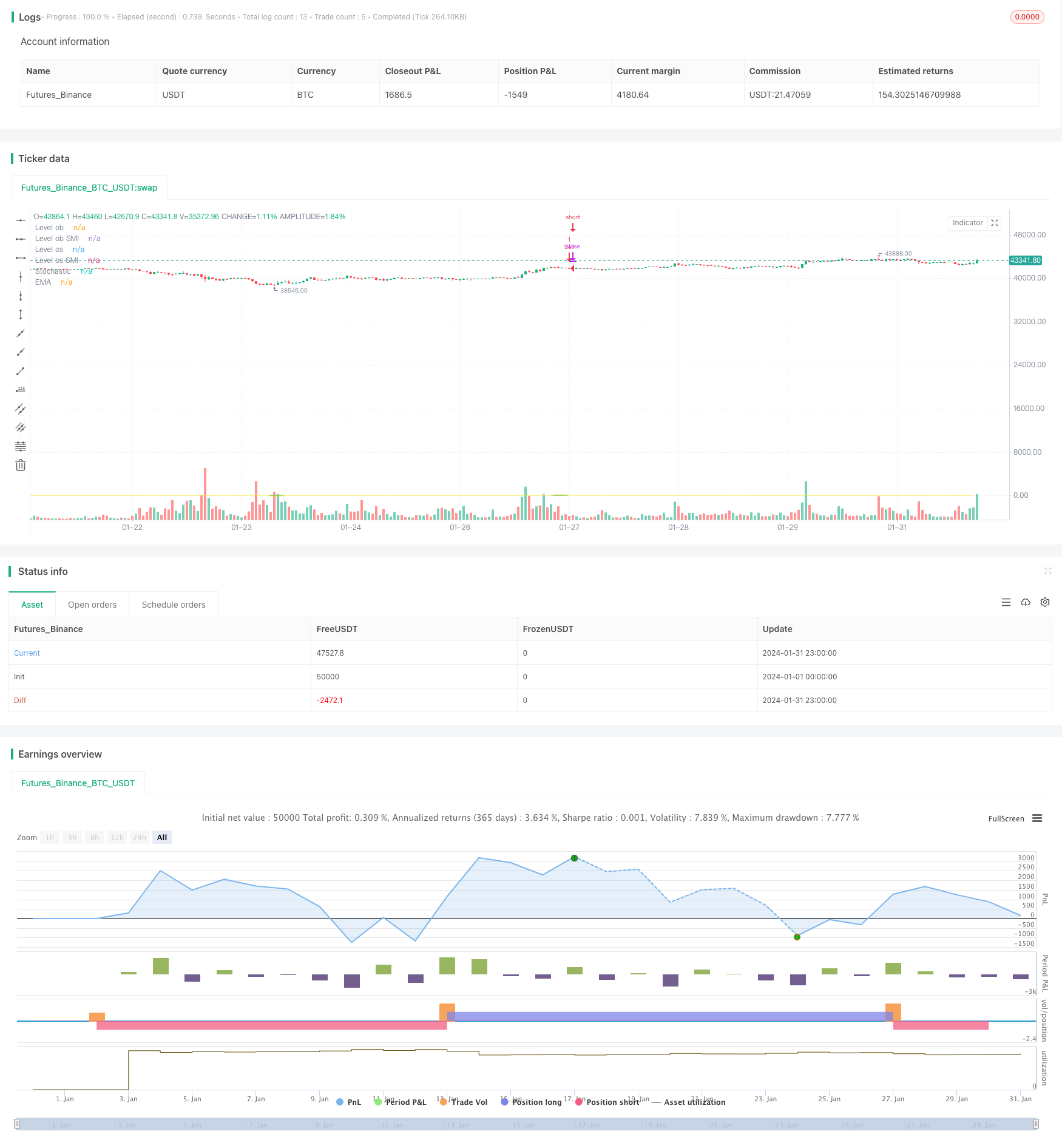

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Stochastics Momentum Index Strategy", shorttitle="Stoch_MTM_Doan", overlay=true)

// Input parameters

a = input.int(10, "Percent K Length")

b = input.int(3, "Percent D Length")

ob = input.int(40, "Overbought")

os = input.int(-40, "Oversold")

// Range Calculation

ll = ta.lowest(low, a)

hh = ta.highest(high, a)

diff = hh - ll

rdiff = close - (hh+ll)/2

avgrel = ta.ema(ta.ema(rdiff,b),b)

avgdiff = ta.ema(ta.ema(diff,b),b)

// SMI calculations

SMI = avgdiff != 0 ? (avgrel/(avgdiff/2)*100) : 0

SMIsignal = ta.ema(SMI,b)

emasignal = ta.ema(SMI, 10)

// Color Definition for Stochastic Line

col = SMI >= ob ? color.green : SMI <= os ? color.red : color.white

plot(SMIsignal, title="Stochastic", color=color.white)

plot(emasignal, title="EMA", color=color.yellow)

level_40 = ob

level_40smi = SMIsignal > level_40 ? SMIsignal : level_40

level_m40 = os

level_m40smi = SMIsignal < level_m40 ? SMIsignal : level_m40

plot(level_40, "Level ob", color=color.red)

plot(level_40smi, "Level ob SMI", color=color.red, style=plot.style_line)

plot(level_m40, "Level os", color=color.green)

plot(level_m40smi, "Level os SMI", color=color.green, style=plot.style_line)

//fill(level_40, level_40smi, color=color.red, transp=ob, title="OverSold")

//fill(level_m40, level_m40smi, color=color.green, transp=ob, title="OverBought")

// Strategy Tester

longCondition = ta.crossover(SMIsignal, emasignal) and (SMI < os)

if (longCondition)

strategy.entry("Buy", strategy.long)

shortCondition = ta.crossunder(SMIsignal, emasignal) and (SMI > ob)

if (shortCondition)

strategy.entry("Sell", strategy.short)