概述

本策略是一个基于EMA均线交叉来生成交易信号的趋势跟随策略。利用快慢均线的交叉来判断价格趋势的变化,在趋势开始的时候进入市场,在趋势结束的时候退出市场,从而获利。

策略原理

该策略使用快速EMA和慢速EMA两个均线。快速EMA参数设置为20,反应价格变化比较灵敏;慢速EMA参数设置为50,对价格变化响应比较平稳。

当快速EMA从下方向上穿过慢速EMA的时候,表示价格开始上涨,属于买点信号;当快速EMA从上方向下穿过慢速EMA的时候,表示价格开始下跌,属于卖点信号。

根据这两个信号,我们可以做出相应的交易决策:买点信号出现时做多头入场,卖点信号出现时做空头入场;相反的信号出现时对应的多/空头平仓。

优势分析

- 利用均线交叉判断价格趋势变化,是一种较为可靠的技术指标

- 快慢均线配合使用,可以有效过滤掉部分噪音,跟踪趋势

- 策略逻辑简单清晰,容易理解和实现

- 可通过调整均线参数来优化策略

风险分析

- 均线具有滞后性,可能错过价格变化的最佳时间点

- whipsaw效应可能导致过于频繁交易,增加交易成本和滑点损失

- 退市的時候,如果是由于非技术性原因引起,可能无法及時抛出头寸

优化方法:

- 优化均线参数,找到最佳 parameter

- 增加过滤条件,避免 whipsaw 带来的损失

- 设置止损策略,控制单笔损失

优化方向

该策略可以从以下几个方面进行优化:

优化均线参数,找到最佳参数组合。可以通过遍历不同的参数,回测不同的组合,找到收益最优的参数。

增加其他技术指标作为过滤条件,避免错 trades。例如可以加入MACD,KDJ等指标,当它们的信号与均线信号一致时才入场。

增加止损策略,例如设置固定止损或追踪止损,控制单笔损失。

可以考虑结合其他策略,例如趋势跟踪策略,在趋势中乘胜追击;或者mean reversion策略,在价格过度扩张的时候介入反转。

总结

本策略是一个非常典型的趋势跟随策略。通过快慢均线交叉来判断价格趋势的变化,简单有效地捕捉价格趋势。同时也存在一些问题,如延迟入场、whipsaw带来的损失等。这些问题都有对应的解决方案。总的来说,这是一个良好的策略框架,通过参数优化、增加过滤条件、止损策略等手段,可以进一步完善,在实盘中获得良好收益。

策略源码

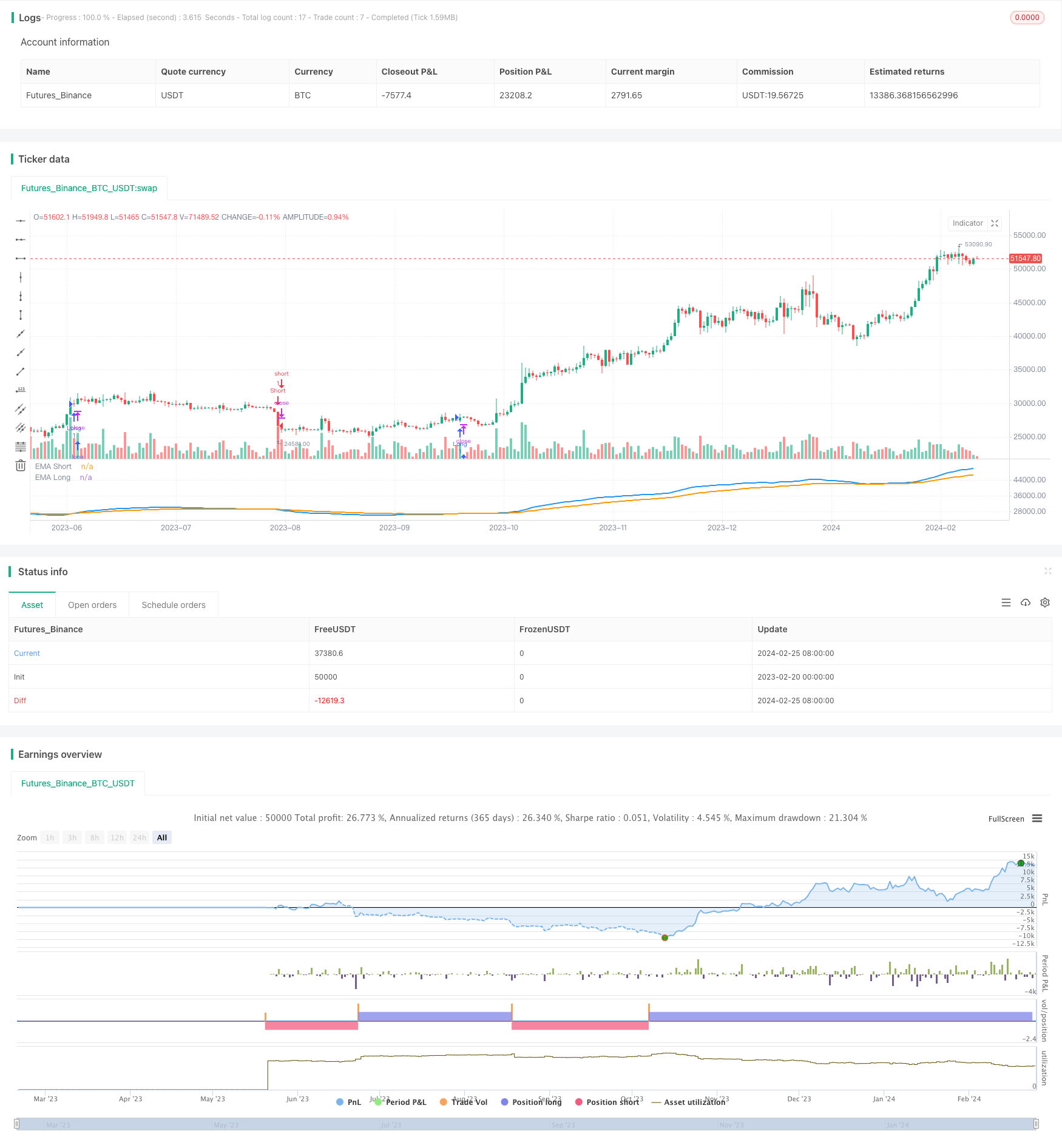

/*backtest

start: 2023-02-20 00:00:00

end: 2024-02-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Habitrade EMA Cross Strategy"), overlay=true

//Input for EMA lengths

emaShortLength = input.int(20, title="Short EMA Length")

emaLongLength = input.int(50, title="Long EMA Length")

//Calculate EMAs based on inputs

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

//Plot the EMAs

plot(emaShort, color=color.blue, linewidth=2, title="EMA Short")

plot(emaLong, color=color.orange, linewidth=2, title="EMA Long")

//Generate long and short signals

longCondition = ta.crossover(emaShort, emaLong)

shortCondition = ta.crossunder(emaShort, emaLong)

//Enter long positions

if (longCondition)

strategy.entry("Long", strategy.long)

//Enter short positions

if (shortCondition)

strategy.entry("Short", strategy.short)

//Close long positions

if (shortCondition)

strategy.close("Long")

//Clos short positions

if (longCondition)

strategy.close("Short")