概述

玛雅寻宝指南是一个基于EMA指标的简单股票交易策略。该策略结合了EMA均线指标和价格高低点判断,设定买入和卖出条件,实现自动化交易。

策略原理

该策略的核心依据是EMA均线指标。EMA即指数移动平均线,是一种常用的趋势判断指标。EMA线能平滑价格波动,判断价格趋势方向。

当股价上涨时会站上EMA线,这时视为买入信号。当股价下跌时会站在EMA线下方,这时作为卖出信号。本策略设置20日EMA线作为判断依据。

此外,策略还结合价格当日最高价和最低价进行辅助判断。在EMA金叉时刻,如果收盘价低于当日最高价,则产生买入信号;如果收盘价高于当日最低价,则产生卖出信号。这可以过滤掉部分不稳定的交易信号。

策略优势

该策略优势主要体现在利用EMA指标判断主要买卖点上。EMA指标是一种常用且实用的技术指标,可以有效平滑价格波动,判断大致的股价走势。相比复杂指标,EMA简单且直观,容易实现自动化交易。

此外,结合当日高低点进行辅助判断,可以进一步提高信号质量,过滤掉部分假信号。这种组合使用技术指标的思想值得推广应用。

总体来说,该策略简单实用,容易理解和使用,非常适合量化交易的自动化实现。这是该策略的最大优势。

策略风险

尽管该策略使用简单有效的EMA指标,但任何技术指标都可能出现失效情况。特别是在价格剧烈波动时,EMA线可能产生滞后,导致交易信号延迟,从而错过最佳买卖时机。这是该策略面临的主要风险。

此外,辅助判断条件虽可过滤假信号,但也可能过滤掉部分真实信号,导致获得信号不足的情况。这同样会影响策略效果。

最后,该策略仅基于技术指标设计交易规则,没有考虑基本面因素。如果公司基本面发生重大变化,行情可能出现技术指标无法预测的大幅波动。这时策略交易信号可能完全失效。

策略优化

该策略可从以下几个方面进行优化:

调整EMA参数,适应更多行情环境。可以设置自适应EMA长度,根据市场波动程度动态调整。

增加其他技术指标进行组合。比如加入 MACD 指标判断买卖点,提高信号准确性。或使用 K 线形态等图形指标进行辅助。

增加机器学习模型预测行情,辅助人工智能判断买卖点。这可以克服纯规则交易的局限性。

考虑公司基本面和宏观政策面。加入这些因素后,策略可以应对更复杂的行情环境。

总结

玛雅寻宝指南是一个简单直观的股市交易策略。它使用广泛认可的EMA均线指标判断价格趋势、确认交易信号。同时辅以价格高低点进行过滤提高信号质量。该策略容易理解使用,适合自动化量化交易。但也存在技术指标失效等潜在风险。未来可从调参优化、增强信号、引入机器学习等多个角度进行改进,使策略效果更佳。

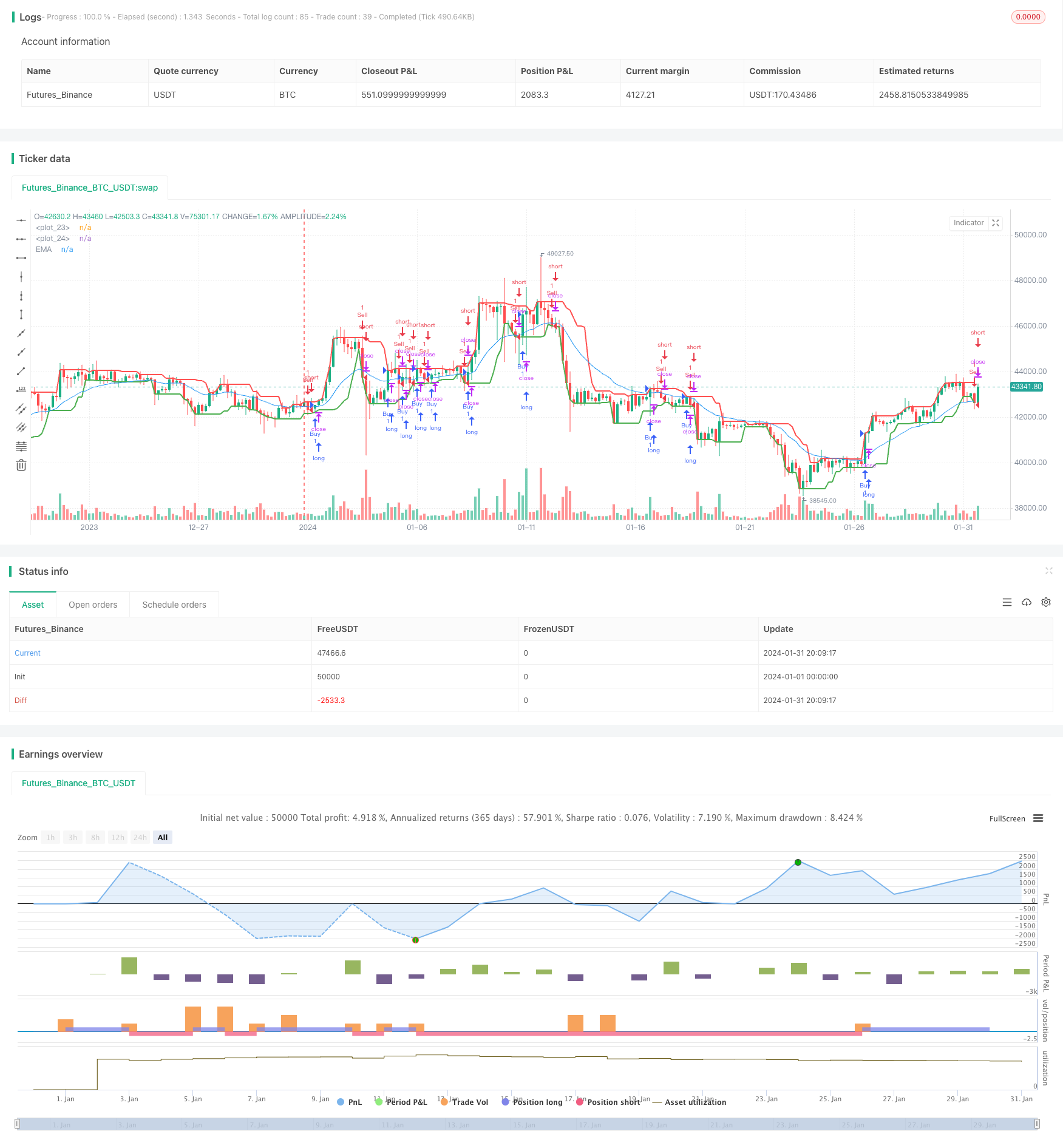

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © alex-aftc

//@version=5

strategy("Megalodon", shorttitle="Megalodon", overlay=true)

// Parámetros de la EMA

length = input.int(20, minval=1, title="Length")

src = input(close, title="Source")

// Calcular la EMA

ema = ta.ema(src, length)

// Plot de la EMA

plot(ema, title="EMA", color=color.blue)

// Encontrar los puntos más altos y más bajos

last8h = ta.highest(close, 8)

lastl8 = ta.lowest(close, 8)

// Plot de los puntos más altos y más bajos

plot(last8h, color=color.red, linewidth=2)

plot(lastl8, color=color.green, linewidth=2)

// Condiciones de compra y venta

buy_condition = ta.cross(close, ema) == 1 and close[1] < close

sell_condition = ta.cross(close, ema) == 1 and close[1] > close

// Estrategia de trading

strategy.entry("Buy", strategy.long, when=buy_condition)

strategy.entry("Sell", strategy.short, when=sell_condition)