概述

一目均衡图趋势追踪策略(Ichimoku Cloud Trend Following Strategy)是一种技术分析策略。它利用一目均衡图的五条指标线,判断市场趋势方向、支持阻力位和进场时机。

原理

该策略的核心指标线包含:

- 转换线:最近9日高点与低点的平均值,反映短期趋势。

- 基准线:最近26日高点与低点的平均值,反映中长期趋势。

- 先行线A:转换线与基准线的平均值,位移26日,判断中期支撑与阻力。

- 先行线B:最近52日高点与低点的平均值,位移26日,判断长期支撑与阻力。

- 随动线:价格位移26日,反映趋势动量。

当转换线上穿基准线时为买入信号;下穿为卖出信号。随动线位于价格之上且云团颜色为绿色为多头趋势,否则为空头。

策略根据转换线和基准线的关系判断趋势方向。比如,转换线向上突破基准线则判断为进入多头,此时如果满足随动线高于价格的条件,则产生买入信号。

止损或止盈依据先行线A或基准线来设置。如果选择基准线止损,当价格跌破基准线时平仓。

优势分析

该策略具有以下优势:

- 利用多指标综合判断,提高精确度。

- 先行线可提前判断支撑与阻力。

- 随动线验证趋势动量,防止虚假突破。

- 基准线作为中长期趋势指标,可减少噪音交易。

风险及优化

该策略主要风险在于容易产生虚假信号。优化建议:

- 调整平均周期参数,优化指标灵敏度。

- 添加其他指标或图形过滤,如MACD、布林带。

- 降低交易频率,追踪中长线趋势。

总结

一目均衡图策略综合多指标判断市场走势,既考量短期动量,也重视中长期趋势。转换线与基准线的关系判断市场买卖时机,基准线作为止损线锁定利润,可有效控制风险。该策略适合中长线追踪趋势交易。

策略源码

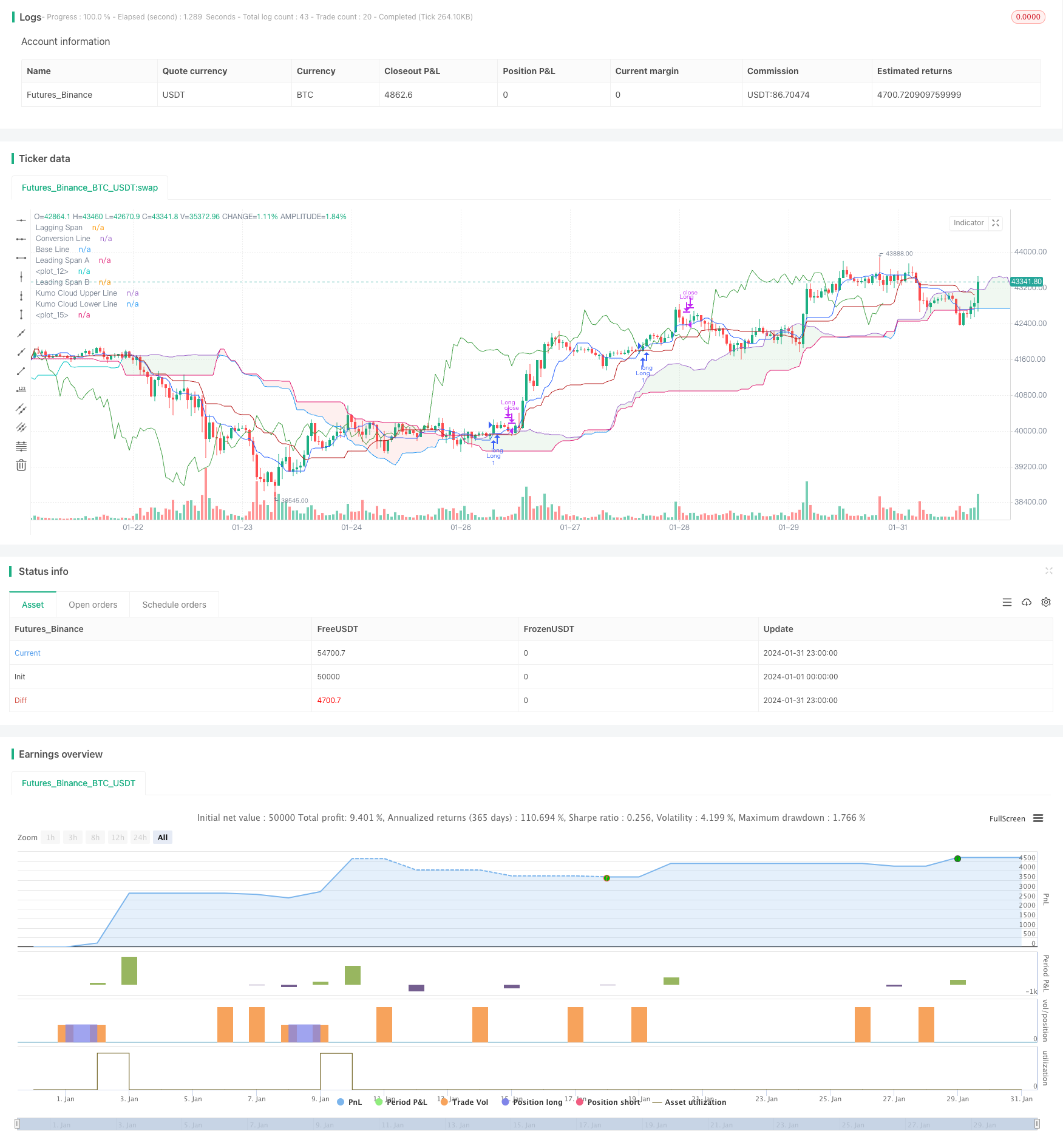

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Ichimoku Cloud - BitBell", shorttitle="Ichimoku Cloud - BitBell", overlay=true)

conversionPeriods = input.int(9, minval=1, title="Conversion Line Length")

basePeriods = input.int(26, minval=1, title="Base Line Length")

laggingSpan2Periods = input.int(52, minval=1, title="Leading Span B Length")

displacement = input.int(26, minval=1, title="Lagging Span")

donchian(len) => math.avg(ta.lowest(len), ta.highest(len))

conversionLine = donchian(conversionPeriods)

baseLine = donchian(basePeriods)

leadLine1 = math.avg(conversionLine, baseLine)

leadLine1bbbbb = math.avg(conversionLine, baseLine)[displacement - 1]

plot(leadLine1bbbbb)

leadLine2 = donchian(laggingSpan2Periods)

leadLine2bbbbbb = donchian(laggingSpan2Periods)[displacement - 1]

plot(leadLine2bbbbbb)

support = leadLine1bbbbb > leadLine2bbbbbb

Resistance = leadLine1bbbbb < leadLine2bbbbbb

TrailStop = input.string(title='Choose Trail Line', options=["ConversionLine", "BaseLine"], defval="ConversionLine")

var stopLong = 0.0

var stopShort = 0.0

var TagetLong = 0.0

var TargetShort = 0.0

if close > leadLine1bbbbb and close > leadLine2bbbbbb and conversionLine[1] <= baseLine[1] and conversionLine > baseLine and close > conversionLine and support

strategy.entry("Long",strategy.long)

stopLong := conversionLine

// if close < stopLong and strategy.position_size > 0

// strategy.close("Long")

// stopLong := 0.0

if (close < conversionLine and strategy.position_size > 0) and (TrailStop == 'ConversionLine')

strategy.close("Long")

stopLong := 0.0

if (close < baseLine and strategy.position_size > 0) and (TrailStop == 'BaseLine')

strategy.close("Long")

stopLong := 0.0

if close < leadLine1bbbbb and close < leadLine2bbbbbb and conversionLine[1] >= baseLine[1] and conversionLine < baseLine and close < conversionLine and Resistance

strategy.entry("Short",strategy.short)

stopShort := conversionLine

// if close > stopShort and strategy.position_size < 0

// strategy.close("Short")

// stopShort := 0.0

if (close > conversionLine and strategy.position_size < 0) and (TrailStop == 'ConversionLine')

strategy.close("Short")

stopShort := 0.0

if (close > baseLine and strategy.position_size < 0) and (TrailStop == 'BaseLine')

strategy.close("Short")

stopShort := 0.0

// if close >= 1.0006 * strategy.position_avg_price and strategy.position_size > 0

// strategy.close("Long")

// stopLong := 0.0

plot(conversionLine, color=#2962FF, title="Conversion Line")

plot(baseLine, color=#B71C1C, title="Base Line")

plot(close, offset = -displacement + 1, color=#43A047, title="Lagging Span")

p1 = plot(leadLine1, offset = displacement - 1, color=#A5D6A7,

title="Leading Span A")

p2 = plot(leadLine2, offset = displacement - 1, color=#EF9A9A,

title="Leading Span B")

plot(leadLine1 > leadLine2 ? leadLine1 : leadLine2, offset = displacement - 1, title = "Kumo Cloud Upper Line", display = display.none)

plot(leadLine1 < leadLine2 ? leadLine1 : leadLine2, offset = displacement - 1, title = "Kumo Cloud Lower Line", display = display.none)

fill(p1, p2, color = leadLine1 > leadLine2 ? color.rgb(67, 160, 71, 90) : color.rgb(244, 67, 54, 90))