概述

该策略综合运用EMA均线指标,Bollinger带指标和MACD指标,在实现EMA九均线和三十均线的金叉死叉的基础上,结合价格分布范围和动量指标判断买入卖出时机。

策略原理

计算3日EMA、9日EMA和30日EMA。

计算20日内价格的标准差,并绘制1倍和2倍标准差范围的Bollinger带。

计算12日、26日MACD和9日信号线。

当9日EMA上穿30日EMA,并且价格超出1倍标准差Bollinger带上限时,发出买入信号。

当30日EMA下穿9日EMA,并且价格低于1倍标准差Bollinger带下限时,发出卖出信号。

优势分析

该策略结合均线指标和动量指标,能较好地把握市场趋势和时机,具有以下优势:

EMA指标能快速响应价格变化,判断市场趋势;MACD指标判断力度,防止假突破。

Bollinger带标准差指标结合EMA,可以更精确判断买入卖出时机。

多种指标组合,可以互补。在一次突破中,不同指标可以验证判断。

风险及优化分析

该策略也存在一些风险,需要注意以下几点进行优化:

EMA均线组合可以调整和优化,不同周期可以更好捕捉趋势。

Bollinger带参数可以优化,变化倍数标准差以过滤假信号。

MACD指标参数可以优化和组合,判断力度效果可以提高。

总结

该策略整合EMA均线指标判断大趋势,辅以Bollinger带指标可以准确在力度较大时把握买卖点;MACD指标补充趋势确认,可以有效过滤假信号。通过参数优化,该策略可以进一步提高效果。

策略源码

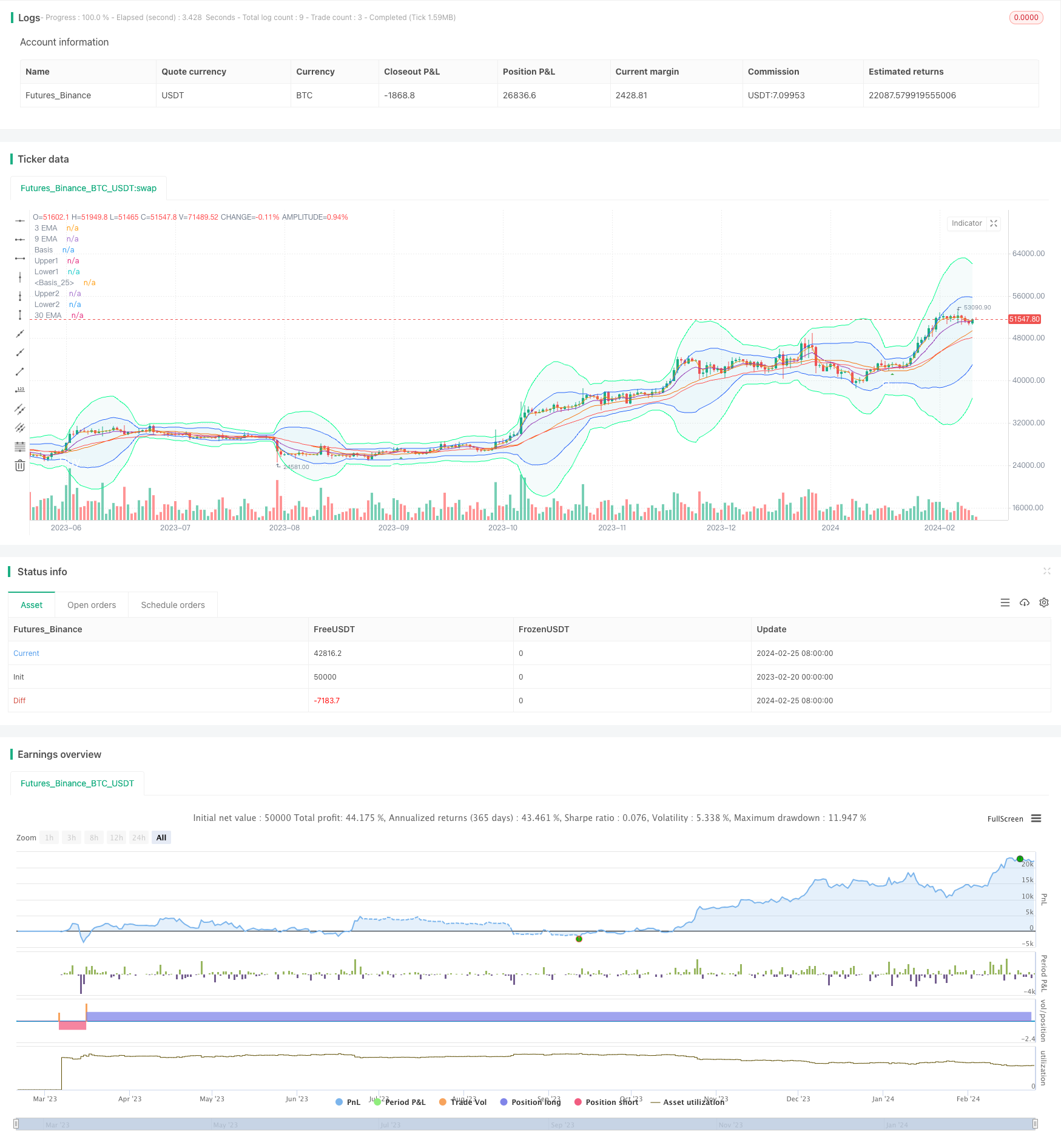

/*backtest

start: 2023-02-20 00:00:00

end: 2024-02-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("emabb_collab", shorttitle="emabb", overlay=true)

// Input parameters

ema3 = input(3, title="3 EMA")

ema9 = input(9, title="9 EMA")

ema30 = input(30, title="30 EMA")

macdShort = input(12, title="MACD Short")

macdLong = input(26, title="MACD Long")

macdSignal = input(9, title="MACD Signal")

length = input.int(20, minval=1)

src = input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ta.sma(src, length)

dev1 = mult * ta.stdev(src, length)

upper1 = basis + dev1

lower1 = basis - dev1

dev2 = mult * 2 * ta.stdev(src, length)

upper2 = basis + dev2

lower2 = basis - dev2

plot(basis, "Basis", color=#FF6D00)

p1 = plot(upper1, "Upper1", color=#2962FF)

p2 = plot(lower1, "Lower1", color=#2962FF)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

plot(basis, "Basis", color=#FF6D00)

p3 = plot(upper2, "Upper2", color=#00FF8C)

p4 = plot(lower2, "Lower2", color=#00FF8C)

fill(p3, p4, title = "Background", color=color.rgb(0, 153, 140, 95))

// Calculate EMAs

ema3Value = ta.ema(close, ema3)

ema9Value = ta.ema(close, ema9)

ema30Value = ta.ema(close, ema30)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdShort, macdLong, macdSignal)

// Conditions for buy signal

buyCondition = ta.crossover(ema9Value, ema30Value) and ta.stdev(close, 20) > ta.stdev(close, 20)[1]

//Conditions for sell signal

sellCondition = ta.crossover(ema30Value, ema9Value) and ta.stdev(close, 20) < ta.stdev(close, 20)[1]

// Plot signals on the chart

plotshape(buyCondition, title='Buy Label', style=shape.triangleup, location=location.belowbar, size=size.normal, text='Buy', textcolor=color.new(color.white, 0), color=color.new(color.green, 0))

plotshape(sellCondition, title='sell Label', style=shape.triangledown, location=location.abovebar, size=size.normal, text='sell', textcolor=color.new(color.white, 0), color=color.new(color.red, 0))

// Plot EMAs

plot(ema3Value, title="3 EMA", color=color.orange)

plot(ema9Value, title="9 EMA", color=color.purple)

plot(ema30Value, title="30 EMA", color=color.red)

if buyCondition

strategy.entry('Long', strategy.long)

if sellCondition

strategy.entry('Short', strategy.short)