概述

本策略通过结合布铺猎手(Boom Hunter)、赫尔套件(Hull Suite)和波动率振荡器(Volatility Oscillator)三个指标,实现在多时间框架下进行趋势追踪和突破交易的量化策略。该策略适用于比特币等具有高波动性和突发性价格行情的数字资产。

原理

该策略的核心逻辑基于以下三个指标:

布铺猎手(Boom Hunter):一种利用指标压缩技术实现的振荡器,通过两个指标 (Quotient1和Quotient2) 的交叉来判断买入和卖出信号。

赫尔套件(Hull Suite):一组平滑移动均线指标,通过中轨和上下轨的关系来判断趋势方向。

波动率振荡器(Volatility Oscillator):一种量化价格波动信息的振荡器指标。

本策略的入场逻辑为,在布铺猎手的两个Quotient指标发生向上或向下交叉的同时,价格要突破赫尔中轨并与上轨或下轨发生背离, meanwhile波动率指标位于超买超卖区域。这样可以过滤掉一些假突破信号,提高入场的准确性。

止损通过查找一定周期内(默认20根K线)的最低谷或最高峰来设定,利润则通过止损百分比乘以配置的止盈比例(默认3倍)来获得。仓位根据账号总资产的百分比(默认3%)和具体标的的止损幅度来计算。

优势

- 利用压缩指标技术提取价格中的主要交易信号,提高盈利概率

- 多指标组合验证,避免假突破,准确判断趋势方向

- 动态止损止盈设定,实现风险可控的趋势追踪

- 采用波动率指标确保高波动环境下的交易

- 多时间框架分析,提高策略稳定性

风险

- 布铺猎手指标可能存在压缩失真,导致产生错误信号

- 赫尔套件中轨会有滞后,无法及时跟踪价格变化

- 波动率下降时会错过交易机会或引发亏损平仓

解决方法:

- 调整压缩指标的参数,平衡指标的灵敏度

- 尝试使用EHMA等指数移动平均线来代替中轨指标

- 增加其他判断指标,避免波动率的误导

优化

该策略可以从以下几个方面进行优化:

参数优化:通过更改指标参数如周期长度、压缩系数等来获得最佳参数组合

时间框架优化:测试不同的时间周期(1分钟、5分钟、30分钟等),找到最适合的交易周期

仓位优化:改变每次交易的仓位大小和比例,找到最优的资金利用方案

止损优化:根据不同的交易对调整止损位置,实现最佳的风险回报比

条件优化:增加或减少指标过滤条件,获得更准确的入场时机

总结

本策略通过布铺猎手、赫尔套件和波动率振荡器三个指标的组合运用,实现了多时间框架下的趋势追踪交易,能够有效识别价格的突发行为,适用于具有高波动性的数字资产。该策略风险可控,通过参数、滤波条件及止损等多方面优化,具有较强的实战性和可扩展性。

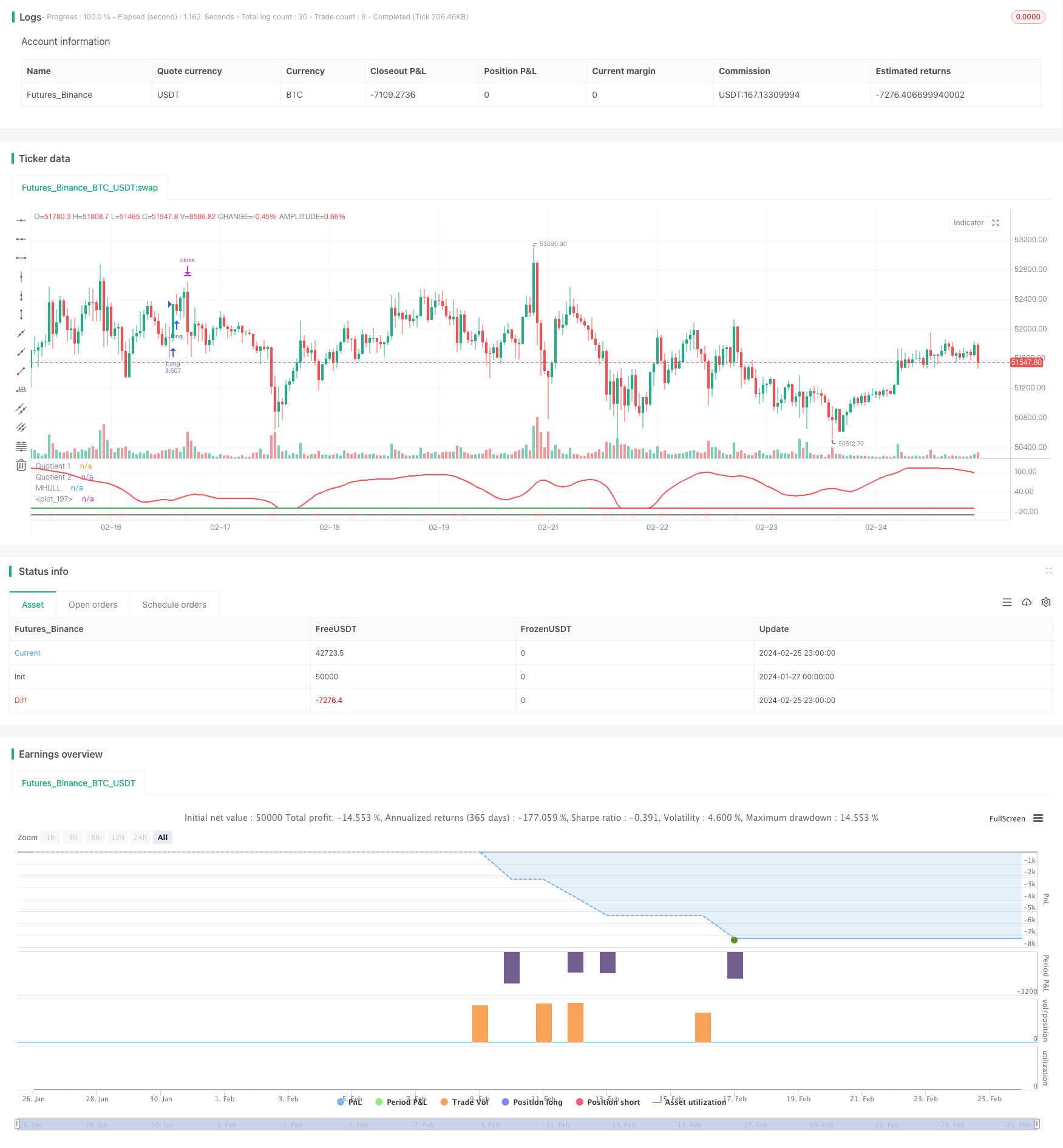

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Strategy based on the 3 indicators:

// - Boom Hunter Pro

// - Hull Suite

// - Volatility Oscillator

//

// Strategy was designed for the purpose of back testing.

// See strategy documentation for info on trade entry logic.

//

// Credits:

// - Boom Hunter Pro: veryfid (https://www.tradingview.com/u/veryfid/)

// - Hull Suite: InSilico (https://www.tradingview.com/u/InSilico/)

// - Volatility Oscillator: veryfid (https://www.tradingview.com/u/veryfid/)

//@version=5

strategy("Boom Hunter + Hull Suite + Volatility Oscillator Strategy", overlay=false, initial_capital=1000, currency=currency.NONE, max_labels_count=500, default_qty_type=strategy.cash, commission_type=strategy.commission.percent, commission_value=0.01)

// =============================================================================

// STRATEGY INPUT SETTINGS

// =============================================================================

// ---------------

// Risk Management

// ---------------

swingLength = input.int(20, "Swing High/Low Lookback Length", group='Strategy: Risk Management', tooltip='Stop Loss is calculated by the swing high or low over the previous X candles')

accountRiskPercent = input.float(3, "Account percent loss per trade", step=0.1, group='Strategy: Risk Management', tooltip='Each trade will risk X% of the account balance')

profitFactor = input.float(3, "Profit Factor (R:R Ratio)", step = 0.1, group='Strategy: Risk Management')

// ----------

// Date Range

// ----------

start_year = input.int(title='Start Date', defval=2022, minval=2010, maxval=3000, group='Strategy: Date Range', inline='1')

start_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

start_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

end_year = input.int(title='End Date', defval=2023, minval=1800, maxval=3000, group='Strategy: Date Range', inline='2')

end_month = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

end_date = input.int(title='', defval=1, group='Strategy: Date Range', inline='2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

in_date_range = true

// =============================================================================

// INDICATORS

// =============================================================================

// ---------------

// Boom Hunter Pro

// ---------------

square = input.bool(true, title='Square Line?', group='Main Settings')

//Quotient

LPPeriod = input.int(6, title='Quotient | LPPeriod', inline='quotient', group='EOT 1 (Main Oscillator)')

K1 = input.int(0, title='K1', inline='quotient', group='EOT 1 (Main Oscillator)')

esize = 60 //, title = "Size", inline = "quotient2", group = "EOT 1 (Main Oscillator)")

ey = 50 //, title = "Y axis", inline = "quotient2", group = "EOT 1 (Main Oscillator)")

trigno = input.int(1, 'Trigger Length', group='EOT 1 (Main Oscillator)', inline='quotient2')

trigcol = input.color(color.white, title='Trigger Color:', group='EOT 1 (Main Oscillator)', inline='q2')

// EOT 2

//Inputs

LPPeriod2 = input.int(28, title='LPPeriod2', group='EOT 2 (Red Wave)', inline='q2')

K22 = input.float(0.3, title='K2', group='EOT 2 (Red Wave)', inline='q2')

//EOT 1

//Vars

alpha1 = 0.00

HP = 0.00

a1 = 0.00

b1 = 0.00

c1 = 0.00

c2 = 0.00

c3 = 0.00

Filt = 0.00

Peak = 0.00

X = 0.00

Quotient1 = 0.00

pi = 2 * math.asin(1)

//Highpass filter cyclic components

//whose periods are shorter than 100 bars

alpha1 := (math.cos(.707 * 2 * pi / 100) + math.sin(.707 * 2 * pi / 100) - 1) / math.cos(.707 * 2 * pi / 100)

HP := (1 - alpha1 / 2) * (1 - alpha1 / 2) * (close - 2 * nz(close[1]) + nz(close[2])) + 2 * (1 - alpha1) * nz(HP[1]) - (1 - alpha1) * (1 - alpha1) * nz(HP[2])

//SuperSmoother Filter

a1 := math.exp(-1.414 * pi / LPPeriod)

b1 := 2 * a1 * math.cos(1.414 * pi / LPPeriod)

c2 := b1

c3 := -a1 * a1

c1 := 1 - c2 - c3

Filt := c1 * (HP + nz(HP[1])) / 2 + c2 * nz(Filt[1]) + c3 * nz(Filt[2])

//Fast Attack - Slow Decay Algorithm

Peak := .991 * nz(Peak[1])

if math.abs(Filt) > Peak

Peak := math.abs(Filt)

Peak

//Normalized Roofing Filter

if Peak != 0

X := Filt / Peak

X

Quotient1 := (X + K1) / (K1 * X + 1)

// EOT 2

//Vars

alpha1222 = 0.00

HP2 = 0.00

a12 = 0.00

b12 = 0.00

c12 = 0.00

c22 = 0.00

c32 = 0.00

Filt2 = 0.00

Peak2 = 0.00

X2 = 0.00

Quotient4 = 0.00

alpha1222 := (math.cos(.707 * 2 * pi / 100) + math.sin(.707 * 2 * pi / 100) - 1) / math.cos(.707 * 2 * pi / 100)

HP2 := (1 - alpha1222 / 2) * (1 - alpha1222 / 2) * (close - 2 * nz(close[1]) + nz(close[2])) + 2 * (1 - alpha1222) * nz(HP2[1]) - (1 - alpha1222) * (1 - alpha1222) * nz(HP2[2])

//SuperSmoother Filter

a12 := math.exp(-1.414 * pi / LPPeriod2)

b12 := 2 * a12 * math.cos(1.414 * pi / LPPeriod2)

c22 := b12

c32 := -a12 * a12

c12 := 1 - c22 - c32

Filt2 := c12 * (HP2 + nz(HP2[1])) / 2 + c22 * nz(Filt2[1]) + c32 * nz(Filt2[2])

//Fast Attack - Slow Decay Algorithm

Peak2 := .991 * nz(Peak2[1])

if math.abs(Filt2) > Peak2

Peak2 := math.abs(Filt2)

Peak2

//Normalized Roofing Filter

if Peak2 != 0

X2 := Filt2 / Peak2

X2

Quotient4 := (X2 + K22) / (K22 * X2 + 1)

q4 = Quotient4 * esize + ey

//Plot EOT

q1 = Quotient1 * esize + ey

trigger = ta.sma(q1, trigno)

Plot3 = plot(trigger, color=trigcol, linewidth=2, title='Quotient 1')

Plot44 = plot(q4, color=color.new(color.red, 0), linewidth=2, title='Quotient 2')

// ----------

// HULL SUITE

// ----------

//INPUT

src = input(close, title='Source')

modeSwitch = input.string('Hma', title='Hull Variation', options=['Hma', 'Thma', 'Ehma'])

length = input(200, title='Length(180-200 for floating S/R , 55 for swing entry)')

lengthMult = input(2.4, title='Length multiplier (Used to view higher timeframes with straight band)')

useHtf = input(false, title='Show Hull MA from X timeframe? (good for scalping)')

htf = input.timeframe('240', title='Higher timeframe')

//FUNCTIONS

//HMA

HMA(_src, _length) =>

ta.wma(2 * ta.wma(_src, _length / 2) - ta.wma(_src, _length), math.round(math.sqrt(_length)))

//EHMA

EHMA(_src, _length) =>

ta.ema(2 * ta.ema(_src, _length / 2) - ta.ema(_src, _length), math.round(math.sqrt(_length)))

//THMA

THMA(_src, _length) =>

ta.wma(ta.wma(_src, _length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

//SWITCH

Mode(modeSwitch, src, len) =>

modeSwitch == 'Hma' ? HMA(src, len) : modeSwitch == 'Ehma' ? EHMA(src, len) : modeSwitch == 'Thma' ? THMA(src, len / 2) : na

//OUT

_hull = Mode(modeSwitch, src, int(length * lengthMult))

HULL = useHtf ? request.security(syminfo.ticker, htf, _hull) : _hull

MHULL = HULL[0]

SHULL = HULL[2]

//COLOR

hullColor = MHULL > SHULL ? color.green : color.red

//PLOT

///< Frame

Fi1 = plot(-10, title='MHULL', color=hullColor, linewidth=2)

// -----------------

// VOLUME OSCILLATOR

// -----------------

volLength = input(80)

spike = close - open

x = ta.stdev(spike, volLength)

y = ta.stdev(spike, volLength) * -1

volOscCol = spike > x ? color.green : spike < y ? color.red : color.gray

plot(-30, color=color.new(volOscCol, transp=0), linewidth=2)

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// Boom Hunter Pro entry conditions

boomLong = ta.crossover(trigger, q4)

boomShort = ta.crossunder(trigger, q4)

// Hull Suite entry conditions

hullLong = MHULL > SHULL and close > MHULL

hullShort = MHULL < SHULL and close < SHULL

// Volatility Oscillator entry conditions

volLong = spike > x

volShort = spike < y

inLong = strategy.position_size > 0

inShort = strategy.position_size < 0

longCondition = boomLong and hullLong and volLong and in_date_range

shortCondition = boomShort and hullShort and volShort and in_date_range

swingLow = ta.lowest(source=low, length=swingLength)

swingHigh = ta.highest(source=high, length=swingLength)

atr = ta.atr(14)

longSl = math.min(close - atr, swingLow)

shortSl = math.max(close + atr, swingHigh)

longStopPercent = math.abs((1 - (longSl / close)) * 100)

shortStopPercent = math.abs((1 - (shortSl / close)) * 100)

longTpPercent = longStopPercent * profitFactor

shortTpPercent = shortStopPercent * profitFactor

longTp = close + (close * (longTpPercent / 100))

shortTp = close - (close * (shortTpPercent / 100))

// Position sizing (default risk 3% per trade)

riskAmt = strategy.equity * accountRiskPercent / 100

longQty = math.abs(riskAmt / longStopPercent * 100) / close

shortQty = math.abs(riskAmt / shortStopPercent * 100) / close

if (longCondition and not inLong)

strategy.entry("Long", strategy.long, qty=longQty)

strategy.exit("Long SL/TP", from_entry="Long", stop=longSl, limit=longTp, alert_message='Long SL Hit')

buyLabel = label.new(x=bar_index, y=high[1], color=color.green, style=label.style_label_up)

label.set_y(id=buyLabel, y=-40)

label.set_tooltip(id=buyLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(longQty) + " Swing low: " + str.tostring(swingLow) + " Stop Percent: " + str.tostring(longStopPercent) + " TP Percent: " + str.tostring(longTpPercent))

if (shortCondition and not inShort)

strategy.entry("Short", strategy.short, qty=shortQty)

strategy.exit("Short SL/TP", from_entry="Short", stop=shortSl, limit=shortTp, alert_message='Short SL Hit')

sellLabel = label.new(x=bar_index, y=high[1], color=color.red, style=label.style_label_up)

label.set_y(id=sellLabel, y=-40)

label.set_tooltip(id=sellLabel, tooltip="Risk Amt: " + str.tostring(riskAmt) + " Qty: " + str.tostring(shortQty) + " Swing high: " + str.tostring(swingHigh) + " Stop Percent: " + str.tostring(shortStopPercent) + " TP Percent: " + str.tostring(shortTpPercent))