概述

该策略综合利用了价格的趋势、交易量的动量和价格波动的波幅这三个指标来产生买入和卖出信号。主要的思想是在价格上升趋势和价格波动放大的市场环境下买入,在价格下跌趋势和价格波动收缩的市场环境下卖出,通过捕捉价格趋势和利用价格波动来获利。

策略原理

该策略使用以下三个关键指标:

趋势指标:简单移动平均线(SMA)。该指标基于用户定义的“趋势周期”参数在该周期内计算价格的平均值,作为评估价格趋势的依据。

动量指标:成交量加权移动平均线(VWMA)。该指标基于用户定义的“动量周期”参数,考虑了成交量的影响,计算价格的加权移动平均来显示价格动量。

波幅指标:布林带。该指标包含上带、中带和下带三条线。带宽度由用户定义的“布林带周期”和“布林带偏差”参数决定。

买入信号的产生依据是当价格上穿趋势指标即SMA时产生,且价格高于布林带上带时产生。卖出信号的产生依据是当价格下穿趋势指标即SMA时产生,且价格低于布林带下带时产生。

优势分析

该策略综合考虑了多种市场指标,可以有效判断市场的走势。利用趋势指标判断价格走势方向,利用动量指标判断力度与速度,利用波幅指标判断机会。相比单一指标,该组合指标可以更全面地把握市场,回避错误信号,从而提高决策的准确性。

风险分析

该策略最大的风险在于指标设置不当。如果趋势周期参数设置过短,则容易产生错误信号;如果布林带参数设置过宽或者过窄,也会影响判断。此外,突发事件也可能影响价格大幅波动而产生意外损失。所以需要充分测试参数的稳定性,同时控制好仓位规模和止损点。

优化方向

该策略可以从以下几个方向进行优化:

优化指标参数,寻找最优参数组合。可以通过历史回测和参数扫描来确定参数。

增加止损机制。当价格突破止损线时强制CLOSE订单,可以有效控制单笔损失。

结合其他指标,如能量潮指标、相对强弱指标等,提高决策的准确性。

开发动态仓位管理机制。当市场不确定性较大时,适当减小仓位;当信号更明确时,适当加大仓位。

总结

该策略整合多种指标判断走势,在理论上可以提高决策准确率。但关键在于指标参数的选择与调整,需要充分测试找到最优参数。同时也需要注意控制风险,防范突发事件的影响。如果不断优化和完善,该策略可以成为稳定可靠的量化交易策略。

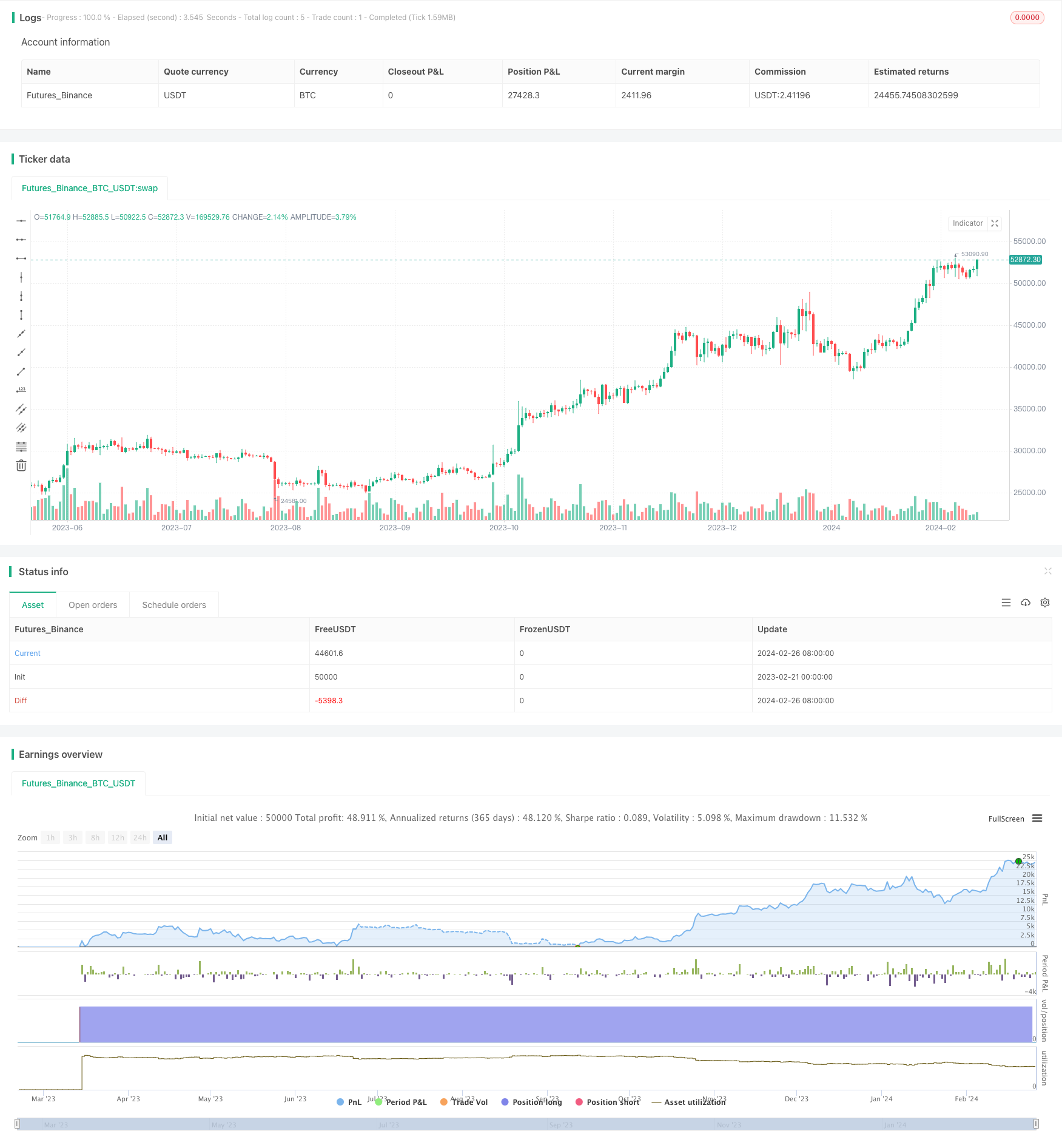

/*backtest

start: 2023-02-21 00:00:00

end: 2024-02-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Trend, Momentum ve Volatilite Stratejisi", overlay=true)

// Kullanıcı tarafından ayarlanabilir girdilerin panelde görüntülenmesi

trendPeriod = input(50, "Trend Periyodu")

momentumPeriod = input(14, "Momentum Periyodu")

bbPeriod = input(20, "Bollinger Bantları Periyodu")

bbDeviation = input(2, "Bollinger Bantları Sapması")

// Fiyat hareketlerine dayalı trend göstergesi (Örneğin: Basit Hareketli Ortalama)

trendIndicator = sma(close, trendPeriod)

// Hacim tabanlı momentum göstergesi (Örneğin: Hacim Ağırlıklı Ortalama Fiyat)

momentumIndicator = vwma(close, momentumPeriod)

// Volatilite göstergesi (Bollinger Bantları)

[upperBB, middleBB, lowerBB] = bb(close, bbPeriod, bbDeviation)

// Alım ve satım sinyallerinin belirlenmesi

buySignal = crossover(close, trendIndicator) and close > upperBB

sellSignal = crossunder(close, trendIndicator) and close < lowerBB

// Alım ve satım işlemlerinin gerçekleştirilmesi

if (buySignal)

strategy.entry("Buy", strategy.long)

if (sellSignal)

strategy.close("Buy")

if (sellSignal)

strategy.entry("Sell", strategy.short)

if (buySignal)

strategy.close("Sell")