概述

双EMA策略是一种趋势追踪策略,它通过计算不同周期的EMA,识别价格的趋势方向,以此来决定建仓或平仓。该策略简单实用,适用于趋势性较强的市场。

策略原理

该策略主要基于两个EMA指标,一个是短周期9日EMA,另一个是较长周期的21日EMA。它们的交叉为建仓和平仓信号。

当短期EMA上穿长期EMA时,被视为价格进入上升趋势,该策略会在此时开多单,追踪价格上涨。当短期EMA下穿长期EMA时,被视为价格进入下降趋势,该策略会在此时开空单,追踪价格下跌。

EMA指标能够有效过滤价格数据中的噪声,识别出价格趋势的主要方向。因此,该策略使用双EMA指标作为建仓和平仓的依据,以期望能够抓住较长的价格趋势周期。

策略优势

该策略具有以下优势:

- 策略思路简单清晰,易于理解和实施。

- 能够有效识别价格趋势,及时建仓追踪趋势。

- 使用EMA指标过滤噪声,避免被短期价格震荡干扰。

- 可配置EMA参数,调整策略的敏感度。

策略风险

该策略也存在一些风险:

- 在趋势反转时,EMA指标的滞后特性可能导致损失加大。

- EMA参数设置不当时,会提高假信号率。

- 本策略更适合强趋势市,在盘整时易受损。

策略优化

该策略可以从以下方面进行优化:

- 结合其他指标判断趋势反转,降低损失。例如MACD、KDJ等。

- 添加止损逻辑,好的止损策略可以大幅降低策略最大回撤。

- 优化EMA参数,使之更加契合不同品种的价格特性。

- 结合机器学习算法实现EMA参数的自动优化。

总结

双EMA策略整体而言是一个非常实用的趋势追踪策略。它操作简便,易于理解,在强趋势市场中表现优异。同时该策略也存在一些风险,可以从多种维度进行优化提高策略稳定性。总的来说,双EMA策略是量化交易的一个重要参考模板。

策略源码

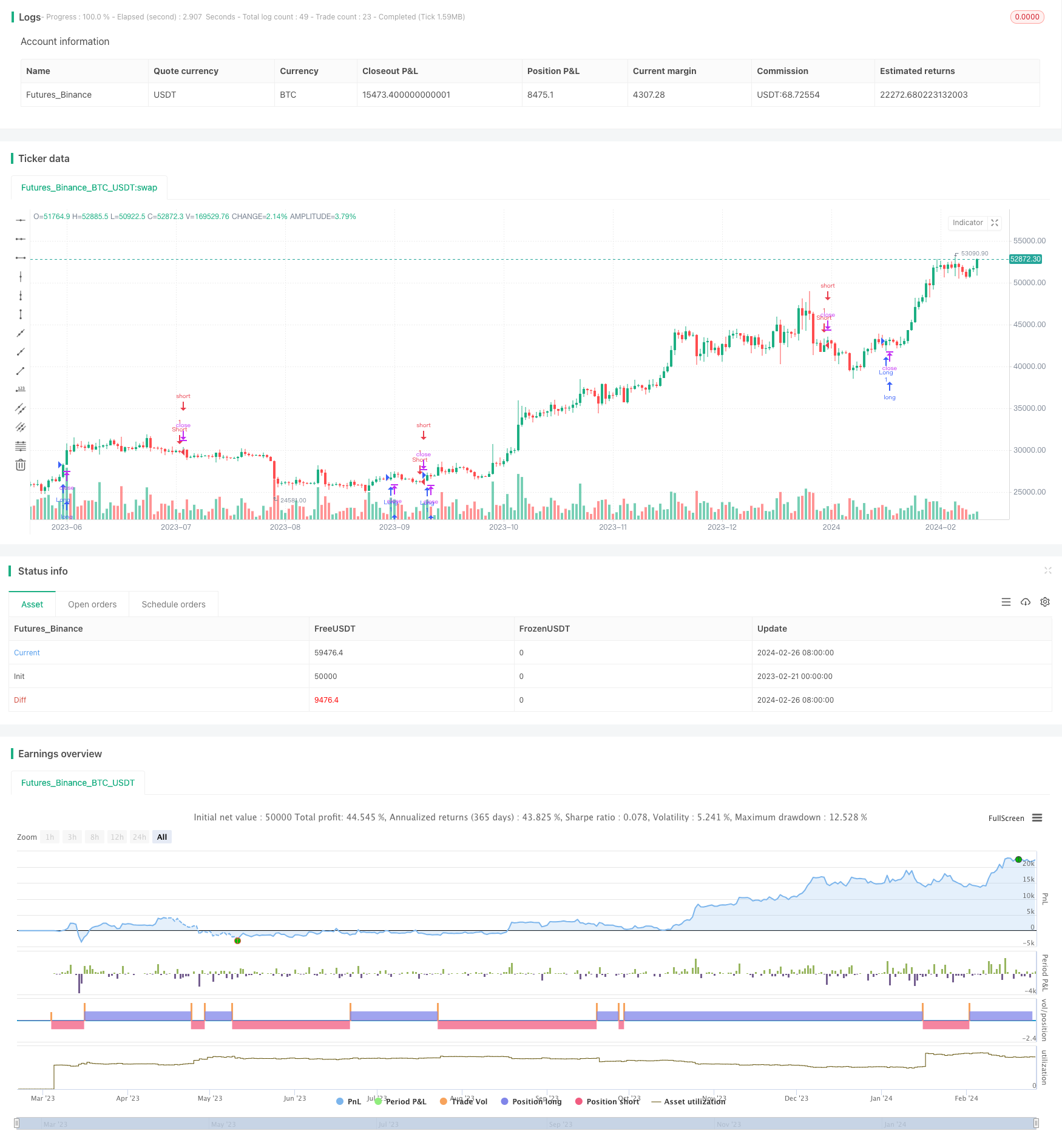

/*backtest

start: 2023-02-21 00:00:00

end: 2024-02-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This can only draw so many lines. Use bar replay to go back further

strategy("Strategy Lines", shorttitle="Strategy Lines", overlay=true, max_lines_count=500)

//###########################################################################################################################################

// Replace your strategy here

//###########################################################################################################################################

shortEMA = ta.ema(close, input(9, title="Short EMA Length"))

longEMA = ta.ema(close, input(21, title="Long EMA Length"))

// Entry conditions for long and short positions

longCondition = ta.crossover(shortEMA, longEMA)

shortCondition = ta.crossunder(shortEMA, longEMA)

//###########################################################################################################################################

// Strategy Lines

//###########################################################################################################################################

var timeLow = bar_index

var line li = na

var openLPrice = 0.0000

var openSPrice = 0.0000

LongWColor = input.color(color.rgb(0,255,0,0),"Long Win Color", group="Strategy Lines")

LongLColor = input.color(color.rgb(0,0,255,0),"Long Loss Color", group="Strategy Lines")

ShortWColor = input.color(color.rgb(255,255,0,0),"Short Win Color", group="Strategy Lines")

ShortLColor = input.color(color.rgb(255,0,0,0),"Short Loss Color", group="Strategy Lines")

WinFontColor = input.color(color.rgb(0,0,0,0),"Win Font Color", group="Strategy Lines")

LossFontColor = input.color(color.rgb(255,255,255,0),"Loss Font Color", group="Strategy Lines")

LinesShowLabel = input(false,"Show Labels?",group = "Strategy Lines")

// // Start new line when we go long

// if strategy.position_size >0

// line.delete(li)

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close>openLPrice?LongWColor:LongLColor)

// // Start new line when we go short

// if strategy.position_size <0

// line.delete(li)

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close<openSPrice?ShortWColor:ShortLColor)

// //Delete Lines if we don't have a position open

// if strategy.position_size ==0

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=color.rgb(0,0,0,100))

// line.delete(li)

if LinesShowLabel

// Short Label

if strategy.position_size>=0 and strategy.position_size[1] <0

label.new(

timeLow, na,

text=str.tostring((openSPrice-close[1])/(syminfo.mintick*10)),

color=close[1]<openSPrice?ShortWColor:ShortLColor,

textcolor=close[1]<openSPrice?WinFontColor:LossFontColor,

size=size.small,

style=label.style_label_down, yloc=yloc.abovebar)

// Long Label

if strategy.position_size<=0 and strategy.position_size[1] >0

label.new(

timeLow, na,

text=str.tostring((close[1]-openLPrice)/(syminfo.mintick*10)),

color=close[1]>openLPrice?LongWColor:LongLColor,

textcolor=close[1]>openLPrice?WinFontColor:LossFontColor,

size=size.small,

style=label.style_label_down, yloc=yloc.abovebar)

// Open long position and draw line

if (longCondition)

//strategy.entry("Long", strategy.long)

// timeLow := bar_index

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close>openLPrice?LongWColor:LongLColor)

openLPrice := close

// Open short position and draw line

if (shortCondition)

//strategy.entry("Short", strategy.short)

// timeLow := bar_index

// li := line.new(timeLow, close[bar_index-timeLow], bar_index, close, width=2, color=close<openSPrice?ShortWColor:ShortLColor)

openSPrice := close

//###########################################################################################################################################

// Strategy Execution (Replace this as well)

//###########################################################################################################################################

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)