概述

该策略是一个基于5分钟时间周期的比特币scalping策略。它利用9周期和15周期的移动平均线交叉以及K线形态作为交易信号。具体来说,当快速移动平均线向上穿越慢速移动平均线,且K线形成锤头或纯阳线时产生买入信号;当快速移动平均线向下穿越慢速移动平均线时产生卖出信号。入场后设置0.5%的止损和0.5%的止盈。

策略原理

该策略使用两个不同周期的移动平均线进行趋势判断。9周期移动平均线更加灵敏,可以捕捉短期趋势;15周期移动平均线较为稳定,能过滤掉部分噪音。当较快的移动平均线向上穿越较慢的移动平均线时,表示短期趋势转为上涨;反之,短期趋势转为下跌。

另外,该策略还结合K线形态进行过滤。仅在形成锤头或纯阳线等强势K线时才产生买入信号。这能避免在盘整过程中产生错误的交易信号。

具体的交易信号和规则如下:

9周期移动平均线上穿15周期移动平均线,且15周期移动平均线角度大于30度时,表示短期趋势转为上涨;

此时如果K线形态为锤头或纯阳线,表明上涨势头强劲,则产生买入信号;

9周期移动平均线下穿15周期移动平均线时,表示短期趋势转为下跌,此时产生卖出信号,不需要判断K线形态;

入场后设置0.5%的止损和0.5%的止盈。

优势分析

该策略具有以下几个优势:

回撤小、获利稳定。作为scalping策略,设置了较小的止损止盈幅度,单笔损失有限,即使遇到逆市也不会大幅回撤。

信号比较明确。移动平均线交叉结合K线形态识别趋势转折点,避免无效突破。

容易实现自动交易。策略信号规则清晰,参数调整简单,适合算法交易。

适合比特币高波动行情。作为数字货币,比特币波动较大,短期调整频繁,运用该策略可以捕捉短线交易机会。

风险分析

该策略也存在一些风险:

容易产生多次小额损失。比特币行情两面性较强,止损被触发概率大,连续止损会形成亏损;

参数设置需要不断优化。移动平均线参数和止损止盈设置需要根据市场调整,否则效果会打折扣;

效果依赖趋势。在盘整行情中,该策略可能会产生频繁交易但小额盈亏。

对应解决方法如下:

加大单笔订单规模,确保盈亏比合适;

调整参数设置,跟随市场变化;

识别行情状态,避免在盘整中无效交易。

优化方向

该策略还可从以下几个方向进行优化:

增加止损止盈自适应机制。比如,跟踪移动平均线实时调整止损线、动态更改目标利润等;

结合其他指标过滤信号。例如,RSI指标判断超买超卖、成交量放大等;

测试不同品种合约。运用该策略进行原油、股指期货等品种的scalping交易;

进行参数优化和回测优化,确定最佳参数。

总结

总体来说,该策略是一个有效的比特币短线scalping策略。它简单并且易于实施,可配置性较高。通过不断优化和调整,可望获取稳定的scalping交易收益。 但是交易中也需要警惕风险,合理控制止损和仓位。此外,可根据市场和自身情况进行策略优化,以获得更好的效果。

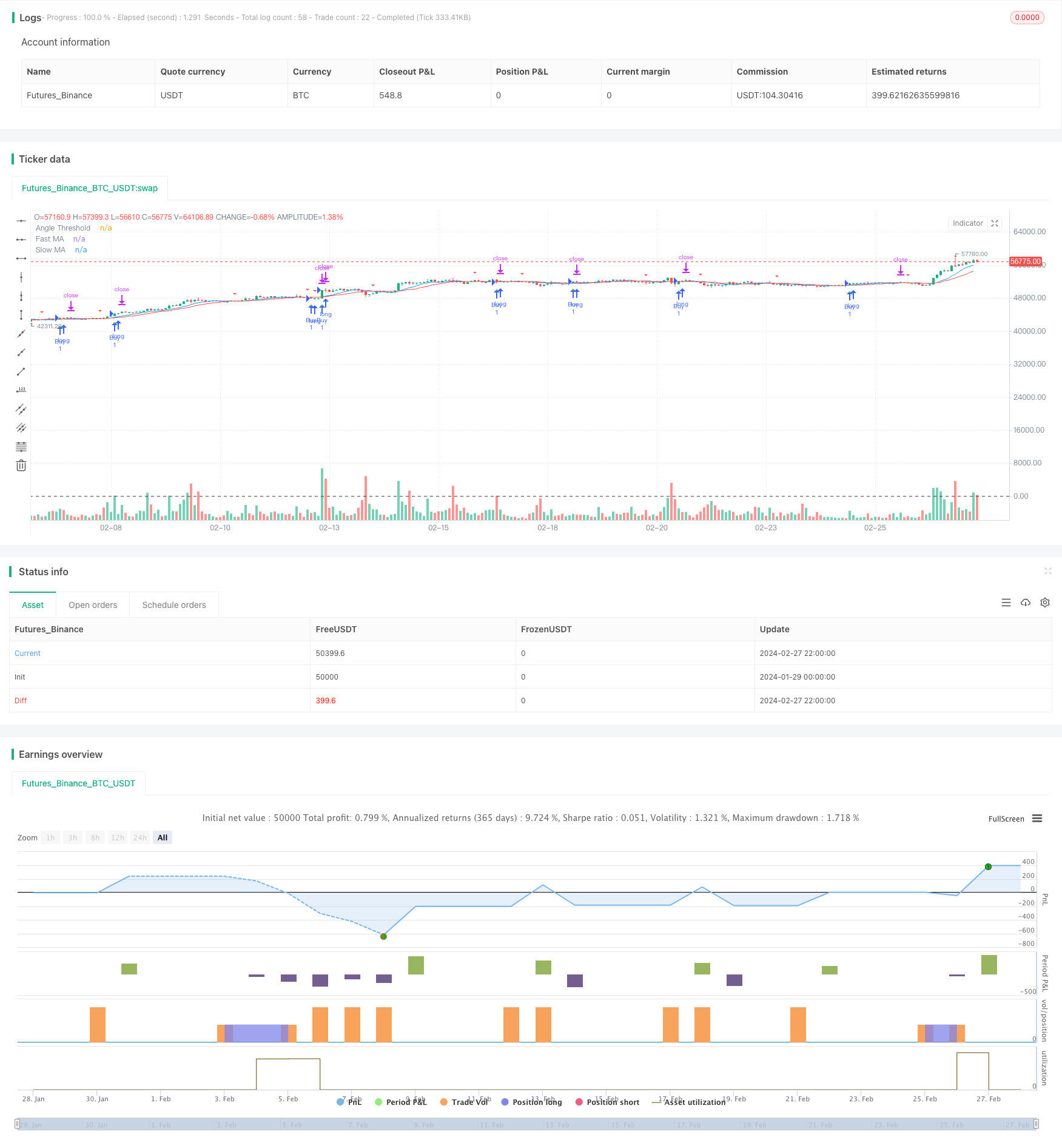

/*backtest

start: 2024-01-29 00:00:00

end: 2024-02-28 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Moving Average Crossover Strategy with Candlestick Patterns", overlay=true)

// Define input parameters

fast_length = input(9, "Fast MA Length")

slow_length = input(15, "Slow MA Length")

stop_loss_percent = input(0.5, "Stop Loss (%)")

target_percent = input(0.5, "Target (%)")

angle_threshold = input(30, "Angle Threshold (degrees)")

// Calculate moving averages

fast_ma = sma(close, fast_length)

slow_ma = sma(close, slow_length)

// Define candlestick patterns

is_pin_bar() =>

pin_bar = abs(open - close) > 2 * abs(open[1] - close[1])

high_tail = max(open, close) - high > abs(open - close) * 1.5

low_tail = low - min(open, close) > abs(open - close) * 1.5

pin_bar and high_tail and low_tail

is_marubozu() =>

marubozu = abs(open - close) > abs(open[1] - close[1]) * 0.75

no_upper_shadow = high == max(open, close)

no_lower_shadow = low == min(open, close)

marubozu and no_upper_shadow and no_lower_shadow

is_full_body() =>

full_body = abs(open - close) > abs(open[1] - close[1]) * 0.95

full_body

// Plot moving averages

plot(fast_ma, color=color.blue, title="Fast MA")

plot(slow_ma, color=color.red, title="Slow MA")

// Calculate angle of slow moving average

ma_angle = abs(180 * (atan(slow_ma[1] - slow_ma) / 3.14159))

// Generate buy/sell signals based on angle condition and candlestick patterns

buy_signal = crossover(fast_ma, slow_ma) and ma_angle >= angle_threshold and (is_pin_bar() or is_marubozu() or is_full_body())

sell_signal = crossunder(fast_ma, slow_ma)

// Calculate stop-loss and target levels

stop_loss_level = close * (1 - stop_loss_percent / 100)

target_level = close * (1 + target_percent / 100)

// Execute trades based on signals with stop-loss and target

strategy.entry("Buy", strategy.long, when=buy_signal)

strategy.exit("Exit", "Buy", stop=stop_loss_level, limit=target_level)

// Plot buy/sell signals on chart (optional)

plotshape(series=buy_signal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=sell_signal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Plot angle line

hline(angle_threshold, "Angle Threshold", color=color.black, linestyle=hline.style_dashed)