概述

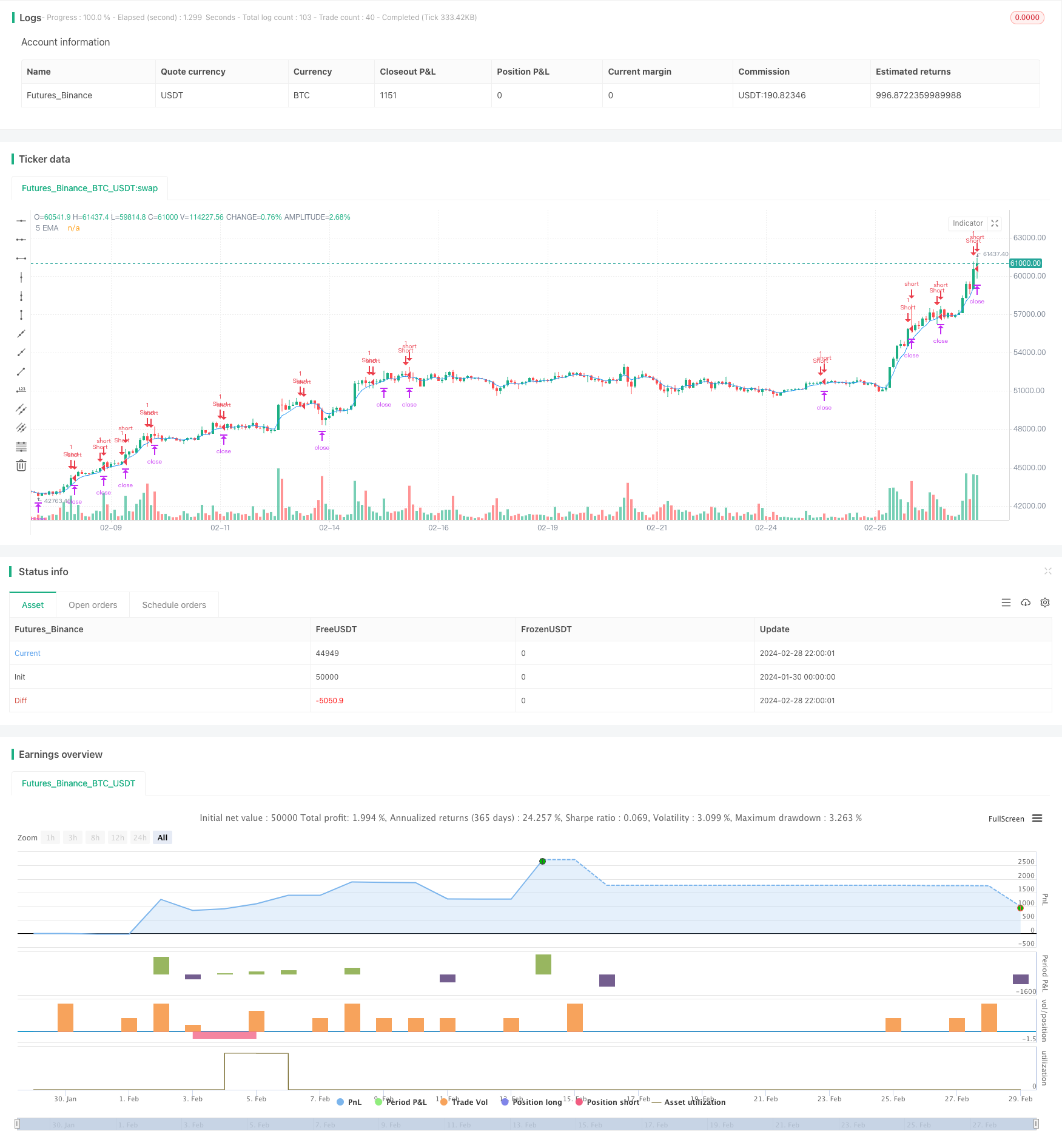

这个策略是基于EMA指标的突破交易策略,当价格突破EMA时看作入场信号,采取三角止损方式设置止损位和止盈位,具有较高的获利可能性。

策略原理

该策略通过计算5日EMA作为指标,当收盘价从上方触碰5日EMA时,作为做空信号;然后设置入场价格为信号生成柱的高点,止损位为前一根K线的最高点,止盈位为入场价格减去风险值的3倍(假设止盈止损比例为2:1)。这样当价格突破EMA向下时,我们做空;如果价格重新回升,止损点可以将损失控制在一定范围;而三角止盈可以获得较好的风险回报比率。

优势分析

这是一个较简单的突破EMA的策略,具有如下优势:

1. 规则简单清晰,容易实施;

2. EMA能很好地描绘价格趋势,利用突破信号易获利;

3. 采用三角止盈止损,可以获得较高的盈亏比;

4. 可视化的止损止盈位有助于风险控制。

风险分析

该策略也存在一些风险:

1. 市场突然发生巨大变动,止损可能无法起到作用;

2. EMA指标滞后,可能错过最佳入场时机;

3. 三角套可能被套牢,无法止损。

为控制风险,可以结合其他指标判断大趋势,避免逆势交易;也可以根据市场波动程度调整止损幅度。

优化方向

这是一个较为简单的策略,后续还可以从以下几个方向进行优化:

1. 优化EMA周期参数,适应不同周期;

2. 增加其他指标判断,提高策略稳定性;

3. 采用动态止损方式,根据市场波动程度调整止损幅度;

4. 结合交易量等指标避免假突破。

总结

该策略整体是一个简单实用的短期突破EMA策略。它具有规则清晰、容易实现、止盈止损完备等优势,可以获得较好的风险回报比率。但也存在被套风险等问题。后续可以从调整参数、增加指标、动态止损等方面进行优化,使策略更加稳定可靠。

策略源码

/*backtest

start: 2024-01-30 00:00:00

end: 2024-02-29 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Short Entry EMA Strategy with Visual SL and TP", shorttitle="SE-EMA-SL-TP-Viz", overlay=true)

// Customization Inputs

emaPeriod = input.int(5, title="EMA Period", minval=1)

// EMA Calculation

emaValue = ta.ema(close, emaPeriod)

plot(emaValue, title="5 EMA", color=color.blue)

// Detecting Short Entry Conditions

shortEntryCondition = close > emaValue and low <= emaValue and low[1] > emaValue[1] and close[1] > emaValue[1]

// Entry, SL, and TP Logic

if (shortEntryCondition)

entryPrice = open[1]

slLevel = high[1]

risk = slLevel - entryPrice

tpLevel = entryPrice - risk * 3 // Assuming a 2:1 risk-reward ratio for TP calculation

// Execute short trade

strategy.entry("Short", strategy.short)

strategy.exit("Exit", "Short", stop=slLevel, limit=tpLevel)

// Visualizing SL and TP levels

// line.new(bar_index, slLevel, bar_index + 20, slLevel, color=color.red, width=2)

// line.new(bar_index, tpLevel, bar_index + 20, tpLevel, color=color.green, width=2)

// Plotting Short Entry Signal

plotshape(series=shortEntryCondition, style=shape.triangledown, location=location.abovebar, color=color.red, title="Short Signal")