概述

该策略通过RSI指标与平滑RSI指标的结合,寻找价格低点买入机会。当RSI指标创新低而价格没有创新低时,认为是多头分型信号。结合平滑RSI指标的趋势判断,可以提高策略的效果。

策略原理

- 计算RSI指标,参数为14日线。

- 计算平滑RSI指标,通过双重WMA平均实现平滑效果。

- 判断RSI是否低于30,即超卖。

- 判断平滑RSI是否低于35,方向性较强。

- 判断RSI的最低点是否低于25。

- 计算RSI分型,即寻找RSI创新低而价格没有创新低的情况。

- 计算平滑RSI的下降周期,需要达到3日。

- 当上述条件都满足时,产生买入信号。

- 设置止损和止盈条件。

该策略主要依靠RSI指标反转性质,结合平滑RSI判断趋势,在价格承压而RSI超卖时买入。达到止盈或止损后平仓。

策略优势分析

- 双RSI指标组合,提高策略效果。

- 利用RSI指标的反转特征,有一定的概率优势。

- 平滑RSI判断趋势有助于避免假反转。

- 完整的止损止盈逻辑,可以限制风险。

风险分析

- RSI反转失败的概率,无法完全避免。

- 平滑RSI指标滞后,可能错过最佳买入时机。

- 止损点设置过于宽松,亏损扩大的风险。

可以通过调整RSI参数,优化买入时机。适当缩短止损间距,加快止损速度。结合其他指标判断趋势风险,降低假反转概率。

优化方向

- 可以测试不同参数下RSI指标的效果。

- 优化平滑RSI的计算方法,提高平滑质量。

- 调整止盈止损点,寻找最优风险回报比。

- 增加量能指标等判断力度,避免量能不足情况。

通过参数调整和组合更多指标,可以进一步提升策略交易效果。

总结

该策略整体是一个利用RSI反转特征的策略思路。双RSI指标组合充分发挥RSI反转效果的同时,也增加了指标分歧带来的不确定性。整体是一个典型的指标策略思路。通过不断测试优化可以提高指标参数的适用性,也可以组合更多指标判断来降低误判概率,增强策略健壮性。

策略源码

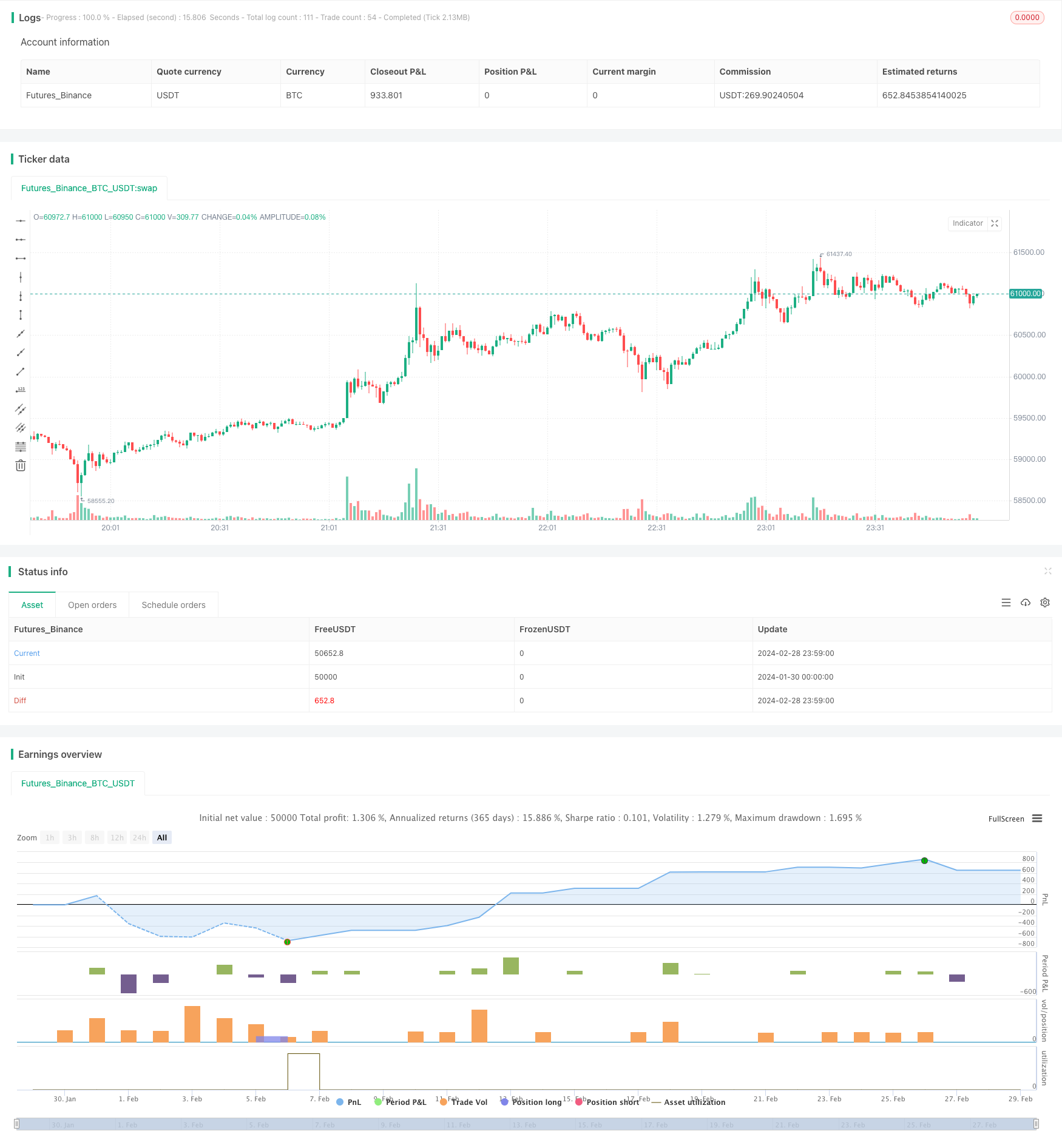

/*backtest

start: 2024-01-30 00:00:00

end: 2024-02-29 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © BigBitsIO

//@version=4

strategy(title="RSI and Smoothed RSI Bull Div Strategy [BigBitsIO]", shorttitle="RSI and Smoothed RSI Bull Div Strategy [BigBitsIO]", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=.1, slippage=0)

TakeProfitPercent = input(3, title="Take Profit %", type=input.float, step=.25)

StopLossPercent = input(1.75, title="Stop Loss %", type=input.float, step=.25)

RSICurve = input(14, title="RSI Lookback Period", type=input.integer, step=1)

BuyBelowTargetPercent = input(0, title="Buy Below Lowest Low In RSI Divergence Lookback Target %", type=input.float, step=.05)

BuyBelowTargetSource = input(close, title="Source of Buy Below Target Price", type=input.source)

SRSICurve = input(10, title="Smoothed RSI Lookback Period", type=input.integer, step=1)

RSICurrentlyBelow = input(30, title="RSI Currently Below", type=input.integer, step=1)

RSIDivergenceLookback = input(25, title="RSI Divergence Lookback Period", type=input.integer, step=1)

RSILowestInDivergenceLookbackCurrentlyBelow = input(25, title="RSI Lowest In Divergence Lookback Currently Below", type=input.integer, step=1)

RSISellAbove = input(65, title="RSI Sell Above", type=input.integer, step=1)

MinimumSRSIDownTrend = input(3, title="Minimum SRSI Downtrend Length", type=input.integer, step=1)

SRSICurrentlyBelow = input(35, title="Smoothed RSI Currently Below", type=input.integer, step=1)

PlotTarget = input(false, title="Plot Target")

RSI = rsi(close, RSICurve)

SRSI = wma(2*wma(RSI, SRSICurve/2)-wma(RSI, SRSICurve), round(sqrt(SRSICurve))) // Hull moving average

SRSITrendDownLength = 0

if (SRSI < SRSI[1])

SRSITrendDownLength := SRSITrendDownLength[1] + 1

// Strategy Specific

ProfitTarget = (close * (TakeProfitPercent / 100)) / syminfo.mintick

LossTarget = (close * (StopLossPercent / 100)) / syminfo.mintick

BuyBelowTarget = BuyBelowTargetSource[(lowestbars(RSI, RSIDivergenceLookback)*-1)] - (BuyBelowTargetSource[(lowestbars(RSI, RSIDivergenceLookback)*-1)] * (BuyBelowTargetPercent / 100))

plot(PlotTarget ? BuyBelowTarget : na)

bool IsABuy = RSI < RSICurrentlyBelow and SRSI < SRSICurrentlyBelow and lowest(SRSI, RSIDivergenceLookback) < RSILowestInDivergenceLookbackCurrentlyBelow and BuyBelowTargetSource < BuyBelowTarget and SRSITrendDownLength >= MinimumSRSIDownTrend and RSI > lowest(RSI, RSIDivergenceLookback)

bool IsASell = RSI > RSISellAbove

if IsABuy

strategy.entry("Positive Trend", true) // buy by market

strategy.exit("Take Profit or Stop Loss", "Positive Trend", profit = ProfitTarget, loss = LossTarget)

if IsASell

strategy.close("Positive Trend")