概述

EfficiVision Trader是一个基于双均线交叉和止损策略的高效交易策略。该策略通过使用两条不同周期的移动平均线(MA)来判断市场趋势,并根据均线交叉的情况来决定进场方向。同时,该策略采用了止损机制,通过设置止损价格来控制风险。

策略原理

EfficiVision Trader的核心原理是利用两条不同周期的移动平均线(本策略中使用了10日MA和20日MA)来判断市场趋势。当短期均线(10日MA)上穿长期均线(20日MA)时,表明市场处于上升趋势,策略将开仓做多;反之,当短期均线下穿长期均线时,表明市场处于下降趋势,策略将开仓做空。

同时,为了控制风险,该策略采用了止损机制。在开仓的同时,策略会根据当前价格和预设的止损百分比(本策略中默认为2%)来计算止损价格。如果市场价格达到止损价格,策略将自动平仓,以减少进一步的损失。

总的来说,EfficiVision Trader通过均线交叉来捕捉市场趋势,并通过止损机制来控制风险,从而实现高效的交易。

优势分析

简单有效:EfficiVision Trader使用简单的双均线交叉原理来判断市场趋势,易于理解和实现,同时具有较好的实用性。

趋势跟踪:通过均线交叉来判断趋势,可以帮助策略顺应市场趋势,提高交易成功率。

风险控制:采用止损机制,可以有效控制单笔交易的最大损失,降低策略的整体风险。

适应性强:该策略可以通过调整参数(如均线周期、止损百分比等)来适应不同的市场环境和交易品种。

风险分析

市场波动风险:在市场剧烈波动的情况下,频繁的均线交叉可能导致策略产生较多的交易信号,增加交易成本和风险。

参数优化风险:策略的表现依赖于均线周期和止损百分比等参数的选择,不恰当的参数可能导致策略表现不佳。

趋势转折风险:在市场趋势转折的过程中,策略可能会出现连续的损失交易。

黑天鹅事件风险:面对不可预测的极端市场事件,策略可能会出现较大的损失。

针对以上风险,可以通过以下方式进行优化和改进:

引入适应性均线周期,根据市场波动情况动态调整均线周期,减少频繁交易。

使用多组参数进行回测,选择表现最优的参数组合,并定期进行参数优化。

在趋势转折期,可以通过降低仓位或暂停交易来减少损失。

设置合理的风险限额,控制策略的最大回撤和净值跌幅,必要时进行人工干预。

优化方向

多时间框架分析:结合不同时间框架的均线交叉情况,提高趋势判断的准确性。

引入其他技术指标:如RSI、MACD等,构建多因子交易模型,提高策略的稳健性。

动态止损:根据市场波动情况动态调整止损百分比,在趋势明确时使用较宽的止损,在趋势不明朗时使用较紧的止损。

仓位管理:根据市场趋势强度和策略净值情况,动态调整仓位大小,在趋势强劲时加大仓位,在趋势减弱或净值回撤时减小仓位。

机器学习优化:利用机器学习算法对历史数据进行训练,寻找最优的参数组合和交易规则,不断提高策略的表现。

以上优化方向可以帮助EfficiVision Trader在不同的市场环境中实现更稳健、更高效的交易表现,同时也可以降低策略的整体风险。

总结

EfficiVision Trader是一个基于双均线交叉和止损策略的高效交易策略。它利用不同周期的移动平均线来判断市场趋势,通过均线交叉来决定进场方向,同时采用止损机制来控制单笔交易的风险。该策略简单易用,适应性强,可以通过优化参数和引入其他技术指标来提高策略的稳健性和盈利能力。

然而,在实际应用中,EfficiVision Trader也面临着市场波动、参数优化、趋势转折和黑天鹅事件等风险。为了更好地应对这些风险,我们可以从多个方面对策略进行优化,如引入适应性均线周期、多时间框架分析、动态止损和仓位管理等。此外,利用机器学习算法对策略进行优化也是一个有前景的方向。

总的来说,EfficiVision Trader是一个具有良好潜力的交易策略,通过不断的优化和改进,它有望在各种市场环境中实现稳定的盈利。同时,我们也要充分认识到交易市场的风险和不确定性,谨慎地应用该策略,并结合自己的风险偏好和交易目标来做出合理的决策。

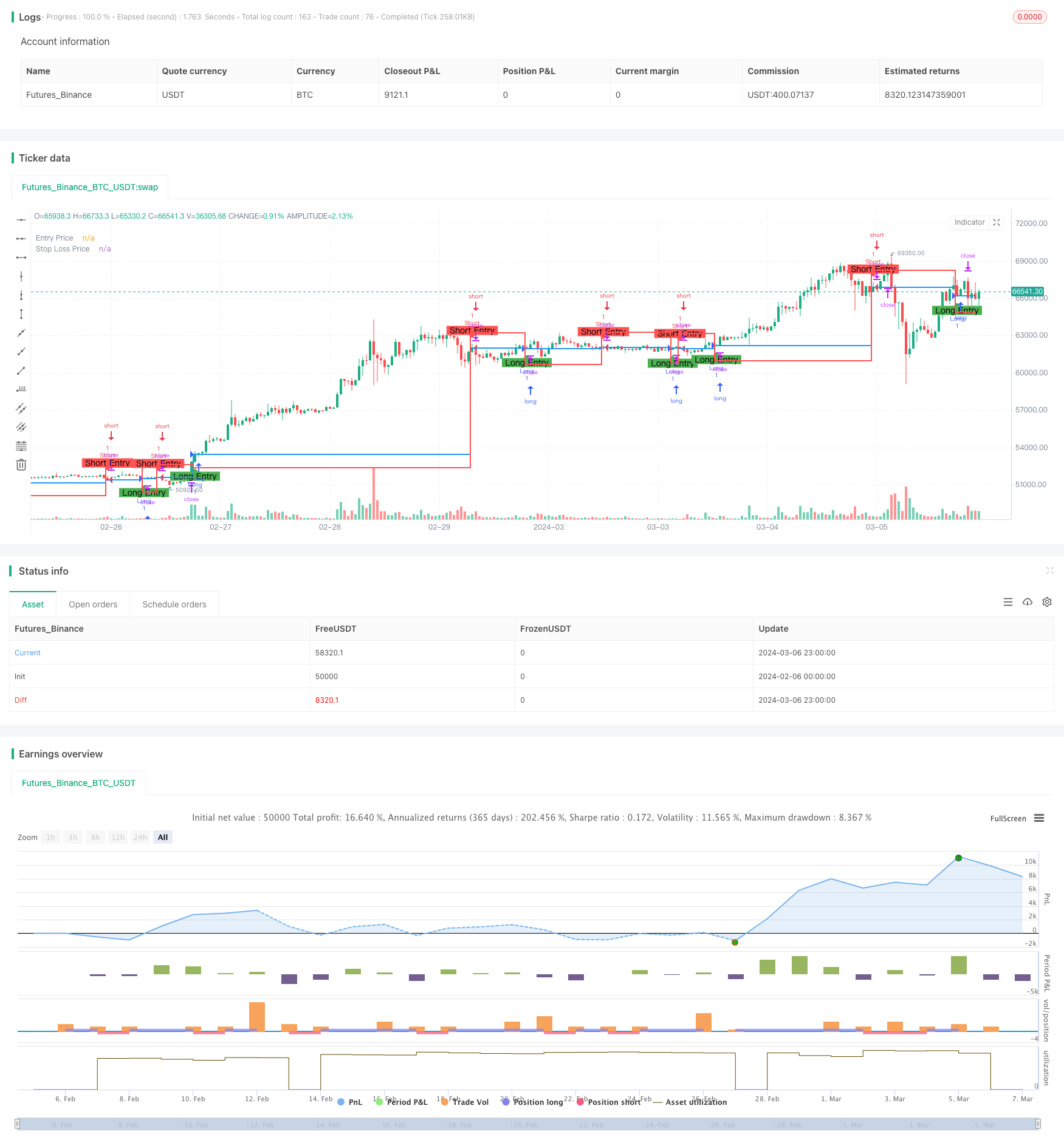

/*backtest

start: 2024-02-06 00:00:00

end: 2024-03-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EfficiVision Trader Strategy", overlay=true)

// Input parameters

// Define the conditions for entering a long trade and a short trade

longCondition = ta.crossover(ta.sma(close, 10), ta.sma(close, 20)) // Long condition: 10 SMA crosses above 20 SMA

shortCondition = ta.crossunder(ta.sma(close, 10), ta.sma(close, 20)) // Short condition: 10 SMA crosses below 20 SMA

stopLossPerc = input(2.0, title="Stop Loss Percentage") // Percentage for calculating stop loss

var float entryPrice = na // Price at which the trade is entered

var float stopLossPrice = na // Price at which the stop loss is set

// Calculate stop loss based on the current price and the stop loss percentage

if (longCondition)

entryPrice := close

stopLossPrice := close * (1 - stopLossPerc / 100) // Calculate stop loss for long trades

if (shortCondition)

entryPrice := close

stopLossPrice := close * (1 + stopLossPerc / 100) // Calculate stop loss for short trades

// Enter long trade when long condition is met

if (longCondition)

strategy.entry("Long", strategy.long)

// Enter short trade when short condition is met

if (shortCondition)

strategy.entry("Short", strategy.short)

// Exit long trade when stop loss price is reached

strategy.exit("Exit Long", "Long", stop=stopLossPrice)

// Exit short trade when stop loss price is reached

strategy.exit("Exit Short", "Short", stop=stopLossPrice)

// Plot entry and stop-loss levels on the chart

plotshape(series=longCondition, location=location.belowbar, color=color.green, style=shape.labelup, text="Long Entry")

plotshape(series=shortCondition, location=location.abovebar, color=color.red, style=shape.labeldown, text="Short Entry")

plot(entryPrice, color=color.blue, style=plot.style_stepline, linewidth=2, title="Entry Price")

plot(stopLossPrice, color=color.red, style=plot.style_stepline, linewidth=2, title="Stop Loss Price")