策略概述

该策略是经典的21日指数移动平均线(21 EMA)交易方法的升级版本,结合了成交量分析和相对强弱指数(RSI)来提供更可靠的买卖信号。该策略旨在利用趋势动量,并通过额外的确认层来识别牛市和熊市中的高概率入场点。

策略原理

该策略的核心是21日EMA,当价格上穿EMA时产生潜在的买入信号,下穿时产生潜在的卖出信号,表明趋势反转。为了提高信号的可靠性,使用成交量进行过滤。买入信号要求当前成交量明显高于平均水平(由用户定义的百分比设置,高于21周期成交量的EMA),表明强劲的买盘兴趣。相反,卖出信号要求当前成交量较低,表明卖盘压力减弱。

RSI(默认为14周期)作为动量过滤器。只有当RSI高于50时,才考虑买入信号,表明看涨势头;而当RSI低于50时,才考虑卖出信号,突显看跌势头。

该策略利用平均真实波幅(ATR)动态设置止损水平,根据当前市场波动性进行调整。这种方法通过根据市场情况调整止损水平来帮助管理风险。

当价格上穿21日EMA、成交量高于阈值且RSI高于50时,产生买入信号。策略建立多头仓位,并根据ATR在进场价下方设置动态止损。

当价格下穿21日EMA、成交量低于阈值且RSI低于50时,产生卖出信号。策略建立空头仓位,止损位置在进场价上方,同样由ATR决定。

策略优势

多指标结合:该策略将趋势、成交量和动量指标结合起来,提供更全面的市场分析,有助于过滤掉虚假信号。

动态止损:根据ATR动态调整止损水平,可以更好地适应不同的市场条件,帮助控制风险。

适应性强:该策略可以应用于各种金融工具和时间周期,交易者可以根据自己的交易风格和风险承受能力进行调整。

趋势跟踪:通过21日EMA捕捉主要趋势,让交易者能够顺应市场方向。

策略风险

参数优化:该策略的性能在很大程度上取决于输入参数的优化,包括成交量阈值百分比、RSI水平和ATR倍数。不恰当的参数设置可能导致策略表现不佳。

振荡市:在波动较大但没有明确趋势的市场中,该策略可能会产生较多的虚假信号,导致频繁交易和潜在损失。

突发事件:异常的市场事件,如重大新闻公告或经济数据发布,可能导致价格和成交量的剧烈波动,影响策略的表现。

优化方向

多时间周期确认:考虑在不同时间周期(如1小时、4小时、日线)上使用该策略,寻找多个时间周期一致的信号,提高可靠性。

止盈设置:在当前策略中加入止盈规则,例如根据风险回报比或价格目标设置止盈位,以锁定利润并优化策略回报。

加入其他过滤器:可以探索加入其他技术指标作为过滤器,如MACD、布林带等,以进一步确认趋势和动量。

市场环境适应:根据不同的市场状态(如趋势、震荡、高波动)调整策略参数,以适应变化的市场条件。

总结

基于21日EMA、成交量和RSI的趋势动量策略是一种多指标结合的方法,旨在捕捉趋势并利用成交量和动量的确认来提高信号质量。通过动态止损和参数优化,该策略可以适应不同的市场条件并控制风险。然而,交易者需要意识到过度优化和频繁交易的风险,并根据自己的风险承受能力和交易目标进行调整。

该策略提供了一个系统化的框架,综合考虑了趋势、成交量和动量等多个维度,为交易决策提供依据。通过回测和优化,交易者可以进一步提高策略的表现,并根据市场状态的变化进行动态调整。此外,将该策略与基本面分析和风险管理原则相结合,可以形成一个更全面的交易方法。

总的来说,基于21日EMA、成交量和RSI的趋势动量策略是一种灵活且可定制的交易方法,适合追求趋势交易并希望通过多个指标确认来提高信号可靠性的交易者。在实际应用中,交易者应谨慎评估自己的风险承受能力,并对策略进行充分的回测和优化,以确保其符合自己的交易目标和市场环境。

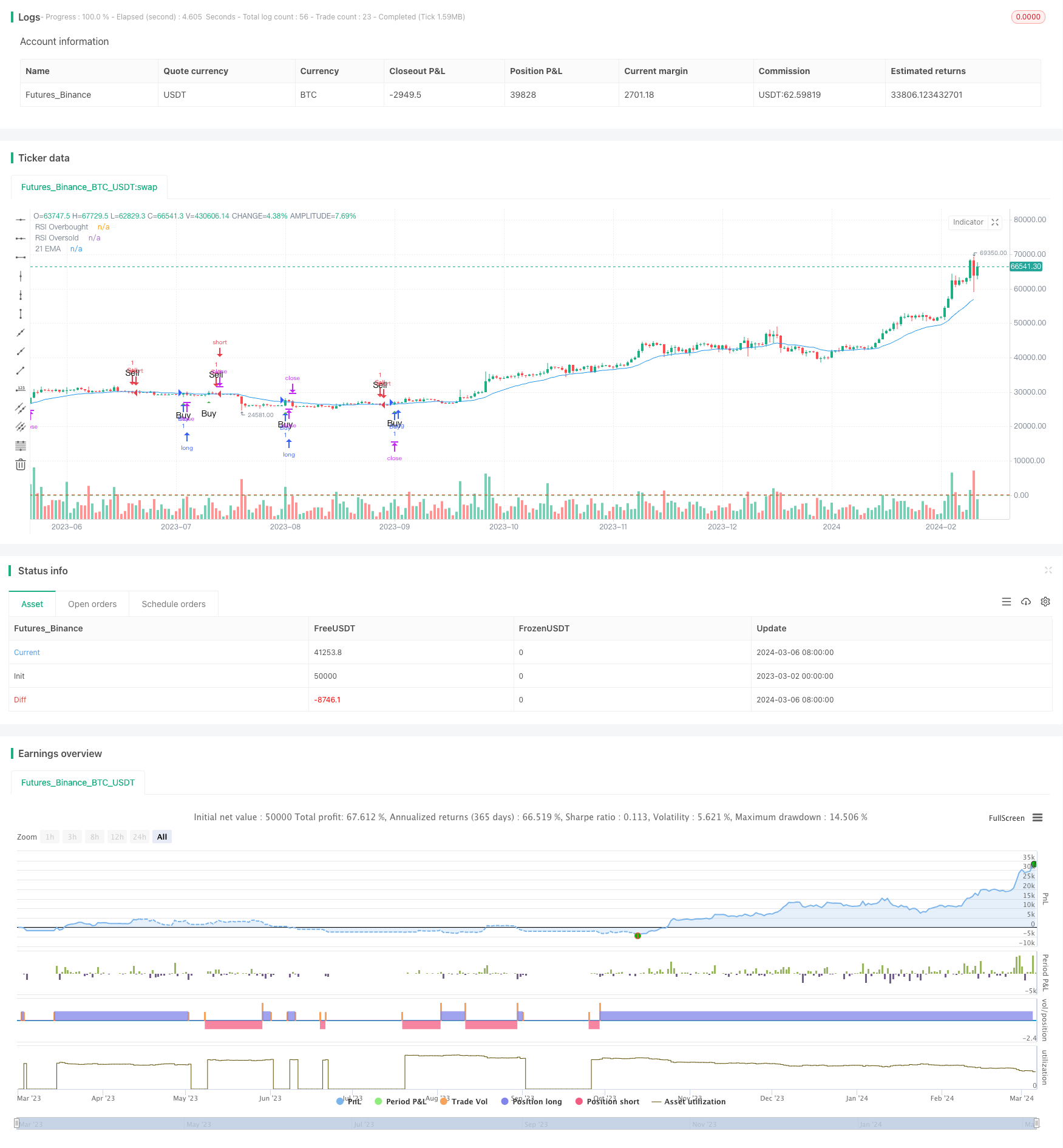

/*backtest

start: 2023-03-02 00:00:00

end: 2024-03-07 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Enhanced 21 EMA Strategy with Volume and RSI", overlay=true)

// Input parameters

input_volumeThresholdPct = input(10, title="Volume Threshold Percentage")

input_rsiPeriod = input(14, title="RSI Period")

input_rsiOverbought = input(70, title="RSI Overbought Level")

input_rsiOversold = input(30, title="RSI Oversold Level")

input_atrPeriod = input(14, title="ATR Period for Stop Loss")

input_atrMultiplier = input(1.5, title="ATR Multiplier for Stop Loss")

// Calculate indicators

ema21 = ta.ema(close, 21)

rsi = ta.rsi(close, input_rsiPeriod)

ema21_volume = ta.ema(volume, 21)

volumeThreshold = ema21_volume * (1 + input_volumeThresholdPct / 100)

atr = ta.atr(input_atrPeriod)

// Generate buy and sell signals with volume and RSI confirmation

buySignal = ta.crossover(close, ema21) and volume > volumeThreshold and rsi > 50

sellSignal = ta.crossunder(close, ema21) and volume < volumeThreshold and rsi < 50

// Plot the 21 EMA and RSI on the chart

plot(ema21, color=color.blue, title="21 EMA")

hline(input_rsiOverbought, "RSI Overbought", color=color.red)

hline(input_rsiOversold, "RSI Oversold", color=color.green)

// Execute buy and sell orders based on signals with dynamic stop-loss levels

if (buySignal)

strategy.entry("Buy", strategy.long)

strategy.exit("Sell", "Buy", stop=close - atr * input_atrMultiplier)

if (sellSignal)

strategy.entry("Sell", strategy.short)

strategy.exit("Buy", "Sell", stop=close + atr * input_atrMultiplier)

// Plot buy and sell signals on the chart

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small, text="Buy")

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small, text="Sell")