概述

抛物线SAR趋势跟踪策略6.0是一个全面的交易策略,利用抛物线SAR指标在趋势反转时产生交易信号。该策略适用于多个金融市场,包括加密货币、股票、外汇和大宗商品,旨在帮助交易者利用系统的方法进出场交易,从而在多空两个方向的市场波动中获利。

策略原理

该策略基于以下原理: 1. 计算抛物线SAR指标,使用用户自定义的起始值、增量和最大值。 2. 根据收盘价与SAR值的交叉情况产生交易信号。当价格向上突破SAR值时,产生做多信号;反之,当价格向下突破SAR值时,产生做空信号。 3. 使用1小时周期的SAR值作为二次过滤,确保交易只在即时SAR和1小时SAR指标都同意市场方向时才进场。 4. 设置进场条件:只有在多头信号确认且前期涨幅达到阈值时才开多仓;类似地,只有在空头信号确认且前期跌幅超过阈值时才开空仓。 5. 设置出场条件:基于止盈和止损两个标准平仓。止盈条件在达到目标获利百分比时平仓锁定利润;止损条件在价格反向超过允许百分比时平仓止损。

优势分析

抛物线SAR趋势跟踪策略6.0的主要优势包括: 1. 适应性强,可应用于多个金融市场和不同的交易风格。 2. 同时考虑即时SAR和1小时SAR,提高信号可靠性。 3. 内置止盈止损,有助于控制风险。 4. 参数可调,方便用户根据自己的需求进行优化。 5. 逻辑清晰,易于理解和实施。

风险分析

尽管该策略具有上述优势,但仍存在一些潜在风险: 1. 市场波动剧烈时,频繁的趋势反转可能导致过多的亏损交易。 2. 参数设置不当可能导致策略效果不佳。 3. 策略未考虑重要的基本面因素,仅依赖技术指标。 4. 缺乏头寸管理和资金管理方面的考量。 针对这些风险,可以通过以下方式进行改进:引入波动率过滤器、优化参数、纳入基本面分析、加入头寸管理和资金管理模块等。

优化方向

- 引入更多技术指标,如移动平均线、RSI等,以提高信号准确性。

- 优化进出场阈值,以适应不同的市场状况。

- 加入头寸管理和资金管理模块,控制单笔交易风险敞口和总体账户风险。

- 考虑市场波动率,在波动加剧时减小仓位或停止交易。

- 纳入基本面分析,如经济数据、重大事件等,以辅助判断趋势可持续性。

总结

抛物线SAR趋势跟踪策略6.0提供了一种系统化的趋势交易方法。通过跟踪抛物线SAR指标,策略能够捕捉到趋势反转的机会。同时,该策略采用了严格的进出场条件,并设置了止盈止损规则,以控制风险。尽管策略有一定的优势,但仍存在一些局限性和潜在风险。未来可以通过引入更多技术指标、优化参数、加强风险管理等方式对策略进行改进,以提升其稳健性和盈利能力。总的来说,抛物线SAR趋势跟踪策略6.0为趋势交易者提供了一种可供参考的交易框架,但在实际应用中还需要根据自身情况进行适当调整和优化。

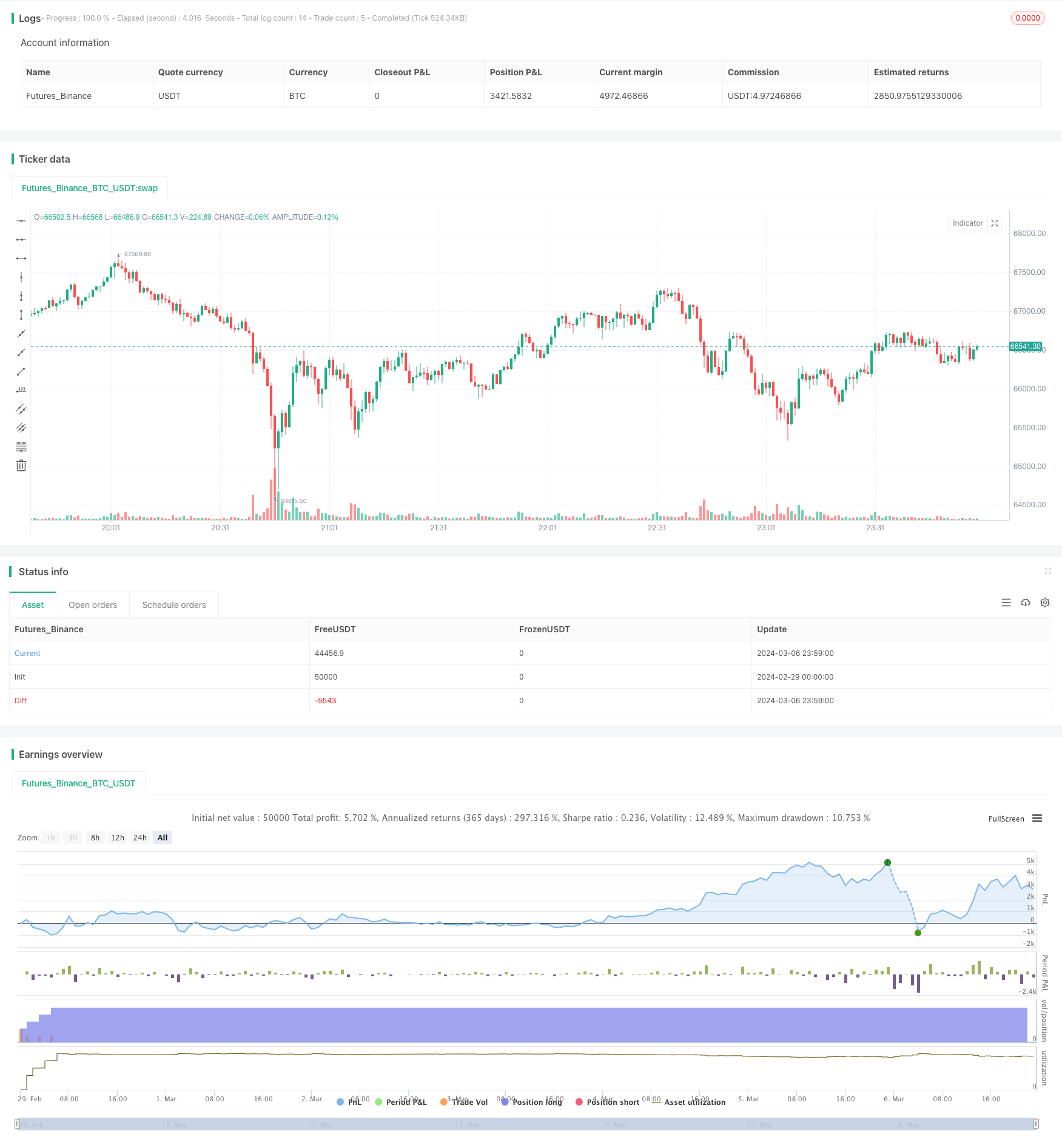

/*backtest

start: 2024-02-29 00:00:00

end: 2024-03-07 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SAR Trend 6.0", default_qty_type = strategy.percent_of_equity, default_qty_value =20, initial_capital=500, commission_type=strategy.commission.percent, commission_value=0.08, pyramiding=5 )

// Parabolic SAR Parameters

start = input(0.02, title="Start Value")

increment = input(0.02, title="Increment Value")

maximum = input(0.2, title="Maximum Value")

long_win=input(0.1,title = "Preceding Increase for Long (%)")/100

short_win=input(2,title = "Preceding Decrease for Short (%)")/100

lose_pct=input (0.5, title="Stop Loss Percentage")

win_pct_long=input(0.2,title = "Take Profit for Long Positions")

win_pct_short=input(0.1,title = "Take Profit for Short Positions")

start1 = input(0.02, title="Start Value (1H)")

increment1 = input(0.02, title="Increment Value (1H)")

maximum1 = input(0.2, title="Maximum Value (1H)")

// Calculating Parabolic SAR

sarValue = ta.sar(start, increment, maximum)

// Generating Trading Signals

longSignal = ta.crossover(close, sarValue)

shortSignal = ta.crossunder(close, sarValue)

// Get Parabolic SAR value for 1-hour time frame

sarValue_1h = request.security(syminfo.tickerid, "5", ta.sar(start1, increment1, maximum1)[1])

// Generating Trading Signals

longSignal1 = close > sarValue_1h

shortSignal1 = close < sarValue_1h

if longSignal and (close - open)/open > long_win and longSignal1

strategy.entry("Long", strategy.long)

if shortSignal and (open - close)/open > short_win and shortSignal1

strategy.entry("Short", strategy.short)

if strategy.position_size > 0 and shortSignal and (close - strategy.position_avg_price)/strategy.position_avg_price > win_pct_long

strategy.close_all("Take Profit")

if strategy.position_size < 0 and longSignal and (strategy.position_avg_price - close)/strategy.position_avg_price > win_pct_short

strategy.close_all("Take Profit")

if strategy.position_size > 0 and (strategy.position_avg_price - close)/strategy.position_avg_price > lose_pct

strategy.close_all("Stop Loss")

if strategy.position_size < 0 and (close - strategy.position_avg_price)/strategy.position_avg_price > lose_pct

strategy.close_all("Stop Loss")