概述

该策略基于QuantNomad开发的UT Bot指标,结合了移动止损的思路。原始代码由@Yo_adriiiiaan编写,@HPotter进行了修改。该策略将与LuxAlgo的Smart Money Concepts配合使用。目前该策略处于测试阶段。

策略原理

该策略的主要原理如下:

- 当收盘价高于50期简单移动平均线时,进行做多交易。

- 对于多头仓位,设置移动止损价格。移动止损价格为当前收盘价的80%(1-20%)。移动止损价格会随着价格上涨而上移,但不会下移,从而起到保护利润的作用。

- 对于空头仓位,同样设置移动止损价格。移动止损价格为当前收盘价的120%(1+20%)。移动止损价格会随着价格下跌而下移,但不会上移。

- 使用ATR(Average True Range,平均真实波幅)作为移动止损的参考依据。ATR移动止损价格的计算方法为:向上移动时,取前一个ATR移动止损价格和(当前收盘价-ATR*Key Value)两者的较大值;向下移动时,取前一个ATR移动止损价格和(当前收盘价+ATR*Key Value)两者的较小值。其中Key Value为用户设置的参数,用于调节移动止损的敏感度。

- 根据ATR移动止损价格的突破情况,判断当前持仓方向。当价格向上突破ATR移动止损价格时,持多头仓位;当价格向下突破ATR移动止损价格时,持空头仓位;其他情况下保持当前持仓状态不变。

优势分析

- 移动止损的设置可以很好地保护利润,使得策略在趋势行情中能够获得更多收益。

- 分别对多头和空头仓位设置止损,能够适应不同的行情。

- 使用ATR作为止损的参考依据,可以动态调整止损位置,更加灵活有效。

- 提供了Key Value参数供用户优化,可以根据不同品种和周期进行调节,提高适应性。

风险分析

- 在震荡行情中,频繁的止损可能导致过多的交易,增加手续费成本,降低收益。

- 固定百分比的移动止损方式相对简单,在一些行情中可能无法很好地应对价格波动。

- 策略中只考虑了移动止损,而没有设置移动止盈,可能错失一些盈利机会。

- 参数的选择对策略表现有较大影响,不当的参数可能带来更大的回撤风险。

优化方向

- 可以考虑结合其他指标或条件,例如交易量、波动率等,对进场条件进行优化,提高信号的可靠性。

- 对于移动止损的计算方法,可以探索更加复杂和有效的方式,例如使用抛物线止损、动态百分比止损等。

- 可以加入移动止盈的机制,例如根据ATR或百分比设置动态止盈位,以更好地锁定利润。

- 针对不同的品种和周期,可以进行参数优化,寻找最适合的参数组合。也可以根据市场状态的变化,动态调整参数。

总结

该策略在UT Bot指标的基础上,加入了移动止损的逻辑,能够在趋势行情中起到保护利润的作用。同时,策略对多头和空头仓位分别设置止损,适应性较强。使用ATR作为移动止损的参考依据,可以动态调整止损位置,提高灵活性。但是,该策略在震荡行情中可能面临频繁止损带来的高交易成本风险,且缺乏移动止盈的设置,有错失盈利的可能。此外,参数的选择对策略表现有较大影响。

未来,可以从优化进场条件、探索更复杂的移动止损方式、加入移动止盈机制、针对不同品种和周期进行参数优化等方面对策略进行完善,以期获得更稳健的收益。总的来说,该策略思路简单明了,易于理解和实现,但还有进一步优化的空间,值得继续探索和改进。

策略源码

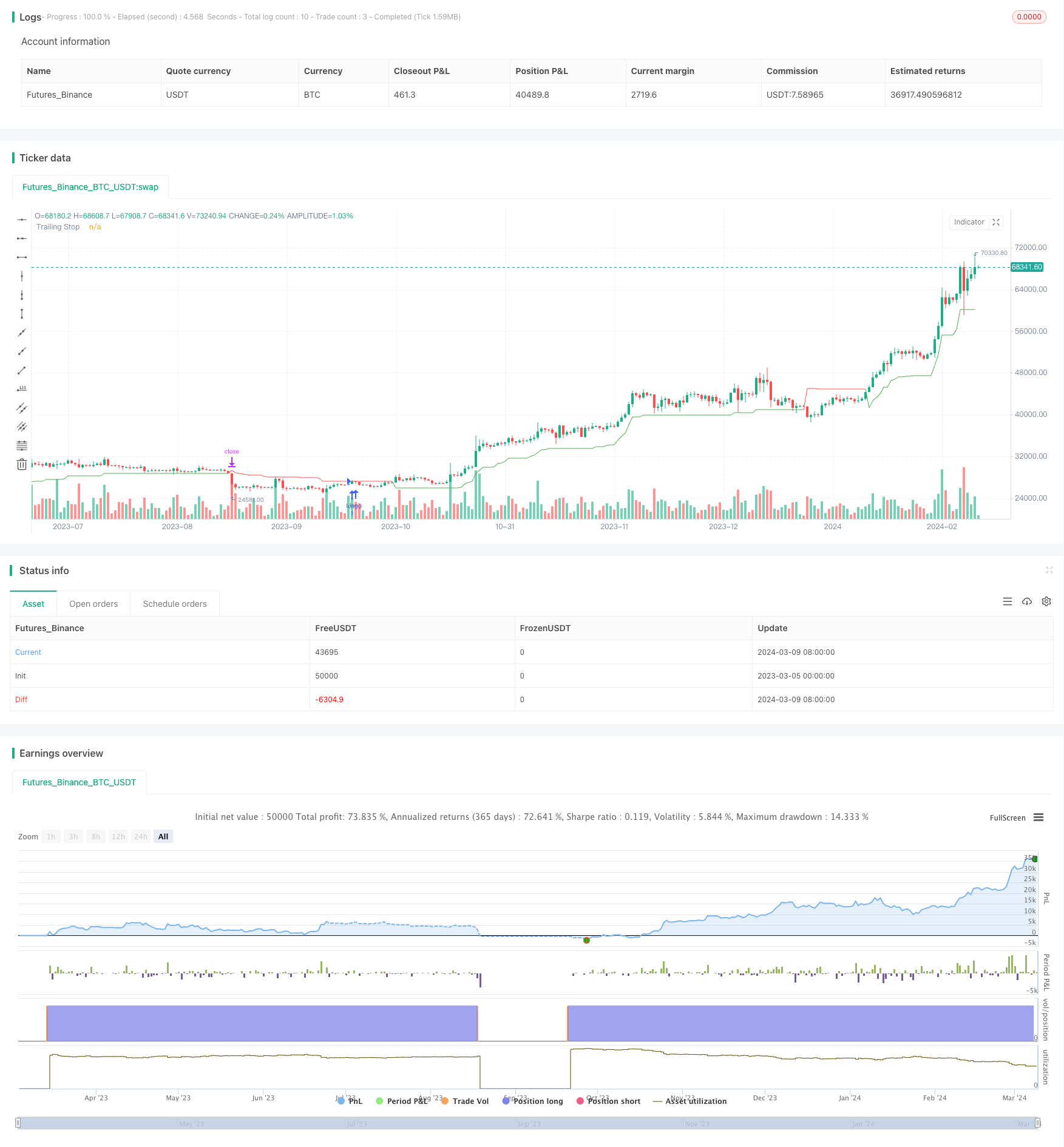

/*backtest

start: 2023-03-05 00:00:00

end: 2024-03-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Trailingstop", overlay=true)

if close > sma(close, 50)

strategy.entry("long", strategy.long)

// Trailing stop loss for long positions

Trailperc = 0.20

price_stop_long = 0.0

if (strategy.position_size > 0)

stopValue = close * (1 - Trailperc)

price_stop_long := max(stopValue, price_stop_long[1])

else

price_stop_long := 0

if (strategy.position_size > 0)

strategy.exit(id="stoploss_long", stop=price_stop_long)

// Trailing stop loss for short positions

Trailperc_short = 0.20

price_stop_short = 0.0

if (strategy.position_size < 0)

stopValue_short = close * (1 + Trailperc_short)

price_stop_short := min(stopValue_short, price_stop_short[1])

else

price_stop_short := 0

if (strategy.position_size < 0)

strategy.exit(id="stoploss_short", stop=price_stop_short)

// ATR Trailing Stop for visualization

keyvalue = input(3, title="Key Value. 'This changes the sensitivity'", step=0.5)

atrperiod = input(10, title="ATR Period")

xATR = atr(atrperiod)

nLoss = keyvalue * xATR

xATRTrailingStop = 0.0

xATRTrailingStop := iff(close > nz(xATRTrailingStop[1], 0) and close[1] > nz(xATRTrailingStop[1], 0), max(nz(xATRTrailingStop[1]), close - nLoss),

iff(close < nz(xATRTrailingStop[1], 0) and close[1] < nz(xATRTrailingStop[1], 0), min(nz(xATRTrailingStop[1]), close + nLoss),

iff(close > nz(xATRTrailingStop[1], 0), close - nLoss, close + nLoss)))

pos = 0

pos := iff(close[1] < nz(xATRTrailingStop[1], 0) and close > nz(xATRTrailingStop[1], 0), 1,

iff(close[1] > nz(xATRTrailingStop[1], 0) and close < nz(xATRTrailingStop[1], 0), -1, nz(pos[1], 0)))

xcolor = pos == -1 ? color.red: pos == 1 ? color.green : color.blue

plot(xATRTrailingStop, color = xcolor, title = "Trailing Stop")