概述

该策略利用日内锤子反转形态和后续绿色蜡烛结合,寻找潜在的上涨机会。当出现锤子反转形态,且下一根蜡烛为绿色上涨蜡烛时,策略开仓做多。止损位置设置在锤子蜡烛的低点,止盈位置设置为开仓价格的1.5倍。

策略原理

锤子形态是一种常见的技术形态,常出现在下跌趋势尾声,预示着趋势反转的到来。典型的锤子形态具有以下特征: 1. 整体蜡烛实体较小,通常低于整个蜡烛高低范围的30%。 2. 下影线较长,至少是蜡烛实体长度的2倍。 3. 上影线很短或者没有,最多不超过蜡烛开盘价的1%。

当锤子形态确认后,如果下一根蜡烛为绿色上涨蜡烛,且低点高于锤子蜡烛的低点,则形成看涨信号,此时入场做多。止损设置在锤子蜡烛低点,以控制风险;止盈设置为开仓价的1.5倍,以获取潜在利润。

优势分析

- 锤子形态是常见的反转形态,配合趋势背景使用胜率较高。

- 严格限制锤子形态和后续看涨蜡烛的形态,提高信号质量。

- 止损位置设置在锤子蜡烛低点,风险可控。

- 止盈位置设置为1.5R,具备不错的盈亏比。

风险分析

- 即使形态和后续走势满足策略条件,行情仍有反复甚至继续下跌的风险。

- 锤子蜡烛低点止损位置较近,一旦触发止损,单次损失相对较大。

- 趋势转折初期波动较大,策略面临较高的价格波动风险。

优化方向

- 可以考虑引入更多技术指标,如RSI、MACD等,结合指标状态来提高信号有效性。

- 对锤子形态和后续看涨蜡烛的形态定义可以进一步优化,如引入更多量化标准。

- 止盈止损位置设置可以进一步优化,如采用动态止盈或者移动止损策略。

- 考虑市场趋势状态,在上涨趋势中寻找锤子形态可能胜率更高。

总结

日内锤子反转形态多头策略充分利用了锤子形态反转的特点,结合后续绿色蜡烛的确认,在两个连续K线形态基础上形成看涨信号。同时,策略采用固定的止盈止损比例,控制了风险暴露水平,也让盈亏比维持在较高水平。但是,该策略对于形态的定义相对简单,缺乏其他技术指标的验证,在实际应用中可能面临较高的信号失效率。此外,由于止损位置设置相对较近,策略也面临单次损失较高的问题。未来可以从信号确认、风险控制等方面对策略进行进一步的优化和改进,以提升整体稳定性和盈利能力。

策略源码

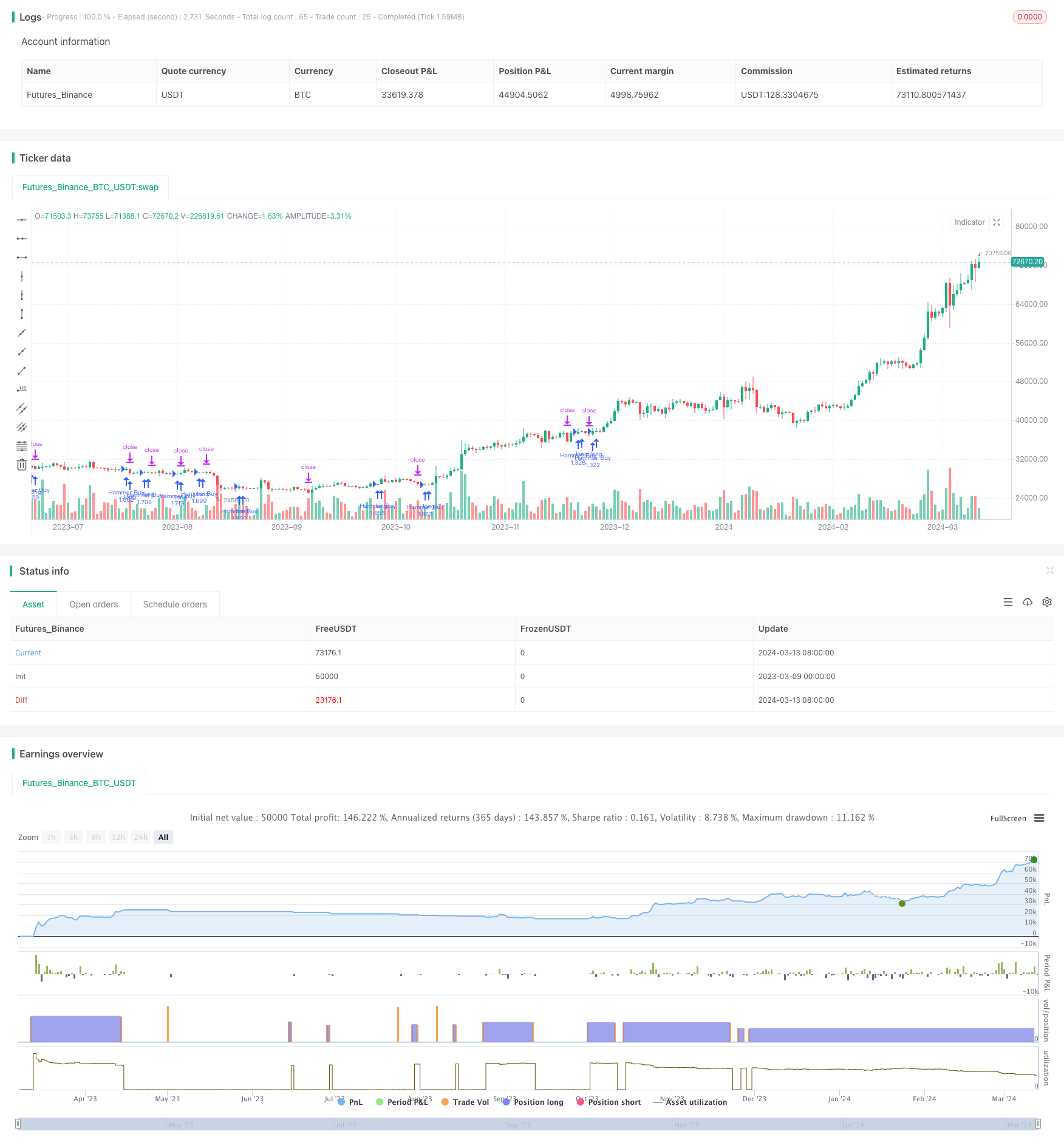

/*backtest

start: 2023-03-09 00:00:00

end: 2024-03-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Hammer Pattern and Follow-Up Green Candle Strategy", overlay=true)

// Detecting a Hammer candle

isHammer() =>

bodySize = math.abs(close[1] - open[1])

lowerWickSize = open[1] - low[1]

upperWickSize = high[1] - open[1] // For a red candle, the upper wick is from the open to the high

bodyIsSmall = bodySize <= (high[1] - low[1]) * 0.3 // Body is less than 30% of the entire candle range

lowerWickIsLong = lowerWickSize >= bodySize * 2 // Lower wick is at least twice the body length

noUpperWick = upperWickSize == 0 or high[1] <= open[1] * 1.01 // No upper wick or very small

close[1] < open[1] and bodyIsSmall and lowerWickIsLong and noUpperWick

// Check if the current candle is green with no or small tail

isGreenWithNoSmallTail() =>

close > open

// Entry condition

entryCondition = isHammer() and isGreenWithNoSmallTail() and low >low[1]

// Calculate stop loss and take profit levels

stopLossLevel = low[1]

profitTargetLevel = close * 1.5

//Calculate position bodySize

positionSize = 50000 / close

// Execute strategy

if (entryCondition)

strategy.entry("Hammer Buy", strategy.long,qty=positionSize)

strategy.exit("Take Profit / Stop Loss", "Hammer Buy", stop=stopLossLevel, limit=profitTargetLevel)