概述

该策略基于9:15分钟K线的高低点,自动计算多空方向的目标价位和止损价位。通过RSI指标判断当前市场的超买超卖情况,在价格突破9:15高低点且RSI满足条件时进行开仓操作。该策略能够自动预测多空方向的目标价位和止损价位,简化了交易者的操作流程。

策略原理

- 确定9:15分钟K线的高低点,分别作为多空方向的关键价位。

- 多头方向:目标价位为9:15高点+200个点,止损价位为9:15低点。

- 空头方向:目标价位为9:15低点-200个点,止损价位为9:15高点。

- 计算RSI指标,默认参数为14,超买线为60,超卖线为40。

- 多头开仓条件:收盘价突破9:15高点,且RSI大于超买线。

- 空头开仓条件:收盘价突破9:15低点,且RSI小于超卖线。

- 当开仓条件满足时,执行相应的多头或空头开仓操作。

- 在图表上绘制9:15高低点,多空目标价位和止损价位,以及开仓信号。

该策略利用9:15分钟K线的高低点作为关键价位,自动计算出多空方向的目标和止损,简化了交易者的操作。同时,引入了RSI指标作为过滤条件,在一定程度上可以避免频繁开仓和假突破。

优势分析

自动计算多空目标和止损:该策略基于9:15分钟K线的高低点,自动计算出多空方向的目标价位和止损价位。交易者无需手动设置,简化了操作流程,提高了交易效率。

RSI指标过滤:策略引入了RSI指标作为开仓的过滤条件。在价格突破关键位置时,还需要RSI指标达到超买或超卖状态,才会触发开仓信号。这在一定程度上可以帮助交易者避免频繁交易和假突破陷阱。

直观的图表展示:该策略在图表上绘制了9:15高低点,多空目标价位,止损价位以及开仓信号。交易者可以直观地看到关键价位和交易信号,便于做出交易决策。

适用于短线交易:该策略以9:15分钟的高低点为基础,目标价位和止损价位的设置也相对较近。因此,该策略更适合短线交易操作,可以快速进出,博取短期内的价格波动。

风险分析

盘中波动风险:该策略以9:15分钟K线的高低点为关键位置,但盘中价格可能出现大幅波动。如果价格在触发开仓后迅速反转,可能导致交易者的损失超出预期。

止损位置风险:策略中的止损位置是固定的,即多头止损位置为9:15低点,空头止损位置为9:15高点。如果价格突破了9:15高低点后继续大幅运行,固定的止损位置可能导致较大的损失。

RSI指标参数风险:该策略使用了默认的RSI参数,即长度为14,超买线为60,超卖线为40。但在不同的市场环境和标的中,这些参数可能并不适用。固定的参数设置可能影响策略的有效性。

盈亏比风险:策略中固定的目标价位和止损价位,决定了每次交易的盈亏比。如果盈亏比设置不当,可能导致长期内策略的收益性不佳。

解决方法: 1. 对于盘中波动风险,可以考虑引入更多的过滤条件,如加入交易量指标,或者缩小止损范围。 2. 对于止损位置风险,可以考虑使用追踪止损或者条件止损,根据市场情况动态调整止损位置。 3. 对于RSI指标参数风险,可以对不同市场和标的进行参数优化,找到更适合的参数组合。 4. 对于盈亏比风险,可以根据历史数据测试不同的目标价位和止损价位组合,找到更优的盈亏比设置。

优化方向

动态止损:目前策略使用固定的止损位置,可以考虑引入动态止损机制,如追踪止损或条件止损。这样可以在价格出现超预期波动时,及时控制风险。

引入更多过滤条件:策略目前主要依赖价格突破和RSI指标,可以考虑引入更多过滤条件,如交易量指标,波动率指标等。通过多个条件的共同确认,可以提高开仓信号的有效性。

参数优化:对于RSI指标的参数设置,可以针对不同的市场和标的进行优化。通过对历史数据的测试,找到更适合当前交易标的的参数组合,提高策略的稳定性。

盈亏比优化:策略的盈亏比对长期收益有重要影响。可以通过对历史数据的回测,测试不同的目标价位和止损价位组合,找到能够带来更高收益的盈亏比设置。

加入趋势判断:该策略目前主要依赖于盘中高低点的突破,属于逆势交易。可以考虑加入趋势判断,在大趋势方向上进行交易,提高胜率和盈亏比。

总结

该策略基于9:15分钟K线的高低点,自动计算多空目标价位和止损价位,同时使用RSI指标作为过滤条件,简化了交易者的操作流程。策略的优势在于自动化程度高,直观易用,适合短线交易操作。但同时也存在一些风险,如盘中波动风险,止损位置风险,指标参数风险和盈亏比风险等。针对这些风险,可以从动态止损,引入更多过滤条件,参数优化,盈亏比优化和趋势判断等方面进行策略改进。通过不断的优化和改进,可以提高该策略的稳定性和盈利能力,更好地适应不同的市场环境。

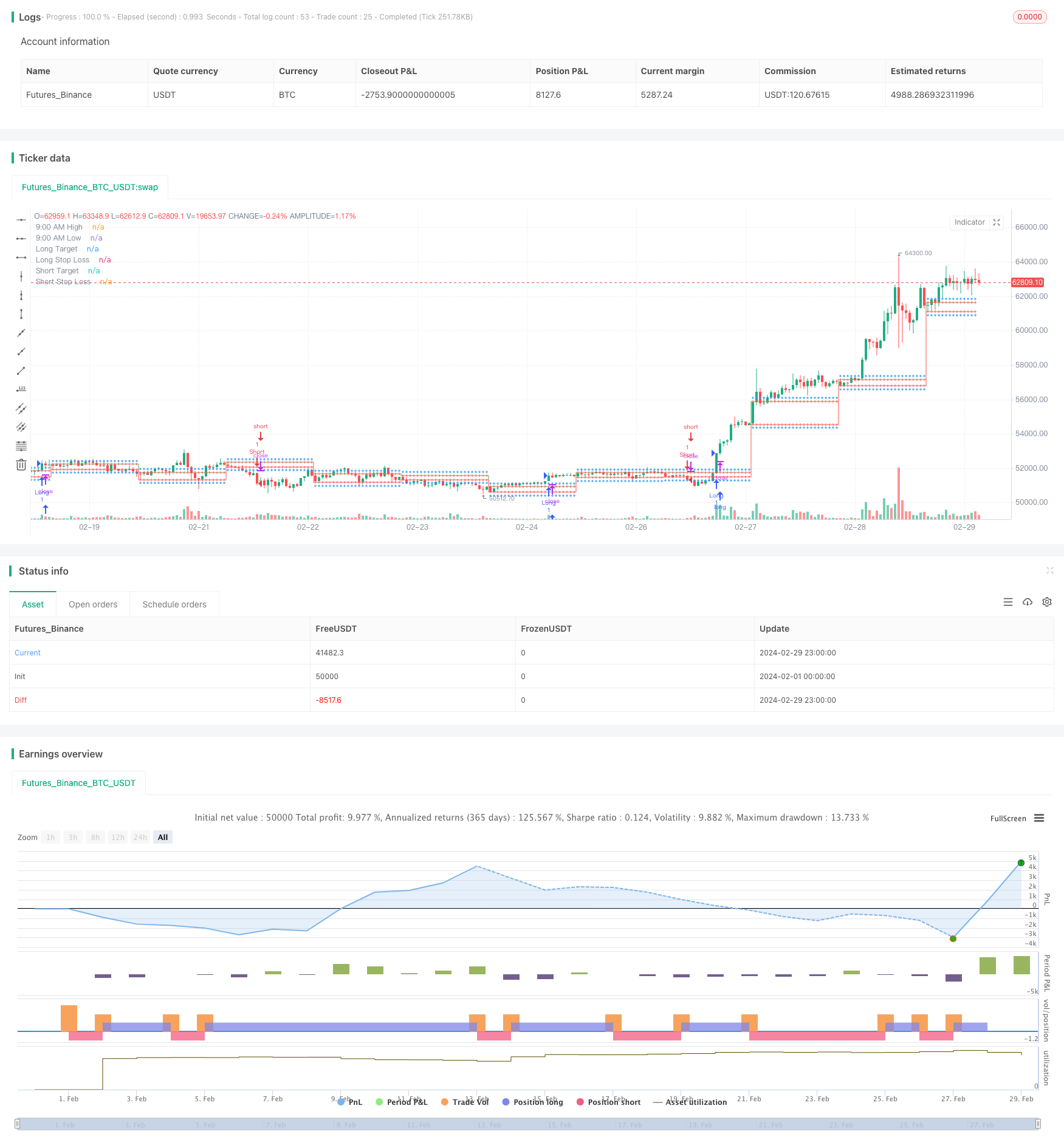

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("9:15 AM High/Low with Automatic Forecasting", overlay=true)

// Parameters

showSignals = input(true, title="Show Signals")

// Define session time

sessionStartHour = input(9, title="Session Start Hour")

sessionStartMinute = input(0, title="Session Start Minute")

sessionEndHour = input(9, title="Session End Hour")

sessionEndMinute = input(15, title="Session End Minute")

// Calculate session high and low

var float sessionHigh = na

var float sessionLow = na

if (hour == sessionStartHour and minute == sessionStartMinute)

sessionHigh := high

sessionLow := low

// Update session high and low if within session time

if (hour == sessionStartHour and minute >= sessionStartMinute and minute < sessionEndMinute)

sessionHigh := high > sessionHigh or na(sessionHigh) ? high : sessionHigh

sessionLow := low < sessionLow or na(sessionLow) ? low : sessionLow

// Plot horizontal lines for session high and low

plot(sessionHigh, color=color.green, title="9:00 AM High", style=plot.style_stepline, linewidth=1)

plot(sessionLow, color=color.red, title="9:00 AM Low", style=plot.style_stepline, linewidth=1)

// Calculate targets and stop loss

longTarget = sessionHigh + 200

longStopLoss = sessionLow

shortTarget = sessionLow - 200

shortStopLoss = sessionHigh

// Plot targets and stop loss

plot(longTarget, color=color.blue, title="Long Target", style=plot.style_cross, linewidth=1)

plot(longStopLoss, color=color.red, title="Long Stop Loss", style=plot.style_cross, linewidth=1)

plot(shortTarget, color=color.blue, title="Short Target", style=plot.style_cross, linewidth=1)

plot(shortStopLoss, color=color.red, title="Short Stop Loss", style=plot.style_cross, linewidth=1)

// RSI

rsiLength = input(14, title="RSI Length")

overboughtLevel = input(60, title="Overbought Level")

oversoldLevel = input(40, title="Oversold Level")

rsi = ta.rsi(close, rsiLength)

// Entry conditions

longCondition = close > sessionHigh and rsi > overboughtLevel

shortCondition = close < sessionLow and rsi < oversoldLevel

// Long entry

if (showSignals and longCondition)

strategy.entry("Long", strategy.long)

// Short entry

if (showSignals and shortCondition)

strategy.entry("Short", strategy.short)