概述

多重均线与RSI交叉交易策略是一种结合多重移动平均线、相对强弱指数(RSI)和移动平均线收敛发散指标(MACD)的量化交易策略。该策略通过分析快速移动平均线和慢速移动平均线的交叉关系,以及RSI和MACD指标的信号,来判断市场趋势和交易时机,从而做出买入或卖出决策。

策略原理

该策略的核心原理是利用不同周期的移动平均线和技术指标来捕捉市场趋势和交易信号。具体来说,策略使用以下逻辑:

- 计算快速移动平均线(默认为9周期的指数移动平均线)和慢速移动平均线(默认为21周期的指数移动平均线)。

- 当快速移动平均线上穿慢速移动平均线时,视为看涨趋势;当快速移动平均线下穿慢速移动平均线时,视为看跌趋势。

- 计算相对强弱指数(RSI),默认周期为14。当RSI低于超卖水平(默认为30)时,表明市场可能处于超卖状态;当RSI高于超买水平(默认为70)时,表明市场可能处于超买状态。

- 计算移动平均线收敛发散指标(MACD),默认快线周期为12,慢线周期为26,信号线周期为9。当MACD快线上穿信号线时,视为看涨信号;当MACD快线下穿信号线时,视为看跌信号。

- 综合以上条件,当市场处于看涨趋势,RSI未处于超买区域,且MACD出现看涨信号时,策略开仓做多;当市场处于看跌趋势,RSI未处于超卖区域,且MACD出现看跌信号时,策略开仓做空。

- 在持仓过程中,如果市场趋势发生逆转或RSI进入超买/超卖区域,策略将平仓离场。

通过综合考虑多重均线、RSI和MACD指标,该策略能够较为全面地判断市场趋势和交易时机,从而做出更加稳健的交易决策。

优势分析

多重均线与RSI交叉交易策略具有以下优势:

- 趋势跟踪能力强:通过结合不同周期的移动平均线,策略能够较好地捕捉市场的主要趋势,避免在震荡市中频繁交易。

- 考虑超买超卖状态:引入RSI指标,策略能够识别市场的超买超卖状态,避免在极端行情下入场,降低风险。

- 确认交易信号:通过MACD指标的交叉信号来确认交易时机,提高交易信号的可靠性。

- 参数可调:策略中的各项参数,如移动平均线周期、RSI超买超卖阈值等,都可以根据市场特点和个人偏好进行调整,提高策略的适应性。

风险分析

尽管该策略具有一定的优势,但仍存在以下潜在风险:

- 参数优化风险:策略的表现依赖于参数的选择,不恰当的参数设置可能导致策略失效。因此,在实际应用中,需要对参数进行优化和测试,以确保策略的稳健性。

- 市场风险:策略主要基于技术指标,而市场受基本面、政策、事件等多重因素影响。当市场出现非理性行为或异常波动时,策略可能遭受损失。

- 滑点和交易成本:在实际交易中,滑点和交易成本会对策略收益产生影响。频繁交易可能导致较高的交易成本,降低策略的净收益。

为了应对这些风险,可以采取以下措施:

- 定期回测和优化参数,确保策略在不同市场环境下的稳健性。

- 设置合理的止损和止盈位,控制单笔交易的风险敞口。

- 合理设置交易频率和仓位管理,降低交易成本对收益的影响。

- 关注市场基本面和重大事件,必要时对策略进行人工干预。

优化方向

- 引入更多技术指标:考虑引入其他技术指标,如布林带、KDJ等,以提高交易信号的可靠性和多样性。

- 动态调整参数:根据市场状态的变化,动态调整策略参数,如在趋势明显时使用较长周期的移动平均线,在震荡市中使用较短周期的移动平均线等。

- 加入止损止盈机制:设置合理的止损止盈位,减小单笔交易的风险敞口,提高策略的风险调整后收益。

- 优化仓位管理:根据市场波动性和交易信号的强度,动态调整仓位大小,在趋势明显且信号强烈时加大仓位,在市场不确定性加大时减小仓位。

通过以上优化措施,可以进一步提高策略的稳健性、盈利能力和适应性,更好地应对多变的市场环境。

总结

多重均线与RSI交叉交易策略是一种经典的趋势跟踪和超买超卖判断策略。该策略通过结合不同周期的移动平均线、RSI和MACD指标,综合考虑市场趋势、超买超卖状态和交易信号的可靠性,从而做出更加稳健的交易决策。尽管该策略具有趋势跟踪能力强、信号确认可靠等优势,但在实际应用中仍需注意参数优化、市场风险、交易成本等因素的影响。通过引入更多技术指标、动态调整参数、设置止损止盈和优化仓位管理等措施,可以进一步提升策略的表现。总的来说,多重均线与RSI交叉交易策略为量化交易提供了一种简单而有效的思路,但在实践中需要根据具体市场环境和个人偏好进行适当调整和优化,以期获得稳定的收益。

策略源码

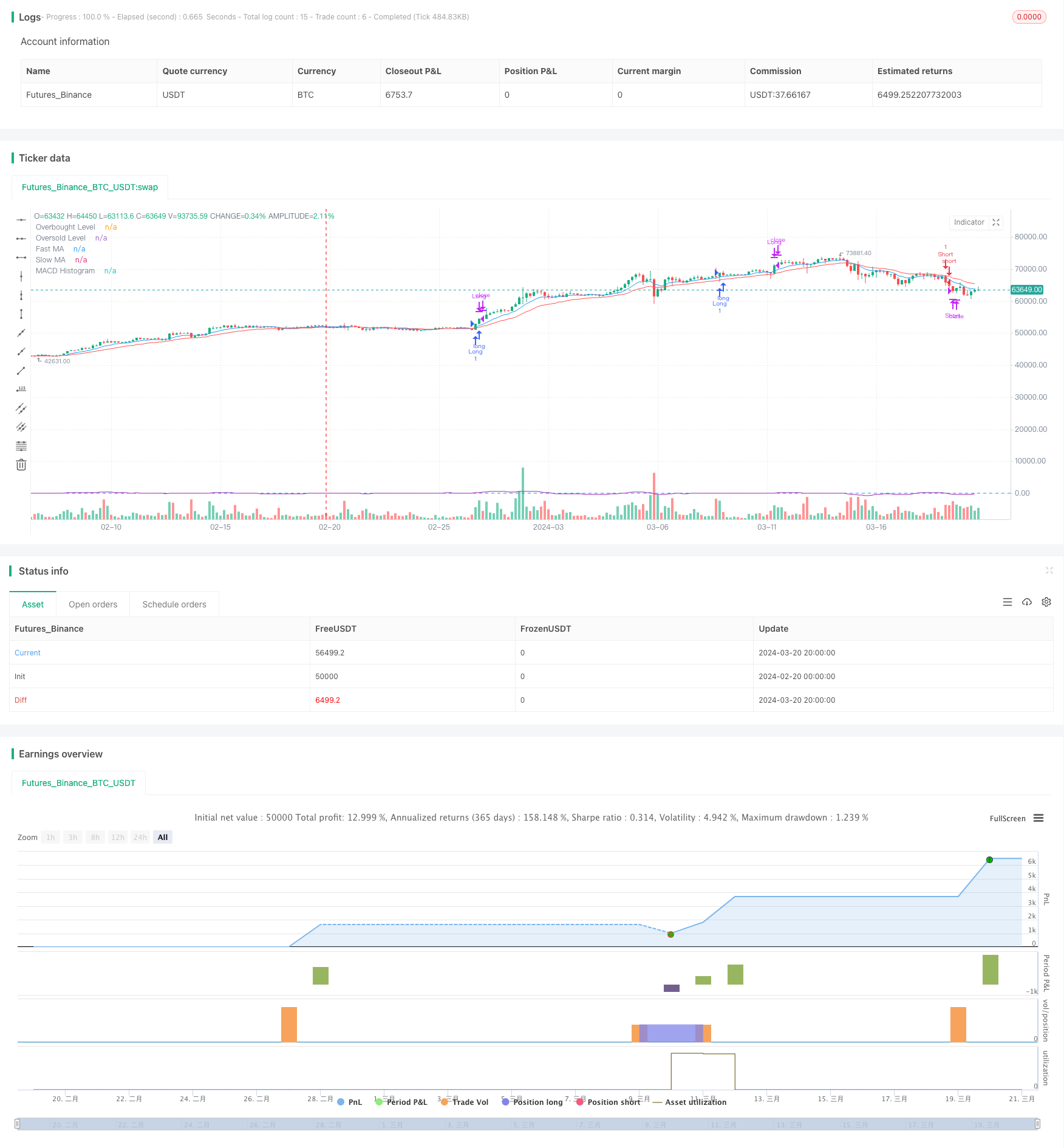

/*backtest

start: 2024-02-20 00:00:00

end: 2024-03-21 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Candle Genie Strategy", shorttitle="CGS", overlay=true)

// Parameters

fastLength = input(9, title="Fast MA Length")

slowLength = input(21, title="Slow MA Length")

rsiLength = input(14, title="RSI Length")

rsiOverboughtLevel = input(70, title="RSI Overbought Level")

rsiOversoldLevel = input(30, title="RSI Oversold Level")

macdFast = input(12, title="MACD Fast Length")

macdSlow = input(26, title="MACD Slow Length")

macdSignal = input(9, title="MACD Signal Length")

// Indicators

fastMA = ta.ema(close, fastLength)

slowMA = ta.ema(close, slowLength)

rsi = ta.rsi(close, rsiLength)

[macdLine, signalLine, _] = ta.macd(close, macdFast, macdSlow, macdSignal)

// Trend Conditions

bullishTrend = fastMA > slowMA

bearishTrend = fastMA < slowMA

// Trading Conditions

longCondition = bullishTrend and rsi < rsiOverboughtLevel and ta.crossover(macdLine, signalLine)

shortCondition = bearishTrend and rsi > rsiOversoldLevel and ta.crossunder(macdLine, signalLine)

// Entry Conditions

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Exit Conditions

strategy.close("Long", when = bearishTrend or rsi > rsiOverboughtLevel)

strategy.close("Short", when = bullishTrend or rsi < rsiOversoldLevel)

// Plotting

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

hline(rsiOverboughtLevel, "Overbought Level", color=color.red)

hline(rsiOversoldLevel, "Oversold Level", color=color.blue)

plot(macdLine - signalLine, color=color.purple, title="MACD Histogram")