概述

RSI与EMA双重过滤策略是一种基于相对强弱指标(RSI)和指数移动平均线(EMA)的量化交易策略。该策略利用RSI指标判断市场超买超卖情况,同时结合快慢两条EMA线的趋势判断,以此作为进场和出场的依据。通过RSI和EMA的双重过滤,可以有效降低假信号,提高策略的稳定性和盈利能力。

策略原理

该策略的核心原理可以分为以下几个部分:

RSI指标的计算和应用:策略首先计算了一个自定义周期(默认为2)的RSI指标。当RSI值低于超卖阈值(默认为10)时,表明市场处于超卖状态,可以考虑做多;当RSI值高于超买阈值(默认为90)时,表明市场处于超买状态,可以考虑做空。

快慢EMA线的趋势判断:策略计算了两条EMA线,一条是慢线(默认周期为200),一条是快线(默认周期为50)。当快线在慢线上方且价格在慢线上方时,认为市场处于上升趋势;反之,当快线在慢线下方且价格在慢线下方时,认为市场处于下降趋势。

趋势过滤:策略提供了一个趋势过滤的选项。如果开启该选项,那么只有在多头趋势下触发RSI超卖才会开多仓,在空头趋势下触发RSI超买才会开空仓。这样可以进一步降低逆势交易的风险。

交易信号的确认:策略综合考虑RSI指标和EMA趋势判断的结果,产生最终的交易信号。在多头趋势下,当RSI低于超卖阈值时,开多仓;在空头趋势下,当RSI高于超买阈值时,开空仓。

仓位管理:策略采用了最小交易间隔(默认为5分钟)来控制交易频率,避免过度交易。同时,策略使用了追踪止损和固定止损相结合的方式进行风险管理,既能让利润充分延续,又能有效控制损失。

优势分析

RSI与EMA双重过滤策略具有以下优势:

趋势跟踪能力强:通过快慢EMA线的趋势判断,策略可以有效把握市场的主要趋势,避免在震荡市中频繁交易。

有效过滤假信号:RSI指标容易产生较多的假信号,特别是在趋势不明确的市场中。而EMA趋势过滤可以有效识别主要趋势,降低RSI产生的假信号。

风险管理完善:策略采用了追踪止损和固定止损相结合的方式,既能让利润充分延续,又能有效控制损失。这种风险管理方式可以提高策略的稳定性和回撤控制能力。

参数灵活可调:策略提供了多个参数供使用者调整,如RSI周期、超买超卖阈值、EMA周期、止损比例等。这使得策略可以灵活适应不同的市场环境和交易习惯。

风险分析

尽管RSI与EMA双重过滤策略具有较好的优势,但仍然存在一些潜在的风险:

趋势转折风险:在市场趋势发生转折时,EMA线可能出现滞后,导致策略错过最佳的入场时机或者延迟出场。

参数优化风险:该策略的表现对参数设置较为敏感,不同参数组合可能带来完全不同的结果。如果参数优化过度,可能导致策略在未来市场中表现不佳。

黑天鹅事件风险:策略基于历史数据进行回测和优化,但历史数据无法完全反映未来可能发生的极端事件。一旦出现黑天鹅事件,策略可能遭受较大损失。

为了应对这些风险,可以考虑以下解决方法:

结合其他技术指标或者价格行为模式来辅助判断趋势转折,提早做出调整。

采用适度的参数优化,避免过度拟合历史数据。同时,定期进行参数复核和调整,适应最新的市场特征。

设置合理的止损位,控制单笔交易的最大损失。同时,在组合层面进行风险控制,如分散投资、仓位控制等。

优化方向

引入更多技术指标:在现有RSI和EMA指标的基础上,可以引入更多有效的技术指标,如MACD、布林带等,以提高策略的信号准确度和稳定性。

优化趋势判断方法:除了使用EMA线判断趋势外,还可以探索其他趋势判断方法,如高低点法、均线系统等。通过多种趋势判断方法的结合,可以提高策略的适应性。

改进风险管理方式:在现有的追踪止损和固定止损基础上,可以引入更加先进的风险管理方法,如波动性止损、动态止损等。这些方法可以更好地适应市场的波动性变化,从而更好地控制风险。

加入仓位管理模块:目前策略采用了固定仓位的方式,可以考虑引入动态仓位管理模块,根据市场波动性、账户权益等因素动态调整仓位,提高资金利用效率。

适应多个市场和品种:将策略扩展到更多的交易市场和品种,通过分散投资来降低整体风险。同时,可以研究不同市场和品种间的相关性,利用这些信息来优化策略的资产配置。

总结

RSI与EMA双重过滤策略通过相对强弱指标和指数移动平均线的有机结合,有效捕捉市场趋势,同时降低了RSI指标容易产生假信号的问题。策略逻辑清晰,包含了完善的风险管理措施,具有良好的稳定性和盈利潜力。但是,策略也存在一些潜在的风险,如趋势转折风险、参数优化风险和黑天鹅事件风险等。针对这些风险,我们提出了相应的应对措施和优化方向,如引入更多技术指标、优化趋势判断方法、改进风险管理方式、加入仓位管理模块以及扩展到多个市场和品种等。通过不断的优化和改进,相信该策略能够更好地适应未来的市场变化,为投资者带来稳定的收益。

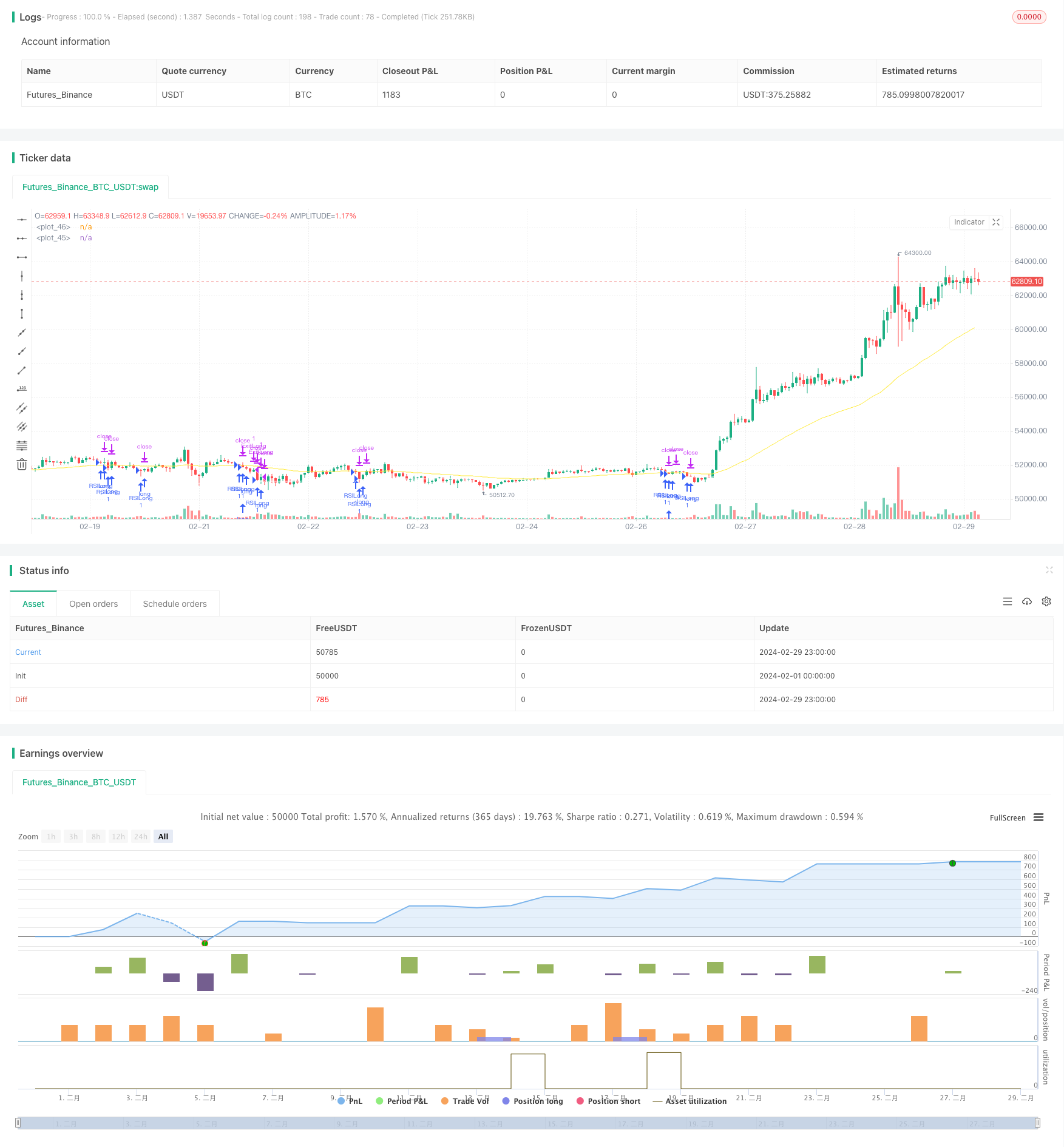

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("RSI2", overlay=true)

// RSILength input

len = input(2, minval=1, title="RSILength")

// Threshold RSI up input

RSIthreshUP = input(90, title="Threshold RSI up")

// Threshold RSI down input

RSIthreshDWN = input(10, title="Threshold RSI down")

// Slow MA length input

mmlen = input(200, title="Slow MA len")

// Fast MA length input

mmflen = input(50, title="Fast MA len")

// Moving Average type input

machoice = input("EMA", defval="EMA", options=["SMA", "EMA"])

// Ticker size input

tick=input(0.5,title="Ticker size",type=input.float)

// Trend Filter input

filter=input(true,title="Trend Filter",type=input.bool)

// Trailing Stop percentage input

ts_percent = input(1, title="TrailingStop%")

// Stop Loss percentage input

sl_percent = input(0.3, title="Stop Loss %")

// Calculate RSI

src = close

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - 100 / (1 + up / down)

// Calculate moving averages

mmslow = machoice == "SMA" ? sma(close, mmlen) : ema(close, mmlen)

mmfast = machoice == "SMA" ? sma(close, mmflen) : ema(close, mmflen)

// Plot moving averages

plot(mmslow, color=color.white)

plot(mmfast, color=color.yellow)

// Conditions for entry and exit

var lastLongEntryTime = 0

var lastShortEntryTime = 0

ConditionEntryL = if filter == true

mmfast > mmslow and close > mmslow and rsi < RSIthreshDWN

else

mmfast > mmslow and rsi < RSIthreshDWN

ConditionEntryS = if filter == true

mmfast < mmslow and close < mmslow and rsi > RSIthreshUP

else

mmfast < mmslow and rsi > RSIthreshUP

// Calculate trailing stop and stop loss

ts_calc = close * (1/tick) * ts_percent * 0.01

sl_price = close * (1 - sl_percent / 100)

// Entry and exit management

if ConditionEntryL and time - lastLongEntryTime > 1000 * 60 * 5 // 5 minutes

strategy.entry("RSILong", strategy.long)

lastLongEntryTime := time

if ConditionEntryS and time - lastShortEntryTime > 1000 * 60 * 5 // 5 minutes

strategy.entry("RSIShort", strategy.short)

lastShortEntryTime := time

lastLongEntryTimeExpired = time - lastLongEntryTime >= 1000 * 60 * 5

lastShortEntryTimeExpired = time - lastShortEntryTime >= 1000 * 60 * 5

strategy.exit("ExitLong", "RSILong", when=lastLongEntryTimeExpired, trail_points=0, trail_offset=ts_calc, stop=sl_price)

strategy.exit("ExitShort", "RSIShort", when=lastShortEntryTimeExpired, trail_points=0, trail_offset=ts_calc, stop=sl_price)