策略概述

该策略基于布林带指标,在价格触及布林带上下轨时进行开仓,并设置动态止盈与动态加仓逻辑。当价格从下轨反弹并突破布林带中轨时,策略认为上涨趋势形成,此时策略会在价格回撤至中轨一定比例时进行加仓;当价格最终突破布林带上轨时,策略平仓获利了结。在下跌趋势中,策略则采取相反的操作逻辑。通过布林带动态止盈与动态加仓,该策略能够在趋势行情中获得更多利润。

策略原理

该策略的主要原理如下:

计算布林带上轨、中轨和下轨。上轨和下轨的计算公式为中轨加减标准差的 N 倍,其中 N 可以自定义。

当收盘价跌破布林带下轨且此前未开仓时,策略开多仓;当收盘价突破布林带上轨且此前未开仓时,策略开空仓。这里的开仓逻辑与传统布林带突破系统类似。

在开多仓后,如果收盘价向上突破布林带中轨,则认为上涨趋势形成,标记变量 basisCrossed 为 true。在开空仓后,如果收盘价向下突破布林带中轨,也标记 basisCrossed 为 true。

在多头情况下,如果收盘价跌破下轨且 basisCrossed 为 true,并且当前价格较原开仓价跌幅超过 2%,此时策略加仓,同时将 basisCrossed 重置为 false。空头情况与之相反。这里的加仓逻辑可以使策略在趋势回撤时低位加仓,增加获利空间。

如果多头持仓时收盘价突破布林带上轨,或空头持仓时收盘价跌破布林带下轨,策略平掉所有仓位,了结利润,并将各个标记变量重置,以准备下一次开仓。

通过以上动态开仓、加仓和止盈的逻辑,该策略能够在趋势行情中灵活操作,博取更高的利润。同时通过布林带这一经典技术指标来捕捉趋势,也使得策略具有一定的适应性和稳定性。

优势分析

动态止盈:该策略通过布林带上下轨来动态调整止盈位,相比固定点位止盈,能够更好地适应市场波动,灵活地保护利润。

动态加仓:在趋势形成后的回撤阶段,策略会逐步加仓,这样可以在趋势行情中博取更高利润。动态加仓使得该策略在趋势交易中更具优势。

参数灵活:布林带的参数如 N、P 值等都可以灵活调整,以适应不同的市场特点和交易风格。

适应性强:布林带是一个经典的技术指标,具有较好的趋势捕捉能力。将其与动态头寸管理相结合,可以在各类金融市场中发挥稳定的效用。

逻辑清晰:该策略的开平仓条件和加减仓逻辑非常清晰明了,便于traders理解和掌控。清晰的逻辑也意味着更容易做二次开发和策略优化。

风险分析

震荡市:布林带策略在震荡市中表现往往不佳,此时频繁的开平仓会导致较多交易成本,从而影响总体收益。

趋势转折:在趋势转折的关键时刻,该策略可能出现判断滞后,导致在错误的方向加仓,从而产生较大回撤。

极端行情:在极端行情下(如暴涨暴跌),布林带的走势可能出现异常,导致该策略失效。

参数设置:不恰当的参数设置会严重影响该策略的表现,如 N 值设置过小会导致频繁交易,N 值设置过大则会导致信号滞后。

黑天鹅事件:如遇重大的政治经济事件,该策略可能面临较大的风险敞口。

针对以上风险,可以从两方面着手控制:1)合理设置参数,针对不同的标的和市场状态进行参数优化;2)在策略中加入更多的过滤条件,如趋势判断、波动率过滤等,提高信号的质量。此外,在实际运用中还需要做好仓位控制和风险管理,严格控制单次交易的风险敞口。

优化方向

趋势过滤:在开仓时加入趋势判断的逻辑,如 MA 多头排列作为做多的过滤条件,MA空头排列作为做空的过滤条件,这样可以提高趋势把握的成功率。

波动率过滤:布林带实际上也是一种波动率指标,可以通过引入 ATR、历史波动率等指标来识别市场的波动状态,在高波状态下可以适当降低仓位,在低波状态下加大仓位,从而更好地控制风险。

动态参数优化:布林带的参数可以根据市场状态动态调整。如在趋势行情中可以增大N值,在震荡市中减小N值。这需要借助于机器学习等技术,通过对历史数据的训练来寻找最优参数。

组合策略:可以将该策略与其他经典策略如 MACD、RSI等结合,形成组合策略,提高系统的稳健性和盈利能力。

加入止损逻辑:目前该策略缺乏明确的止损逻辑,可以考虑加入移动止损或固定百分比止损等机制,以控制单次交易的最大损失。

仓位管理优化:在加仓和减仓的过程中,可以借鉴 Kelly 公式、最优F值等经典的仓位管理方法,以期在可控风险下实现利润最大化。

通过以上优化,可以进一步提升该策略的风险收益比,使其能够更好地适应多变的市场环境,为交易者带来稳定的回报。

总结

布林带动态止盈与动态加仓策略是一个经典的趋势追踪策略,它以布林带为基础,通过动态调整头寸来博取更高的趋势利润。该策略逻辑清晰,参数灵活,适应性强,是一个值得深入研究和应用的量化交易策略。但同时我们也要看到,该策略在震荡市中表现不佳,对极端行情和黑天鹅事件缺乏应对能力,这就需要我们在实际应用中注重参数优化、风险控制和策略组合,并定期检验策略在不同市场状态下的有效性。通过深入理解该策略的内在逻辑,不断优化和改进,相信该策略能够成为量化交易者的重要工具,为投资者带来长期而稳定的回报。

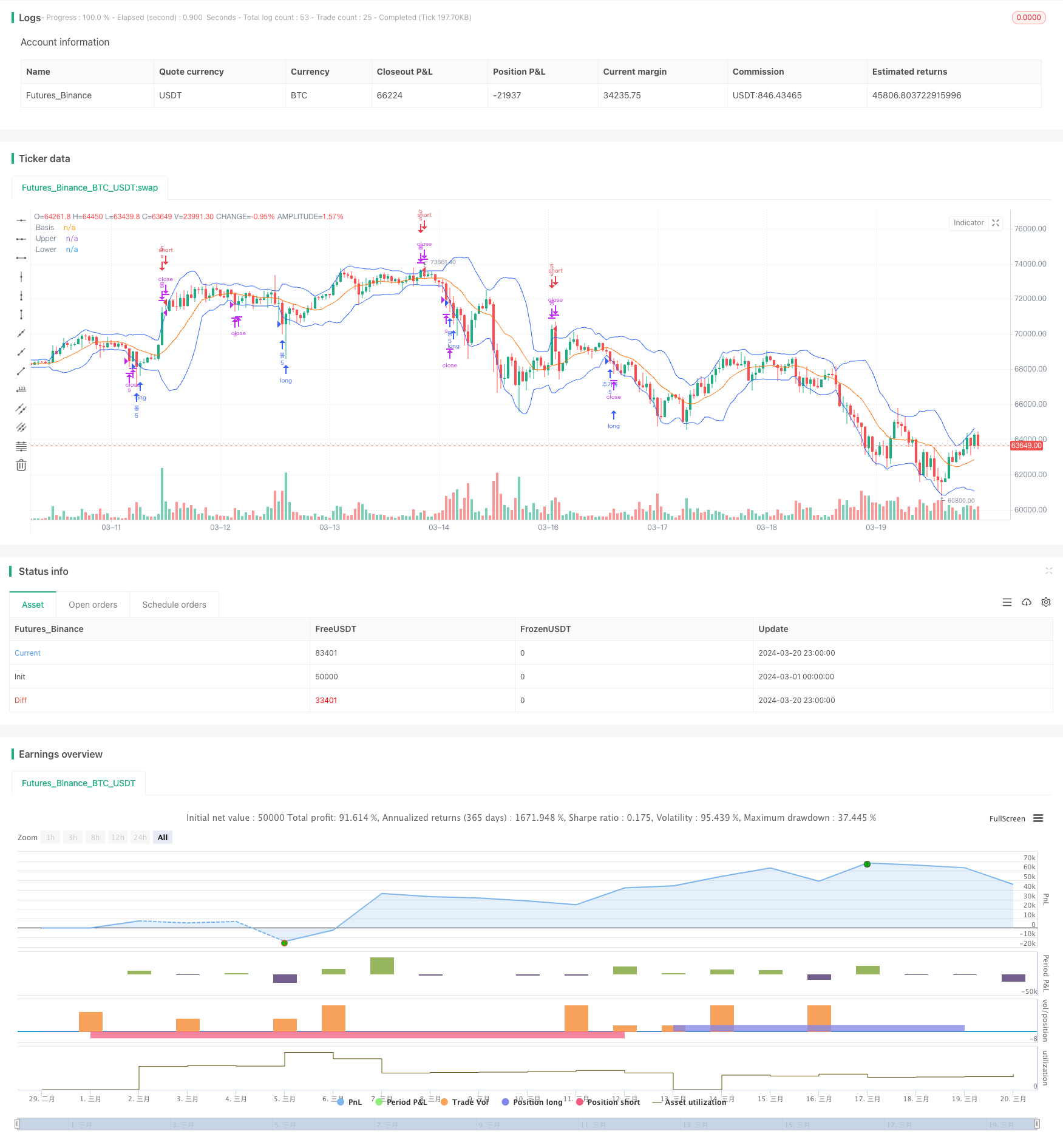

/*backtest

start: 2024-03-01 00:00:00

end: 2024-03-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Bollinger Bands 1Bb 상하한 크로스 롱숏 실행

strategy(shorttitle="BB", title="Bollinger Bands", overlay=true )

// bb

length = input.int(12, minval=1)

src = input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

add = input.float(0.98, step = 0.001)

// plot(upper - lower, "Basis", color=color.red, offset = offset)

var bool entryMade = false

var bool basisCrossed = false

var bool upperCrossed = false

var bool lowerCrossed = false

strategy.initial_capital = 50000

if close < lower and not entryMade

strategy.entry("롱", strategy.long, qty = strategy.initial_capital/10000)

entryMade := true

if ta.crossover(close, basis) and entryMade and not upperCrossed

basisCrossed := true

if close > upper

upperCrossed := true

if close < lower and entryMade and basisCrossed and not upperCrossed and close < strategy.position_avg_price*add

strategy.entry("추가롱", strategy.long, strategy.initial_capital/10000)

basisCrossed := false

if close > upper

strategy.close("롱")

strategy.close("추가롱")

entryMade := false

basisCrossed := false

upperCrossed := false

///////////반대 포지션

if close > upper and not entryMade

strategy.entry("s", strategy.short, qty = strategy.initial_capital/10000)

entryMade := true

if ta.crossunder(close, basis) and entryMade and not lowerCrossed

basisCrossed := true

if close < lower

lowerCrossed := true

if close > upper and entryMade and basisCrossed and not lowerCrossed and close > strategy.position_avg_price*add

strategy.entry("추가s", strategy.short, strategy.initial_capital/10000)

basisCrossed := false

if close < lower

strategy.close("s")

strategy.close("추가s")

entryMade := false

basisCrossed := false

upperCrossed := false