概述

该策略利用相对强弱指数(RSI)指标来判断市场超卖情况,当RSI小于30时开仓做多,同时设置止损价格为开仓价格的98.5%。该策略的主要思路是在市场出现超卖信号时入场,同时严格控制风险,一旦价格跌破止损价格立即平仓止损。

策略原理

- 计算RSI指标,使用14根K线的收盘价。

- 当RSI小于30时,发出超卖信号,此时开仓做多。

- 开仓的同时,记录开仓价格,并根据开仓价格和止损比例(1.5%)计算出止损价格。

- 当价格跌破止损价格时,立即平仓止损。

- 平仓后,重置开仓价格和止损价格,等待下一次开仓机会。

策略优势

- 简单易懂,逻辑清晰,适合新手学习和使用。

- 严格控制风险,设置止损价格,一旦触及止损价格立即平仓,最大程度上避免了损失扩大。

- 利用RSI指标判断超卖情况,能够在市场短期超跌后及时入场,把握反弹机会。

- 代码简洁高效,执行速度快,不会错过交易信号。

策略风险

- RSI指标属于滞后指标,有可能出现指标已经超卖,但价格仍在继续下跌的情况,此时入场可能会面临进一步的损失风险。

- 固定止损比例可能无法动态应对市场波动,在市场剧烈波动时,固定止损可能会导致频繁止损,错失后续反弹机会。

- 策略缺乏盈利目标,完全依靠止损来控制风险,可能导致总体盈利水平不高。

策略优化方向

- 在RSI指标之外,引入其他技术指标辅助判断,提高信号准确性,比如MACD、KDJ等。

- 对止损比例进行优化,可以根据历史数据测试不同的止损比例,找到最佳的止损设置。

- 在止损的基础上,增加移动止损或追踪止损等动态止损机制,使得止损更加灵活有效。

- 设置盈利目标,在达到一定盈利水平后主动平仓,而不是完全依靠止损出场。

总结

RSI止损追踪交易策略通过RSI指标判断超卖情况,同时设置固定止损比例严格控制风险,整体思路简单易懂,适合新手学习使用。但是该策略也存在滞后性、止损机制简单、盈利水平不高等问题,需要在实际应用中不断优化改进,提高策略的稳定性和盈利性。

策略源码

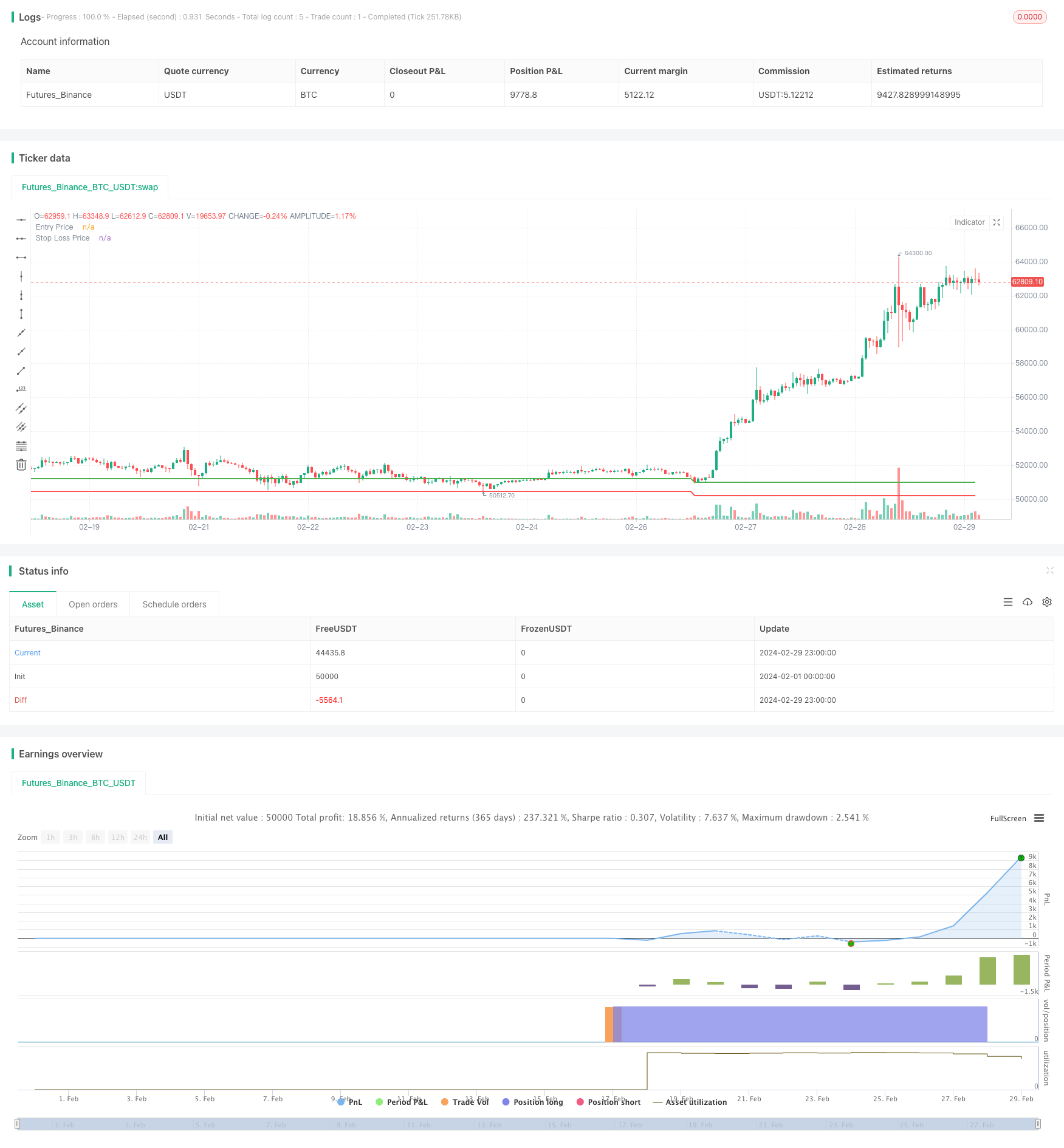

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('RSI Trading Bot', overlay=true)

// RSI threshold value and stop loss percentage

rsiThreshold = 30

stopLossPercentage = 1.5

// Calculate RSI

rsiLength = 14

rsiValue = ta.rsi(close, rsiLength)

// Initialize variables

var bool positionOpen = false

var float entryPrice = na

var float stopLossPrice = na

// Enter position when RSI crosses below threshold

if ta.crossunder(rsiValue, rsiThreshold)

strategy.entry('Long', strategy.long)

positionOpen := true

entryPrice := close

stopLossPrice := entryPrice * (1 - stopLossPercentage / 100)

stopLossPrice

// Exit position on stop loss

if positionOpen and close < stopLossPrice

strategy.close('Long')

positionOpen := false

entryPrice := na

stopLossPrice := na

stopLossPrice

// Plot entry and stop loss prices

plot(entryPrice, title='Entry Price', color=color.new(color.green, 0), linewidth=2)

plot(stopLossPrice, title='Stop Loss Price', color=color.new(color.red, 0), linewidth=2)