概述

该策略采用相对强弱指数(RSI)和两条简单移动平均线(SMA)作为主要指标,在1小时时间框架内产生多头和空头信号。通过放宽RSI和SMA的条件设置,提高了信号触发的频率。同时,策略还利用平均真实波动幅度(ATR)指标进行风险管理,动态设置止盈和止损位。

该策略的主要思路如下: 1. 使用RSI指标识别潜在的超买和超卖状态,分别作为做多和做空的信号。 2. 使用快速SMA和慢速SMA的交叉来判断潜在的上涨趋势(金叉)和下跌趋势(死叉)。 3. 当RSI和SMA同时满足做多或做空条件时,开仓建立相应方向的头寸。 4. 利用ATR指标计算动态止盈和止损位,控制每笔交易的风险。 5. 通过图表背景色的变化来直观显示策略信号的触发情况,便于调试和理解策略逻辑。

策略原理

- RSI指标:当RSI低于50时,表明市场可能处于超卖状态,价格有上涨的潜力,因此触发做多信号;当RSI高于50时,表明市场可能处于超买状态,价格有下跌的潜力,因此触发做空信号。

- 双均线交叉:当快速SMA上穿慢速SMA时(金叉),表明潜在的上涨趋势,触发做多信号;当快速SMA下穿慢速SMA时(死叉),表明潜在的下跌趋势,触发做空信号。

- 开仓条件:只有当RSI和双均线同时满足做多或做空条件时,才会开仓建立相应方向的头寸,以提高信号的可靠性。

- 风险管理:使用ATR指标计算动态止盈和止损位,止盈位设为开仓价格加/减ATR的1.5倍,止损位设为开仓价格加/减ATR的1倍。这样可以根据市场波动情况动态调整止盈止损,控制每笔交易的风险。

策略优势

- 适应性强:通过放宽RSI和双均线的条件设置,策略可以在1小时时间框架内适应不同的市场状态,捕捉更多的交易机会。

- 风险管理:利用ATR指标动态设置止盈和止损位,可以根据市场波动情况灵活调整,有效控制每笔交易的风险敞口。

- 简单易用:策略逻辑清晰,使用的指标简单易懂,便于理解和实现。

- 视觉辅助:通过图表背景色的变化直观显示策略信号,便于调试和优化。

策略风险

- 频繁交易:由于放宽了RSI和双均线的条件设置,策略可能会产生较为频繁的交易信号,导致交易成本增加,影响整体收益。

- 盘整市场:在波动较小的盘整市场中,RSI和双均线可能会产生频繁的虚假信号,导致策略表现不佳。

- 趋势缺失:策略主要依赖RSI和双均线来判断趋势,但在某些情况下,市场可能没有明显的趋势特征,导致策略信号失效。

- 参数敏感性:策略的表现可能对RSI、SMA和ATR等指标的参数设置较为敏感,不同的参数组合可能导致策略表现差异较大。

策略优化方向

- 参数优化:对RSI、SMA和ATR等指标的参数进行优化,找到在历史数据上表现最佳的参数组合,提高策略的稳定性和可靠性。

- 信号过滤:引入其他技术指标或市场情绪指标,对RSI和双均线产生的信号进行二次确认,减少虚假信号的出现。

- 动态权重调整:根据市场趋势的强度动态调整RSI和双均线信号的权重,在趋势明显时给予更高的权重,在盘整市场中降低权重,提高策略的适应性。

- 止盈止损优化:对ATR倍数进行优化,找到最佳的止盈止损比例,提高策略的风险调整后收益。同时,可以考虑引入其他止盈止损方法,如基于支撑/阻力位的止盈止损,或者基于时间的止盈止损等。

- 多时间框架分析:结合其他时间框架(如4小时、日线等)的信号,对1小时时间框架的信号进行过滤和确认,提高信号的可靠性。

总结

该策略通过结合RSI和双均线两个简单易用的技术指标,在1小时时间框架内产生趋势追踪信号,同时利用ATR指标进行动态风险管理。策略逻辑清晰,易于理解和实现,适合初学者学习和使用。但是,策略也存在一些潜在的风险,如频繁交易、盘整市场表现不佳、趋势缺失等。因此,在实际应用中,需要对策略进行进一步的优化和改进,如参数优化、信号过滤、动态权重调整、止盈止损优化和多时间框架分析等,以提高策略的稳健性和盈利能力。总的来说,该策略可以作为一个基础模板,为traders提供一个可行的思路和方向,但还需要根据自己的经验和市场特点进行个性化的调整和优化。

策略源码

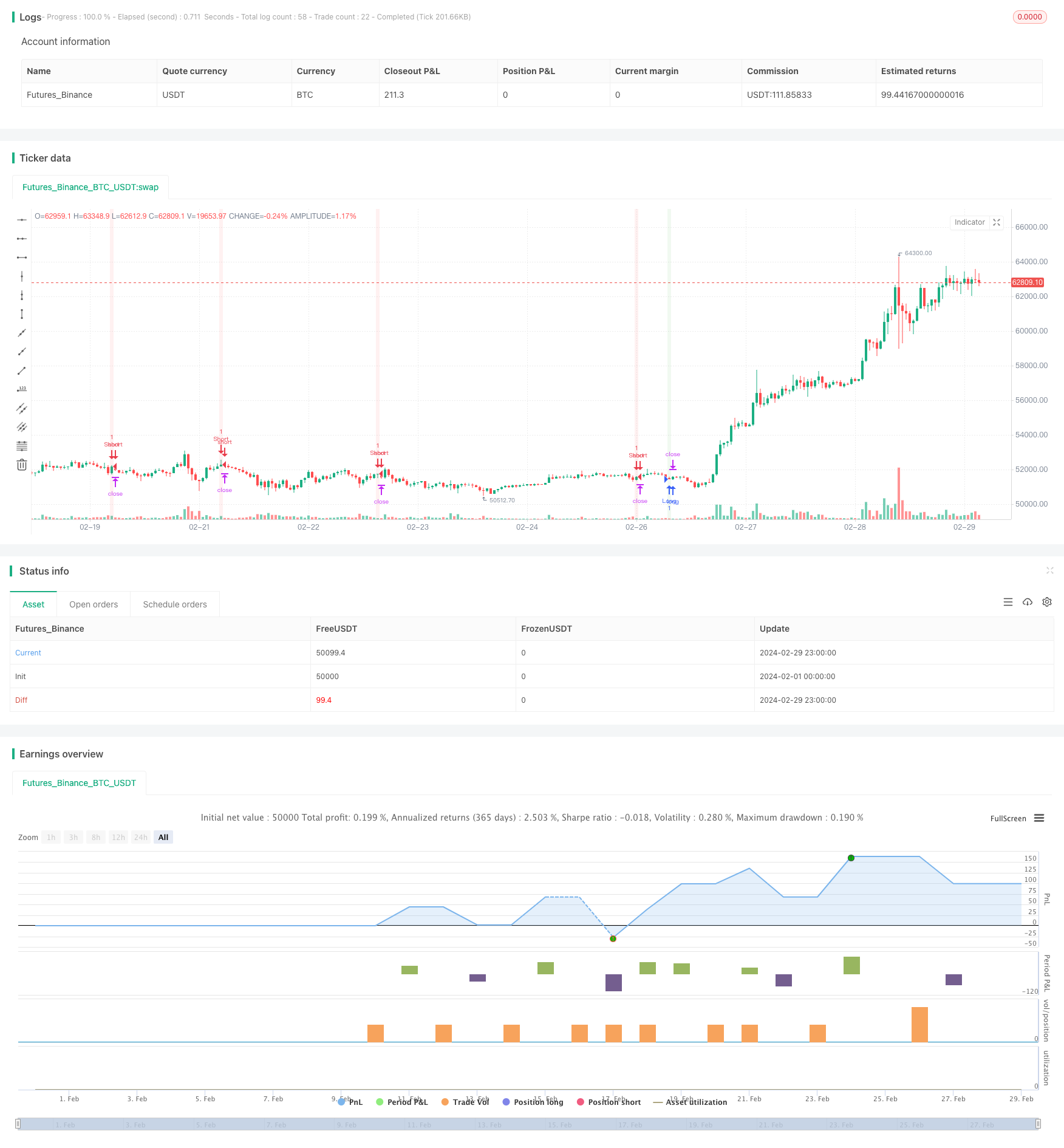

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-29 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Debugged 1H Strategy with Liberal Conditions", shorttitle="1H Debug", overlay=true, pyramiding=0)

// Parameters

rsiLength = input.int(14, title="RSI Length")

rsiLevel = input.int(50, title="RSI Entry Level") // More likely to be met than the previous 70

fastLength = input.int(10, title="Fast MA Length")

slowLength = input.int(21, title="Slow MA Length")

atrLength = input.int(14, title="ATR Length")

atrMultiplier = input.float(1.5, title="ATR Multiplier for SL")

riskRewardMultiplier = input.float(2, title="Risk/Reward Multiplier")

// Indicators

rsi = ta.rsi(close, rsiLength)

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

atr = ta.atr(atrLength)

// Trades

longCondition = ta.crossover(fastMA, slowMA) and rsi < rsiLevel

shortCondition = ta.crossunder(fastMA, slowMA) and rsi > rsiLevel

// Entry and Exit Logic

if (longCondition)

strategy.entry("Long", strategy.long)

strategy.exit("Exit Long", "Long", profit=atrMultiplier * atr, loss=atr)

if (shortCondition)

strategy.entry("Short", strategy.short)

strategy.exit("Exit Short", "Short", profit=atrMultiplier * atr, loss=atr)

// Debugging: Visualize when conditions are met

bgcolor(longCondition ? color.new(color.green, 90) : na)

bgcolor(shortCondition ? color.new(color.red, 90) : na)