概述

“动态趋势追踪策略”是一种基于移动平均线和趋势带指标的量化交易策略。该策略利用快速和慢速移动平均线的交叉信号来识别潜在的买卖机会,同时使用趋势带指标来确认趋势的强度。该策略还结合了动态仓位管理和止损/止盈机制,以优化风险回报比。

通过灵活的参数设置和API集成,该策略可以适应不同的交易风格和市场环境。”动态趋势追踪策略”旨在帮助交易者捕捉显著的市场波动,并在趋势形成的早期阶段进行交易,以最大化利润潜力。

策略原理

“动态趋势追踪策略”基于以下核心原理:

双重移动平均线:该策略使用快速和慢速移动平均线来确定价格趋势的方向。当快速移动平均线上穿慢速移动平均线时,表明上升趋势,产生买入信号;反之,当快速移动平均线下穿慢速移动平均线时,表明下降趋势,产生卖出信号。

趋势带指标:策略采用趋势带指标来衡量趋势的强度。当价格上穿趋势带时,表明看涨动能增强;当价格下穿趋势带时,表明看跌动能增强。趋势带的颜色变化提供了趋势转折的视觉线索。

动态仓位管理:该策略根据账户杠杆和投资组合比例动态计算每笔交易的仓位大小。这种方法优化了资金分配,同时考虑了交易者的风险承受能力。

止损/止盈机制:策略允许交易者设置基于百分比的止损和止盈水平。一旦达到预定的价格水平,该机制就会触发,以保护利润并限制潜在损失。

API集成:通过API参数的自定义输入字段,策略提供了灵活的执行选项。交易者可以根据自己的偏好调整参数,实现自动化交易。

策略优势

“动态趋势追踪策略”具有以下优势:

趋势识别:通过双重移动平均线和趋势带指标的结合,该策略能够有效识别市场趋势,帮助交易者及时进场并把握趋势机会。

动态仓位管理:策略根据账户杠杆和投资组合比例动态调整仓位大小,优化资金分配,同时控制风险敞口。这种方法有助于交易者在不同市场条件下实现稳定的回报。

风险管理:内置的止损/止盈机制为每笔交易提供了风险管理工具。交易者可以根据自己的风险承受能力设置百分比水平,从而将潜在损失限制在可接受的范围内。

灵活性:通过API集成和自定义参数输入,该策略可以适应不同的交易风格和偏好。交易者可以调整移动平均线的长度、趋势带参数和仓位大小,以优化策略性能并满足个人需求。

趋势捕捉:该策略旨在尽早识别趋势,并在趋势形成的早期阶段进行交易。通过及时进场,交易者可以最大化利润潜力,同时降低错过重要市场机会的风险。

策略风险

尽管”动态趋势追踪策略”提供了多种优势,但交易者也应了解潜在的风险:

市场波动:该策略在波动市场中可能会产生频繁的交易信号,导致更高的交易成本和潜在的虚假信号。为了缓解这一风险,交易者可以考虑调整移动平均线的长度或添加额外的确认指标。

趋势反转:在突然的趋势反转期间,该策略可能会遭受损失。止损机制可以在一定程度上降低这种风险,但在极端市场条件下,价格可能会迅速突破止损水平,导致更大的损失。

参数敏感性:策略的性能在很大程度上取决于移动平均线和趋势带参数的选择。不恰当的参数设置可能导致次优结果。交易者应该根据不同的市场条件和资产类别对参数进行优化和调整。

过度拟合:过度优化参数可能导致策略过度拟合历史数据,在实际交易中表现不佳。为了最小化这种风险,交易者应在各种市场条件下对策略进行全面的回测和前向测试。

策略优化方向

为了进一步提高”动态趋势追踪策略”的性能,可以考虑以下优化方向:

多时间框架分析:将不同时间框架的移动平均线和趋势带指标结合起来,以获得更全面的市场视角。这种方法可以帮助交易者识别主要趋势,同时避免次级波动带来的虚假信号。

动态参数调整:根据市场状况的变化动态调整移动平均线的长度和趋势带参数。这可以通过使用波动率指标或机器学习算法来实现,以适应不断变化的市场环境。

风险管理增强:引入更高级的风险管理技术,如基于波动率的仓位调整或动态止损水平。这些方法可以帮助交易者在保持策略性能的同时,更好地控制风险。

多资产多元化:将该策略应用于多个资产类别和市场,以实现投资组合的多元化。这可以降低单一市场或资产的风险敞口,提高策略的稳健性。

集成其他指标:考虑将其他技术指标或基本面因素纳入策略,以提供额外的确认信号和过滤机制。这可以帮助交易者避免虚假信号,提高策略的整体准确性。

总结

“动态趋势追踪策略”是一种基于移动平均线和趋势带指标的量化交易方法,旨在捕捉显著的市场趋势并优化风险回报比。通过动态仓位管理、止损/止盈机制以及灵活的参数设置,该策略可以适应不同的交易风格和市场条件。

尽管该策略具有趋势识别、风险管理和灵活性等优势,但交易者也应了解潜在的风险,如市场波动、趋势反转和参数敏感性。为了进一步优化策略性能,可以考虑多时间框架分析、动态参数调整、风险管理增强、多资产多元化和集成其他指标等方向。

通过审慎的回测、持续的监控和适当的风险管理,交易者可以利用”动态趋势追踪策略”在不同市场环境中追求稳定的回报。然而,重要的是要记住,过去的表现并不能保证未来的结果,交易者在实施该策略时应谨慎行事并进行充分的尽职调查。

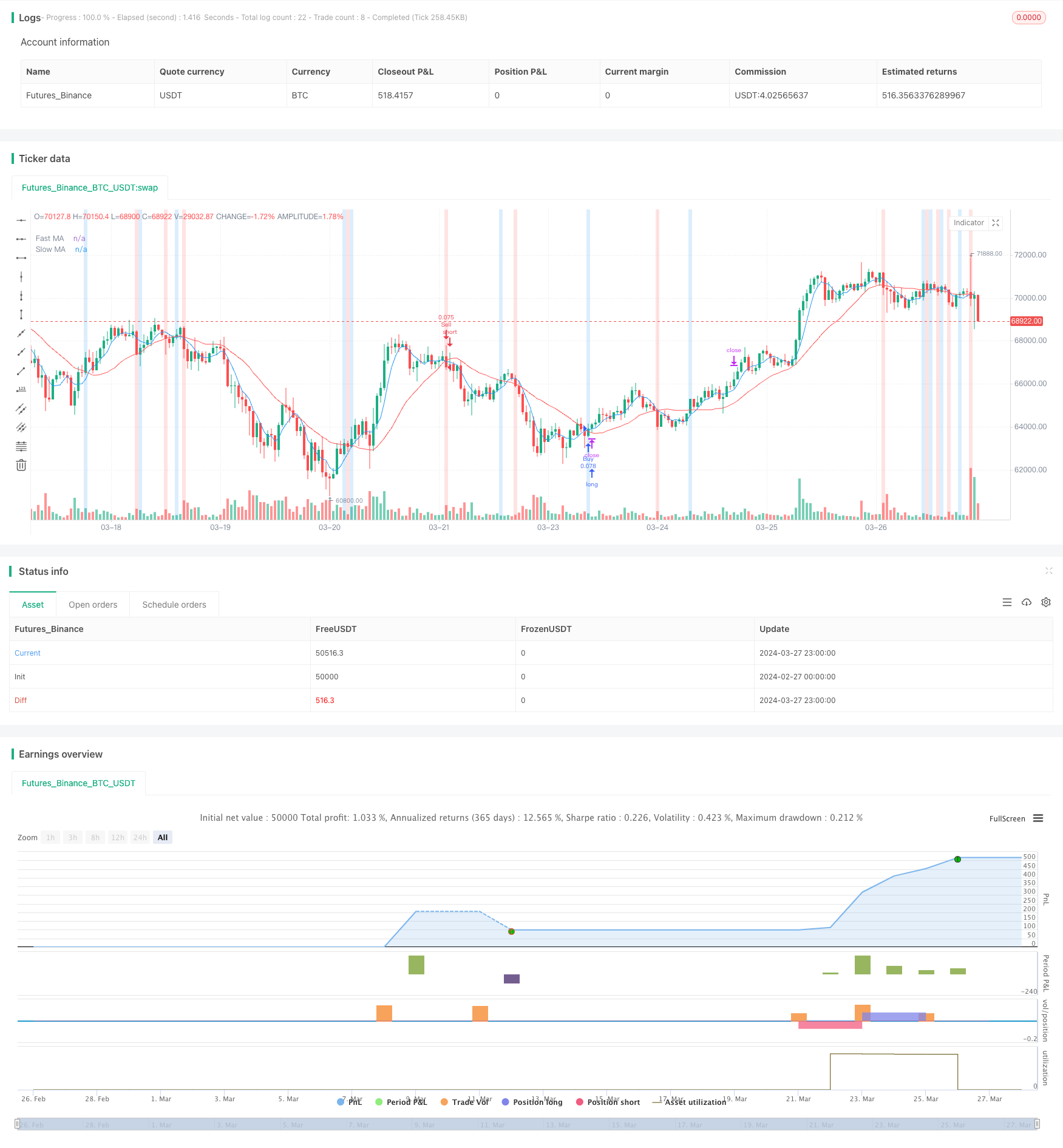

/*backtest

start: 2024-02-27 00:00:00

end: 2024-03-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Big Runner", shorttitle="Sprinter", overlay=true,

initial_capital=100000,

default_qty_type=strategy.percent_of_equity,

default_qty_value=100)

// Leverage Input

leverage = input.float(1, title="Leverage", minval=1, step=0.1)

// Moving Average Settings

fastLength = input(5, title="Fast Length")

slowLength = input(20, title="Slow Length")

fastMA = ta.sma(close, fastLength)

slowMA = ta.sma(close, slowLength)

// Trend Ribbon Settings

ribbonColor = input(true, title="Show Trend Ribbon")

ribbonLength = input(20, title="Ribbon Length")

ribbonColorUp = color.new(color.blue, 80)

ribbonColorDown = color.new(color.red, 80)

ribbonUp = ta.crossover(close, ta.sma(close, ribbonLength))

ribbonDown = ta.crossunder(close, ta.sma(close, ribbonLength))

// Buy and Sell Signals

buySignal = ta.crossover(close, fastMA) and ta.crossover(fastMA, slowMA)

sellSignal = ta.crossunder(close, fastMA) and ta.crossunder(fastMA, slowMA)

// Input for SL/TP percentages and toggle

use_sl_tp = input(true, title="Use Stop Loss/Take Profit")

take_profit_long_percent = input(4.0, title="Take Profit Long (%)") / 100

take_profit_short_percent = input(7.0, title="Take Profit Short (%)") / 100

stop_loss_long_percent = input(2.0, title="Stop Loss Long (%)") / 100

stop_loss_short_percent = input(2.0, title="Stop Loss Short (%)") / 100

// Calculate SL and TP levels

calculate_sl_tp(entryPrice, isLong) =>

stopLoss = isLong ? entryPrice * (1 - stop_loss_long_percent) : entryPrice * (1 + stop_loss_short_percent)

takeProfit = isLong ? entryPrice * (1 + take_profit_long_percent) : entryPrice * (1 - take_profit_short_percent)

[stopLoss, takeProfit]

// Plotting Moving Averages

plot(fastMA, color=color.blue, title="Fast MA")

plot(slowMA, color=color.red, title="Slow MA")

// Plotting Trend Ribbon

bgcolor(ribbonColor ? ribbonUp ? ribbonColorUp : ribbonDown ? ribbonColorDown : na : na)

// Calculate position size based on the percentage of the portfolio and leverage

percentOfPortfolio = input.float(10, title="Percent of Portfolio")

positionSizePercent = percentOfPortfolio / 100 * leverage

positionSize = strategy.equity * positionSizePercent / close

// Strategy Execution with Leverage

var float stopLossLong = na

var float takeProfitLong = na

var float stopLossShort = na

var float takeProfitShort = na

if (buySignal)

entryPrice = close

[stopLossLong, takeProfitLong] = calculate_sl_tp(entryPrice, true)

strategy.entry("Buy", strategy.long, qty=positionSize)

if use_sl_tp

strategy.exit("Take Profit Long", "Buy", limit=takeProfitLong)

strategy.exit("Stop Loss Long", "Buy", stop=stopLossLong)

if (sellSignal)

entryPrice = close

[stopLossShort, takeProfitShort] = calculate_sl_tp(entryPrice, false)

strategy.entry("Sell", strategy.short, qty=positionSize)

if use_sl_tp

strategy.exit("Take Profit Short", "Sell", limit=takeProfitShort)

strategy.exit("Stop Loss Short", "Sell", stop=stopLossShort)

strategy.close("Buy", when = sellSignal)

strategy.close("Sell", when = buySignal)

// Manual Input Fields for API Parameters

var string api_enter_long = input("", title="API Enter Long Parameters")

var string api_exit_long = input("", title="API Exit Long Parameters")

var string api_enter_short = input("", title="API Enter Short Parameters")

var string api_exit_short = input("", title="API Exit Short Parameters")